Small Business Market Research: Examples and Tips

Doing market research for a small business can be the difference between success and failure, helping you seamlessly pivot from good to great.

Yes, it’s that important.

With the latest stats on SMB survival rates from the U.S bureau of labor statistics showing just 25% make it to the 15-year mark, small business market research is one of the most important things you can do for your future success.

How can market research for a small business help?

Doing market research helps business owners uncover vital information that helps set a clear strategic direction for the future. You can learn about consumer needs and demands, growth opportunities, competitors’ tactics, underserved or new markets – and see first-hand what’s working (or not) in your space at any time.

Small business market research helps you:

- Establish consumer likes and dislikes

- Create a competitive blueprint

- Find new customers

- Discover new markets

- Uncover opportunities for growth

- Understand your market

- See what is and isn’t working

- Spot emerging trends

- Establish the competitor landscape

- Find good traffic sources

- Discover new affiliate prospects

- Create a data-driven strategy

- Build a sustainable business model

How to do market research for a small business in five steps

The best way to do small business market research is to use a method known as secondary research. It’s affordable, it’s highly effective, and it doesn’t actually take that much time.

Read our desk research guide to discover everything you need to know about this technique in more detail.

Here are five steps to follow when doing market research for your business:

- Define your research topic – consider what you want to know, and list the questions you want to answer with your research.

- Detail all the resources you plan to use – tools, customer lists, industry data, reports, competitors, etc.

- Collect the data.

- Collate all information in a useable format.

- Analyze the data. Look at the questions you defined at the start. Hopefully, you found the answers you needed. If not, return to step 2, and find other resources to help you get clearer insights.

The beauty of this process is its simplicity. Use it as a recipe for success in almost any scenario. Adapt your ingredients (market research questions), and use different techniques (market research tools) to discover new outcomes. As long as you stick to the format, you’ll be able to quickly identify trends and opportunities to drive growth and build well-informed, data-driven strategies.

How often should you do small business research?

To stay ahead and achieve sustainable growth, market research should form part of your bi-weekly routine.

I know….it sounds a little OTT, but hear me out.

Typically, events like quarterly or end-of-year business reviews, investment, and grant applications spark small business market research activities.

I know this for two reasons:

When I worked in a product team, everyone would ‘down tools’ the week before end-of-quarter. People would prep for their vendor reviews, and this was considered best practice. However, having seen how quickly today’s markets and consumer behaviors shift; that tactic is no longer viable or effective.

Having these insights is just one piece of the puzzle. I was curious to see if others did the same thing – and as any good researcher should, I sought to validate my suspicions. Sure enough, using Similarweb Research Intelligence, a quick search interest analysis around keywords like, ‘how to do small business market research’, ‘market sizing’, and ‘competitive analysis’, my instincts were immediately confirmed, with solid data to back everything up.

See search interest analysis with Similarweb. Notice spikes in search trends periodically, and a higher volume of searches for small business market research terms at end of year, half-year, and quarterly periods.

Infrequent market research leaves you susceptible to emerging threats. Which is why it should form part of a monthly habit. This way, you won’t miss the chance to respond to shifts; making it easier to stay ahead of the curve and find new growth opportunities faster than your rivals.

Pro Tip: Find your tool of choice for small business research, and master it. This way, the different types of benchmarking become second nature, making the process fast and more effective.

Small business market research tools

For a small business, market research tools are invaluable. Oh, and the best tools aren’t always the most expensive.

Here are some of the best types of market research tools a small business can use:

1. Online surveys

Are a low-cost, quick, and easy way to gather feedback from people about what they want, like, and dislike. If you don’t have a mailing list, you can easily share via social channels or a website. Survey Monkey and Typeform are considered two of the best. Uncover 18 ways to use surveys in small business research here.

2. Digital intelligence software

Similarweb is a great place to start any market research for a small business. View high-level estimations for any website or app, and better understand the size, reach, and potential traffic sources. Sign-up to Similarweb for free insights for any domain URL, or download our Similarweb Chrome extension for on-the-fly analytics.

3. Answer the public

Answer the public is free to use, and you can get insights into what questions people are asking about a topic. It can help shape content strategy, optimize website content, and even develop new products or services.

4. Think with Google

Think with Google is good for digging into consumer insights and persona development. Use the ‘affinity audiences’ and ‘in-market audiences’ in tandem to develop a better understanding of a target audience’s habits and interests.

5. BuzzSumo

BuzzSumo is known to most content marketers, and useful for small business market research. See what a target audience cares about and what content they engage with. Set-up alerts for social mentions, keywords, or comments relevant to your audience or business.

