83 Qualitative Research Questions & Examples

Qualitative research questions help you understand consumer sentiment. They’re strategically designed to show organizations how and why people feel the way they do about a brand, product, or service. It looks beyond the numbers and is one of the most telling types of market research a company can do.

The UK Data Service describes this perfectly, saying, “The value of qualitative research is that it gives a voice to the lived experience.”

Read on to see seven use cases and 83 qualitative research questions, with the added bonus of examples that show how to get similar insights faster with Similarweb Research Intelligence.

What is a qualitative research question?

A qualitative research question explores a topic in-depth, aiming to better understand the subject through interviews, observations, and other non-numerical data. Qualitative research questions are open-ended, helping to uncover a target audience’s opinions, beliefs, and motivations.

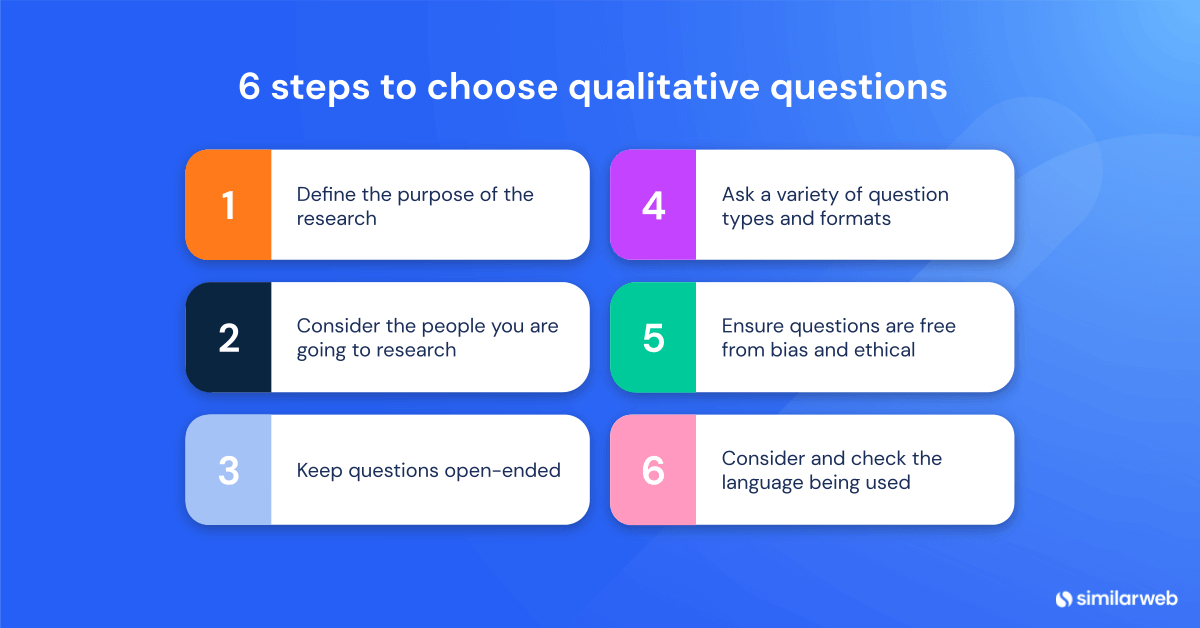

How to choose qualitative research questions?

Choosing the right qualitative research questions can be incremental to the success of your research and the findings you uncover. Here’s my six-step process for choosing the best qualitative research questions.

- Start by understanding the purpose of your research. What do you want to learn? What outcome are you hoping to achieve?

- Consider who you are researching. What are their experiences, attitudes, and beliefs? How can you best capture these in your research questions?

- Keep your questions open-ended. Qualitative research questions should not be too narrow or too broad. Aim to ask specific questions to provide meaningful answers but broad enough to allow for exploration.

- Balance your research questions. You don’t want all of your questions to be the same type. Aim to mix up your questions to get a variety of answers.

- Ensure your research questions are ethical and free from bias. Always have a second (and third) person check for unconscious bias.

- Consider the language you use. Your questions should be written in a way that is clear and easy to understand. Avoid using jargon, acronyms, or overly technical language.

