Exploring the Impact of Inflation on US Consumers

The US was on track to experience full economic recovery from the COVID-19 pandemic until the eruption of the Ukraine War. We all witnessed the war’s global repercussions, which led to supply-chain disruption in several industries, driving energy and manufacturing costs up and eventually affecting consumers’ budgets.

These adverse factors impacted the ecommerce space: Recent findings from Similarweb’s report on US digital spending reveal a drop of 6% year-over-year (YoY) in desktop Converted Visits for the top 2251 ecommerce websites across various industries.

External data corroborates these findings. A recent report by McKinsey announced that consumer spending declined in comparison to the previous year for the 2nd month in a row in May 2023. In fact, Similarweb’s recent survey of a market research panel of 2,507 respondents reveals that 43% of consumers are saving less money than last year, and 87% of them believed inflation was the reason for a decrease in spare and extra spending money.

Based on the key findings of our recent report, this blog post will explore new behaviors adopted by US consumers with regard to rising prices and uncover which industries and demographics are suffering the most from decreased disposable income. Read on to find untapped, inflation-proof opportunities in your market and create a strategy based on real-user insights.

Topics covered in the blog

- The consumer trends of different age demographics

- Which product categories saw an increase in Converted Visits in 2023

- New opportunities in the dupe, white-label, and second-hand markets

- The rise and target audience of alternative financing

Younger consumers, especially Gen Z, are less likely to suffer from the cost of living crisis

During this time of inflation, the financial hardships faced by the American consumer have varied based on household needs, and the generational gap has become more apparent.

