Research Intelligence

Research Intelligence

Market Research Tips Straight From the Experts

Rather than simply write another guide, I’ve spoken to industry leaders and research experts to bring you actionable market research tips – backed up with real-life examples. And as if that wasn’t enough, I’ve included ten mistakes to avoid. And believe us, these mistakes are more common than you might think.

Regardless of your business, product, or industry, chances are, there’s already another company out there doing the same thing. Focusing on what you want to achieve is crucial, but can often get forgotten.

Seven growth-focused market research tips

- Don’t just focus on the big players

- Qualitative tells you ‘what’, quantitative shows you ‘why’

- Look at the sample size carefully

- Choose the right market research methods

- Make market research part of your monthly routine

- Think of yourself as a customer – often

- Only use trusted, verifiable data sources

Tip #1 – Don’t just focus on the big players

Why it matters:

Trying to emulate the successes of prominent players in your market can be a major source of distraction. This is why this market research tip, cited by multiple sources tops the list. These bigger brands often operate with complacency, exposing them to emerging threats from dynamic market changes. By considering industry leaders and those experiencing rapid growth, you see the tactics and channels working in current market conditions. You’ll also learn about alternative strategies being used by brands that are more in tune with current consumer needs.

How can you replicate:

Don’t focus on market share alone. Instead, review industry growth trends. Then, explore how the fastest-growing brands are commanding a share of interest higher by drilling down into traffic channels, keywords, and referral sources.

