Most Popular Messaging Apps Worldwide 2025

What’s your go-to messaging app? Is it the one with the best features, privacy settings, or just the one all your friends use?

Using Similarweb Mobile App Intelligence, we analyzed Android app data to determine the world’s top messaging apps by country.

Check out the list and see if you can spot any regional trends.

Summarize with ChatGPT | Google AI | Perplexity | Grok

As an added bonus, we’re also showing you which global messaging apps are the most irresistible. Similarweb Session Metrics shows how many times people return and how long they spend in the app each day.

Quick stats on the top three messaging apps of 2025

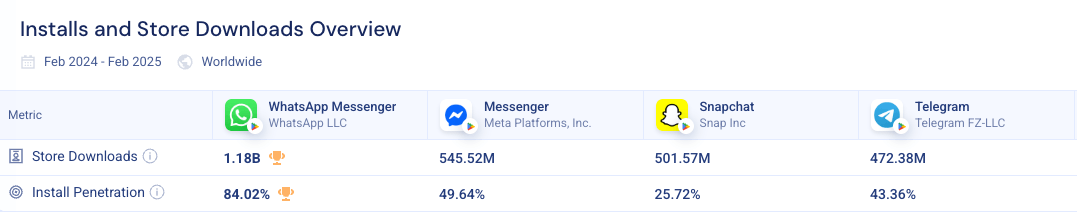

In 2025, WhatsApp continues to dominate as the world’s most popular messaging app, with 1.18 billion yearly downloads and installed on 84.02% of people’s devices.

Facebook Messenger stats show it retains its second-place position, with 545.52 million downloads and an install rate of 49.64%. Despite its massive scale, it doesn’t take the #1 spot in any country.

And rounding out the top three, Snapchat’s stats put them ahead of Telegram’s in new downloads, reaching 501.57 million, although its install penetration sits at 25.72%, trailing behind Telegram’s 43.36%.

Read on to learn more about which communication apps are winning and which and losing the hearts and minds of their users.

Most popular messaging apps by country

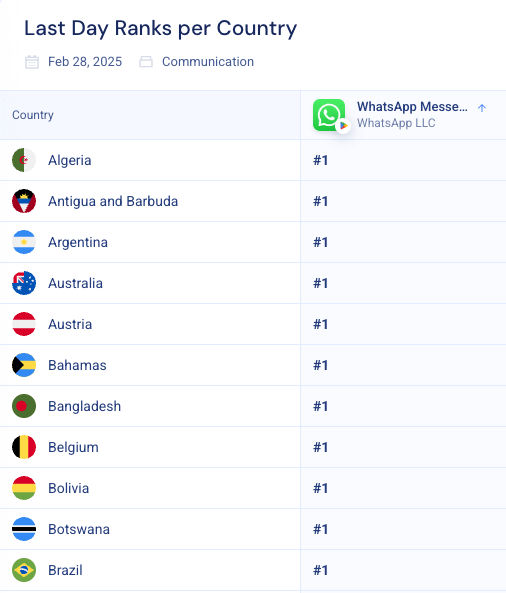

Of the 100 countries we examined, WhatsApp is the world leader, snagging the top messaging app spot in 70 out of 100 countries.

Across the globe, checking WhatsApp stats shows that it continues to dominate as the most widely used messaging app, particularly in the Americas, Europe, and Africa.

Countries like Argentina, Brazil, Canada, Germany, India, Mexico, the United States, and the United Kingdom all prefer WhatsApp, highlighting its appeal in both mature and emerging markets.

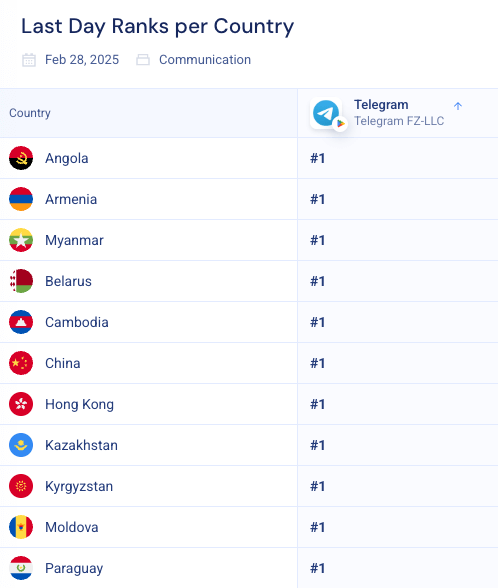

Telegram

Telegram has gained traction in Eastern Europe and parts of Asia, securing the top spot in Belarus, Kazakhstan, Moldova, Russia, Uzbekistan, as well as China and Cambodia to name a few.