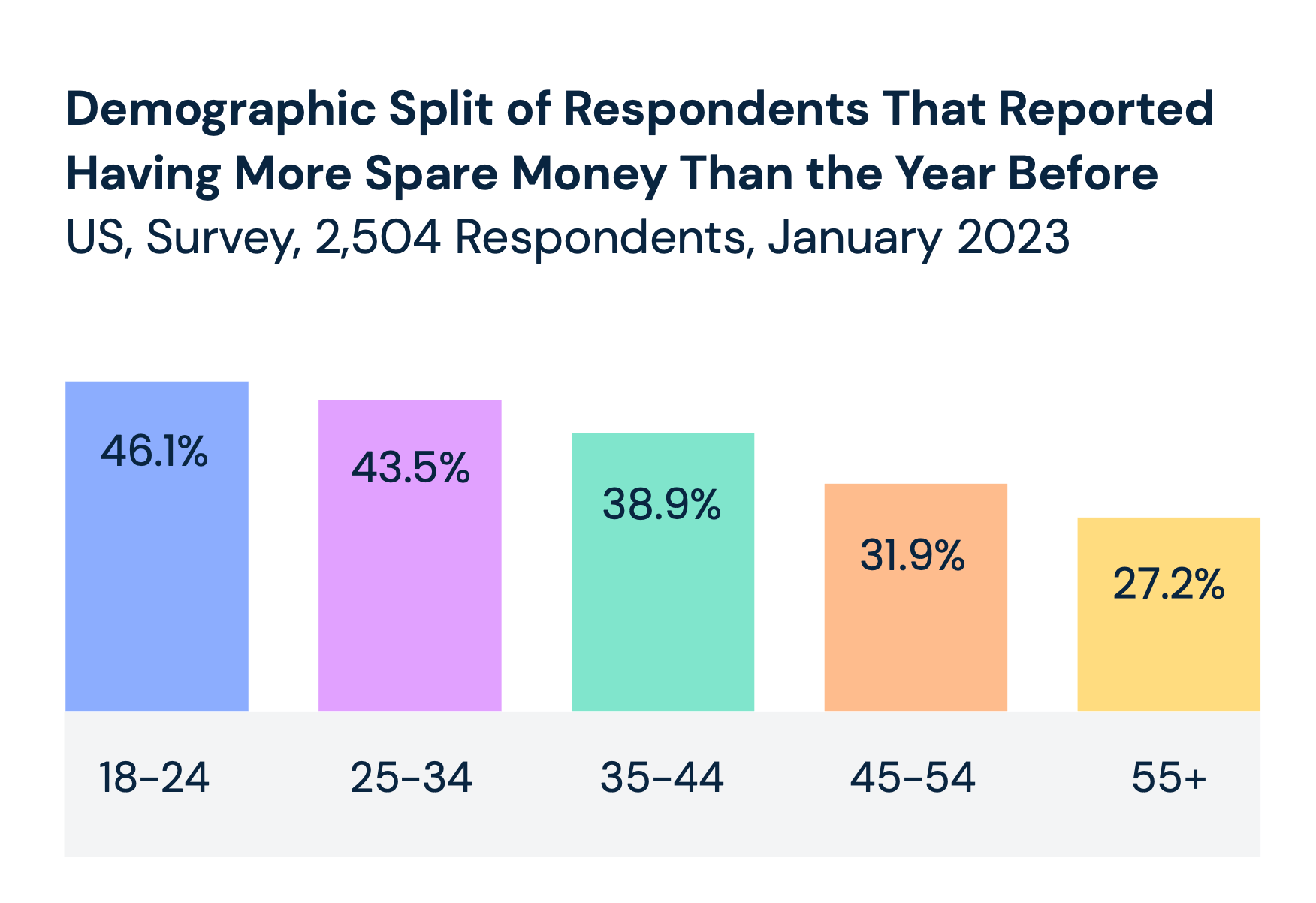

The buying power of the Gen Z consumer is now taking its hold on the market and creating new opportunities for retailers. On average, younger respondents (up to 34 years old) are likelier to declare having an increase in spare money than the previous year. While this may feel counterintuitive, it is, in fact, tied to household size. The older demographics are more likely to have a household of 3+ and be impacted by price surges than the younger demographics faced with fewer responsibilities.

As many as 46% of Gen Z Americans declared having “a little more or a lot more” disposable income than last year, vs. only 27% of 55+ years-old consumers.

This generational difference is not only rooted in the fact that younger consumers are less likely to have dependents such as young children but that they might also be living with their parents to save on rent. In comparison, Gen X consumers have more mouths to feed and additional housing expenses.

Our male respondents were less likely to face financial stress (37%) compared to 44% of female respondents in the past year. This could also be related to the extra strains on single-mother households.

Retailers in the fashion, auto parts, and beauty industries can capture more demand, with Converted Visits up YoY

