Similarweb Partners with S&P Global Market Intelligence to Enhance Transparency within Credit Risk

In the ever-evolving financial landscape, data accuracy and timeliness are paramount for making informed decisions. We are proud to announce our partnership with S&P Global, a leader in credit scoring and risk management analytics. This collaboration underscores the growing role of digital data in reshaping financial services, particularly in providing additional transparency within credit risk, enhancing risk scoring and mitigating credit transitions.

Why accurate credit risk assessment is more important than ever

Financial institutions and larger non-financial corporations rely heavily on credit risk assessment to understand their corporate borrowers’ health and manage their exposures to impending risks. However, traditional credit assessment methods often depend on historical financial data, which may not reflect a company’s current performance or its position in an increasingly digital economy. This gap creates potential risks for lenders, such as exposure to distressed companies or inaccurate risk assessments.

To address these challenges, S&P Global sought a dynamic data solution that could provide timely insights into corporate activity, market dynamics, and emerging risks—helping institutions make more precise risk management decisions.

How S&P Global and Similarweb are changing the game

S&P Global partnered with Similarweb to integrate reliable and timely digital data into its credit risk analytics. Similarweb’s vast data ecosystem, includes insights into website traffic, app performance, technology footprint and digital industry trends. S&P Global can provide its clients with a more transparent and enhanced understanding of corporate credit risk.

This integration empowers institutions to:

- Monitor corporate performance: Spot trends that indicate growth or decline with a view on digital activity.

- Identify early warning signs of distress: Use digital signals such as declining traffic or engagement to highlight risk trends.

- Enhance credit assessment accuracy: Combine digital behavior data with S&P’s robust credit analytics for a more comprehensive view of a company’s activities.

Dynamic data: The missing piece in risk assessment

In today’s digital-first economy, a company’s online activity provides valuable signals about its health, competitive positioning, and market presence. Website traffic, app engagement, and digital trends offer real-time, actionable intelligence that complements traditional financial metrics.

For financial institutions, integrating these insights into credit risk models means staying ahead of potential risks and identifying growth opportunities faster than ever before.

“Our collaboration with S&P Global underscores the power of combining Similarweb digital data with S&P’s trusted credit data to create accurate and actionable insights for assessing corporate credit risks,” said Or Offer, CEO of Similarweb. “This integration enables a broad range of global companies to better evaluate the financial risk of their customers and make more informed business decisions.”

A partnership that sets a new standard for financial intelligence

S&P Global’s adoption of Similarweb’s Digital Data demonstrates the value of Data as a Service (DaaS) in high-stakes financial decision-making. By aligning digital intelligence with credit risk assessment, S&P has strengthened its ability to deliver more precise and timely credit risk assessment.

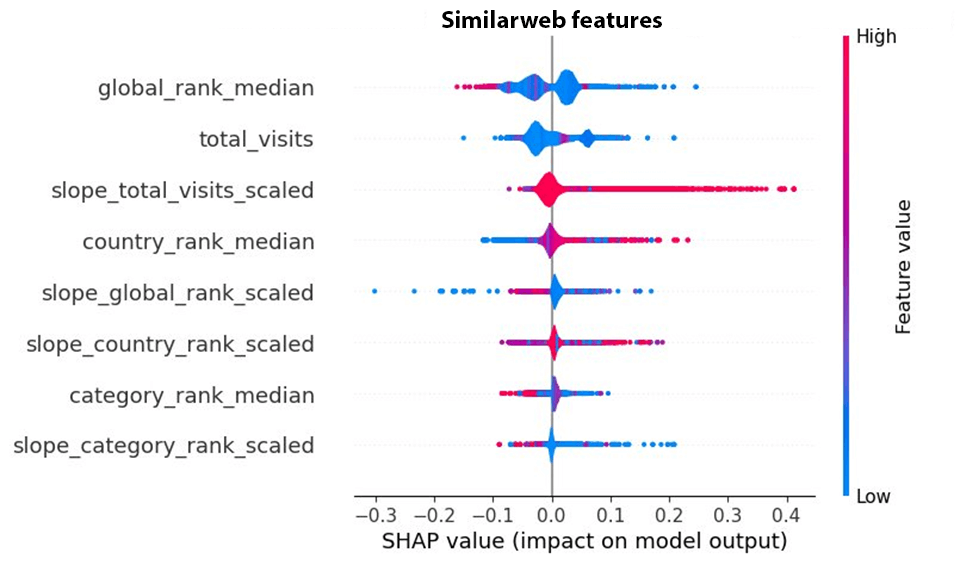

Source: S&P Global Market Intelligence. For Illustrative purposes only.

SHAP value quantifies the contribution of each feature to the prediction. A positive SHAP value of a feature means that presence of that feature contributes to increasing the model’s output for that particular prediction.

Analyzing the Similarweb Digital Data shows the potential impact of web traffic attributes on credit risk. With additional transformations and combining the digital footprint with S&P’s core financial and credit risk information creates a more comprehensive and global view for S&P’s customers to manage their exposures when using RiskGauge™, S&P’s core credit analytics product.

This partnership cements Similarweb’s position as a trusted data provider for the world’s leading financial institutions. By delivering the most comprehensive and actionable digital intelligence available, we enable organizations like S&P Global to navigate complexity, mitigate risk, and unlock new opportunities.

“With an increasingly digital economy, adding Similarweb’s Digital Data with S&P RiskGauge™’s data and analytics provides a reliable, transparent and more comprehensive view for our customers to manage their counterparty exposures.” said Moody Hadi, Head of Risk Solutions New Product Development at S&P Global Market Intelligence.

What this means for global institutions

As the financial sector continues to evolve, the need for accurate, real-time data will only grow. This partnership between Similarweb and S&P Global demonstrates the transformative potential of digital intelligence in enhancing credit risk assessment and empowering financial institutions with confidence in their decisions.

Disclaimer: The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision made or action taken by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for you?

Here are two ways you can get started with Similarweb today!