Free App Analytics

Analyze any Android or iOS app’s engagement and usage stats (as of January 11)

Examples of popular apps: Google Chrome, Facebook, YouTube

Analyze any Android or iOS app’s engagement and usage stats (as of January 11)

Examples of popular apps: Google Chrome, Facebook, YouTube

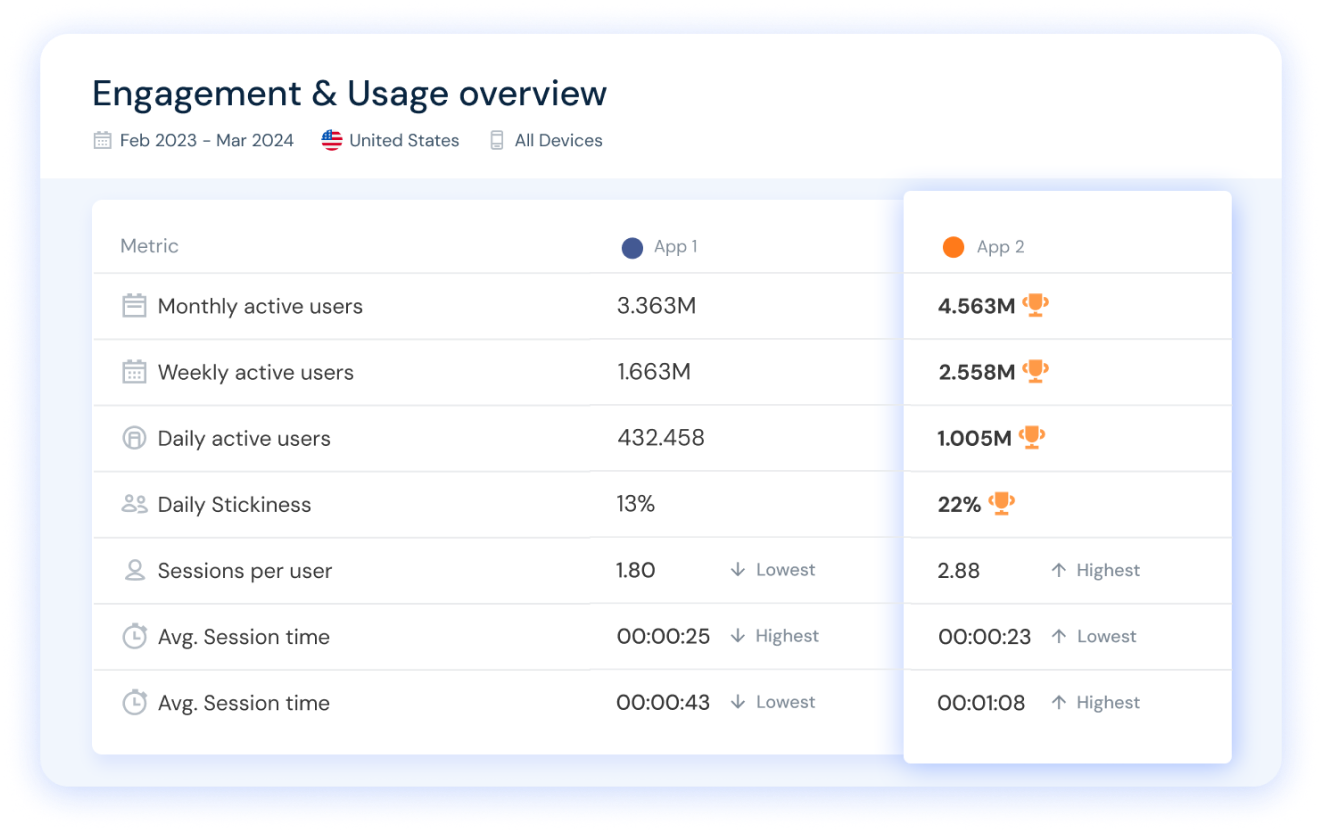

Similarweb lets you analyze any app you want, plus compare app rankings and performance metrics like DAU, MAU, user stickiness, and more, for the perfect competitive app analysis.

Start free trial

Check any app’s Google Play or Apple Store downloads and see install penetration rates over time. Easily analyze & compare any app's store performance.

