TikTok Dances to the Top of the Social Media Charts

While public social media companies like Facebook, SNAP, and Twitter (public, for now, anyway) have had to own up in earnings reports to slackening demand from advertisers, TikTok is on a tear.

Key takeaways

-

Advertiser interest in TikTok is accelerating at a time when competitors are seeing slowing growth or even shrinking traffic to their ad portals. On a year-over-year basis, traffic to ads.tiktok.com was up nearly 200% in the first quarter of 2022, compared with 22% for Facebook and 3.6% for Twitter, according to Similarweb estimates.

-

Advertisers are paying attention to TikTok’s momentum and the amount of time users spend watching short, often silly, videos. In March, users of TikTok’s Android app spent more than an hour and 22 minutes a day on the service, on average – more than for Facebook, Instagram, Twitter, Snapchat, or YouTube – although YouTube comes close in our estimate, at 1 hour 19 minutes.

-

TikTok’s Android app also saw more than 11.8 million downloads in March, more than any rival we’ve mentioned except Facebook, which had 13.5 million.

-

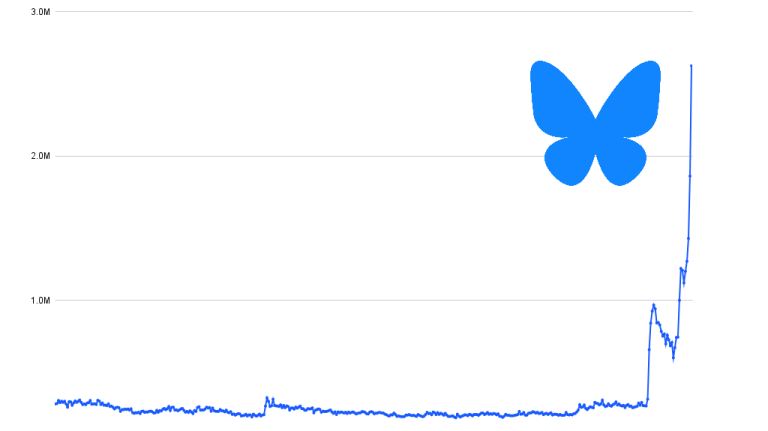

Year over Year growth in desktop and mobile web traffic to tiktok.com topped 600% for several months in 2020 and over 200% into 2021. In March, website traffic was up 70% year-over-year while, for comparison, traffic to twitter.com was up 11% and traffic to facebook.com was down 9.3%.

-

One of TikTok’s secrets to engagement is encouraging participation. Users can record and edit videos with their smartphone apps. In the process, they can mix in copyrighted music TikTok has licensed, making it a popular choice for dance videos. Video creators can upload directly from their phones or do additional editing on a computer and upload to the website. Visits to the uploads page of tiktok.com were up nearly 100%, year over year, in March.

What the kids are into these days

Owned by the Chinese company ByteDance, TikTok is a short video social media service with a strong focus on music, dancing, jokes, cooking demos, and silliness. In July, ByteDance called off plans for an IPO over issues Chinese regulators had raised about data security.

About a third of the TikTok desktop and mobile web audience is in the 18-24 age range, which accounts for just 24% of Facebook’s demographics.

In the U.S., TikTok has survived accusations that it poses a national security threat, with the idea being that it siphons up user data for use by the Chinese government – and in 2020 President Trump threatened to ban the service in the U.S. That drama has since subsided, and TikTok is said to be in talks with Oracle to house the data of U.S. users within the U.S. Perhaps not coincidentally, ByteDance recently appointed a new CFO whose job could include preparing the company for another try at going public.

While serious political or professional content exists on TikTok, if you go looking for it, TikTok users tend not to take themselves nearly as seriously as the Twitter blue checkmark set. Youthful fun turns out to be good business, capturing the attention of advertisers always eager to sell to young people with discretionary income. That’s why, even though it commands only a fraction of the market of Facebook, Meta CEO Mark Zuckerberg has identified TikTok as a serious competitive threat to be countered with short video services on Facebook and Instagram.

Meanwhile, Twitter, which fumbled its own attempt at a short video service (Vine, shut down in 2016) can only bemoan what might have been.

Advertising explosion

Ad portal visits tend to be a reliable leading indicator of ad revenue, and visits to ads.tiktok.com were up nearly 200% in the first quarter of 2022, while the ad portals of social media rivals were modest or even down slightly. TikTok has also innovated in the variety of ways businesses can advertise or otherwise engage with the platform. In early May, TikTok introduced new premium ad units allowing advertisers to pay a premium to get their ads placed adjacent to the platform’s top 4% of viral hits.

For SNAP Inc.’s Snapchat, which like TikTok has a strong focus on mobile video, ad portal visits (forbusiness.snapchat.com + ads.snapchat.com) were down about 9% in the first quarter, according to Similarweb estimates. TikTok has also edged ahead of Snapchat in-app downloads, at least on Android (see below). A recent survey found that TikTok has edged ahead of Snapchat as the favorite app of teens.