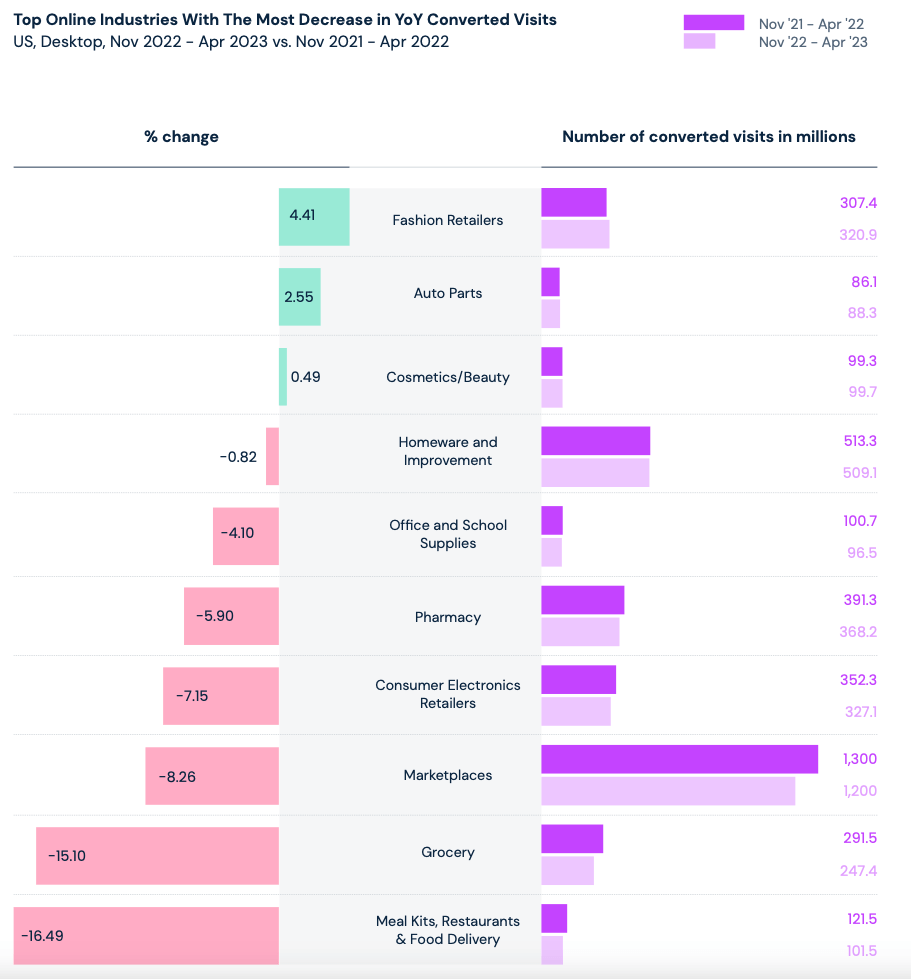

Even during inflation, some categories capitalized on emerging trends and experienced a rise in Converted Visits. Of the top 10 industries in Converted Visits, purchases from the fashion retailers, auto parts, and cosmetics and beauty retailers categories are up YoY.

While consumers were buying more items from fashion retailers, fashion brands were down 10% YoY on desktop, indicating a need to develop brand loyalty programs to attract and retain more interest.

The surge in auto parts purchases reveals that consumers are looking to save on repair costs by doing the work themselves. One of the fastest-growing players was evannex.com, specializing in Tesla parts (+94% YoY), indicating that everyone on the economic spectrum is feeling the financial strain. The second fastest-growing site was tires-easy.com (+94% YoY).

The travel and experiences spaces also saw a rise in Converted Visits YoY; +62% for tours, +23% for cruises, and +8% for tickets and events.

On the other side of the scale, players in the meal kits, restaurant, and food delivery fields saw the most significant drop in Converted Visits as food prices surged.

