You’ve hit your search limit

Start your free trial to keep exploring full traffic and performance insights.

Get Started- Home

- Free App Analytics

- Found: Business Banking

Found: Business Banking app analytics for January 18

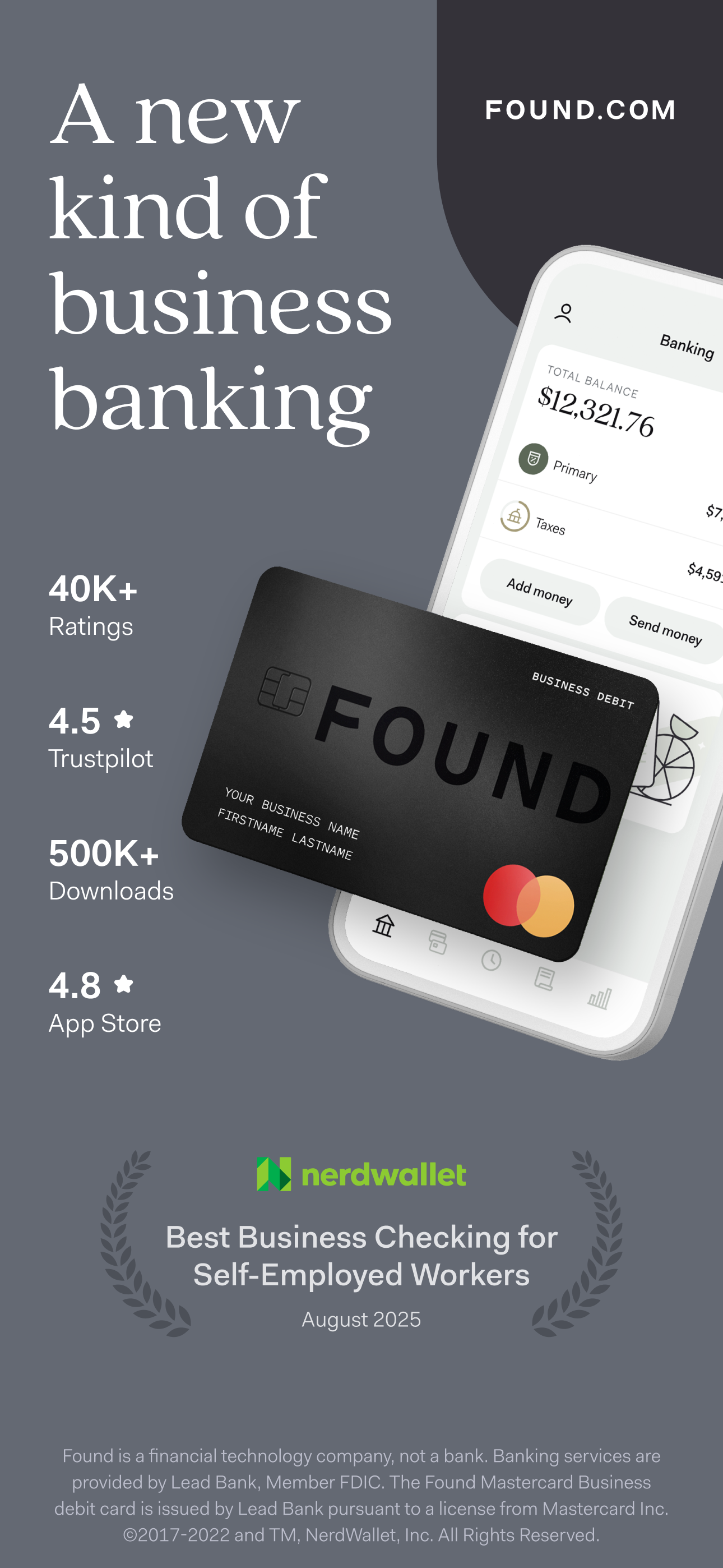

Found: Business Banking

- Indie Technologies Inc

- Apple App Store

- Free

- Finance

Small businesses love Found. With robust business checking plus smart bookkeeping and tax tools, Found simplifies your entire workflow. Track expenses, save receipts, save for taxes, send invoices, and pay contractors—all from the app. And all without costly hidden fees. Get so much more for free with Found.

FAST & FREE SIGN UP

Sign up free in minutes

No credit check or minimum balance

No minimum balance or monthly maintenance fees

BUSINESS BANKING

Get paid up to 2 days early with direct deposit*

Organize, budget, and save with pockets

Create multiple virtual cards for flexible spending

SMART TAX TOOLS

See your tax estimate and auto-save for taxes

Find write-offs for easy tax savings

Auto-fill tax forms like Schedule C and 1099

Pay taxes right from the app**

BUILT-IN BOOKKEEPING & EXPENSE TRACKING

Automatically track and categorize your expenses

Save receipts digitally and add notes

Import transactions from other apps or sources

Send unlimited free invoices

SAFE AND SECURE

Deposits are insured up to $250K through Lead Bank, Member FDIC

Lock your card at any time directly from the Found app

Stay informed with real-time transaction notifications

Disclosures

Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The Found Mastercard® Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category.

*Direct deposit funds may be available for use for up to two days before the scheduled payment date. Early availability is not guaranteed.

**Tax payments are available for Found Plus subscribers who file a Schedule C.

***Found's core features are free. Found also offers two optional paid products, Found Plus for $19.99/month or $149.99/year and Found Pro for $80/month or $720/year.

Store Rank

The Store Rank is based on multiple parameters set by Google and Apple.

All Categories in

United States--

Finance in

United States--

Create an account to see avg.monthly downloadsContact us

Found: Business Banking Ranking Stats Over Time

Similarweb's Usage Rank & Apple App Store Rank for Found: Business Banking

Rank

No Data Available

Found: Business Banking Ranking by Country

Counties in which Found: Business Banking has the highest ranking in its main categories

No Data to Display

Top Competitors & Alternative Apps

Apps with a high probability of being used by the same users, from the same store.

Lili - Small Business Finances

Lili Financial Services LTD

Novo - Small Business Checking

Novo Platform Inc.

Bluevine

Bluevine Capital Inc.

Relay | Business Banking

Relay Financial Technologies Inc.

January 18, 2026