Types of qualitative research questions

For a question to be considered qualitative, it usually needs to be open-ended. However, as I’ll explain, there can sometimes be a slight cross-over between quantitative and qualitative research questions.

Open-ended questions

These allow for a wide range of responses and can be formatted with multiple-choice answers or a free-text box to collect additional details. The next two types of qualitative questions are considered open questions, but each has its own style and purpose.

- Probing questions are used to delve deeper into a respondent’s thoughts, such as “Can you tell me more about why you feel that way?”

- Comparative questions ask people to compare two or more items, such as “Which product do you prefer and why?” These qualitative questions are highly useful for understanding brand awareness, competitive analysis, and more.

Closed-ended questions

These ask respondents to choose from a predetermined set of responses, such as “On a scale of 1-5, how satisfied are you with the new product?” While they’re traditionally quantitative, adding a free text box that asks for extra comments into why a specific rating was chosen will provide qualitative insights alongside their respective quantitative research question responses.

- Ranking questions get people to rank items in order of preference, such as “Please rank these products in terms of quality.” They’re advantageous in many scenarios, like product development, competitive analysis, and brand awareness.

- Likert scale questions ask people to rate items on a scale, such as “On a scale of 1-5, how satisfied are you with the new product?” Ideal for placement on websites and emails to gather quick, snappy feedback.

Qualitative research question examples

There are many applications of qualitative research and lots of ways you can put your findings to work for the success of your business. Here’s a summary of the most common use cases for qualitative questions and examples to ask.

Qualitative questions for identifying customer needs and motivations

These types of questions help you find out why customers choose products or services and what they are looking for when making a purchase.

- What factors do you consider when deciding to buy a product?

- What would make you choose one product or service over another?

- What are the most important elements of a product that you would buy?

- What features do you look for when purchasing a product?

- What qualities do you look for in a company’s products?

- Do you prefer localized or global brands when making a purchase?

- How do you determine the value of a product?

- What do you think is the most important factor when choosing a product?

- How do you decide if a product or service is worth the money?

- Do you have any specific expectations when purchasing a product?

- Do you prefer to purchase products or services online or in person?

- What kind of customer service do you expect when buying a product?

- How do you decide when it is time to switch to a different product?

- Where do you research products before you decide to buy?

- What do you think is the most important customer value when making a purchase?

Qualitative research questions to enhance customer experience

Use these questions to reveal insights into how customers interact with a company’s products or services and how those experiences can be improved.

- What aspects of our product or service do customers find most valuable?

- How do customers perceive our customer service?

- What factors are most important to customers when purchasing?

- What do customers think of our brand?

- What do customers think of our current marketing efforts?

- How do customers feel about the features and benefits of our product?

- How do customers feel about the price of our product or service?

- How could we improve the customer experience?

- What do customers think of our website or app?

- What do customers think of our customer support?

- What could we do to make our product or service easier to use?

- What do customers think of our competitors?

- What is your preferred way to access our site?

- How do customers feel about our delivery/shipping times?

- What do customers think of our loyalty programs?

Qualitative research question example for customer experience

- ♀️ Question: What is your preferred way to access our site?

- Insight sought: How mobile-dominant are consumers? Should you invest more in mobile optimization or mobile marketing?

- Challenges with traditional qualitative research methods: While using this type of question is ideal if you have a large database to survey when placed on a site or sent to a limited customer list, it only gives you a point-in-time perspective from a limited group of people.

- A new approach: You can get better, broader insights quicker with Similarweb Digital Research Intelligence. To fully inform your research, you need to know preferences at the industry or market level.

- ⏰ Time to insight: 30 seconds

- ✅ How it’s done: Similarweb offers multiple ways to answer this question without going through a lengthy qualitative research process.

First, I’m going to do a website market analysis of the banking credit and lending market in the finance sector to get a clearer picture of industry benchmarks.

Here, I can view device preferences across any industry or market instantly. It shows me the device distribution for any country across any period. This clearly answers the question of how mobile dominate my target audience is, with 59.79% opting to access site via a desktop vs. 40.21% via mobile

I then use the trends section to show me the exact split between mobile and web traffic for each key player in my space. Let’s say I’m about to embark on a competitive campaign that targets customers of Chase and Bank of America; I can see both their audiences are highly desktop dominant compared with others in their space.