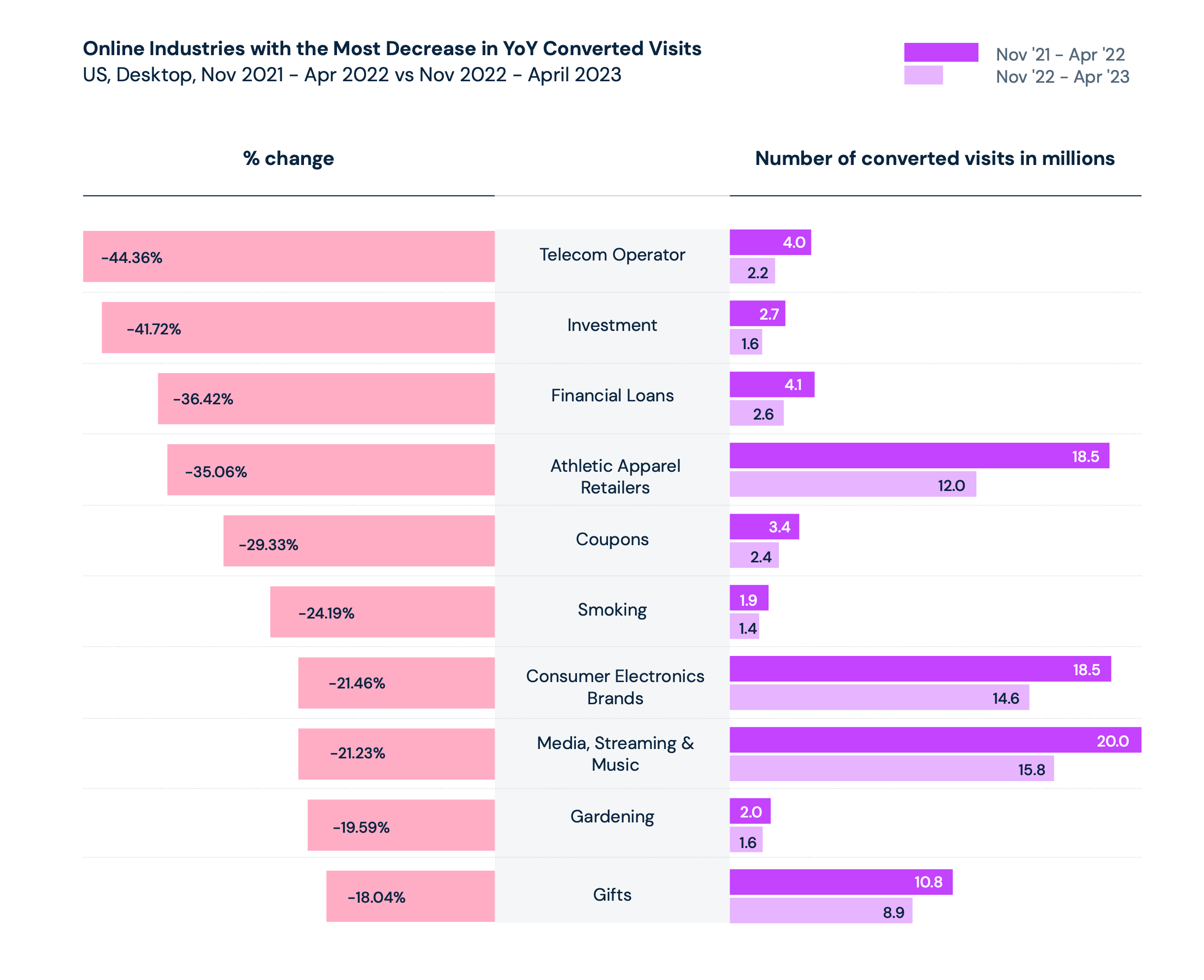

Converted Visits down in financial services, Consumer Electronics, and other non-essential categories

While some categories managed to seize and monetize on rising trends during inflation, many fields took a hit. They would need to pivot their strategies to maintain their footing during this challenging time.

As of January 2023, 46% of respondents declared they were more likely to delay purchases of postponable, nonessential products (e.g., replacing a phone that is not broken) than last year. Below are the top 10 ecommerce industries with the most considerable slowdown in consumer spending:

Not all consumers were impacted equally, but many had to cut down on some purchases, choosing various expense items above others.

Opportunities still exist, however, and while shoppers may be spending less on certain items, products are still being purchased through direct-to-consumer (DTC) channels that receive positive feedback.

In Consumer Electronics, high-tech appliance DTC sites like lg.com (+124%), sharkclean.com (+62%), bosch-home.com (+34%), dyson.com (+31%), and litter-robot.com (+24%) outperformed the market by far. Business consumers consider these brands innovative and of high quality, especially those who have cut spending on their cleaning staff.

While athletic apparel retailers saw a significant drop in Converted Visits (-35% YoY), brands can still explore the DTC route. On average, Converted Visits to apparel brands’ DTC sites jumped 27%, led by on-running.com (+79%), neweracap.com (+74%), and asics.com (+69%).

Consumers also had to adopt different strategies to cope with the increasing cost of living, such as finding cheaper alternatives or more convenient financing for their purchases.

Copycats & white labels: An almost similar, yet cheaper alternative

A new trend is on the rise, headed by the Gen Z consumer. Dupes, or copycats of popular, usually expensive products, are becoming coveted among young Americans who are leveraging TikTok to share their latest findings. An Estee Lauder serum copycat from a drugstore white label brand for a quarter of the original’s price? They’ll test it and post it on social media, which will go viral.

As of early May 2023, #dupes on Tiktok amounted to over 2.5B impressions, with traffic to the top 100 websites in the beauty industry increasing by 9% YoY (April 2022-March 2023). This trend is particularly noticeable in the beauty categories, but search queries show the trend is expanding into Apparel and Consumer Electronics.