Start free trial

Discover apps’ retention rates over time in any country. Compare your app vs. your key competitors and benchmark to the relevant app category in just a few clicks.

Start free trial

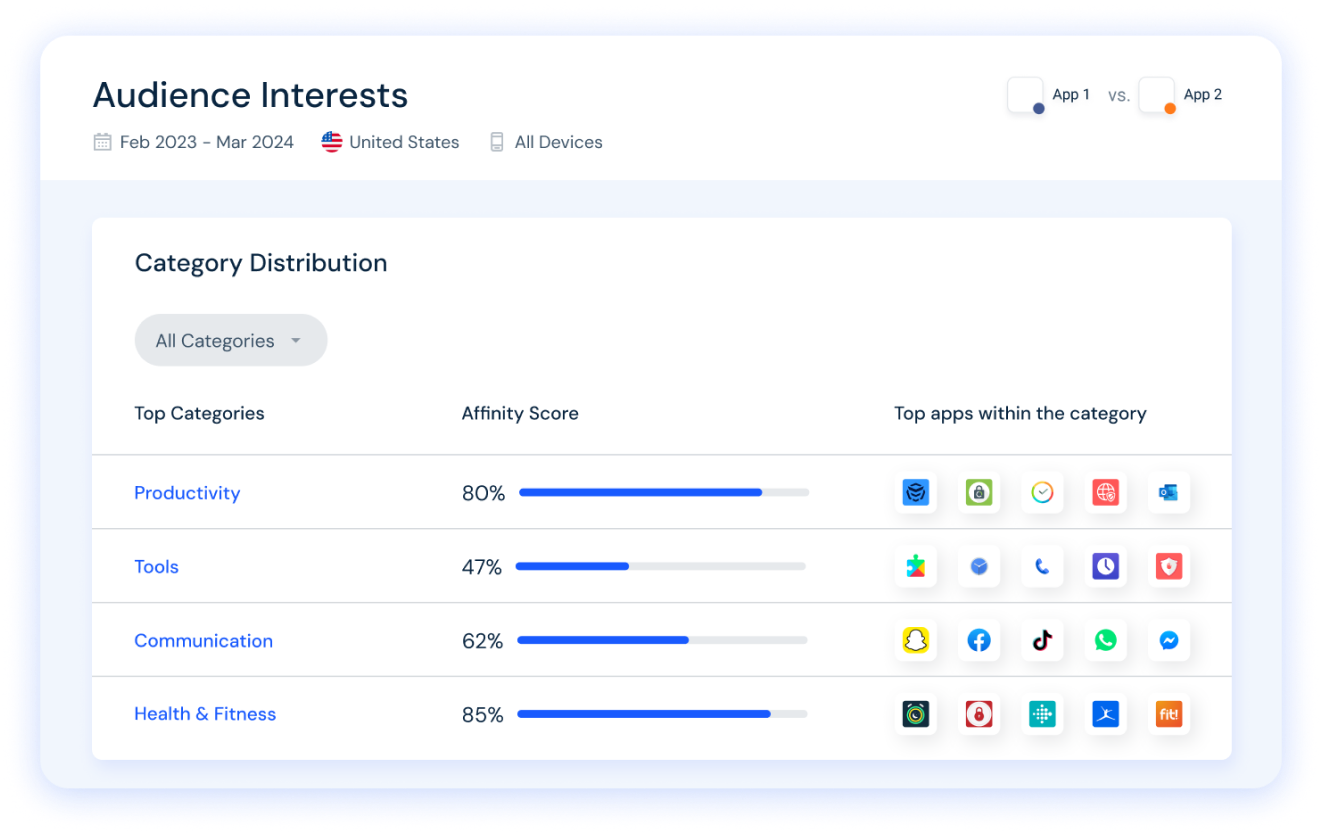

Get insights into category-level data for any app. Analyze top competitors in each category to gain a competitive edge in the app stores.