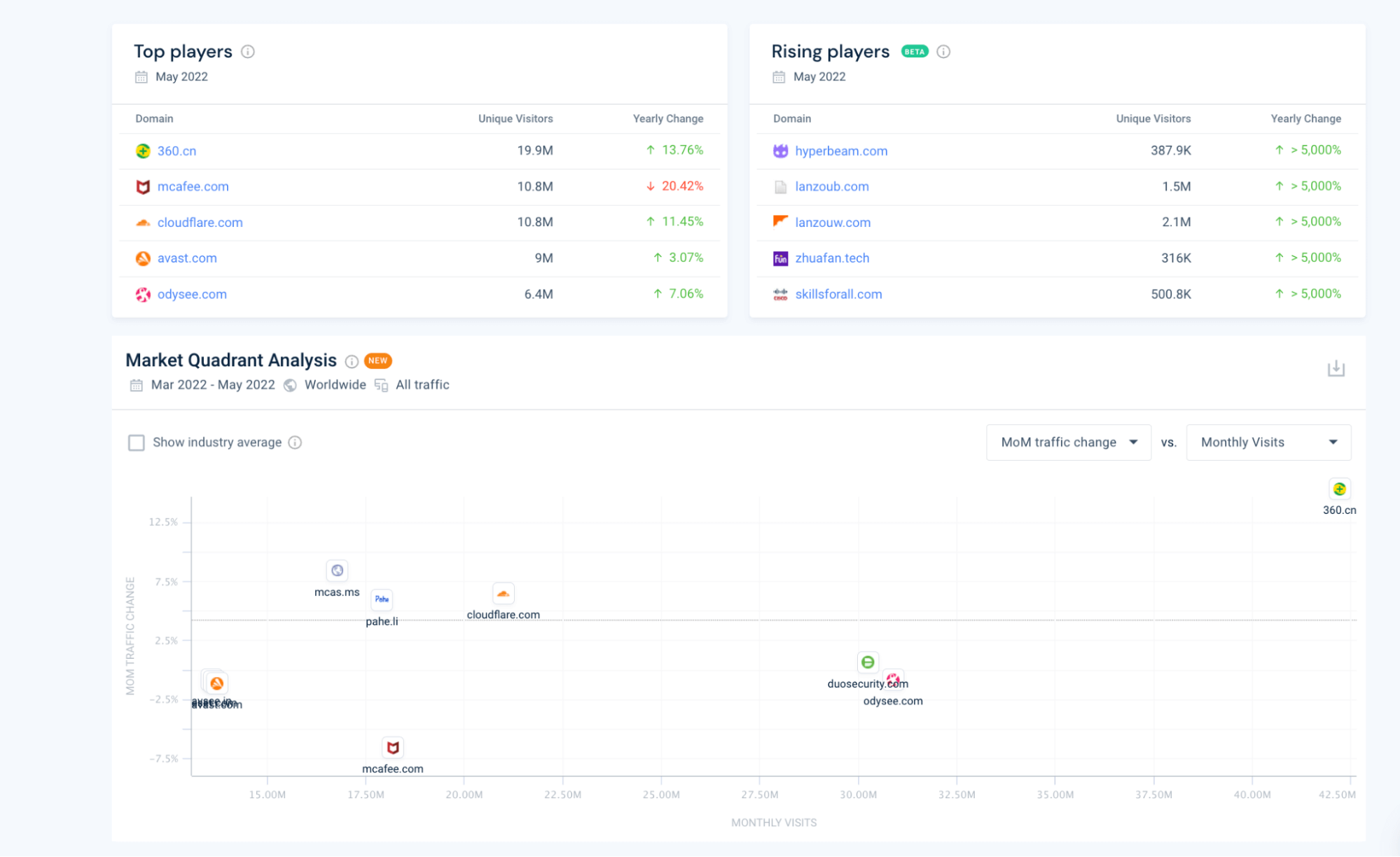

Using the industry trends feature, you see who the top players in an industry are; along with rising players, and their subsequent growth by the number of visitors and yearly change as a %.

