4 Types of Market Research + 6 New Ways to Do It Smarter

In June this year, 500 business leaders shared their favorite types of market research with me via a direct external survey.

Astonishingly, 83% of people said the same thing: favoring qualitative research (specifically market research surveys) over anything else.

Having a favorite is all good and well, but as we know, variety is the spice of life. By avoiding dependency on any single type of market research, you get a relevant, unbiased view of your market and opportunities at all times.

Spoiler alert The types of market research I outline in this post will speed up your time to insight significantly. Instead of a process that spans days and weeks, certain tasks can be done and dusted in a few hours at most.

To help you stay on top of your game, I’m outlining the different types of market research, their benefits, and how to use them. As a bonus, I’m sharing six modern ways to do market research using web intelligence tools (like Similarweb).

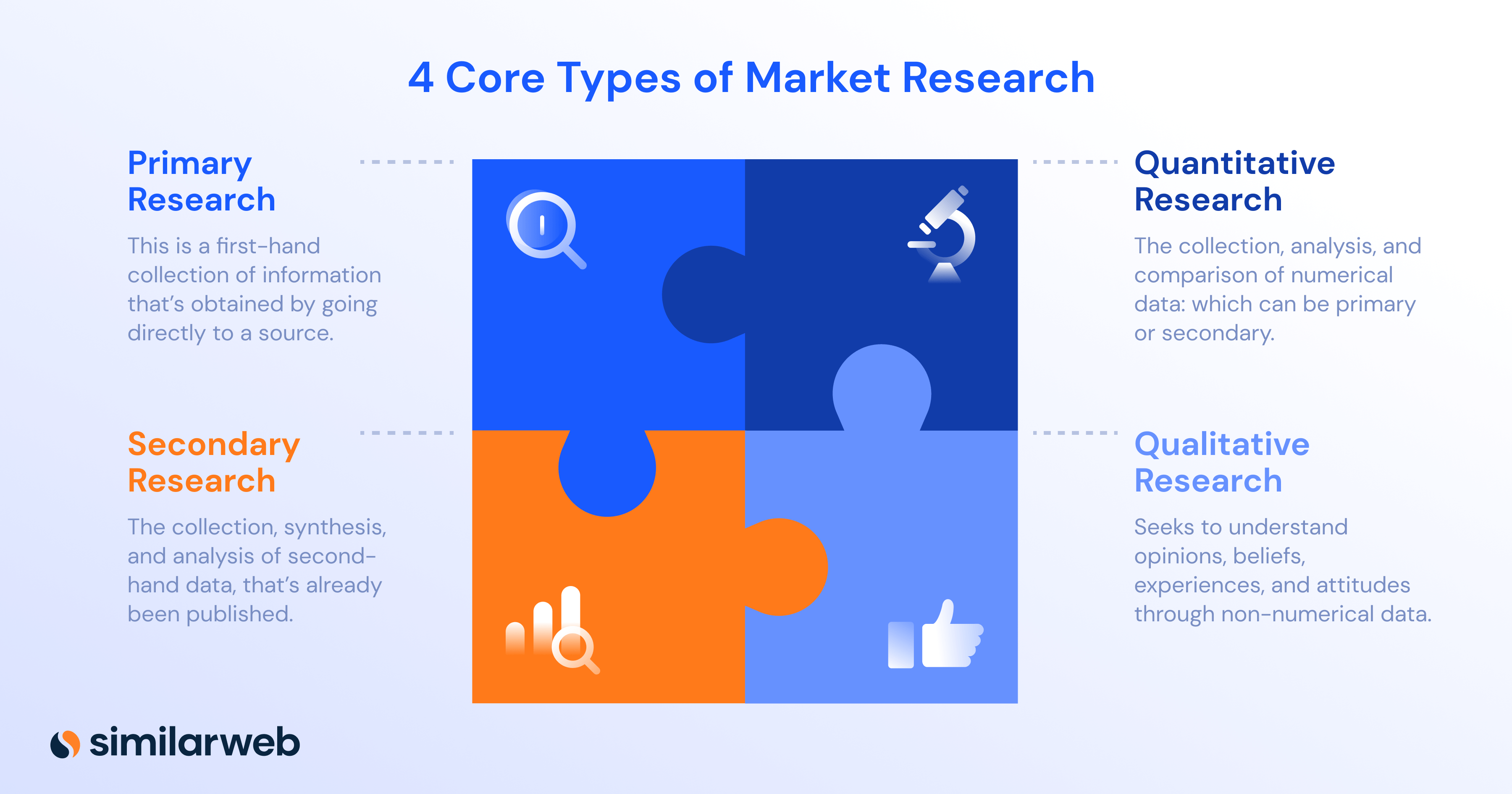

The 4 types of market research

1. Primary research

Primary research is the first-hand collection of data. You go directly to a source instead of relying on existing information. It’s also known as field research.

Who is it for?

Doing primary research involves collecting information relevant to a specific research context. For instance, if data is required about the shifting needs of a target market, primary research methods are a great way to explore this.

How to collect the data?

Usually, an individual will go into the marketplace (field) to find the information they need.

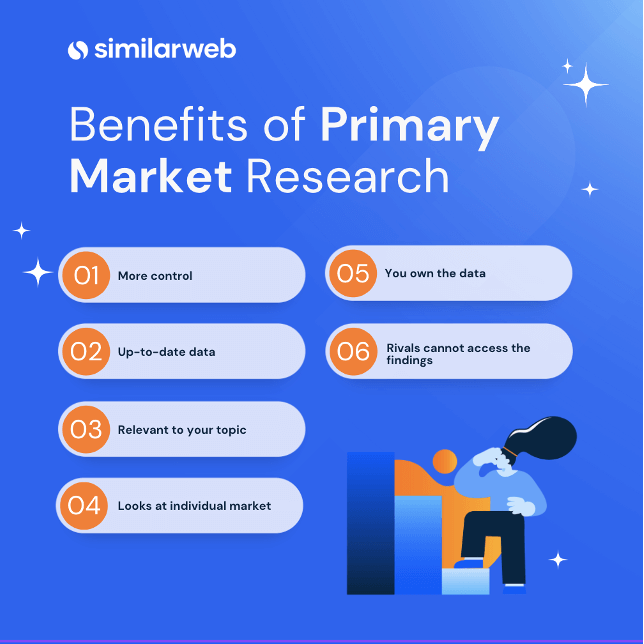

Benefits of primary research

- You get more control over the research methodologies.

- The information is up-to-date.

- Because data is relevant, it reveals current trends, not outdated ones.

- Most primary research addresses the individual market instead of the mass market.

- The data collector retains ownership of the data.