6. Dimensions.ai

Dimension AI is a powerhouse of academic publications and scientific research. It’s a centralized tool giving access to a range of authoritative research papers; helpful if you need to substantiate decisions. Always set your search to filter Open Access (OA) for free results.

Examples of small business market research

Here are five easy ways to use business market research to grow your empire.

1. Find out what’s working, or not

What: Competitive Analysis

Why: Having a clear view of what others do in your space allows you to tailor and optimize marketing efforts accordingly. But it’s not all about web and app traffic; there’s value in doing social media competitive analysis too. This is particularly good to see what people dislike, as some tend to be more vocal on these channels – think, reviews, comments, and promotional posts.

Expert Tip: I spoke with David Bitton, the Co-Founder & CMO of Doorloop, a serial entrepreneur with companies in tech, events, and services. Here’s his take on the topic.

How: There are many ways to do a competitive analysis for your business. This 2-minute video shows you exactly how to do it.

Follow-up activity: Once you’ve done your initial analysis, the next step is competitive benchmarking, tracking and measuring the outcomes and strategies of your rivals.

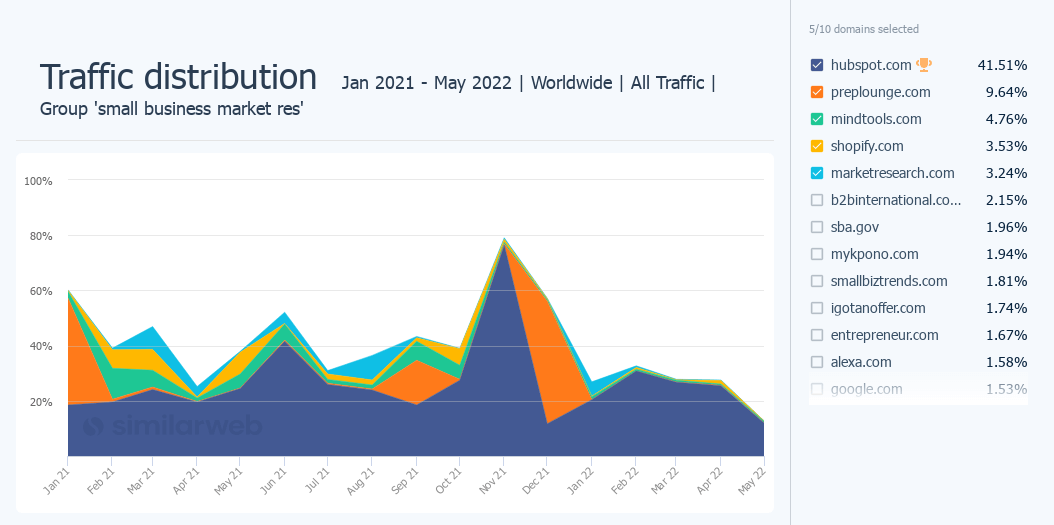

2. Create the ultimate competitor blueprint

What: Market analysis framework

Why: Competitive frameworks take information from the competitive analysis outlined above, and place them into a structured, organized visual model that’s easy for you and others to understand.

How: There are different ways to do this element of business market research. We’ve written an article that gives you the most popular competitive analysis frameworks.