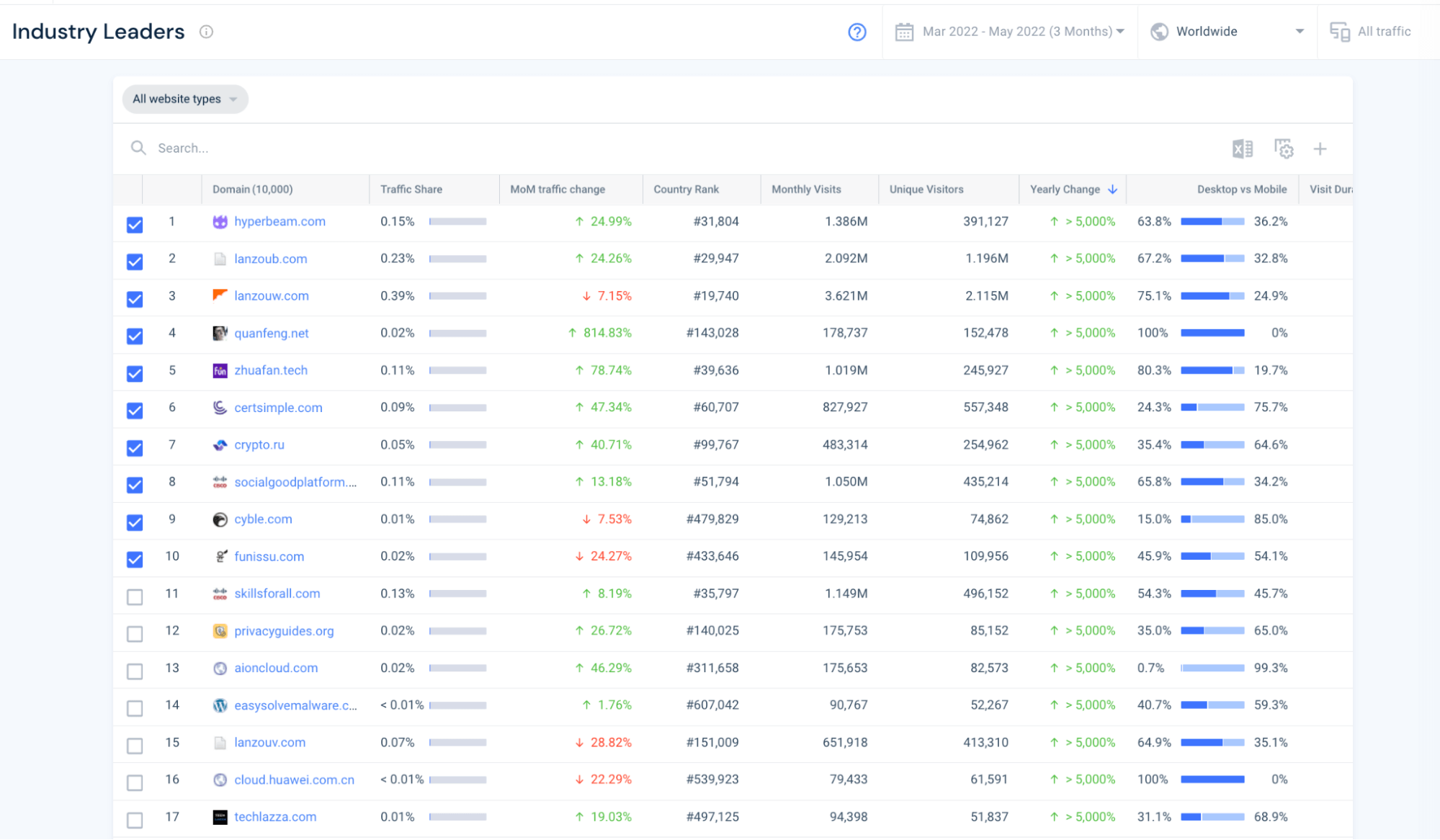

I sorted the results by yearly change %. This places the fastest growing players at the top of the list. View unique visits, bounce rate, desktop vs. mobile split, visit duration, no. of pages, and more.