Types of primary research

The right research method depends on the goal of the research and the resources available. Here are five of the best ways to do primary research.

- Interviews

- Ethnographic or observational research

- Trials or experiments

- Surveys

- Focus groups

2. Secondary research

Secondary research collates existing information or research for analysis. Essentially, it’s a type of market research that uses second-hand data.

Who is it for?

Secondary research is ideal for start-ups and small businesses, needing a type of market research that’s low-cost and quick to undertake.

How to collect the data?

Secondary data is collected from various places but always comes from existing third-party information.

Benefits of secondary research

- A low-cost type of research

- It’s quick to conduct

- Data is easy to access

- Initial findings can help shape any longer-term investment in primary research

- Anybody can do it; there’s no professional training required

- Gives you a broad understanding of a topic quickly

Types of secondary research

Most secondary market research methods can be done for free. It’s also called desk research. Here are some of the most popular places to obtain that data.

- Internet search engines

- Trade associations

- Research companies

- Media outlets

- Industry experts

- Government and non-government agencies

- Digital intelligence platforms (like Similarweb)

- Educational institutions

- Company reports

- Academic journals

- Public libraries

- Competitor websites

3. Qualitative research

Qualitative research aims to understand opinions, beliefs, experiences, attitudes, and interactions by collecting and analyzing non-numerical data. It helps researchers understand why things are so, through observation or unstructured questioning.

Compared to quantitative methods, this is more of a touchy-feely type of market research. It’s more about emotions and opinions than crunching numbers.

Who is it for?