Qualitative question examples for developing new products or services

Research questions like this can help you understand customer pain points and give you insights to develop products that meet those needs.

- What is the primary reason you would choose to purchase a product from our company?

- How do you currently use products or services that are similar to ours?

- Is there anything that could be improved with products currently on the market?

- What features would you like to see added to our products?

- How do you prefer to contact a customer service team?

- What do you think sets our company apart from our competitors?

- What other product or service offerings would like to see us offer?

- What type of information would help you make decisions about buying a product?

- What type of advertising methods are most effective in getting your attention?

- What is the biggest deterrent to purchasing products from us?

Qualitative research question example for service development

- ♀️ Question: What type of advertising methods are most effective in getting your attention?

- Insight sought: The marketing channels and/or content that performs best with a target audience.

- Challenges with traditional qualitative research methods: When using qualitative research surveys to answer questions like this, the sample size is limited, and bias could be at play.

- A better approach: The most authentic insights come from viewing real actions and results that take place in the digital world. No questions or answers are needed to uncover this intel, and the information you seek is readily available in less than a minute.

- ⏰ Time to insight: 5 minutes

- ✅ How it’s done: There are a few ways to approach this. You can either take an industry-wide perspective or hone in on specific competitors to unpack their individual successes. Here, I’ll quickly show a snapshot with a whole market perspective.

Using the market analysis element of Similarweb Digital Intelligence, I select my industry or market, which I’ve kept as banking and credit. A quick click into marketing channels shows me which channels drive the highest traffic in my market. Taking direct traffic out of the equation, for now, I can see that referrals and organic traffic are the two highest-performing channels in this market.

Similarweb allows me to view the specific referral partners and pages across these channels.

Looking closely at referrals in this market, I’ve chosen chase.com and its five closest rivals. I select referrals in the channel traffic element of marketing channels. I see that Capital One is a clear winner, gaining almost 25 million visits due to referral partnerships.

Next, I get to see exactly who is referring traffic to Capital One and the total traffic share for each referrer. I can see the growth as a percentage and how that has changed, along with an engagement score that rates the average engagement level of that audience segment. This is particularly useful when deciding on which new referral partnerships to pursue.

Once I’ve identified the channels and campaigns that yield the best results, I can then use Similarweb to dive into the various ad creatives and content that have the greatest impact.

These ads are just a few of those listed in the creatives section from my competitive website analysis of Capital One. You can filter this list by the specific campaign, publishers, and ad networks to view those that matter to you most. You can also discover video ad creatives in the same place too.

In just five minutes ⏰

- I’ve captured audience loyalty statistics across my market

- Spotted the most competitive players

- Identified the marketing channels my audience is most responsive to

- I know which content and campaigns are driving the highest traffic volume

- I’ve created a target list for new referral partners and have been able to prioritize this based on results and engagement figures from my rivals

- I can see the types of creatives that my target audience is responding to, giving me ideas for ways to generate effective copy for future campaigns

Qualitative questions to determine pricing strategies

Companies need to make sure pricing stays relevant and competitive. Use these questions to determine customer perceptions on pricing and develop pricing strategies to maximize profits and reduce churn.

- How do you feel about our pricing structure?

- How does our pricing compare to other similar products?

- What value do you feel you get from our pricing?

- How could we make our pricing more attractive?

- What would be an ideal price for our product?

- Which features of our product that you would like to see priced differently?

- What discounts or deals would you like to see us offer?

- How do you feel about the amount you have to pay for our product?

Qualitative research question example for determining pricing strategies

- ♀️ Question: What discounts or deals would you like to see us offer?

- Insight sought: The promotions or campaigns that resonate with your target audience.

- Challenges with traditional qualitative research methods: Consumers don’t always recall the types of ads or campaigns they respond to. Over time, their needs and habits change. Your sample size is limited to those you ask, leaving a huge pool of unknowns at play.