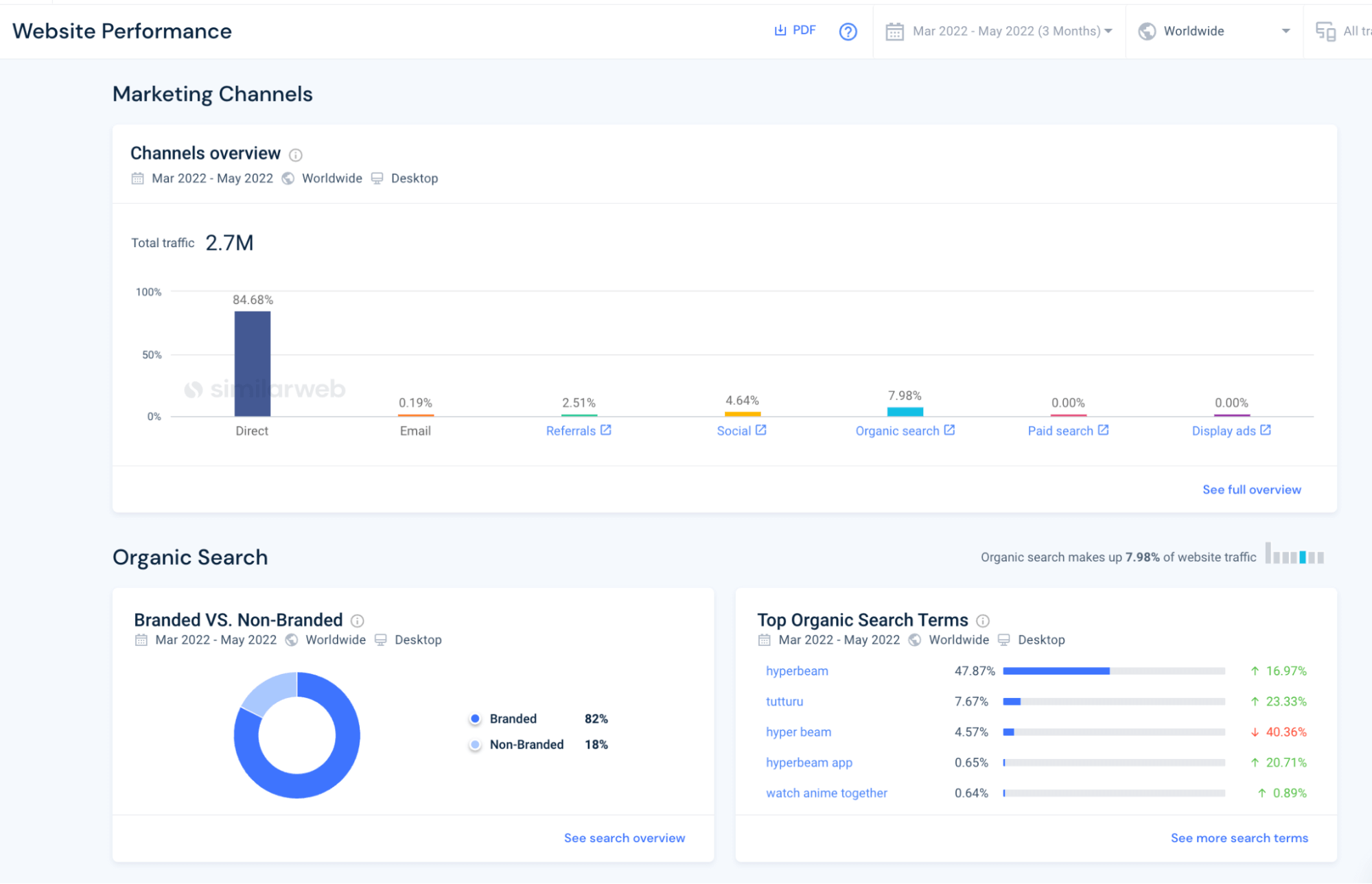

By looking at a specific player in more detail, you can get a full picture of their market channel’s performance, including branded vs. non-branded, total traffic per channel, and top organic search terms.

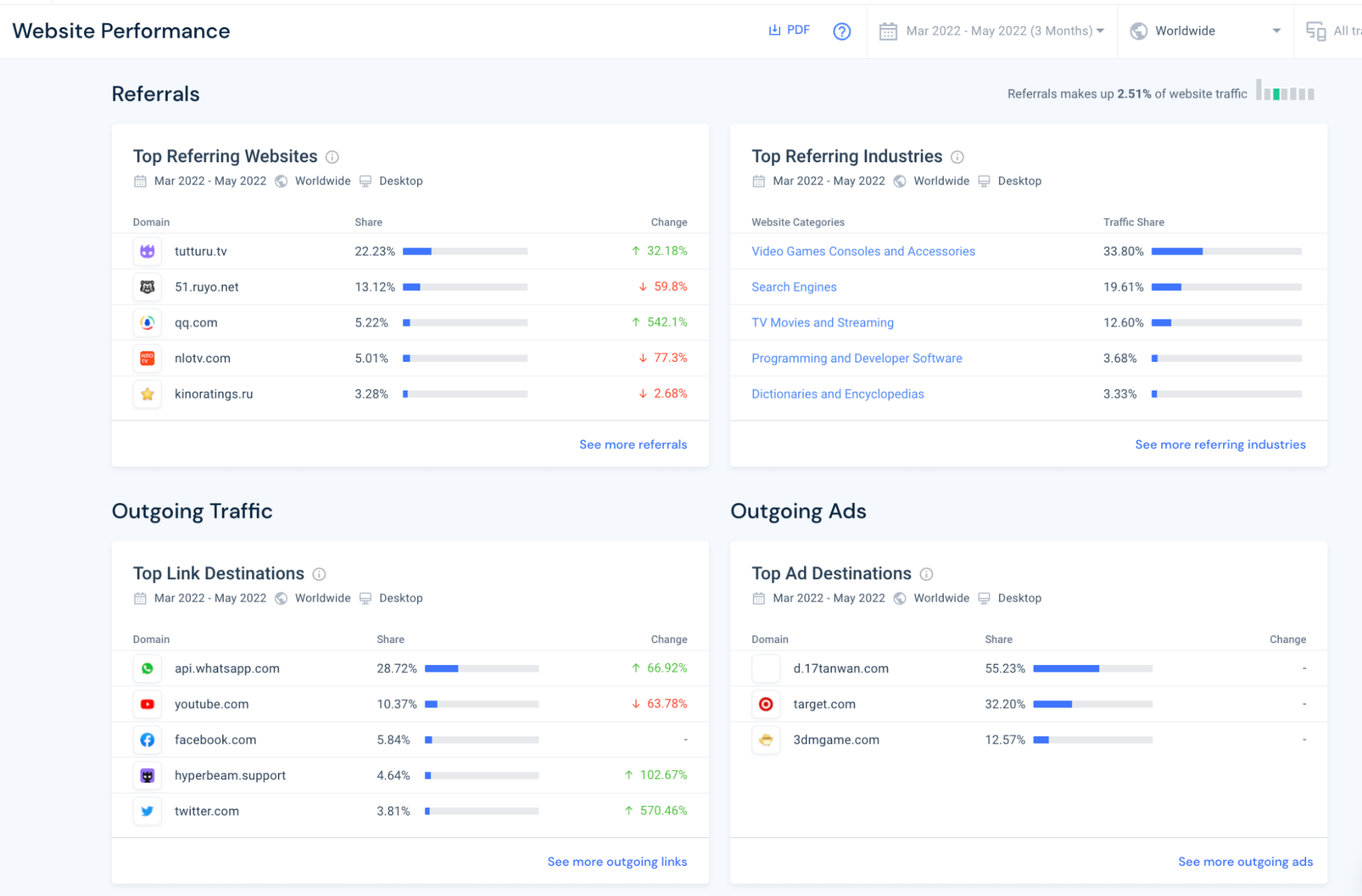

View top referring websites and industries, top link destinations for outgoing traffic and ads. See where and how the fastest growing names in a market are gaining a competitive advantage.

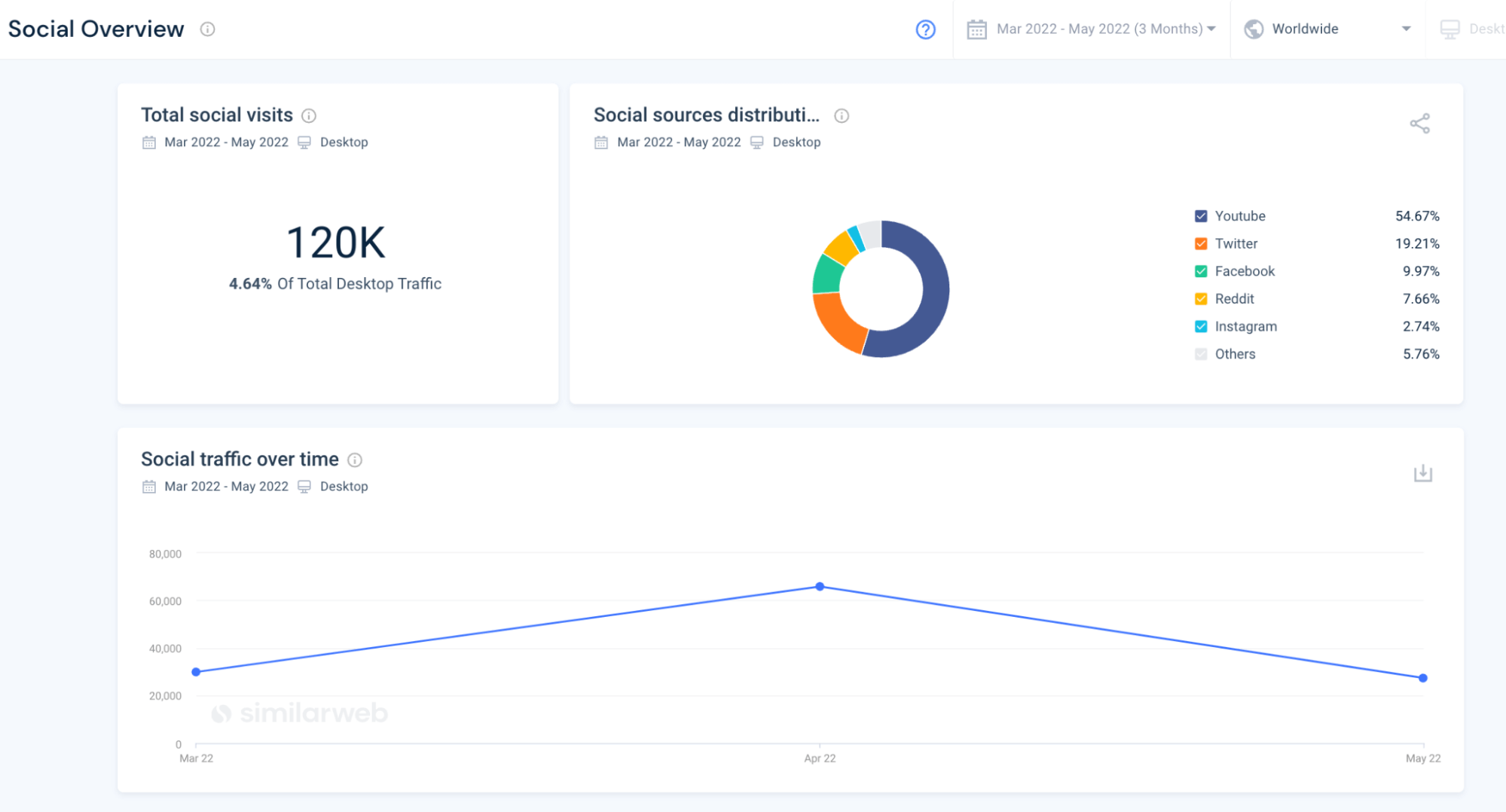

A quick look at the social media overview for the business tells us exactly which channels are working, and those which aren’t.

There’s a whole lot of value to be gained from rising stars in your industry. It’s vital you examine their successes, sources, channels, and tactics in-depth.

Tip #2 – Quantitative tells you ‘what’, qualitative shows you ‘why’

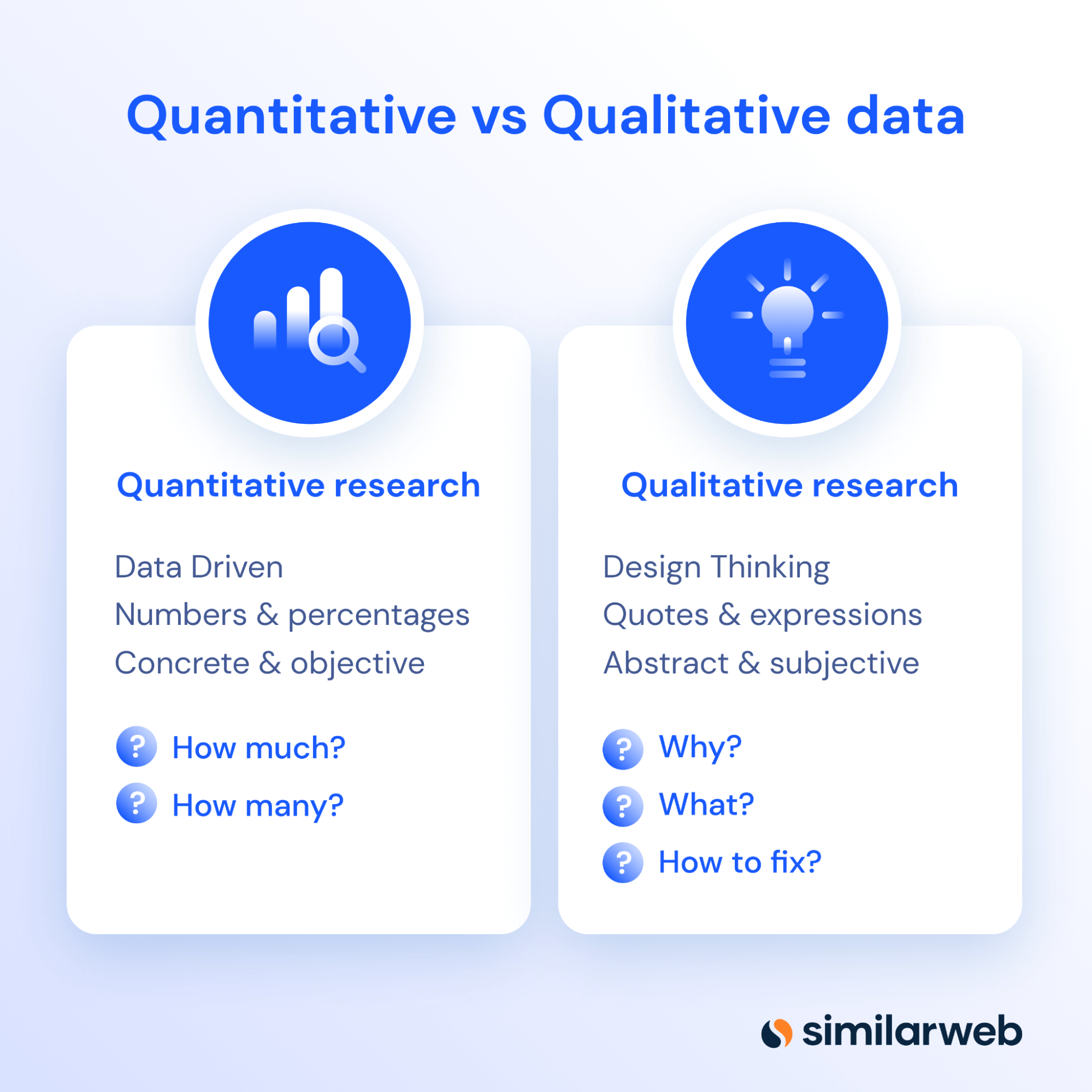

Why it matters: Quantitative research gives you a statistically-robust measurement of what is happening and by how much. But it won’t reveal the ‘why’ – that’s where qualitative research comes into play, and why this market research tip is so important.

What did the expert say? “We conduct a wide range of quantitative and qualitative research, but when it comes to gathering consumer insight, we favor in-depth qualitative research to really help us understand why consumers purchased a product or uncover how they feel about a specific competitor. Essentially, it allows us to better understand and anticipate customer demands, which impacts strategy and messaging”.

How can you replicate: Use our guide to desk-based research to uncover the best ways to do cost-effective, qualitative research. Next, use market research surveys, and look at your competitor’s online reviews to discover the likes and dislikes of your target buyer personas.

Read More: 83 Qualitative Research Questions & Examples and 98 Quantitative Market Research Questions & Examples

Tip #3 – Sample size

Why it matters: When looking to back-up plans or assumptions with hard data, it’s easy to get excited when you find information to support a theory. But, you must ensure any market analysis data has a robust enough sample size of participants to inform key decisions. Most market research intelligence platforms only report results where there is confidence in the sample size and data accuracy. Still, not all research follows this approach and may therefore mislead you.

What did the expert say? “Using good market research tools is highly beneficial to help inform your initial market analysis. Statistics and surveys on a broad sample range must always be considered. There are also free tools such as Google Scholar aid which can further help the process, giving you genuine results from sizeable research studies.

How can you replicate: Use market research tools like Similarweb Digital Research Intelligence for initial market analysis. Then, find other data sources, such as government or trade association reports and scholarly research. Avoid using branded reports or those with a sample size of fewer than 1,000 participants. The only exception is if you find studies that directly relate to your product, industry, or target demographic; in this case, a sample size of >500 could be highly relevant.

Tip #4 – Choose the right market research methods

Why it matters: In recent years, market research methods have shifted. Although surveys and focus groups are considered staple market analysis methods, social listening, and social media data analysis have become more relevant. In a world flooded with information, selecting the best research methods will help you extract insights on market at any time. Many business leaders I spoke with during my research cited this as one of their top market research tips.

Where’s the proof?

We feel so strongly about this one, so we got two founders to share their experiences and insights.

“When we started our business, we had to explore different methods of market research to learn which yielded real results for us. We quickly discovered that a combination of a few different methods gave us really varied but incredibly insightful results that we were able to use to grow our business and brand. My number 1 market research tip for anybody research is to try many first, then define which works best for you.”

“As a founder, what works best for me in market research is to be flexible and have multiple options. I didn’t limit myself to just one method. Multiple courses of action, such as a survey, focus group, and evaluation of secondary data, are essential. As much as possible, we need to widen our scope and see the whole picture than just focusing on one detail.”

How can you replicate: Review the list of market research methods below. Some are low-to-no cost, and others, such as interviews, feasibility studies, or field trials, require investment. If budget is a concern, focus on the more accessible methods: use at least five, and see which ones work best for you. If time and budget permit, test the water with at least two other methods.

Tip #5 – Make market research part of your monthly routine

Why it matters: When you consider both market and consumer needs change at a moment’s notice, identifying and reacting to shifts in a market or identifying changing consumer behaviors is crucial. Firstly, it can help you stay ahead of your rivals. Secondly, it allows you to spot growth opportunities and adapt strategies, products, or positioning accordingly, helping you prosper and grow your bottom line.

Ask yourself the following questions.

- Who are your competitors? (include direct, indirect, industry leaders, & emerging players)

- What is the current and predicted size of your market?

- Who has market share – do you know all the players?

- When was the last time you updated your buyer personas?

- Do you have a clear picture of current market needs and demands?

- Are there any emerging gaps in the market?

- When was the last time you did business benchmarking?

How can you replicate: Set aside 1-2 hours each month to focus on market research. Include trendspotting, competitive benchmarking, audience analysis, market share analysis, and keyword research. These five activities will give you the insights you need to stay relevant, adapt, and grow. Although this market research tip requires time and dedication, it’s probably one of the most important things you can do to future-proof your business.