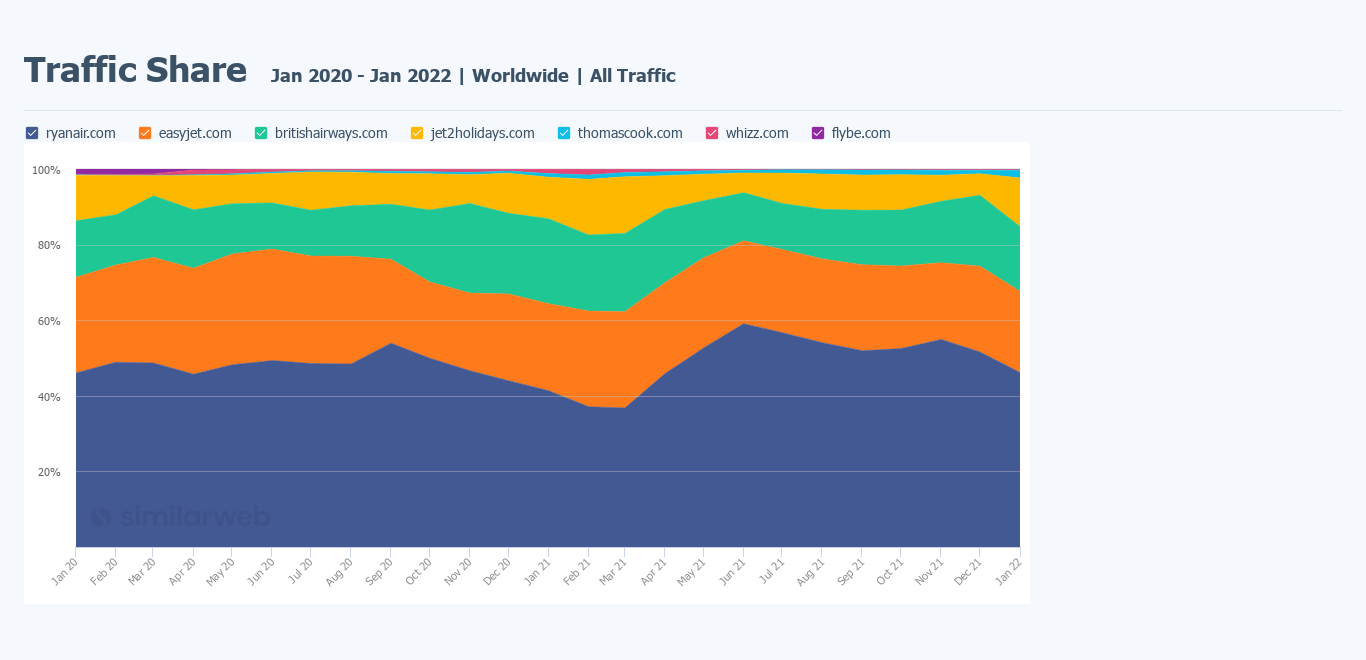

3. Find the right growth strategy

What: Traffic share

Why: With over 400 million small businesses globally, accounting for 95% of all firms, the competition has never been so rife. But with the right strategy, you can focus on activities that help you grow your market share.

How: To increase your market share, find ways to boost your traffic share. After all, in the digital world, traffic represents market volume.

Using Similarweb Research Intelligence, see your own traffic share vs. the competition, as well as an industry-wide view. Drill down into traffic sources as well as various engagement metrics.

Using industry trends, explore how traffic changes impact a custom set of players in an industry. Go a step further to view trends in real-time, and dig deeper into data sets relating to traffic sources, monthly changes, mobile vs. desktop traffic share, bounce rates, duration, and more.

4. Create lasting connections with customers

What: Audience Analysis

Why: Competition across all industries is fierce, giving consumers an abundance of choice. A recent survey undertaken by Salesforce said that almost 70% of people expect companies to accommodate their needs. Indeed, 2020 will be forever known as the year people’s online habits and preferences shifted in a major way.

If you’re not looking after your customer’s needs, somebody else will.

Here’s how market research enabled Steadily, a small business in the insurance sector, to adapt their strategy for growth, which contributed to their ability to secure investment.

How: Audience analysis is so much more than the development of buyer personas. To really understand who they are and what they care about, you need to find out where they spend time online, how much they’re shopping around, how long they’re spending on sites, and other core demographical data about where they are, the types of device they use, their age, gender, and such. While there are lots of complex tools to help with this, Similarweb makes it easy to view audience insights and consumer behavior in a single place.

5. Understand your market

What: Industry analysis

Why: Understanding your market as it was, is no longer enough. Market trends and consumer behavior can shift at a moment’s notice. By failing to keep a close eye on your market, insights into emerging threats and opportunities arrive too late.

- When was the last time you looked at what was going on in your space?

- Did you know about the new app a competitor launched last week that’s getting major footfall? Have you heard about the three new competitors who’ve been growing at a rate of 5,000% for the last three months?

- What about the new content publisher that’s driving over 50 leads per day to your rivals?

How: To find out what’s happening in your market, you’ll need an industry-wide view of the top players, as well as others. This means looking at their traffic sources and channels, and paying close attention to any changes. By doing market research into industry trends, you can understand impactful macro changes while tracking historical trends over time.

App intelligence is another key consideration. With mobile-first consumer habits (and spend) on the rise, having visibility across web and apps has never been more relevant than it is today.