Start free trial

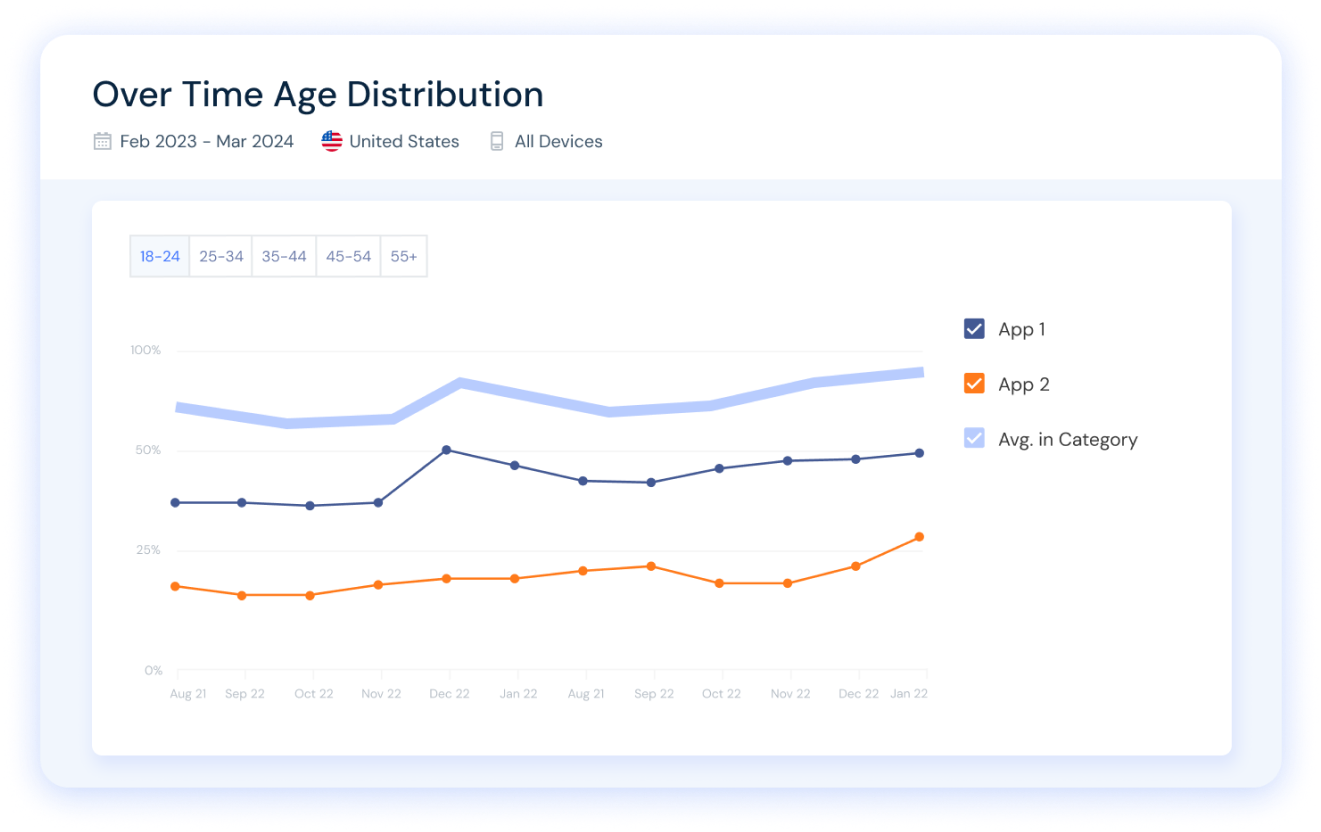

Analyze any app’s audience demographics over time, understand your target audience, and optimize store positioning and distribution.

Start free trialFree App Intelligence Tools

Check the ranking stats for the top apps in any country or category, for both Android and iOS. Choose any category or country below to see the most popular apps ranked by usage.

Analyze the top apps in over 200 countries to gain insights into market behaviors and leading apps. Identify regional opportunities and new markets to target.

Discover the most popular apps in 200+ categories and gain the insights needed to beat the competition. Analyze top industry players and adopt best practices suited to your ASO strategy.

Explore the leading iOS apps across virtually any country to understand market behaviors and regional leaders. Identify new growth opportunities and geos.

Surface a list of the most used apps in 200+ categories and find out how to outpace the competition. Use our insights to analyze top industry players and adopt best practices tailored to your digital strategy.

Unlock industry-leading app usage data and gain valuable insights into your competitors' app store strategies, including App Store Optimization (ASO). Analyze daily usage and user retention, uncover key mobile penetration metrics, and identify growth opportunities to grow your app market share.

Try it now for free