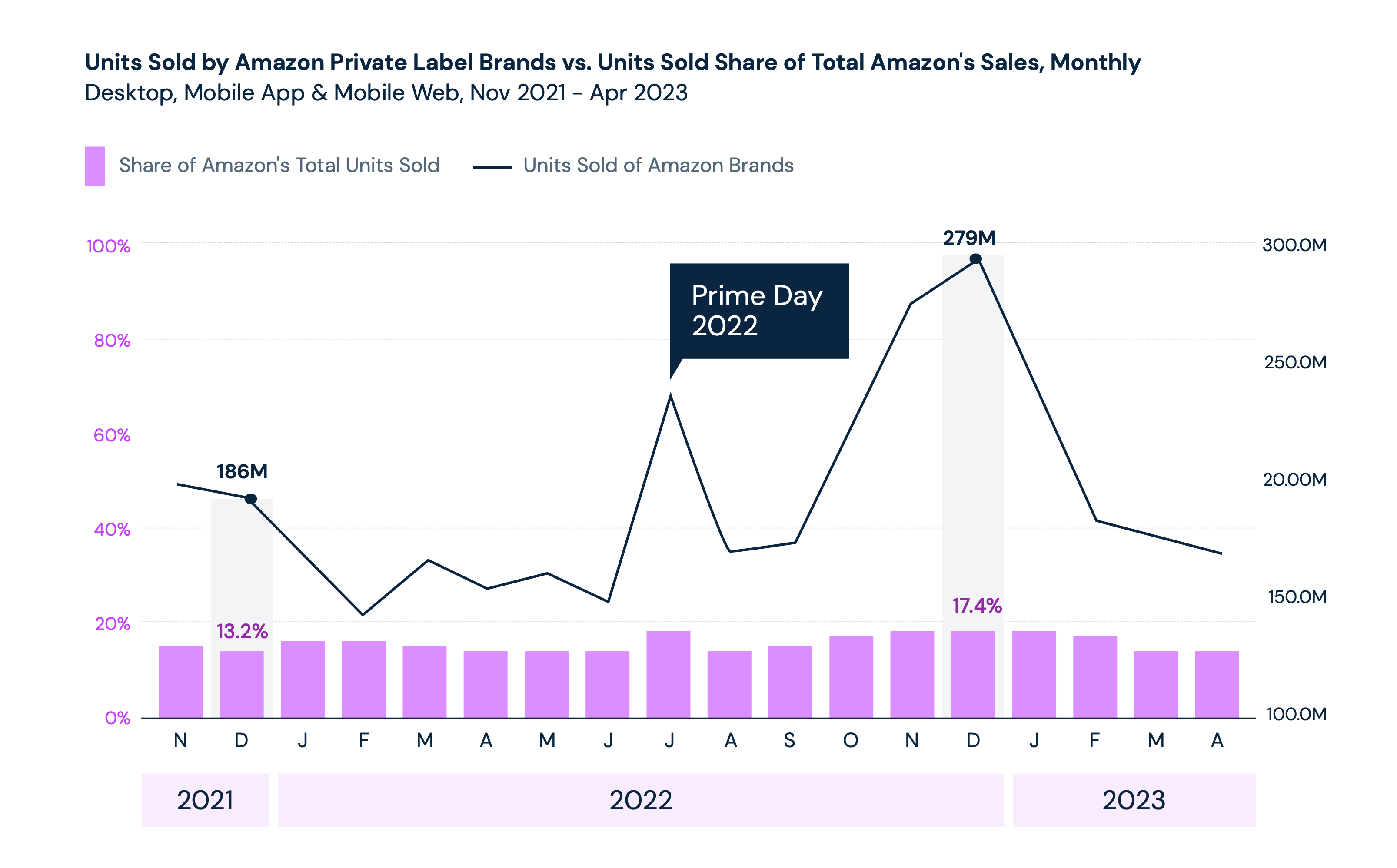

While some consumers are looking for inexpensive copies of their favorite products, others are no longer ashamed of purchasing retailers’ private label brands, which are usually more affordable than national brands. Amazon noticed this opportunity and developed a multitude of private-label brands in many categories, from Eyewear to Electronics.

In December 2022, Amazon’s private label brands held a 17.4% share of all products sold on Amazon, compared to 13.2% the previous year, resulting in an extra 93 million units sold and $1.2 billion in revenue from people looking for affordable Christmas presents.

A key takeaway for the industry

What’s crucial to remember is that consumers are now enthusiastic about white labels and dupes, even amidst rising prices and inflation. Investing in a strong DTC channel can be incredibly profitable, as all the profits go directly to your business. It will also make your customers value your brand more, increasing loyalty and retention.

For more actionable insights about dupes, white labels and other emerging trends, download our latest edition of the US Consumer Spending report.