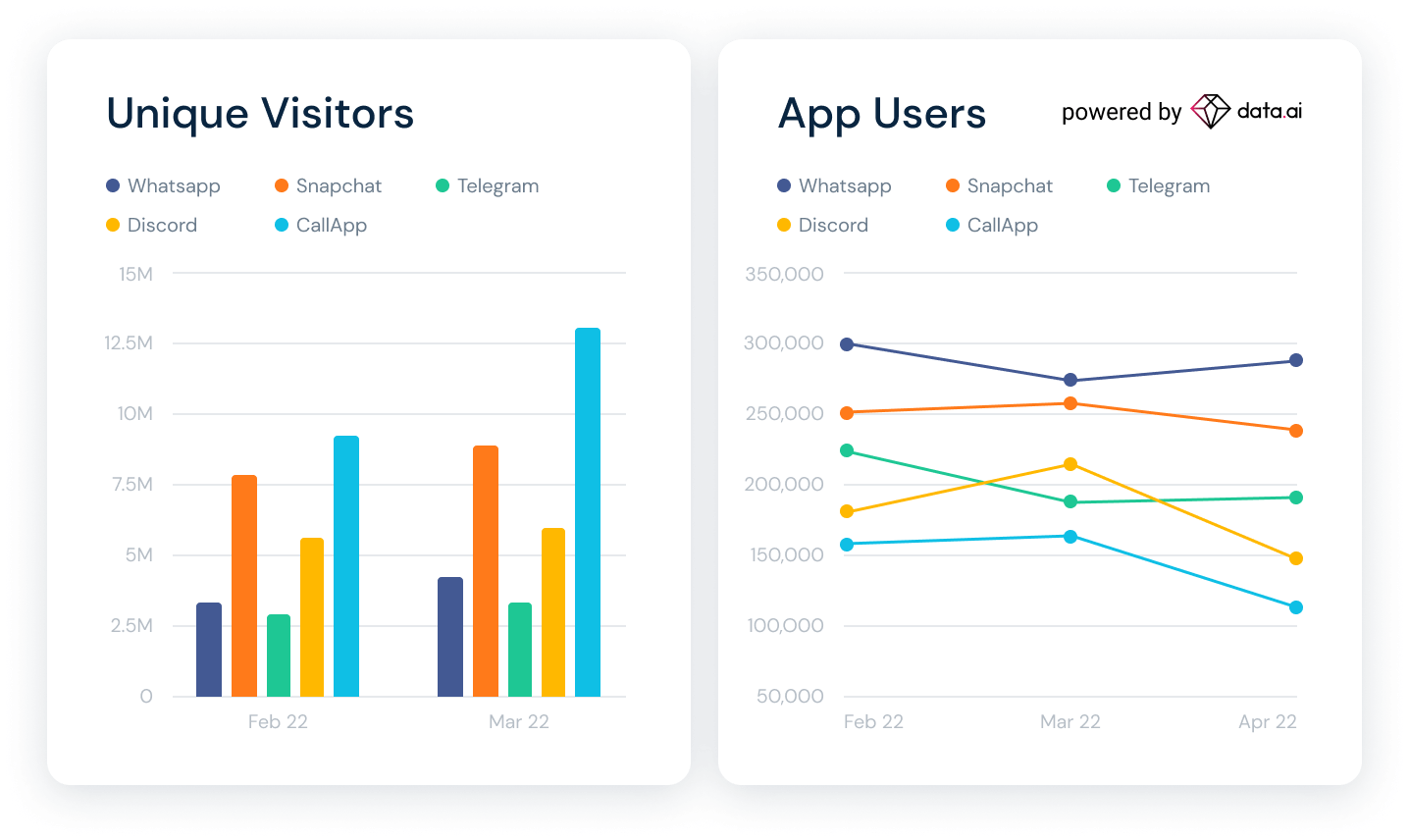

This caption shows unique visitors to apps across an industry and shows how the total number of app users changes over time. With apps entering almost every market, small business research can help you uncover opportunities and threats that can help you succeed.

In summary

Doing small business research is an investment that creates both long and short-term advantages. Using reliable data to shape decisions instead of instinct alone is crucial to the survival and success of your company. Soon, you’ll rapidly pivot from data viewer to data junkie. Seriously, it’s easy to get hooked once you start to see the bottom-line impact of market research for a small business, and the many ways it can help you grow.

Small Business Market Research FAQs

How do small businesses carry out market research?

The best way to do small business research is using a secondary or desk-based research technique. You can use tools like Similarweb Research Intelligence to quickly uncover key information about your market, competitors, and trends.

Is market research useful for a small business?

Yes. Market research helps you uncover strategies for growth, key trends impacting your industry, and allows you to see what is and isn’t working for your rivals. In addition, it can help you get a better understanding of your target market and tailor your products and messaging accordingly.

How do you conduct market research in startups and small firms?

Use desk-based research methods to conduct effective market in start-ups and small firms. It’s low cost, effective, and quickly shows you relevant opportunities, threats, and market trends that could impact your business.

Should I outsource my small business research?

Using an outsourced market research service will cost you more money compared to doing it yourself. It also takes you a step away from key insights and market intel you need to know. After all, if you want to benchmark performance, you’re going to need to pay an outsourced market research service again for this. Learn how to do market research for yourself; you’ll save money in the long run, and spotting emerging threats or changes in trends will be easier, and quicker too.

What is the best form of market research for a new business start-up?

Desk research is the best form of market research for a new business. You can do it yourself, it’s more cost-effective, and it can help you uncover key information that can shape your strategies, messaging, and positioning.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist