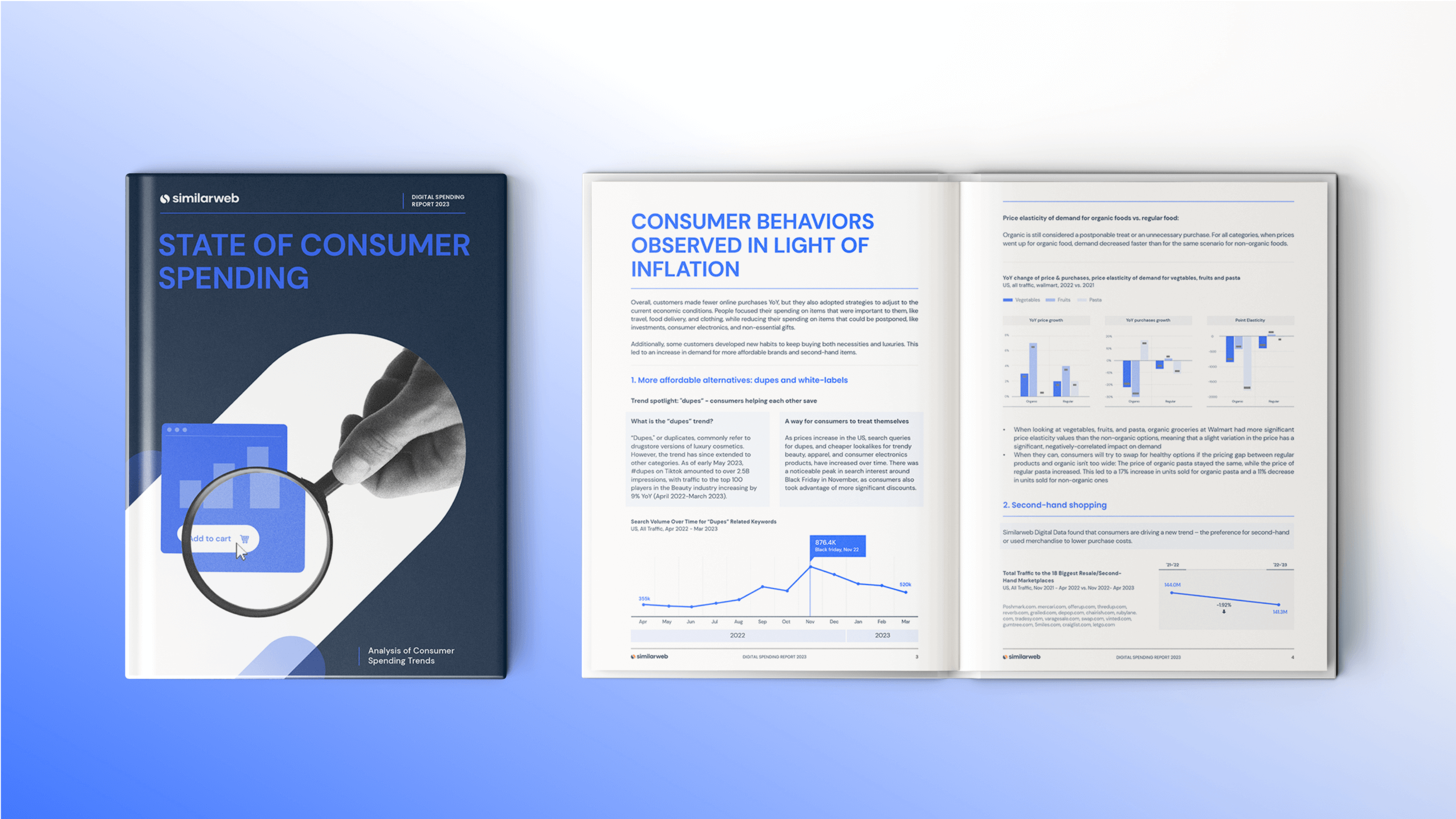

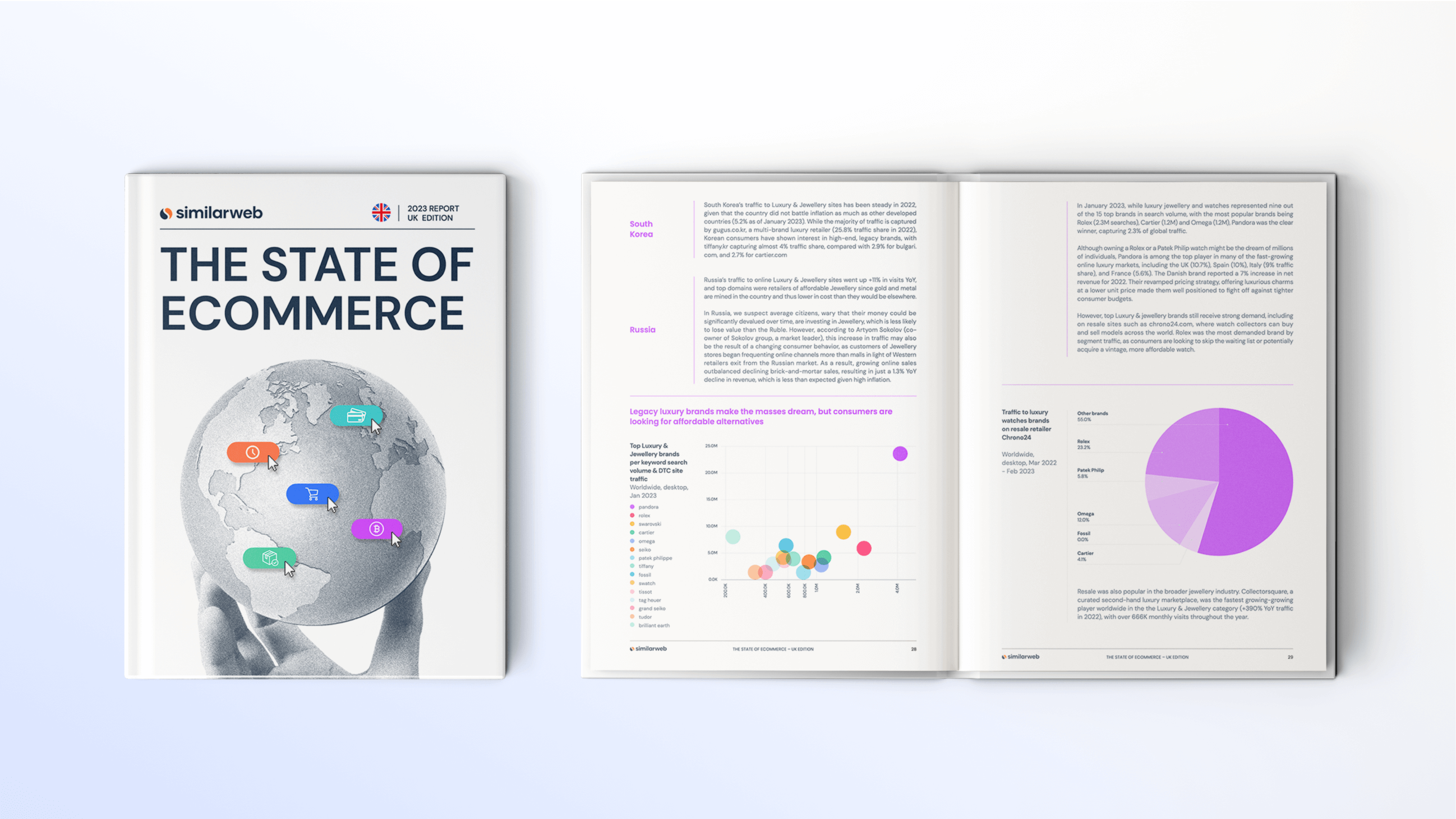

While we found that web traffic to all ecommerce sites remained stable in 2023 (-1% YoY), retailers face new challenges in 2024 in light of cost-conscious spending and expectations for personalized buying experiences.

So how can you stay ahead in an industry that’s constantly in flux? With The State of Ecommerce as your guide.

This comprehensive analysis of current market trends, challenges, and opportunities will help you align and adapt your strategy for the year ahead.