Second-hand shopping is on the rise but limited to lower income brackets

The American fashion industry has enjoyed the thrifting trend for decades, enabling a plethora of small businesses to thrive during times of hardship. Besides the fashion industry, however, second-hand items are less popular in the US than in Europe.

Average Monthly Visits to the 18 biggest resale platforms decreased by 2% in the 6 months leading into April 2023, amounting to 141.2M visits a month. Opportunity lies mainly in peer-to-peer fashion platforms such as Poshmark, Thredup, and Vinted, which experienced traffic hikes of 12% (to 53.9M monthly visits), 6% (11.6M), and 47% (to 360.8K), respectively. Depop.com also saw a 26% YoY increase in Converted Visits in the same period.

Who are second-hand consumers?

- 18-24-year-olds make up 40% of Depop’s audience

- In correlation with app usage, 28% of respondents who reported saving less than the previous year had the highest usage of Mercari (a popular app for second-hand goods), likely due to the low prices

- 79% of consumers that were struggling to buy basics used Mercari, vs. 48% of consumers that were more well-off financially

Amazon and the second-hand market

Amazon is a massive player in most consumer categories but is not usually associated with second-hand goods. According to our survey, however, 28% of American customers were more likely to buy refurbished products than last year, as of January 2023.

Using Similarweb Shopper Intelligence data on Amazon US, we discovered that 7115 Stock Keeping Units (SKUs) included “refurbished” in their product name; units sold have gone up by 11% for the last 6 months YoY, amounting to an increase of 994.6K products between Nov 2021-Apr 2022 and Nov 2022-Apr 2023.

A key takeaway for the industry

The US market may not be as ripe as Europe when it comes to the popularity of second-hand products such as consumer electronics. But when consumer spending lowers, especially on sumptuary expenses like high-tech products, brands, and retailers should include second-hand in their business model rather than letting the fast-growing pure players capture demand for refurbished products.

The rise of alternative financing

American consumers want to enjoy their necessities and little luxuries, even when under economic strain, allowing for the growth of alternative finance options.

According to Similarweb’s BNPL report, with survey data from January 2023:

- 37% of Americans have used BNPL to make purchases, 27% of which happened in the last 12 months

- 59% of respondents who were economically worse off than the previous year indicated BNPL as their only viable finance option

- 25-34 year-olds make up the largest age group using BNPL and accounted for 40% of BNPL app users in 2022

- 53% of respondents reported using BNPL due to its “longer to pay” option, while 32% disclosed it as their “only finance option”

- Fashion & Apparel was the most popular category for BNPL purchases in 2022

Buy Now, Pay Later but still travel today

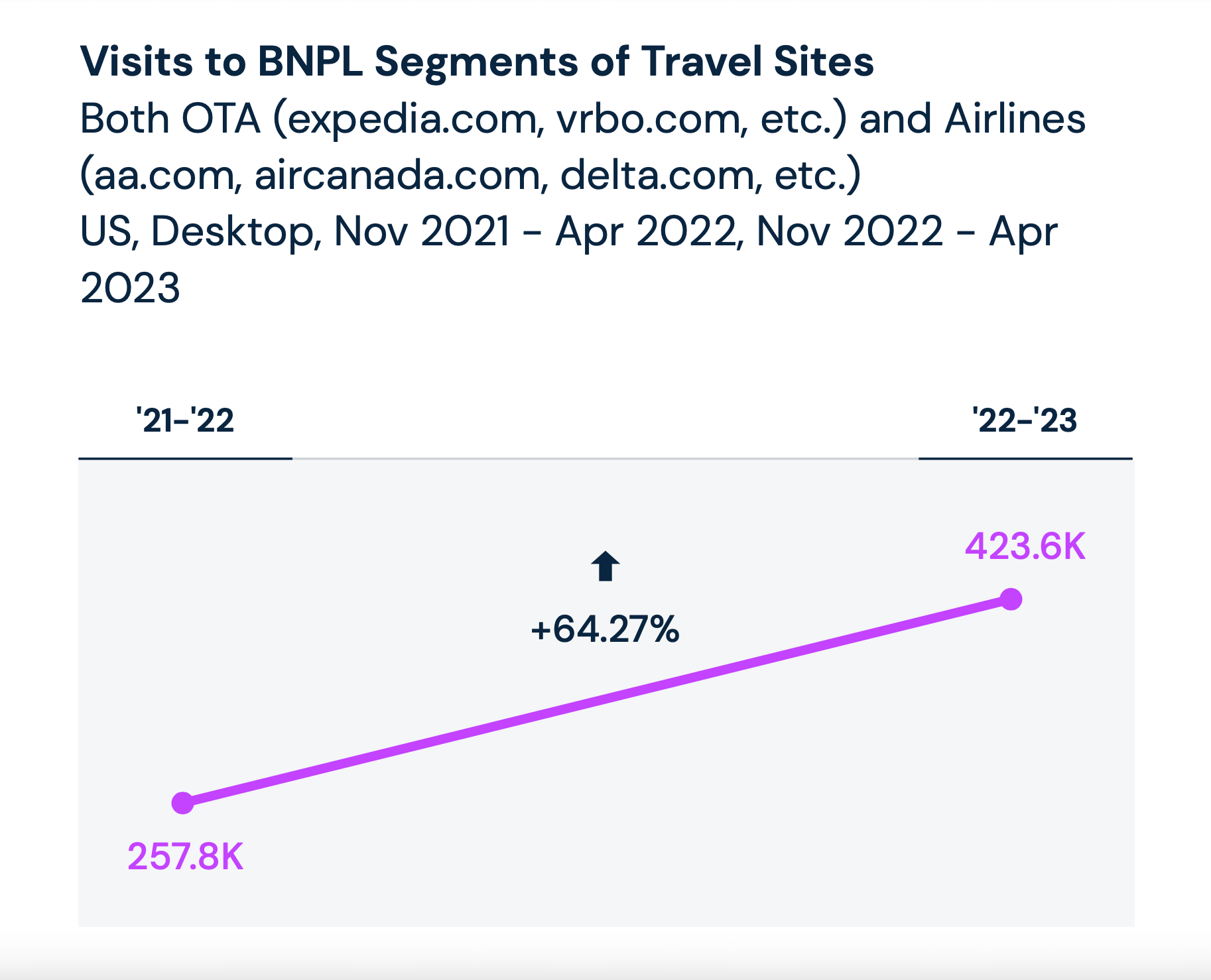

Many categories are profiting from this new finance trend; Visits to the BNPL section of airlines went up by 64% YoY, indicating a strong willingness of US consumers to continue traveling despite increasing living costs, as long as they had flexible financing options.

Conclusion and key takeaways

With questions still looming over whether the US is currently in a recession or about to enter one, the success of ecommerce businesses in the future depends on their ability to spot and capitalize on emerging trends and understand different consumer behaviors. It is essential to understand that opportunities do exist.

The effects of inflation on consumers differ depending on their demographics and lead to different action items, contingent upon the market and consumer segments brands and retailers sit in.

While families with children might prioritize the convenience of food takeout over new clothes and be fine with second-hand options, millennials will still purchase designer clothing but space out their visits to Starbucks.

Grocery retailers that work mainly within white labels, which consumers increasingly opt for due to their typically lower prices, can still see growth.

For Fashion & Apparel brands, it means offering new ways for impoverished customers to buy second-hand or rent items. Still, for premium brands, targeting younger consumers more effectively through social media is crucial.

In Consumer Electronics, Americans are looking for refurbished goods rather than replacing existing items with new ones, but brands should also develop their DTC channels to attract wealthier consumers and strengthen their -relationship with them.

Despite consumer spending decreasing in March 2023 for the first time in over two years, the future is not all bleak, with some retail segments better off than others.

Ralph Lauren’s CEO Patrice Louvet observed increased transactions for premium segments in the fashion industry, declaring that he’s seen consumers gravitating towards higher-priced items. This indicates a will to invest in longer-lasting, better quality items and highlights the discrepancies between consumers impacted by the increasing cost of living, with growth carried mostly by 25 to 34 years old.

Additionally, Buy Now, Pay Later will likely be a significant driver for consumers’ mid-to-high ticket purchases, particularly in the travel industry, as revenge travelers seek more cost-effective alternatives.

To take advantage of the emerging opportunities in your market, get more granular insights by signing up for our State of US Consumer Spending report now.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist