This white paper was written in 2017. Now you can access the full report here for free.

Looking for the latest data? Try Similarweb now for free.

In this report you will find:

1) Contrasting conversion rates for women’s and men’s jeans

2) Indication of conversion rate seasonality

3) External traffic sources and the conversion rate per source, per category

4) On-site search terms (exact match and broad match) and their conversion rates

Introduction

This deep-dive digital insights report focuses on a single eCommerce site, amazon.com, and looks at the conversion funnel for jeans purchased at the site. Tracking external searches coming into amazon.com together with on-site search keywords offers a comprehensive review of customer behavior, from search through to purchase. The focus on search keywords brings insight into specific trends and patterns within a clothing vertical as well as within a brand with multiple variants.

A review of jeans marketed separately to men and women provides an additional behavioral dimension to this deep dive.

Methodology

This paper looks at incoming traffic to amazon.com from September-December 2016 from the U.S. only. Incoming traffic was divided into searches for women’s jeans and searches for men’s jeans. In each instance, the traffic was identified by its source. Once the traffic arrived at amazon.com it was monitored to determine the conversion rate per session. An additional set of data looked at keywords used to search for jeans within the amazon.com domain. Once again these were tracked to calculate the conversion rate per session for these searches.

Conversion rate overview women’s and men’s jeans

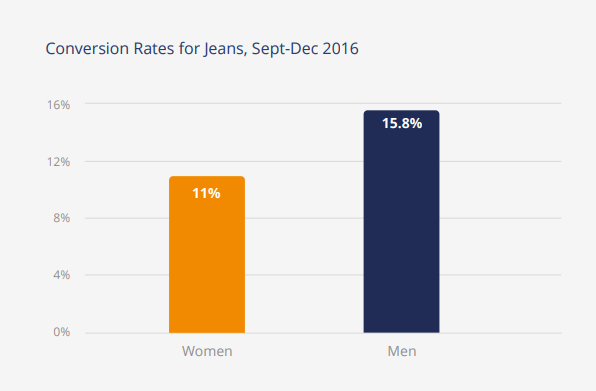

At the highest level, there was a significant gap between the behavior of people shopping for women’s jeans and for men’s jeans.

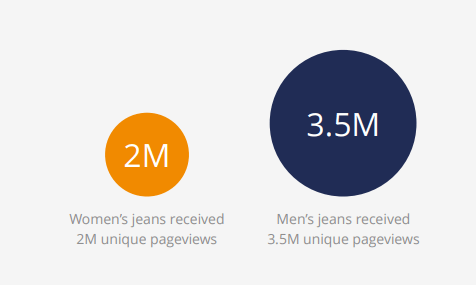

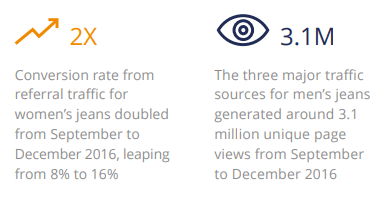

The total number of unique pageviews on amazon.com from September to December 2016 that included women’s jeans was 2 million. There were 3.5 million unique pageviews that included men’s jeans in the same period. In terms of unique pageviews that converted to sales, women’s jeans saw a weighted average conversion of 11% between September and December 2016. The weighted average conversion rate for men’s jeans was 15.8%.

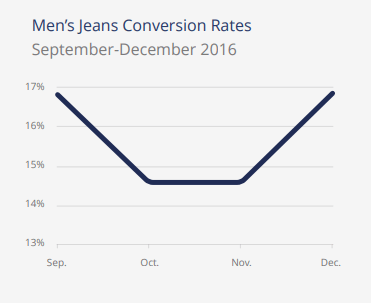

Both women’s and men’s jeans saw their conversion rates peak in December at 13.5% and 16.8% respectively.

Conversion rates over time

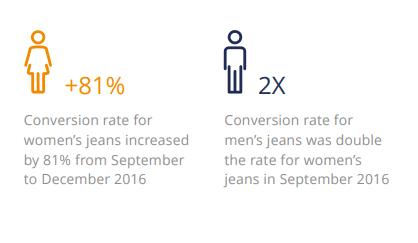

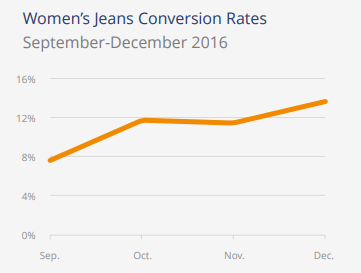

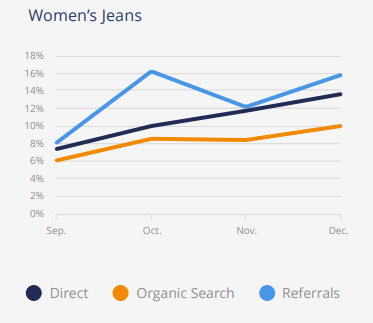

The conversion rates for consumers buying women’s jeans rose impressively between September and December 2016 suggesting a certain amount of seasonality in these purchases. Starting below 8% in September, the conversion rate for women’s jeans reached 13.5% in the last month of the year

There was no significant boost to the conversion rate for women’s jeans over the whole month of November which includes Thanksgiving and other traditionally busy days.

The conversion rates for men’s jeans exhibited a different pattern. In September the conversion rate for men’s jeans was more than double the rate for women’s jeans. It’s unclear what the reason for this discrepancy was, perhaps a back-to-school promotion or some kind of gendered seasonality, but it bears further investigation.

Traffic sources to amazon.com for women’s and men’s jeans

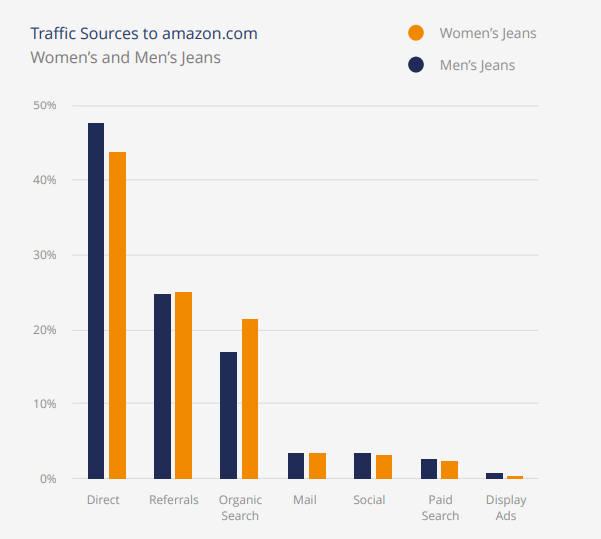

Breaking down the incoming traffic to amazon.com by source reveals fairly similar patterns for women’s and men’s jeans. These sources include all traffic coming to women’s and men’s jeans whether or not it converts to a completed purchase.

Both these products get the largest share of traffic from consumers arriving directly to amazon.com, usually from entering the URL straight into the address bar.

This behavior is slightly more typical for people searching for men’s jeans than for women’s jeans. The corollary of this is that traffic from organic search is higher for women’s jeans than for men’s jeans. This would seem to suggest that people searching for men’s jeans are slightly more likely to start on amazon.com, while people searching for women’s jeans are more likely to use a search engine to give them some ideas with links to competing sites.

Conversion by traffic source

Focusing on the three largest sources of traffic, there are notable differences between the conversion rates for each channel for women and men. In both instances, traffic arriving at amazon.com organically, achieves the lowest conversion rate, while the pattern of conversion rates for each channel over time varies by gender.

Breaking out the conversion rates for women’s jeans based on the source of the traffic to amazon.com delivers some fascinating insights. While the volume of traffic coming directly to amazon.com is almost twice as high as the volume from referrals, the conversion rate for referral traffic is the highest of all sources

For men’s jeans, the source of traffic had a more complicated relationship with its conversion rate. Over the last four months of 2016, the conversion rates for direct and referral traffic to amazon.com stayed fairly even, ending the year around 4% higher than the rates in September. In the same period, the conversion rate for traffic from organic search, powered by SEO efforts, dropped by 21%.

On-site search terms by conversion rate

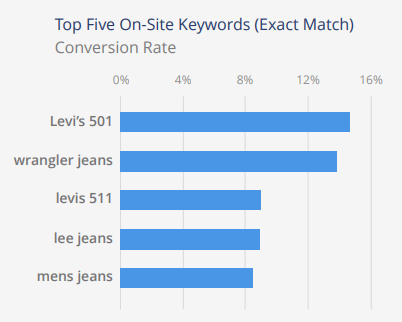

Reviewing on-site search behavior makes it possible to determine the highest converting keywords that consumers use to find jeans once they are already visiting amazon.com. Slicing the conversion rates for on-site search in a number of different ways reveals much about the way consumers relate to specific brands or a particular fit of jeans.

The average conversion rate for searches using a jeans-related keyword is just over 6%. The top five on-site jeans-related keywords on amazon.com from September to December 2016 included three different brands, Levi’s, Wrangler, and Lee, and the more generic term men’s jeans. Their conversion rates all considerably outperformed the average.

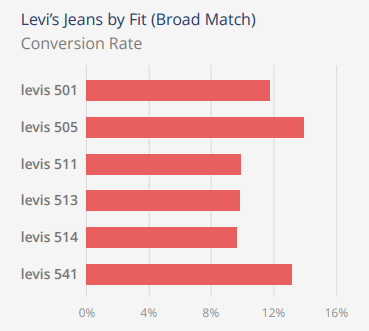

Drilling down still further, Similarweb was able to specify the conversion rates for broad match keywords that correlate to specific models of Levi’s jeans sold through amazon.com. This remarkable level of granularity and precision relates to the positioning and on-site marketing surrounding each fit of jeans

Similarweb digital insights

Digital Insights leverage the power of Similarweb’s extensive data set, covering 80 million websites across more than 190 countries, accessing advanced insights not available anywhere else. Similarweb provides tailor-made answers to some of the biggest, most strategic questions. Using Similarweb’s exclusive reports, brands have 360-degree visibility across all retailers to take back control over sales, track the funnel and performance of brands/ categories within retailers, and access the online behavior of their target audience in order to attract, convert and retain customers.