- A better approach: While qualitative insights are good to know, you get the most accurate picture of the highest-performing promotion and campaigns by looking at data collected directly from the web. These analytics are real-world, real-time, and based on the collective actions of many, instead of the limited survey group you approach. By getting a complete picture across an entire market, your decisions are better informed and more aligned with current market trends and behaviors.

- ⏰ Time to insight: 5 minutes

- ✅ How it’s done: Similarweb’s Popular Pages feature shows the content, products, campaigns, and pages with the highest growth for any website. So, if you’re trying to unpack the successes of others in your space and find out what content resonates with a target audience, there’s a far quicker way to get answers to these questions with Similarweb.

Here, I’m using Capital One as an example site. I can see trending pages on their site showing the largest increase in page views. Other filters include campaign, best-performing, and new–each of which shows you page URLs, share of traffic, and growth as a percentage. This page is particularly useful for staying on top of trending topics, campaigns, and new content being pushed out in a market by key competitors.

Qualitative research questions for product development teams

It’s vital to stay in touch with changing consumer needs. These questions can also be used for new product or service development, but this time, it’s from the perspective of a product manager or development team.

- What are customers’ primary needs and wants for this product?

- What do customers think of our current product offerings?

- What is the most important feature or benefit of our product?

- How can we improve our product to meet customers’ needs better?

- What do customers like or dislike about our competitors’ products?

- What do customers look for when deciding between our product and a competitor’s?

- How have customer needs and wants for this product changed over time?

- What motivates customers to purchase this product?

- What is the most important thing customers want from this product?

- What features or benefits are most important when selecting a product?

- What do customers perceive to be our product’s pros and cons?

- What would make customers switch from a competitor’s product to ours?

- How do customers perceive our product in comparison to similar products?

- What do customers think of our pricing and value proposition?

- What do customers think of our product’s design, usability, and aesthetics?

Qualitative questions examples to understand customer segments

Market segmentation seeks to create groups of consumers with shared characteristics. Use these questions to learn more about different customer segments and how to target them with tailored messaging.

- What motivates customers to make a purchase?

- How do customers perceive our brand in comparison to our competitors?

- How do customers feel about our product quality?

- How do customers define quality in our products?

- What factors influence customers’ purchasing decisions?

- What are the most important aspects of customer service?

- What do customers think of our customer service?

- What do customers think of our pricing?

- How do customers rate our product offerings?

- How do customers prefer to make purchases (online, in-store, etc.)?

Qualitative research question example for understanding customer segments

- ♀️ Question: Which social media channels are you most active on?

- Insight sought: Formulate a social media strategy. Specifically, the social media channels most likely to succeed with a target audience.

- Challenges with traditional qualitative research methods: Qualitative research question responses are limited to those you ask, giving you a limited sample size. Questions like this are usually at risk of some bias, and this may not be reflective of real-world actions.

- A better approach: Get a complete picture of social media preferences for an entire market or specific audience belonging to rival firms. Insights are available in real-time, and are based on the actions of many, not a select group of participants. Data is readily available, easy to understand, and expandable at a moment’s notice.

- ⏰ Time to insight: 30 seconds

- ✅ How it’s done: Using Similarweb’s website analysis feature, you can get a clear breakdown of social media stats for your audience using the marketing channels element. It shows the percentage of visits from each channel to your site, respective growth, and specific referral pages by each platform. All data is expandable, meaning you can select any platform, period, and region to drill down and get more accurate intel, instantly.

This example shows me Bank of America’s social media distribution, with YouTube, Linkedin, and Facebook taking the top three spots, and accounting for almost 80% of traffic being driven from social media.

When doing any type of market research, it’s important to benchmark performance against industry averages and perform a social media competitive analysis to verify rival performance across the same channels.

Qualitative questions to inform competitive analysis

Organizations must assess market sentiment toward other players to compete and beat rival firms. Whether you want to increase market share, challenge industry leaders, or reduce churn, understanding how people view you vs. the competition is key.

- What is the overall perception of our competitors’ product offerings in the market?

- What attributes do our competitors prioritize in their customer experience?

- What strategies do our competitors use to differentiate their products from ours?

- How do our competitors position their products in relation to ours?

- How do our competitors’ pricing models compare to ours?