Despite that, SNAP recently reported that revenue for the quarter was up 38% and forecast that revenue for the quarter ended in June would be up about 20%.

One of the things catching advertisers’ attention is TikTok’s growth rate; Similarweb data shows that its web traffic that’s growing so fast that it makes competitors look like they’re standing still.

Year over Year growth in desktop and mobile web traffic to tiktok.com topped 600% for several months in 2020 and over 200% into 2021. In March, web traffic was up 70% year-over-year while, for comparison, traffic to Twitter.com was up 11% and traffic to facebook.com was down 9.3%.

Of course, it’s always easier to show big percentage gains on a small base, and in terms of web traffic TikTok is still relatively small (although bigger than LinkedIn).

One difference between TikTok and Snapchat (which barely registers on the chart above) is that TikTok allows more user interaction with videos on its website, while Snapchat strongly encourages visitors to switch to a mobile app.

Still, the average user website visit to tiktok.com was less than 4 minutes in March – more than for snapchat.com but far less than youtube.com (21.8 minutes) or facebook.com and twitter.com (both over 10 minutes).

Momentum in apps

TikTok routinely ranks as one of the top apps in both the Apple App Store for iOS and the Google Play Store for Android. In March, it was second only to Facebook for Android downloads. With 11.8 million downloads, TikTok beat Instagram, Snapchat, and – by a wide margin – Twitter, which had about 3.3 million downloads, according to Similarweb estimates for Android activity.

Engagement metrics were also strong with users logging on an average of 10 times a day for a total of about 1 hour 22 minutes per day. Facebook still has about twice as many monthly active users and nearly 3 times as many daily active users, however.

Engaging the creators

TikTok makes it easy for users to be creators, not just viewers, of video content. The service first started to take off, originally in China before going worldwide, when it began allowing users to add licensed music to their videos. Suddenly, any teenager could create a selfie video of themselves dancing to a favorite song and have a chance at becoming a viral video star. TikTok has elaborated on the concept in many ways, for example by making it easy for users to create a “duet” combining their video with another user’s video – think of it as the music video equivalent of “retweet with comment.”

The most successful TikTok advertisers and organic social media marketers embrace the TikTok spirit of fun, which means their videos may be professionally produced but are edited to look ad hoc and informal.

The professional marketers probably account for more of the desktop traffic to the uploads page on tiktok.com, while average users (and some professionals, too) upload video directly from their phones. Still, the steady growth in traffic to that uploads page, which was up nearly 100% year over year in March, is a strong indicator of engagement in the platform.

TikTok vs. YouTube

As fast as TikTok is growing, YouTube still attracts 20 times more desktop and mobile web traffic. On Android, the mobile platform for which Similarweb has the most complete numbers, TikTok is the winner with downloads of its app – more than 1.6 billion over the last 18 months, compared with 64.6 million for the main YouTube app. On the other hand, YouTube is already installed on 95.9% of Android phones, meaning that fewer mobile users need to download it.

Where TikTok looks most impressive in comparison to YouTube is when we look at Year over Year growth.

Here is what that looks like for desktop and mobile web views of tiktok.com vs. youtube.com, with TikTok growing rapidly in months when YouTube traffic was flat or down slightly. For example, in March TikTok desktop and mobile web traffic was up nearly 70%, compared with a 4.4% increase for YouTube.

The pattern looks almost the same if we look at the uploads page on tiktok.com (+97.8% Year over Year in March) versus the YouTube Studio creator’s portal (-13%). That’s important because, in addition to competing for an audience, TikTok and YouTube are creating for the time and attention of those who upload content.

To be clear, this comparison is specific to desktop web uploads, so it doesn’t tell the full story. In addition to uploading video from mobile apps, creators can contribute content through APIs, for example as integrated into video authoring, editing, and streaming tools.

In both cases, TikTok was growing even faster at the beginning of 2021 – over 500% Year over Year for tiktok.com and nearly 700% for the uploads page specifically.

TikTok’s other revenue streams

In addition to advertising, TikTok makes money from in-app eCommerce transactions, affiliate deals, and other products. These are sold through business.tiktok.com, as well as subdomains like shop.tiktok.com for online merchants, and traffic to all these domains is also growing rapidly.

Conclusion

TikTok may never be the place tech CEOs and politicians go to tweet their announcements and pronouncements, and that’s just fine with TikTok users who come looking to binge on snackable videos. With an algorithm that constantly tweaks the video feed to match the content each user engages with, and by encouraging active participation, TikTok keeps them coming back. And by innovating in how it courts video courts viewers, creators, and advertisers, TikTok has created a platform they all love.

The Similarweb Insights Newsroom is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to this post.

By David F. Carr, Senior Insights Manager

Disclaimer

All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!