Social Proof

Using Similarweb’s Digital Research Intelligence weekly, Wonderbly, an online eCommerce company, identified seasonal shifts in its industry and subsequently introduced a new product line that resulted in a 69% increase in revenue. Access to dynamic data allowed it to react and adapt its strategy for success.

You can read more about this success story here.

Tip #6 – Think of yourself as a customer – often

Why it matters: Knowing what a target audience is and how to analyze it is a good first step – but this is about going one step further.

- Have you recently read any comments, reviews, or messages on your social pages?

- Can you recall the last time you downloaded the free trial or used the demo platform you’ve been offering prospects?

- Forget about downloading anything – when was the last time you browsed the site’s pages or used the live chat feature to get help?

Where’s the proof?

Even for companies with a five-star rating across all review channels and a 100% customer satisfaction score, this still offers value. Try looking at the same data for your rivals; it can be incredibly revealing!

How can you replicate: Speaking practically, make a regular habit of looking at reviews, testing your conversion funnels (in incognito mode), analyzing live-chat logs, and getting a summary of questions sent to your company inbox. Take a little time (often) and put yourself in your customers’ shoes. Experience their experiences, read their questions, listen to their feedback – then combine this with your insights to create meaningful narratives that resonate, capturing hearts and minds along the way.

Pro tip: While mystery shopping can get a little pricey, taking time out once a quarter to do this for yourself can be very telling and help you see how things are from the perspective of your prospects and consumers. This is one market research tip you don’t want to overlook!

Tip #7 – Only use trusted, verifiable data sources

Why it matters: Market research involves collecting data to inform strategies that impact growth. If you base a strategy or projections on unstable data, these plans and subsequent forecasts can crumble before your eyes.

What did the expert say?

I spoke directly with a Small Business Administration (SBA) commercial lending expert and VP of Commerce National Bank and Trust. An individual who, in the past 15 years, has approved approximately $150 million in loans to small and medium businesses, non-profits, and investors in commercial debt financing. Here’s what he had to say.

“The biggest market research mistake most small businesses make is that they don’t cite their sources. Most small businesses lack historical performance data, which removes substantial confidence in their plans. As a lender, we cannot then support the assumptions they have in their business plan or their projections.”

How to avoid: Make sure any reports or research is based on data collected in the past two years, five at most. Also, find trusted data sources relevant to your product, market, or audience. The more information you can find to support your decisions, the better. This is one instance where the less is more approach does not apply.

Speaking of things to avoid, I’m sharing the most common mistakes people make with market research.

8 market research mistakes to avoid

I spoke with a group of business leaders and research experts to find out their advice about market research mishaps they’d experienced. Here’s what they said:

- Not doing a thorough competitive analysis.

- Failing to identify your target demographic.

- Not asking the proper market research questions.

- Asking too many questions in surveys or focus groups.

- Failing to do business benchmarking.

- Overspending by assuming outsourced market research is better, faster, and more comprehensive.

- Using old or outdated information for market analysis.

- Ignoring insights and data analysis – following intuition or assumptions.

In Summary

“To improve is to change; to be perfect is to change often.”

With how rapidly markets evolve, being able to adapt is key. But knowing when and how to do this is a challenge most businesses have to deal with. Your continued success will depend on your ability to meet the needs of a changing market and remain competitive in your industry. So, leverage these tips, learn from others, and go be great!

FAQ

What is the quickest way to do online market research?

If you need to do market research fast, leveraging market analysis tools is the best way to start. These tools utilize AI and machine learning to collate in-depth insights for industry, market, competitive, audience, and website or app analysis. If you want to start doing market research today, these market research templates will give you a framework of the different points you should cover.

How long should market research take?

The time you need will depend on the different market research methods used and the overall scale of the task. The key to doing market research effectively is to stay focused on the questions you’re trying to answer. So, while qualitative research requires more time (and money) when compared to quantitative research, making sure you choose the right method from the start will ensure that your research time is optimized.

How often should you do market research?

In a best-practice situation, you should conduct market research monthly for your business and allow 1-2 hours each month for a quick review of your key benchmarks and industry trends. As with anything, the more often you do it, the easier it becomes.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist