Snapchat Losing Advertiser Engagement: SNAP Q2 Preview

Snapchat parent SNAP Inc. set off alarm bells with investors earlier this year when it felt obliged to revise earnings estimates downward shortly after its first quarter announcement. The revision was based on weak advertiser support, which shows no sign of improvement.

Key takeaways

- For the second quarter, the traffic to snapchat.com most closely tied to ad buying payments was down 4.4%, year over year – the third straight quarter of decline, according to Similarweb estimates.

- For the quarter that ended in June, visits to the ads.snapchat.com portal associated with shopping for ads were down 18.4%, year-over-year. This provides a point of comparison for similar ad portals for competitor sites – for example, during the same period traffic to TikTok’s ad buying portal rose 127%. While representing only a fraction of the ad buying traffic enjoyed by the likes of Facebook and Google, TikTok continues to attract attention for its rapid growth.

- Snapchat also trails in mobile app usage, based on Similarweb estimates for Android.

Snapchat is losing advertiser engagement

Advertisers visit accounts.snapchat.com to set up and manage their advertisements. Tracking visits to this subdomain gives a glimpse into how ad-buying traffic has been declining. The last quarter in which that traffic increased was Q3 2021 when it was up 8.2%. Ad buying traffic dropped 3.3% in Q4 2021 and was essentially flat in Q1 2022.

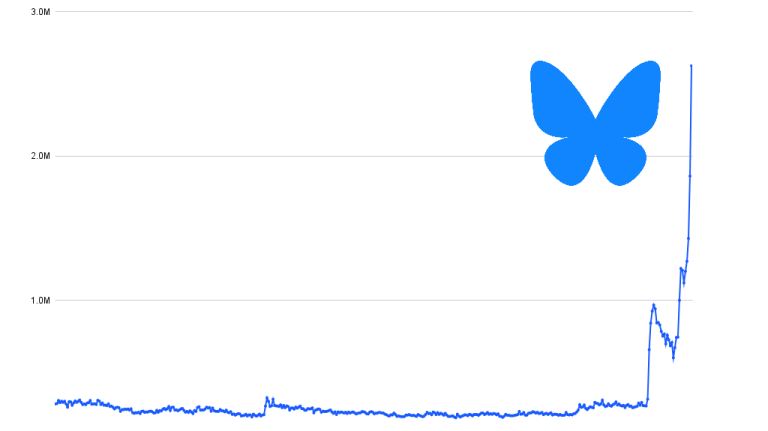

Ad portal traffic lags TikTok and Twitter

Snapchat operates in the second tier of digital advertising where everyone is far behind Facebook and Google, but Snapchat is behind even poor, beleaguered Twitter. The chart below shows traffic to the subdomains the social sites use for direct sales of advertisements. This activity doesn’t tell us how much money the players are making, which also depends on conversions and pricing, but it does show the volume of interest.

TikTok is the champion in the rate of growth it enjoys in traffic to its advertising portal, which is why even far larger competitors like Facebook consider it a threat. While serving a similar market niche in courting the youth market, Snapchat’s ad portal traffic has been flat to slightly down.

Consistently behind TikTok in mobile usage

In this snapshot of user engagement on Android, Snapchat is lagging behind TikTok in daily active users, although not by a huge amount – not as much as you might expect from the ad portal chart shown above. The exaggerated difference may be related to research showing that TikTok has edged ahead of Snapchat as the favorite app of teens, a favorite demographic with advertisers. In June, Snapchat averaged 156.6 million daily users, compared with 187.2 million for TikTok, according to Similarweb estimates.

Both Snapchat and Tiktok are winning more mobile engagement than Twitter (about 90 million daily Android users) but are still far behind Facebook (937.4 million).

An innovator seeking a second act

Snapchat has been an innovator in everything from the disappearing messages that originally made it popular among privacy-conscious teens to incorporating augmented reality “stickers” into its video sharing. After enjoying the advantages of catering to a youth market with disposable income, it is getting stung by the fickle tendency of that audience to move on to the next new thing – along with a general downturn in advertising and trouble in the broader economy.

New business ideas the company is currently testing include NFT-based stickers and a Snapchat+ subscription service. The company may get back on track, but probably not “in a snap.”

The Similarweb Insights Newsroom is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Photo by Thought Catalog on Unsplash

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!