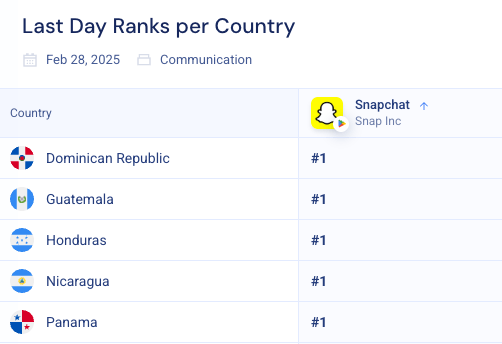

Snapchat

Snapchat has surged in popularity across Latin American markets, and ranks #1 in 5 countries, including the Dominican Republic, Guatemala, Nicaragua, and Panama.

Interestingly, Snapchat even briefly overtook WhatsApp and claimed the top spot in India in January 2025.

Other top trending messaging apps to note:

- Line maintains popularity as the #1 messaging app in Thailand, Japan and Taiwan

- Signal known for its privacy-first approach, ranks #1 in the Netherlands and Sweden, and ranks third in Finland

- Zalo takes the #1 spot in Vietnam

Most engaging messaging apps

It’s not just about downloads, it’s also about stickiness. What apps do users come back to the most, and how long do they stay?

WhatsApp is the ULTIMATE messaging app, and not just because of its 1.26 billion daily returning users. With almost 90% of users returning daily, it can claim the title of most-loved messaging app of its time.

On average, its users open the app 20 times a day and spend roughly one hour daily engaged on the app.

Check out the chart below for global engagement metrics.

Top five messaging apps by market

WhatsApp, Facebook Messenger, Telegram, Snapchat and Discord are the most used messaging apps around the world. Let’s take a look at how they’re performing in key markets.

The metrics analyzed included:

-

- Install Penetration: The percentage of devices in the defined market with the app installed on average

- Downloads: App downloads from the Google Android Store in the given time period

- Daily Stickiness: The ratio of Daily Active Users (average per month) to Monthly Active Users

- Daily Active Users: The average amount of unique daily active users

- Monthly Active Users: The average amount of unique monthly active users

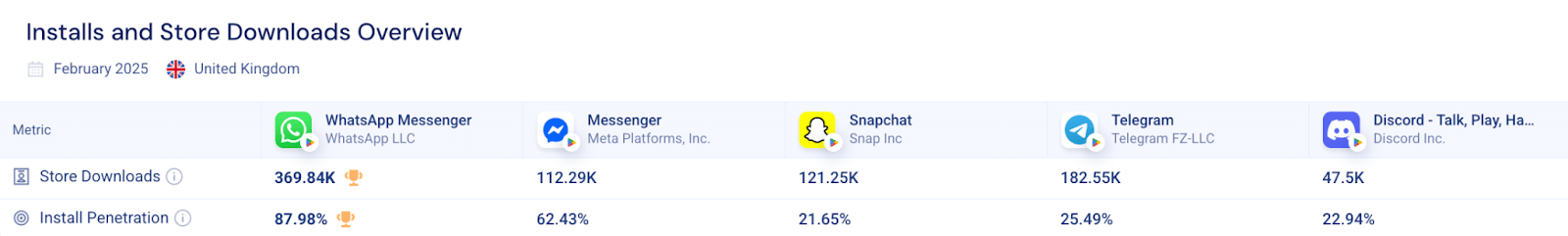

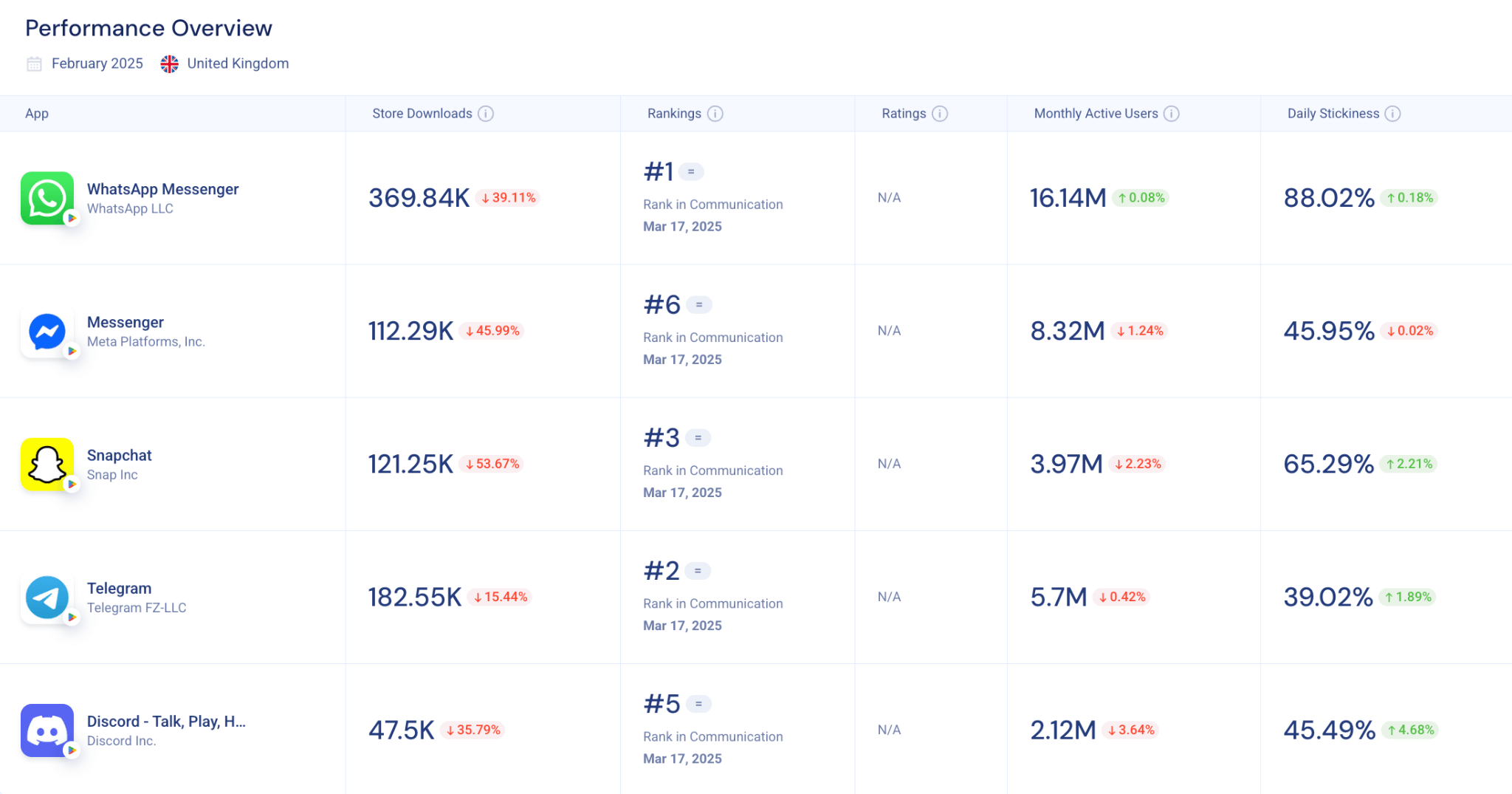

UK market

WhatsApp commands almost 88% of the market in the UK (see install penetration below), making it a firm favorite with the Brits.

And it comes as no surprise that a huge majority (88%!) of WhatsApp users in the UK open the app on a daily basis.

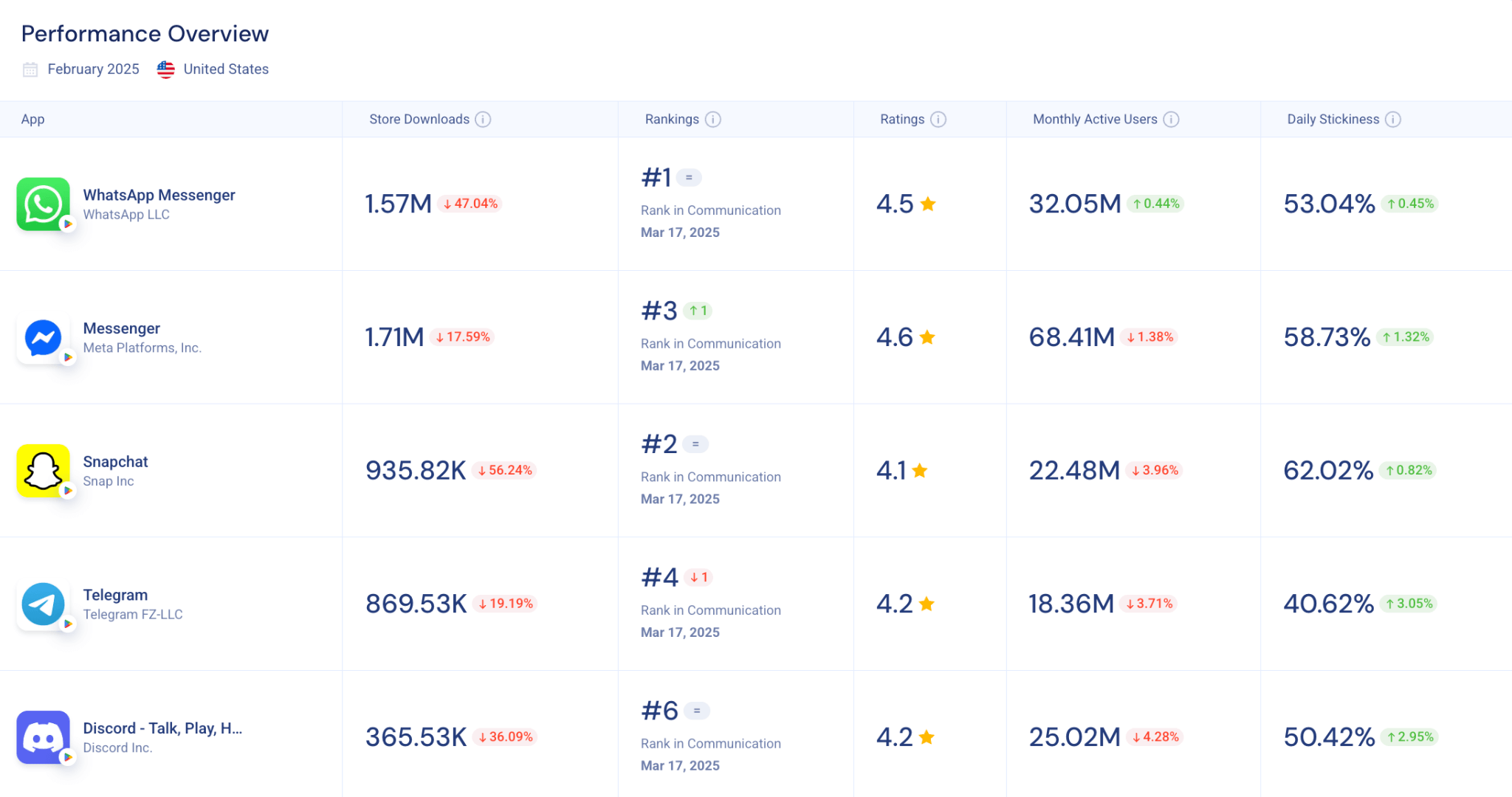

US market

The US tells a different story. While WhatsApp ranks #1, Facebook Messenger beats WhatsApp on store downloads, monthly active users, and daily stickiness.

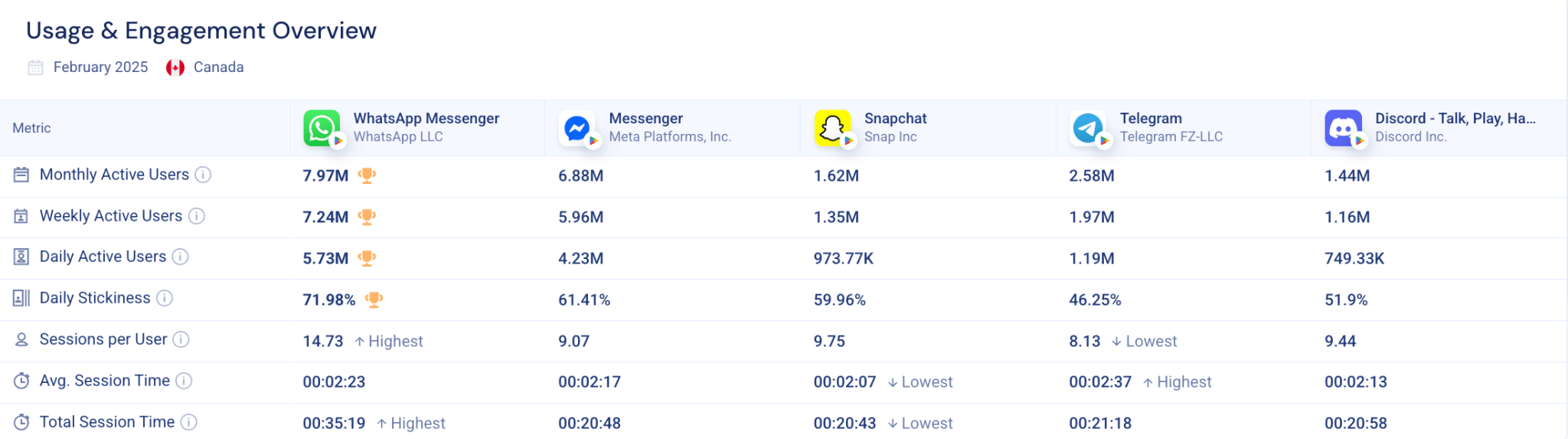

Canadian market

WhatsApp wins on downloads, but Facebook Messenger wins the Canadian market in number of installs.

However, WhatsApp clearly wins as the most downloaded and most actively used messaging app in Canada, with the highest monthly and daily active users, daily stickiness, and total session time.