Any business or start-up can use (and benefit from) qualitative research. To understand the sentiment of a target audience or market in detail, this type of research uncovers key insights that help shape and develop products, services, and strategies.

How to collect the data?

You can conduct qualitative research remotely or in person. What’s key is that the data is collected first-hand, directly from an individual or group of people.

Benefits of qualitative research

- Captures shifting attitudes or sentiments within a target group.

- Can uncover key insights that numbers alone couldn’t reveal.

- More targeted research, is often more concentrated compared to quantitative research.

- Cost and speed can be managed more effectively with smaller groups.

- Promotes authenticity in discussions as responses aren’t formed by pre-set constraints.

- Greater flexibility than other research methods as questions can be adapted over time.

Types of qualitative research

- Focus groups

- Interviews

- Participant observation

- Ethnography

- Case Studies

- Grounded theory (using research to generate a theory)

- Narrative

- Thematic analysis (looks to identify or interpret patterns and their connected meanings)

- Open-ended surveys

- Diary or Journal logging

- Phenomenological study (where you take a customer or individual, and examine things from their perspective)

Read More: 83 Qualitative Research Questions & Examples

4. Quantitative research

Quantitative research is focused on collecting, analyzing, and comparing numerical data. It’s predominantly used to make predictions, spot trends, find patterns, and establish averages. It deals with primary and secondary data, as long as it is represented in numerical form.

Who is it for?

Quantitative research provides data that can shed light on statistical information about a market or business. It’s useful for start-ups and established companies and can help with forecasting, market sizing, market validation, and more.

How to collect the data?

Using various methods, quantitative research is systematically collected and recorded to do analysis in a database through graphics, charts, and tables.

Benefits of quantitative research

- Data can be analyzed reliably and consistently.

- Studies can be easily replicated in the future or a different market.

- It’s possible to do a broader study with large sample sizes.

- Fewer variables are involved as data is often close-ended.

- Automation makes data collection quicker and easier to conduct.

- More cost-effective than qualitative research.

Types of quantitative research

Due to the often complex nature of this type of market research, I’ve added a quick explainer.

- Experimental research

Also referred to as true experimentation, this relies on theory. In most cases, multiple theories that have not yet been proven. An analysis is carried out to prove or disprove the theory. - Descriptive research

This is used better to understand a specific situation, population, or phenomenon. It seeks only to measure (not manipulate) variables through observation to investigate them thoroughly. - Survey research

Quite simply, this uses a range of online or offline polls to understand what customers or a group of people think about products, services, and more. - Quasi-experimental research

Similar to experimental research, it aims to evaluate a cause-and-effect relationship amongst variables. However, it’s a dependent and independent variable in this case. - Correlational research

This is typically undertaken to determine a relationship between two closely related entities. It explores how each entity impacts the other and examines key changes.

Read More: 98 Quantitative Market Research Questions & Examples

Mixed-method research approach

Each of the four different types of market research have their strengths and weaknesses. When you combine methods, you get the best of both worlds: An approach known as mixed-method market research. When done correctly, it can boost outcomes’ accuracy and quality, adding depth and breadth to your research and results.

6 modern types of market research

Outside the four core types of market research, there are modern ways to discover valuable information that can leverage better insights. If you’re looking for new types of research that’ll help you quickly find new opportunities to go after, read on.

1. Competitor research

In-depth competitor analysis allows you to quickly find growth opportunities, by taking a detailed look at what is and isn’t working for your rivals. What’s more, it can help you spot emerging trends and shifts, so you can take action when and where it matters most.

These are some of the things you can expect to uncover with competitive market research:

- Understand how to track and target your competitors’ audiences.

- Discover the best traffic sources to see where rivals are gaining referrals from.

- Establish a clear view of rival’s market share across any industry.

- See traffic changes over time amongst industry leaders and emerging players.

- Find out which channels are working best for competitors.

- Benchmark your business against others in your space.

- Track a customized list of players in your sector to see gains and losses.

2. Audience research

Consumer insights are fundamental to the success of any organization, regardless of size or sector. Through the analysis of consumer behavior, you can drive better engagement, discover new digital strategies, and develop a more detailed understanding of your prospects and customers.

Here are just a few examples of how doing audience-based research can help:

- Better understand audience interests relative to an industry or your rivals.

- Measure audience loyalty.

- See where they spend their time online.

- Build a picture of an audience layered with insights from real-world browsing habits.

- Uncover key demographics, interests, and geographies of an audience.

To help you get started, here are four audience analysis examples.

3. Content and keyword research

At the last count, there were roughly 1.93 billion websites online, and I’m not even going to get into how many social media accounts there are. But with so many digital channels, you must ensure your content and company can be easily found online. This is where (and why) content and keyword-based market research deliver immense value.

Get it right, and you’ll reap the benefits through more visitors, leads, conversions, and revenue. The golden nugget you uncover with keyword and content research is a greater understanding of an audience. Although most people would associate keyword research with SEO, it serves a dual purpose.

To get started, do a competitive content analysis within your market.

4. Campaign effectiveness

Knowing how effective a specific type of advertising channel, message, or format is for a target audience can quickly help you determine where’s best to spend your marketing dollars. By researching the effectiveness of ads in your space, you can more easily see the best places to invest your time and effort.

This type of market research helps you:

- Find out if paid advertising is working or not.

- Discover the highest-converting ads.

- See what types of creatives work best for your target audience.

- Look at competitors’ total spend in a specific channel.

- View social media referrals and their impact on website traffic.

- Drill-down into top-performing ads to see messaging, visuals, and more.

5. Mobile app market research

Mobile-first consumer habits have seen industries turned on their heads overnight. For most, it’s not a question of ‘if’ but ‘when’ mobile apps will infiltrate their market. In any industry, seeing the impact of apps in your space is vital. The need to see a complete view of the digital landscape is rising fast.

Some of the key things you can uncover through app intelligence-focused research include:

- Find trending apps in any sector, specifically looking at growth/decline.

- App usage and engagement metrics across multiple markets.

- Analyze an app’s ranking over time.

- Identify underserved markets and spot opportunities to break into new spaces.

- Evaluate iOS vs. Android stats to determine which platform is optimal for an audience.

- View the performance of competitors’ apps over time.

- Compare app performance metrics directly against desktop or mobile web channels.

- Determine whether or not to invest in a mobile app for your business.

At Similarweb, our app intelligence coverage shows a complete view of the digital landscape, across web and apps, in over 60 countries and for both iOS and Android platforms. Here’s a quick look at some of the insights on offer.

Using app intelligence, you can benchmark your organization across the digital landscape. With this, you can easily compare web and app performance across a range of key usage metrics. This data helps you identify trends, and keep a close eye on the market leaders and rising stars.

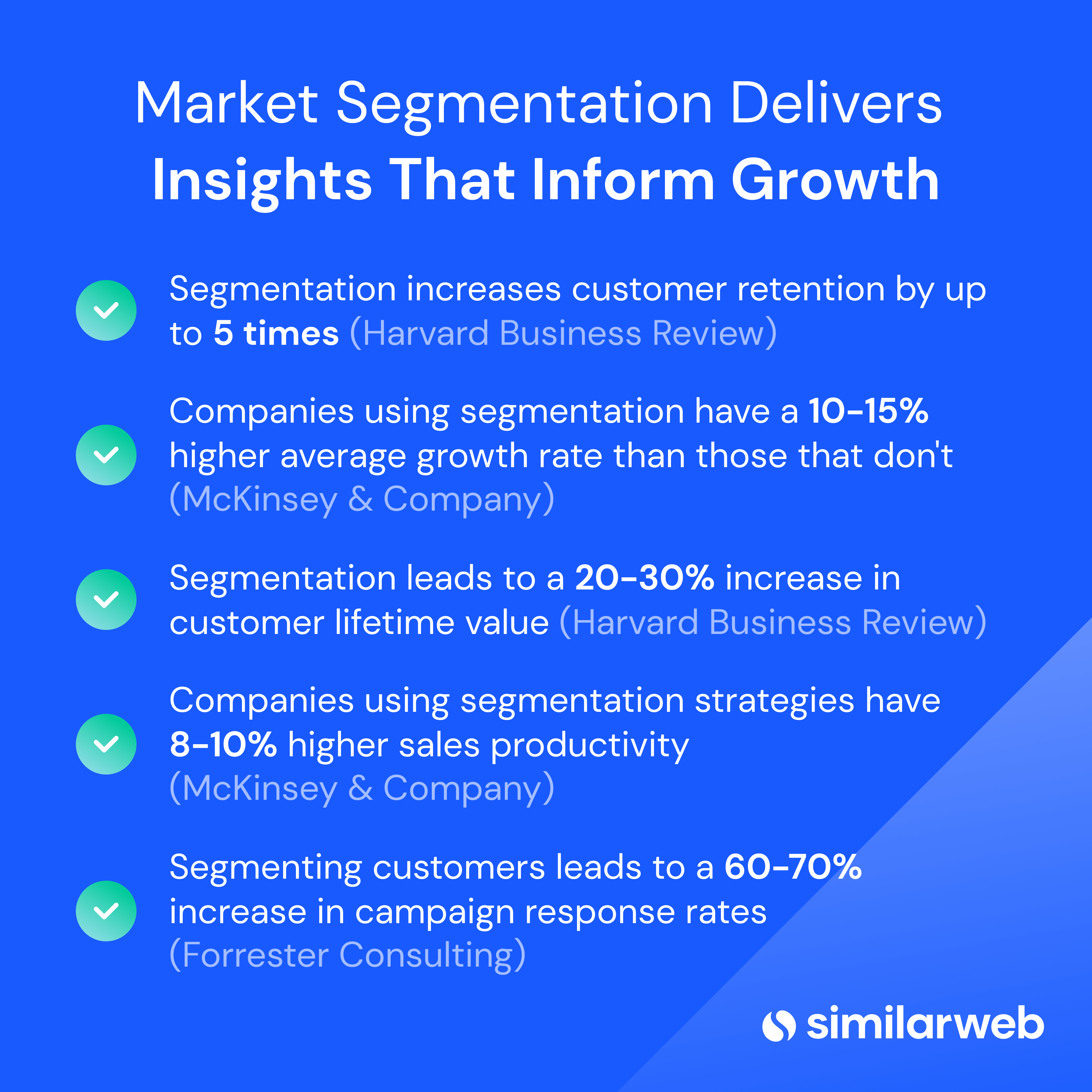

6. Market segmentation

Understanding whole market trends are useful. But the real pearls of wisdom can be found when you slice and dice a market into manageable portions. Market segmentation is important for businesses to identify and target specific customer groups, tailor their products and services, and measure their performance.

This type of market research helps you:

- Deliver personalized marketing

- Identify market shifts

- Find opportunities for growth in specific segments of a market

- Improve targeting

- Allocate resources more efficiently

- Improve customer engagement and loyalty

- Increase return on investment by identifying opportunity segments

Choosing the right type of market research

Whatever your industry, role, or experience, the type of market research you choose will influence key decisions in your business. With rapid shifts in consumer behavior and emerging threats now virtually an everyday thing, you need a broad and relevant view of the landscape. No single type of market research alone gives a complete picture.

Organizations must keep a finger on the pulse to stay relevant, adapt, and compete. While using traditional types of market research is key, you can gain key insights much quicker, often for a much lower cost, using modern tools like Similarweb Web Intelligence.

Why not take it for a trial run today? For free.

FAQ

What’s the difference between qualitative and quantitative research?

Quantitative research is based on numbers and seeks to explain theories or hypotheses. In contrast, qualitative research is more about understanding the ‘how’ and ‘why’ things happen.

Should I use more than one market research method at a time?

Yes, it’s important to take a balanced approach when choosing the best type of research. While it’s vital to clearly understand what is happening, you also need to consider the ‘why’ things happen.

What type of market research is best for start-ups?

Most start-ups use secondary research as it’s quick and affordable. However, there are many benefits to conducting first-hand primary research as well.

What types of market research can you do for free?

Most secondary research is free to conduct. If you have access to a list of subjects or prospects, you can also use market research surveys to conduct primary market research for free.

Is quantitative research primary or secondary?

It can be both. Secondary and primary data can be quantitative (number-based) or qualitative (verbal or opinion-based).

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist