Several stocks, once deemed the darlings of the pandemic, have “round-tripped” and now trade at or below pre-pandemic levels, despite substantial growth of the base of the business.

For most in this group, business model realignments are already underway. Given the scale of disruption over the past two years, it may take time for these new business models to emerge and generate returns.

Nearly all the broken darlings are leaders or dominant in their respective sectors and will be on the edge of adapting to a post-pandemic reality.

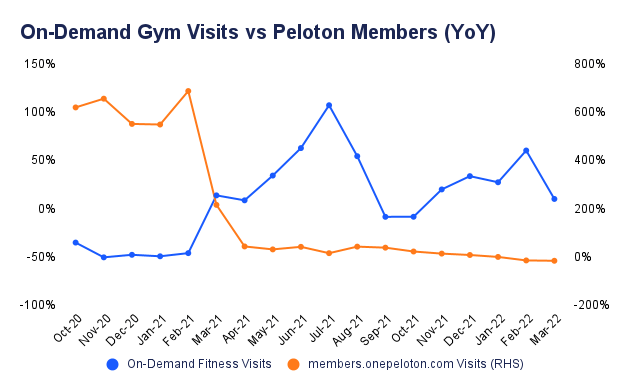

- Peloton faces competition from at-home fitness players and the gyms and studios that disrupted the fitness industry pre-pandemic. Peloton’s net new connected fitness subscribers are measured by checkouts to Connected Fitness Products (excluding digital only) net of cancellations.

- Zillow’s direct visit growth (where users navigate to a website without a referral or search engine, and an indication of brand loyalty) shows promising stabilization into 2022 after months of shrinkage.

- To stay competitive, Redfin needs repeat users with high intent. By this measure, retention on Redfin’s platform has been steady, accounting for about 67.3% of the total user base, and growing by about 9.7% over the trailing 12-month period on a gross basis.

Get more digital insights on Peloton, Zillow, Redfin, and other pandemic winners in the full report.