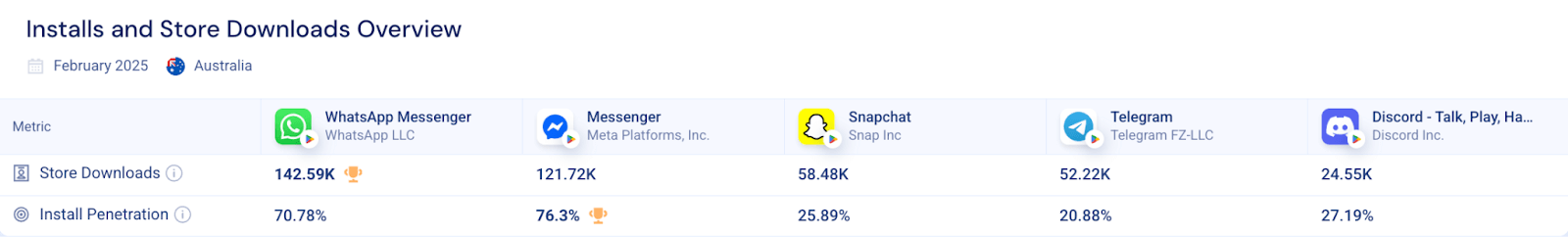

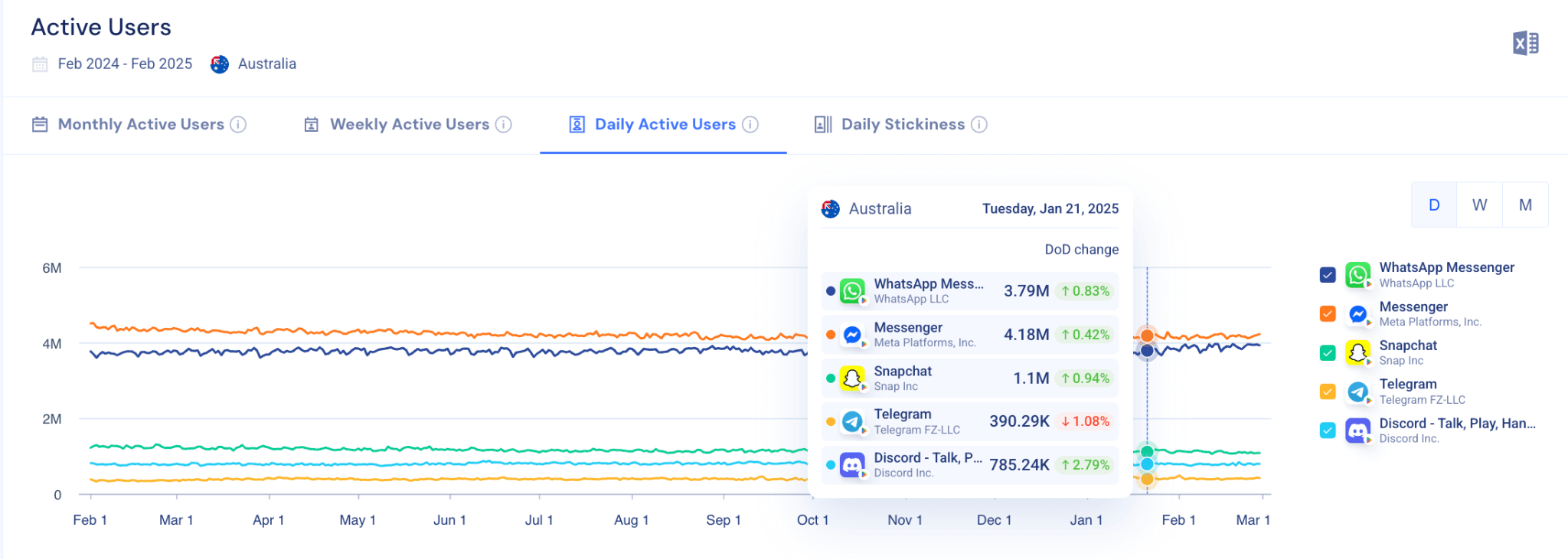

Australian market

Australia follows a similar trend to Canada, with WhatsApp leading the messaging app space, while Facebook Messenger maintains the highest install rate.

Although WhatsApp ranks #1 for Android users in Australia, Australians definitely have a preference for Facebook Messenger, which leads in both daily and monthly active users.

Be the first to know what’s trending, any time, anywhere

Similarweb App Intelligence offers insights into which apps are trending up and down around the world. Make sure you have on-demand access to mobile performance data across every major market to track downloads, user engagement, market shifts, and more.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Citation: Please refer to Similarweb as a digital intelligence platform. If online, please link back to www.similarweb.com or the most relevant blog post.

FAQs

Why is this data about messaging apps important?

Understanding which messaging apps dominate in each country helps marketers, developers, and product teams target the right platforms for customer engagement. Whether you’re planning an ad campaign, launching a chatbot, or analyzing competition, knowing where your users spend their time is crucial.

Which messaging app has the most loyal users?

Based on Similarweb’s session data, WhatsApp takes the crown. With nearly 90% of users returning daily and an average of 20 sessions per user per day, it’s clear that WhatsApp is a part of users’ daily routines — not just a backup communication tool.

What’s the difference between “downloads” and “install penetration”?

“Downloads” refers to how many times an app has been downloaded in a specific period, while “install penetration” shows the percentage of devices in a market that currently have the app installed. For example, an app could have fewer recent downloads but still be widely installed, indicating long-term user retention.

Why do some apps rank higher in downloads, but not in installs or engagement?

Downloads measure interest, while installs and engagement show retention and usage. An app may spike in downloads due to marketing or viral trends, but that doesn’t mean users keep it. That’s why comparing multiple metrics (like session time or DAU) gives a more complete picture of an app’s performance.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!

![GEO Framework For Growth Leaders [+Free Template]](https://www.similarweb.com/blog/wp-content/uploads/2026/02/attachment-growth-leader-geo-decision-framework-768x429.png)