Top Fastest-Growing D2C Brands, Q2 2021

Alcohol-free spirits are in. While this might sound like an oxymoron, it’s one of many health and wellness trends surging in popularity. This is the unifying theme for the fastest-growing direct-to-consumer (D2C) brands for Q2 2021 in the U.S.

We pulled the data for our latest quarterly report using Research Intelligence, one of our eCommerce solutions. Read on to see consumer behavior trending and the D2C brands benefiting:

Can’t wait to see the rankings? Check out a preview of the full report.

1. Total wellness: Sound mind, sound body

Passion for health and wellness isn’t new. In the first quarter of the year, 10 of the top 25 D2C brands were wellness-related, with mental health being top of mind. Brands like Therapy Notebooks ranked in the top 10.

In the latest report, four out of the top 25 fastest-growing D2C brands promote healthy bodies, and embrace and celebrate, the size of the average American woman.

Here are the top brands based on quarter-over-quarter (QoQ) traffic growth and their key messages:

- Youswim (+168%): “Creating swimwear that represents women realistically, accepting our bodies as they are — unique, ever-changing, and unedited”

- Honeylove (+168%): “Sexy isn’t a size”

- Summersalt (+146%): “Everybody is a Summersalt body” (up to size 24)

- 11 Honoré (+143%): “Trendy plus size women’s clothing”

Lessons for brands

Positive messaging around body image reflects consumer interest in curve-friendly fashions (and culture), particularly as they actively shop for apparel post-lockdown. Similarly, our analysis of top trending keywords for summer 2021 fashions reflects consumers’ eagerness to find clothes for people of all shapes and sizes.

Brands can adopt tactics from top D2C brands for Q2 2021 to capitalize on this trend, including:

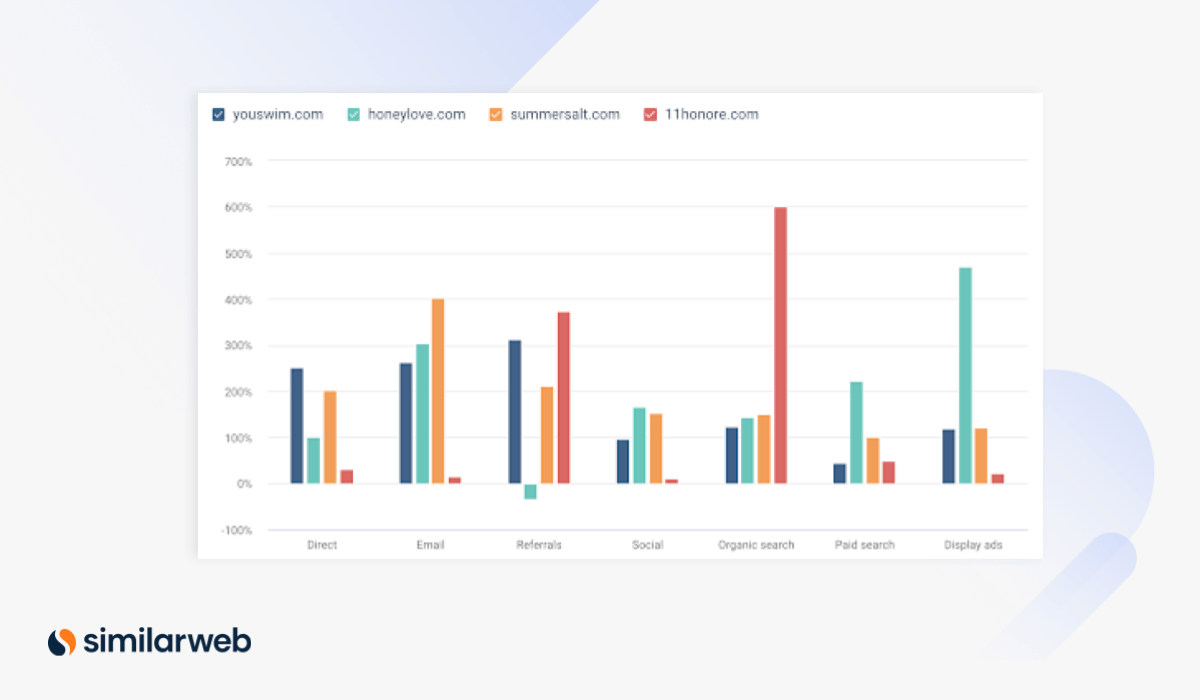

- Celebrity collaboration: 11 Honore shows that celebrity collaboration is a powerful marketing tool. Its partnership with actress Lena Dunham helped boost organic search traffic by 600% for the quarter. In April, the month the partnership was announced, organic traffic surged 1,332%. Direct traffic also increased 86% from March to April, suggesting increased brand awareness. The boost in digital performance through celebrity partnerships is in line with other fashion brands, including Crocs and Adidas.

- Leverage paid marketing: Honeylove demonstrates it’s good to ramp up the marketing budget to supercharge growth. In Q2, Honeylove relied heavily on display ads (+471%) and paid search (+223%) to help highlight its brand in the wake of positive consumer body sentiment. Brands, especially those that are seasonal, can emulate Honeylove’s tactics.

2. Wake-up call: Ingredients matter

As shoppers embrace their bodies, they are also watching the products that they put into them. Four of our top 25 fastest-growing brands show surging consumer interest in food and drink, especially ones with natural, healthy ingredients.

You are what you drink

Consumers’ waning interest in alcohol has been a healthy reversal of course after increased booze consumption during the pandemic. It also has opened opportunities for alcohol alternative brands.

Both Drink Monday (+172%) and Three Spirit (+165%), which make alcohol-free “booze” rank among our top 25.

You are what you eat

Food-related companies that rank in the top 25 reflect similar trends — they cater to consumers seeking whole, quality ingredients without preservatives or chemicals.

Top food brands include Umamicart, ranked third, and Wildgrain, ranked tenth. Traffic to their sites grew 313% and 193.5% QoQ respectively. Umamicart focuses on produce delivery whereas Wildgrain was established after its founders were unable to find clean, high-quality carbs for their diets.

Social lessons: Facebook vs. Instagram

Social media proves an effective marketing channel for food and beverage brands, particularly Facebook and Instagram. This quarter, Facebook generated 96% and 83% of social media traffic for Drink Monday and Three Spirit, and 58% and 53% for Umamicart and Wildgrain, respectively.

Food brands, which can showcase delectable offerings with photos, leveraged Instagram more than beverage brands. Since packaged drinks have less appealing aesthetics (no matter how pretty the bottle), Facebook is the preferred social media channel to capture consumer engagement and interest. Drink Monday and Three Spirit capture zero social media traffic share from Instagram.

Three Spirit and Umamicart capture 17% and 14% of their social media traffic from YouTube. Drink Monday and Wildgrain may also want to consider leveraging this channel.

3. Dose up on dermal protection (and Vitamin D)

In parallel with the increased interest in body nourishment, consumers are eager to go outside, get fit, and enjoy the sun. Therefore, brands that make the outdoors more enjoyable are golden on our fastest-growing D2C list.

Traffic for Supergoop!, which makes sunscreen products, has taken off, increasing 160% QoQ. We suspect that increased sales through online retailers, like Amazon and Sephora, helped generate traffic to its D2C website.

According to data from Shopper Intelligence, our marketplace insights tool, units sold on Amazon increased by 73% QoQ in Q2. Year-over-year (YoY) performance also shows that Supergoop! is having a much stronger summer in 2021 than in both 2020 and 2019.

The sunscreen brand appears to have year-round potential. During the first half (H1) of 2021 (January – June), which includes the colder winter months, units sold on Amazon grew nearly 421%!

Lessons for brands

Brands can use third-party (3P) online retailers to strengthen brand awareness to benefit D2C channels. Shoppers may use retailers like Amazon for search and discovery and come across products offered by D2C brands for the first time.

While unit sales on amazon.com increased dramatically (+421%) during H1, 93% of Supergoop! customers made just one transaction, exceeding Amazon’s sunscreen category average (87%) by 6 percentage points (PPTs). Low customer loyalty suggests that shoppers used other channels for future purchases, including supergoop.com, which helped drive traffic so that Supergoop! ranked among this quarter’s fastest-growing D2C brands.

Selection process: Top D2C brands Q2 2021

We used Research Intelligence, part of our suite of eCommerce intelligence solutions, to measure the QoQ performance of over 2,000 digital brands to see which have the highest growth across categories to make our top D2C brands Q2 2021 list. We limit our report to sites with at least 10,000 monthly visits to ensure brands have gained traction with customers.

The Amazon-related insights were pulled using Shopper Intelligence, our newest addition to our eCommerce intelligence suite, which helps brands analyze shopper behavior on Amazon and online marketplaces.

To test-drive our eCommerce intelligence tools, schedule a demo now.

To see how the performance of D2C brands compares to past years, check out Similarweb’s full listings of D2C reports.

The ultimate edge in marketplace intelligence

Put the full picture at your fingertips to drive product views and sales