- What do consumers think of our competitors’ product quality?

- What do consumers think of our competitors’ customer service?

- What are the key drivers of purchase decisions in our market?

- What is the impact of our competitors’ marketing campaigns on our market share? 10. How do our competitors leverage social media to promote their products?

Qualitative research question example for competitive analysis

- ♀️ Question: What other companies do you shop with for x?

- Insight sought: Who are your competitors? Which of your rival’s sites do your customers visit? How loyal are consumers in your market?

- Challenges with traditional qualitative research methods: Sample size is limited, and customers could be unwilling to reveal which competitors they shop with, or how often they around. Where finances are involved, people can act with reluctance or bias, and be unwilling to reveal other suppliers they do business with.

- A better approach: Get a complete picture of your audience’s loyalty, see who else they shop with, and how many other sites they visit in your competitive group. Find out the size of the untapped opportunity and which players are doing a better job at attracting unique visitors – without having to ask people to reveal their preferences.

- ✅ How it’s done: Similarweb website analysis shows you the competitive sites your audience visits, giving you access to data that shows cross-visitation habits, audience loyalty, and untapped potential in a matter of minutes.

Using the audience interests element of Similarweb website analysis, you can view the cross-browsing behaviors of a website’s audience instantly. You can see a matrix that shows the percentage of visitors on a target site and any rival site they may have visited.

With the Similarweb audience overlap feature, view the cross-visitation habits of an audience across specific websites. In this example, I chose chase.com and its four closest competitors to review. For each intersection, you see the number of unique visitors and the overall proportion of each site’s audience it represents. It also shows the volume of unreached potential visitors.

Here, you can see a direct comparison of the audience loyalty represented in a bar graph. It shows a breakdown of each site’s audience based on how many other sites they have visited. Those sites with the highest loyalty show fewer additional sites visited.

From the perspective of chase.com, I can see 47% of their visitors do not visit rival sites. 33% of their audience visited 1 or more sites in this group, 14% visited 2 or more sites, 4% visited 3 or more sites, and just 0.8% viewed all sites in this comparison.

How to answer qualitative research questions with Similarweb

Similarweb Research Intelligence drastically improves market research efficiency and time to insight. Both of these can impact the bottom line and the pace at which organizations can adapt and flex when markets shift, and rivals change tactics.

Outdated practices, while still useful, take time. And with a quicker, more efficient way to garner similar insights, opting for the fast lane puts you at a competitive advantage.

With a birds-eye view of the actions and behaviors of companies and consumers across a market, you can answer certain research questions without the need to plan, do, and review extensive qualitative market research.

Wrapping up

Qualitative research methods have been around for centuries. From designing the questions to finding the best distribution channels, collecting and analyzing findings takes time to get the insights you need. Similarweb Digital Research Intelligence drastically improves efficiency and time to insight. Both of which impact the bottom line and the pace at which organizations can adapt and flex when markets shift.

Similarweb’s suite of digital intelligence solutions offers unbiased, accurate, honest insights you can trust for analyzing any industry, market, or audience.

- Methodologies used for data collection are robust, transparent, and trustworthy.

- Clear presentation of data via an easy-to-use, intuitive platform.

- It updates dynamically–giving you the freshest data about an industry or market.

- Data is available via an API – so you can plug into platforms like Tableau or PowerBI to streamline your analyses.

- Filter and refine results according to your needs.

FAQs

Are quantitative or qualitative research questions best?

Both have their place and purpose in market research. Qualitative research questions seek to provide details, whereas quantitative market research gives you numerical statistics that are easier and quicker to analyze. You get more flexibility with qualitative questions, and they’re non-directional.

What are the advantages of qualitative research?

Qualitative research is advantageous because it allows researchers to better understand their subject matter by exploring people’s attitudes, behaviors, and motivations in a particular context. It also allows researchers to uncover new insights that may not have been discovered with quantitative research methods.

What are some of the challenges of qualitative research?

Qualitative research can be time-consuming and costly, typically involving in-depth interviews and focus groups. Additionally, there are challenges associated with the reliability and validity of the collected data, as there is no universal standard for interpreting the results.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist