Ecommerce Intelligence

Ecommerce Intelligence

Everything You Want to Know About Walmart Product Categories

Over the last half-decade, the retail market has been moving in two directions: consolidation at the top by large marketplaces (e.g. Amazon, eBay, and Walmart), and emerging direct-to-consumer (D2C) brands that yield strong customer loyalty.

While the size of the marketplaces has such a gravitational force that D2C brands have opted to use them to build awareness and supply chain, it ultimately puts at risk their long-term viability.

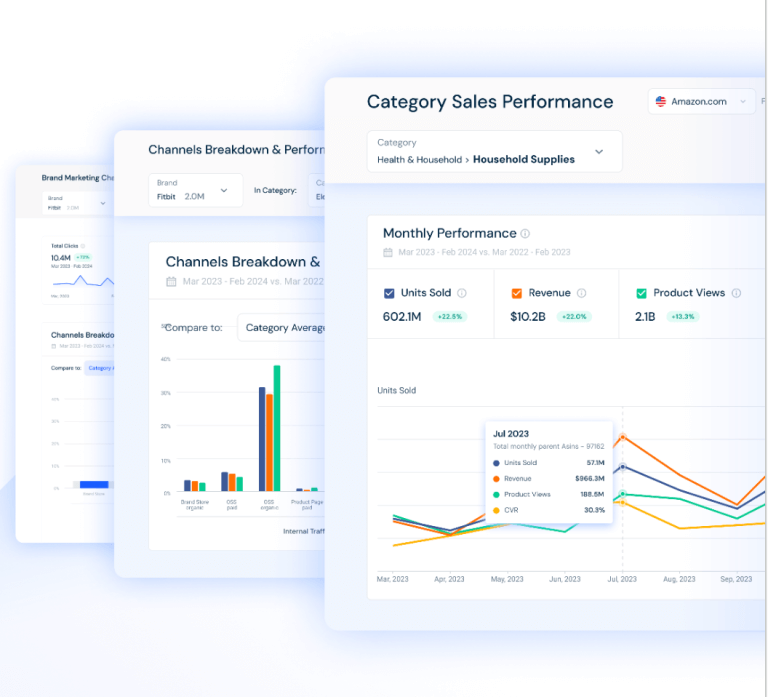

In addition, it’s difficult for brands to truly understand the impact of a marketplace’s push into a new product category because there’s no apples-to-apples comparison of the retailers’ market share compared to D2C brands — that is, until now. Similarweb’s Funnel Analysis now features Walmart and Amazon categories, which allows users to analyze a range of key engagement metrics, including visitation, conversion rate, stickiness, and marketing channel-level conversions.

Marketplace Product Categories: The Gap Between Walmart and Amazon Is Getting Bigger

It’s well known that Amazon is the largest retailer in the United States, capturing 3x more traffic than the closest competitor (eBay), but their dominance in so many categories is remarkable. Even categories where “brick and mortar” retailers maintained advantages of efficiency (such as fast-moving consumer goods) are starting to bend to the size and convenience of Amazon.

Exploring some of the largest visited categories on Amazon and Walmart, we can see the size gap is actually increasing. On average, Amazon is 8x larger than Walmart across top product categories. The one exception is the Food category, where the gap is considerably smaller and Walmart has nearly doubled its number of visitors: from 3.9M in February to 7.3M in March 2020.

Electronics is the largest category on Amazon, by far. Evaluating the size of Amazon’s and Walmart’s electronics categories compared to Best Buy (the largest specialty retailer in the U.S.) and Apple (the largest consumer electronics brand), we can see that Amazon captures 48% of the market share. Apple represents 28% of traffic, which outpaces even Best Buy. Despite Walmart’s Electronics category growing 50% since February, it captures only 4% of visits.

Walmart Shines in Personal Care Products With Above-Average Conversions

Interestingly, while the number of visits and transactions have experienced sharp increases in March and April, the efficiency of conversion is showing only moderate improvements on both Walmart and Amazon. Walmart’s highest-converting category is Personal Care, averaging a 15% conversion rate in 2020 (compared to 22% for Amazon). The Personal Care category for Walmart is driven by direct traffic from consumers, which converts to 20% higher than the category’s average.

If you are interested in learning more about our Consumer Funnel Analysis capabilities or our competitive intelligence platform, Similarweb Pro, feel free to schedule a 15-minute call with one of our consultants.

Want to Read More?

Download our Report on the State of Consumer Electronics to read more about how retailers are battling for consumer attention.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!