How To Create Better Competitive Analysis Reports

Creating a strong competitive analysis report is essential for businesses looking to thrive in today’s fast-paced, data-driven market. By identifying competitors’ strengths, weaknesses, opportunities, and threats, a well-crafted report provides actionable insights that can sharpen your strategic edge. Building comprehensive and insightful reports based on thorough competitive analysis takes more than just gathering data; it requires a structured approach that highlights key metrics, draws meaningful comparisons, and uncovers trends that can guide decision-making.

In this article, we’ll explore the essential steps and best practices for creating better competitive analysis reports that not only inform but also empower your team to make smarter, more strategic moves in your industry.

What’s a competitive analysis report?

In digital marketing, you’re in the dark about your competitors’ strategies until you access and analyze their data. A competitive analysis report organizes this data to inform about your competitors’ performance in the market and places your brand in the context of the competitive landscape.

A competitor analysis report can include insights about market share and spotlight strengths and weaknesses. Presenting this data adds valuable insights your management will appreciate. Agencies also provide extra insights to their client reporting with this type of data.

You can:

- Showcase details on successful traffic sources

- Analyze similarities and differences in audience demographics and behavior

- Identify best-performing marketing channels

- Provide an understanding of pricing structures and positioning

- Uncover the latest industry trends

By digging into your competitors’ data and highlighting the most significant findings related to business goals or specific KPIs in your report, you can check company data and performance and evaluate it in a realistic light.

What can your competitive analysis report achieve?

Marketing reports have two primary functions: one is to keep data on record for follow-up and evaluation, and the second is to present insights to stakeholders inside or outside the business. The data you include in the report and how you submit it can determine the outcome of decisions down the road.

An excellent competitive analysis report can:

1. Show your brand’s strengths and competitive advantages. With the help of a SWOT analysis, you can pinpoint what’s unique about your company and find growth opportunities.

2. Determine your brand’s market position. A detailed comparison of metrics lets you determine where you fit into the competitive landscape in terms of marketing, pricing, product offering, and more.

3. Identify threats and harmful trends. The competitive report identifies areas in which your company is lagging behind the market and unveils industry trends that potentially threaten profitability.

4. Shatter myths about the competition. With a competitor analysis, you can establish if common assumptions are based on reality or caused by buzz. Learn if what brands are saying about themselves is backed by data.

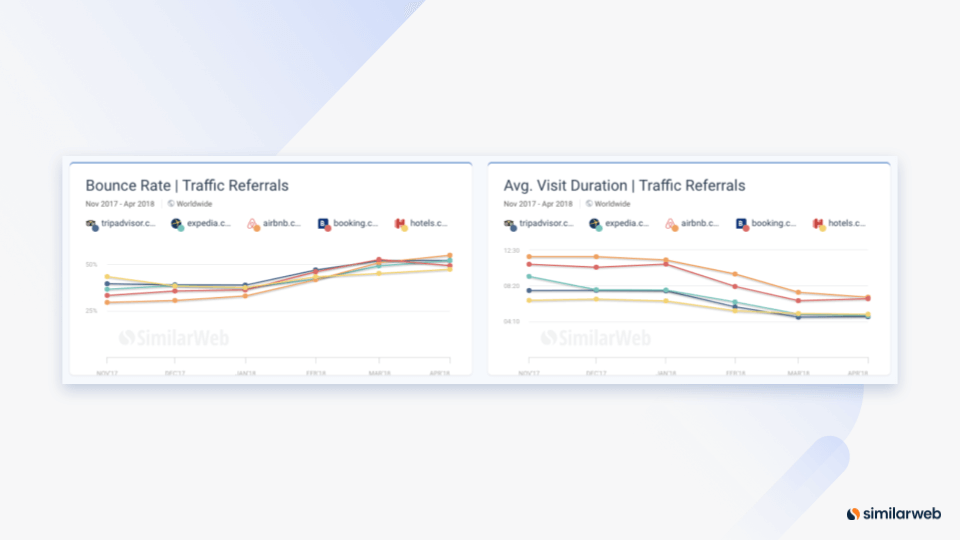

5. Settle internal debates between departments or marketing teams. For example, someone may claim the drop in referral traffic is due to poor content quality, while the affiliate manager insists that all partners are complaining about a traffic crisis. A competitive traffic and engagement analysis will reveal if referral traffic is down for the entire industry or just for your business.

6. Inform about your competitors’ mistakes and successes, so that you can learn from them. Benchmark almost anything and evaluate strategies worth implementing.

7. Help you or your superiors reach strategic decisions or support existing strategies with data. Monitor the performance and evaluate if current KPIs are still relevant in your industry or if the trends have changed and you need to adapt your strategy.

How do you create a competitive analysis report?

We’ll walk you through the steps. Keep the report’s goal in mind when you benchmark each metric and turn the data into an actual asset.

1. Identify competitors

Before investigating specific competitors, you want to benchmark your stats against the industry average. These values function as a guiding thread throughout your analysis.

We usually differentiate between three types of competitors:

- Direct competitors are companies that are similar in three ways: the target audience, the product, and the issue they solve.

- Indirect competitors are competitors that are similar in one or two of these ways. They may provide a similar product for a different audience, or a different solution to the same issue.

- Industry leaders usually set the market pace and trends. You can find these websites in our top websites ranking section, which we update monthly with fresh data

In digital marketing, the approach is a little different. You focus more on the target audience because you compete for attention and engagement before you compete for sales.

So, when analyzing the digital competitive landscape, you want to look at competitors per acquisition strategies and traffic channels.

2. Examine marketing strategies and channels

Select the top direct competitors for your analysis. You want to check where the most valuable traffic comes from – in other words – which channels attract the visitors that turn into loyal customers.

Discover how your stats compare to your competitors’ traffic volume and quality per channel. Based on this info, you can examine how others use their best-performing channels and better understand your competitors’ digital marketing strategy.

In many cases, it’s useful to add the industry leader for reference or keep an eye on industry averages. If your report goes to the management level, remember that they want to see the financial impact of everything. Make sure to address costs and pay special attention to paid competitors and ROI.

Let’s look at acquisition channels and what you can learn from them.

- Organic search traffic

Organic search relies on a good SEO strategy. Competitors who are getting a lot of organic traffic probably invest heavily in content marketing, so they’re an excellent place to look for content ideas. Also, compare their organic traffic volume to the paid search traffic to better understand their strategy and where they invest resources.

To optimize for organic search, start with SEO competitive analysis and examine the search volume per keyword, then discover which sites get the most traffic for which term. Gain insights on traffic share, monthly changes, and keyword seasonality or trends with competitive keyword research.

- Paid search traffic

Understanding how competitors manage paid search campaigns provides a glimpse at their budget priorities. It also helps you evaluate if you’re investing efforts in the right place and at a reasonable cost.

Conduct PPC competitor research to investigate which paid terms generate the highest traffic volume and to which sites.

With Similarweb Competitor Analysis Tools, you even receive an estimate of the cost involved so you can evaluate your competitors’ investment in paid search. Benchmark against your closest competitors and optimize your paid search efforts to make sure you don’t overspend.

- Referral traffic

This is another area where companies spend money. Competitors who receive large amounts of traffic from referrals depend on others to promote the site. Note: This could be a sign they don’t have the internal capacity to manage extensive marketing operations.

You can check which sites refer traffic to these competitors because they could potentially be an affiliate marketing opportunity for you and provide you with traffic.

- Display ads

Investing in display ads can be costly, and companies often use them to supplement their primary acquisition channels. Look at display ad performance in context and discover how the ads fit into the overall strategy, and which other channels they support.

Email is known to be a powerful marketing channel in many industries. It’s cost-effective, and automation tools offer plenty of possibilities for segmentation and personalization.

Check the amount of traffic businesses receive on average in your niche and how individual competitors match up. A high percentage indicates high loyalty. Visitors trust the site and are willing to share their email address. These sites often rely less on organic traffic.

- Direct traffic

Direct traffic comes from visitors who go straight to the site without searching. If a competitor receives an exceptionally high volume of direct traffic, you can assume it has a large customer base.

Another possibility is that its sites are very well known, or its marketing is primarily offline. Take some time to dive into the engagement metrics to better understand how users interact with the site.

- Social media

Social media channels are increasingly popular, however, not necessarily as a direct acquisition channel. Activity on social platforms aims at increasing brand awareness and loyalty.

It’s a good place to examine audience demographics, popular content types, and other preferences.

Let’s say you observe that a specific brand saw a tremendous spike in pages visited from social media traffic. Explore what kind of campaign it ran at the time and examine why it was so successful.

3. Consider company info

Take a closer look at the companies you’ve identified as top competitors for traffic and audience engagement. Consider company size and revenue. If you’re a fraction of the market leader’s size, you may not need to measure yourself against it in every aspect. For example, a larger staff can create significantly more content and should drive more traffic through content marketing.

Check competitors’ market share and see how it correlates with their traffic share. Also, assess the market potential to determine what’s realistic for you to gain.

Having said that, it’s always good to keep an eye on industry leader stats and the industry average to use as benchmarks.

4. Analyze the offering

Investigate products and product lines. Variations in the product portfolio may be something you need to mention in your report. Some competitors compete with you on everything, while others may only offer one similar product – but that could still pose a threat to your market position.

Investigate the tools and technologies competitors use. Find out how rival brands position themselves in terms of pricing and unique advantages. Which promotional methods do they use that work? These could be coupons, a free trial, a loyalty program, etc.

These are things that can be quantified and presented in a report if they impact the bottom line. For example, if all competitors use chatbots, it may be worth noting in the competitive analysis report.

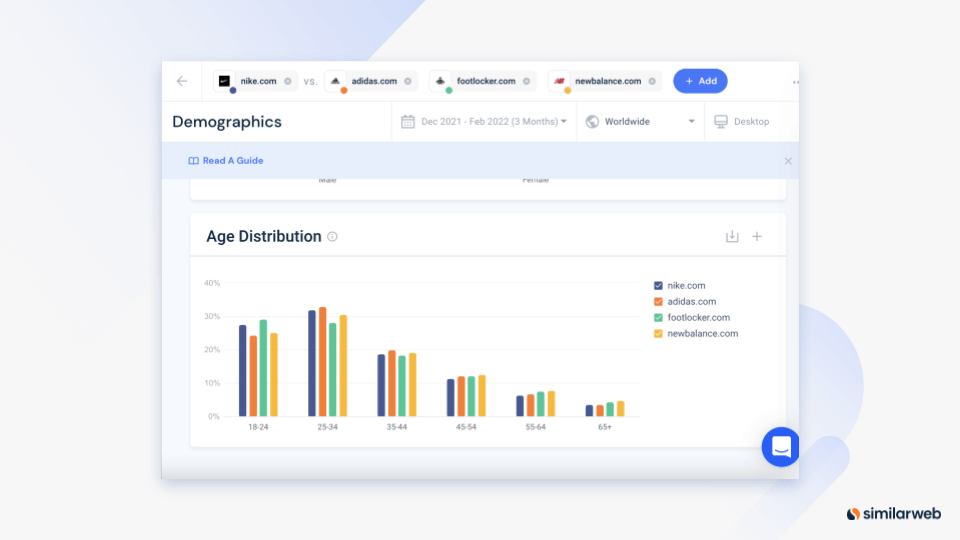

5. Find the right audience

Understanding the audience in your industry and their behavior allows you to better target the relevant personas and pain points. View your closest competitors’ traffic share per geographic region and investigate the demographic make-up of their audience.

Identify what all audiences have in common and what characterizes visitors with high potential. This helps you understand the audience you’re competing for, and against which competitors. Check the share of voice per region and see who’s losing and who’s gaining.

Don’t forget to scope out audience loyalty as well. Compare new vs. returning visitors to see how well competitors retain their customer base.

As you move deeper into your analysis, you’ll discover audience variances. You may stumble upon an underrepresented demographic. This could be an important fact to mention in your report because it can be used to your business’s advantage.

6. Perform a SWOT Analysis

Conduct a SWOT analysis with all your collected data. SWOT stands for strengths, weaknesses, opportunities, and threats, which you can identify using the context of the competitive landscape. Spot each brands’ weak and strong points and understand who’s posing a threat and where your opportunities lie.

How do you show data effectively on your competitor report?

Interpretation. Check the data against your original goals and the purpose of the report. Then decide which metrics and insights best serve that purpose or represent the insights you want to deliver.

Is it a regular periodic monitoring report? Which critical decisions depend on the information? For example, if the intention is to back up a budget increase for PPC, you’ll include a different set of data than in a report to identify top emerging industry trends.

Add conclusions and recommendations if there’s no specific goal attached to the competitive audit report.

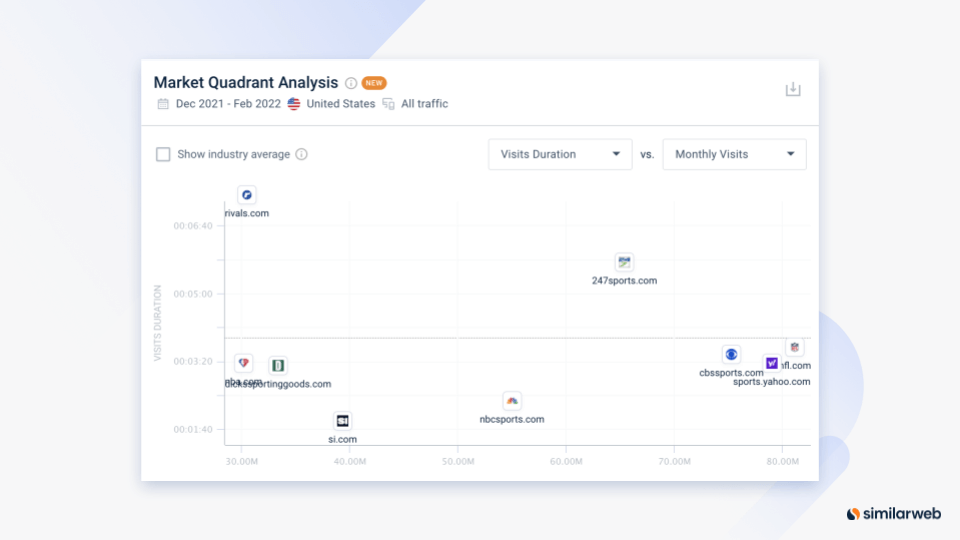

Visualization techniques such as bar charts, bubble graphs, maps, and competitive matrices make for immediate understanding. They also let you highlight critical aspects of the competitive audit report.

A matrix is usually set up as quadrants that make it easy to identify industry leaders, challengers, established brands, and niche players. With Similarweb, you can define engagement measures to compare and apply them to the market quadrant analysis of selected, relevant players on the grid.

Want to stay organized? Use this cheat sheet to create a perfect competitive analysis report every time.

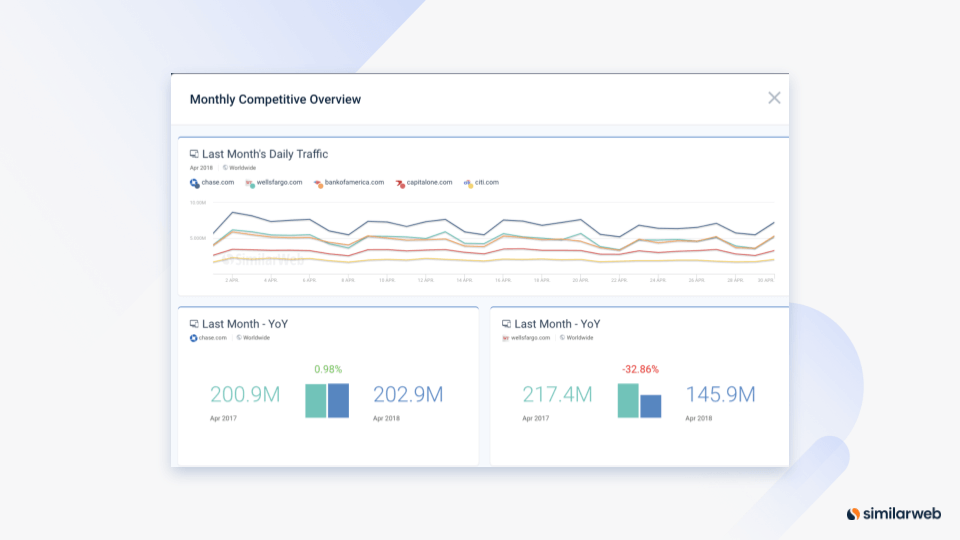

Dashboards are a useful tool for showing data in context and periodic competitive monitoring. They’re also great for creating competitor reports because you may want to monitor progress and understand the impact of strategic changes.

Periodically recording the same essential metrics allows you to evaluate what works for you or the business you’re monitoring. It also enables you to spot trends and detect irregular data behavior.

Similarweb Digital Marketing Intelligence offers a variety of dashboard templates aimed at monitoring selected aspects of the competitive environment. Alternatively, you can put together your own custom dashboard and monitor the exact metrics you need for your reports all within the platform.

When presenting a report to stakeholders, consider using screenshots and adding arrows or text to highlight important data.

What’s an example of a competitor analysis report?

Let’s look at an example of competitive analysis for website performance. Imagine the marketing team is discussing ways to optimize the site and acquisition channels. The goal is to attract a younger audience. How can a competitive analysis report help?

The purpose of the report should be to reveal the brands in your industry with a higher percentage of young visitors. It should then focus on these brands and show a breakdown of marketing channels for this selection of competitors. Show the channels that perform best, so they can be used as benchmarks.

Next, the report should dig into channel performance in detail. If social is a strong traffic driver, identify which specific platforms generate the most traffic. If your competition is getting tons of organic traffic, deep dive into the keywords that generate valuable traffic. Also, find out which pages receive the highest share of organic traffic. A specific website segment, like a blog, may be highly popular, and that’s valuable input for content marketing.

Your report should also include information about engagement resulting from various traffic sources. You want to try and identify the most profitable channels for your competitors before you investigate how they use them.

Give your report an edge

In this article, you’ve learned why presenting data and insights the right way can speed up the decision-making process. We’ve also given you a lot of recommendations on how to get the right data and submit it to superiors, teammates, or clients.

Now, we’re going to let you try your new skills out for free. Similarweb not only provides the tools you need to create a comprehensive competitor audit report but also gives you the most accurate data available on the web. A report based on precise competitive intelligence gives you credibility, not to mention a covetable edge.

FAQ

What should a competitive analysis include?

A competitor analysis report should start with a list and a brief profile of top competitors. The main section should focus on marketing strategies, positioning, and audience based on product offering and pricing.

What are the three types of competitors?

- Direct competitors target the same audience by addressing the same issue with a similar product.

- Indirect competitors compete with you in one or two areas only: the target audience level, the product level, or the issue addressed.

- Industry leaders act as a benchmark.

What are the main steps in competitive analysis?

First, identify your competitors. Next, examine market share and target audience, and understand their digital strategy. Then create company profiles for the top competitors. Finally, conduct a SWOT analysis and compile a report.

Why is a competitive analysis report important?

The competitor audit report provides context for your business performance and lets you position your brand in the competitive landscape, identify unique strengths, opportunities, and risk factors, plus support business decisions with critical data.

Your full marketing toolkit for a winning strategy

The ultimate solution to help you build the best digital strategy