Industry Research: The Data-Backed Approach

For centuries, sea-farers have analyzed the night sky to navigate through the dark, stormy seas and determine the fastest and safest route to land.

In today’s economic landscape, professionals in industrial research play a role akin to strategic astronomers. They facilitate businesses in surveying the expansive realm of industry trends, interconnecting the relevant points amid the various patterns in consumer behavior, and uncovering the hidden treasures within consumer demand.

This article will explore the digital signals available to industry researchers for constructing a comprehensive understanding of their competitive landscape, anticipating the potential storms heading their way, and identifying the bounteous opportunities within their respective industries.

What is industry research?

Industry research is a crucial process businesses employ to understand and navigate the complex landscape of products and services within a specific sector. It allows decision-makers to delve into the intricacies of their particular market and its competitive landscape.

These insights provide a comprehensive view of a company’s environment and consumer demand, guiding its strategic decisions and helping it identify emerging trends that fuel market expansion and business growth.

How does industry research differ from market research?

Both market research and industry research analyze the landscape of selling goods and services. However, market research focuses on the customer’s perspective, while industry research is producer- or vendor-centric.

Market research is a vital companion to industry research, analyzing the dynamics of target markets and consumer behavior to understand how customers respond to any product or service.

These market insights not only shape the marketing strategies of any business but also guide it in anticipating and meeting its consumers’ evolving needs and priorities.

Your industry differs from your market. Think of an industry as a collective of businesses that produce or sell similar products and services. Sally, aged 47, from Iowa, might be interested in vintage vinyl records as well as organic, sustainable food sources. Therefore, she would fall into the target markets of both product lines, but these sectors are in different industries.

Industry research pertains to the specific collective of businesses that provide similar offerings – and so, researching the competitive landscape of your industry can uncover insights that can optimize your business strategies and enable you to spot untapped opportunities.

The importance of industry research

Industry research is an invaluable tool for businesses, helping them understand their position relative to other industry participants.

This knowledge empowers organizations to discern opportunities and threats on the horizon, offering a holistic view of the current and future industry landscape. It also enables them to learn from and emulate the success of new disruptors and industry leaders. Armed with this insight, decision-makers can develop well-informed strategies for their business.

While industry research reports may quickly become outdated, their summaries continue to provide significant benefits to companies. However, in today’s fast-evolving business environment, relying solely on first-party data and panel-based research is no longer sufficient for research professionals.

In a digital age with on-demand consumer trends, companies are increasingly turning to digital intelligence to gather deep and timely insights into their industries and consumers to boost the market share and growth of their enterprises.

To dive deeper into your industry research and discover the consumer trends driving conversions today, download our exclusive State of Ecommerce flagship reports.

What is the first step to doing industry research?

Before diving headfirst into your industry research, it is crucial to establish the overarching goals of this research: what are you trying to do or solve?

You must examine your business’s overarching objectives, growth plan, and hurdles to be clear on your specific research goals. Precise industry research can answer questions like:

- Which new territories should we expand into?

- How can we optimize our product lines to meet consumer demand?

- How can we improve our marketing strategy to entice new consumers?

- What are the emerging trends we can monetize?

Solving some of these objectives may require extensive research that results in an intricate product or business strategy that can take months or years to implement. You’ll have to stay on top of changing trends throughout that time and adjust your strategies accordingly.

Other actions may be easier and faster to implement, resulting in increased conversions with only little tweaks in your packaging or messaging.

Whether you’re making monumental changes to your business strategy or minor modifications to your messaging and packaging, a well-defined problem or objective serves as the cornerstone for effective industry research, enabling a more targeted and purposeful exploration of the cosmos of data and insights available to you.

How to do industry research with Similarweb

Instead of exclusively depending on first-party data or relying on panel-based research, integrating Similarweb’s real-user digital data into your research strategy allows you to stay attuned to what’s changing in your industry right now.

By leveraging market and audience intelligence that analyzes and tracks the competitive landscape, you’ll have a deeper understanding of what consumers are actively searching for, allowing you to pinpoint previously overlooked opportunities in the market.

Similarweb’s Market Research Add-On offers a suite of industry research tools that can help companies easily unearth timely insights they can immediately put into action.

Here’s what we will cover in our step-by-step guide to industry research:

- Market overview: Is your industry experiencing growth or decline, and are there opportunities for market expansion?

- Market segmentation: Can you monetize untapped opportunities within sub-categories in your industry?

- Competitive benchmarking: Who are the key players in your industry, and what can you learn from their business, product, and marketing strategies?

- Audience demographics: Who are your consumers, and how can you connect with them?

- Consumer demand: What trends are converting, and how can you adjust your product lines or messaging to boost conversions?

To learn more about utilizing Similarweb Digital Data for industry research, click below.

How to research an industry: Step-by-step

When researching your industry, it’s essential to be specific about which category your industry falls under so that the insights you discover are distinct to your competitive landscape. You want to compare apples to apples, not oranges.

For example, the Finance industry has many sectors, including Investing, Accounting and Auditing, Banking Credit and Lending, and more. The market dynamics, seasonal trends, and consumer demands vary in each sector and require different management methods.

In this guide, we’ll examine the Banking Credit and Lending sector within the Finance industry, but this method can be adapted for any sector across all industries.

For now, let’s imagine that you own a business within the Banking Credit and Lending sector in the US, and let’s dig into the digital intelligence available to you.

1) Analyze your marketplace

You’ll first want to get a market overview to understand how the Banking Credit and Lending industry is doing in your country. You can get insights into the last 28 days – or up to 37 months to spot seasonal trends.

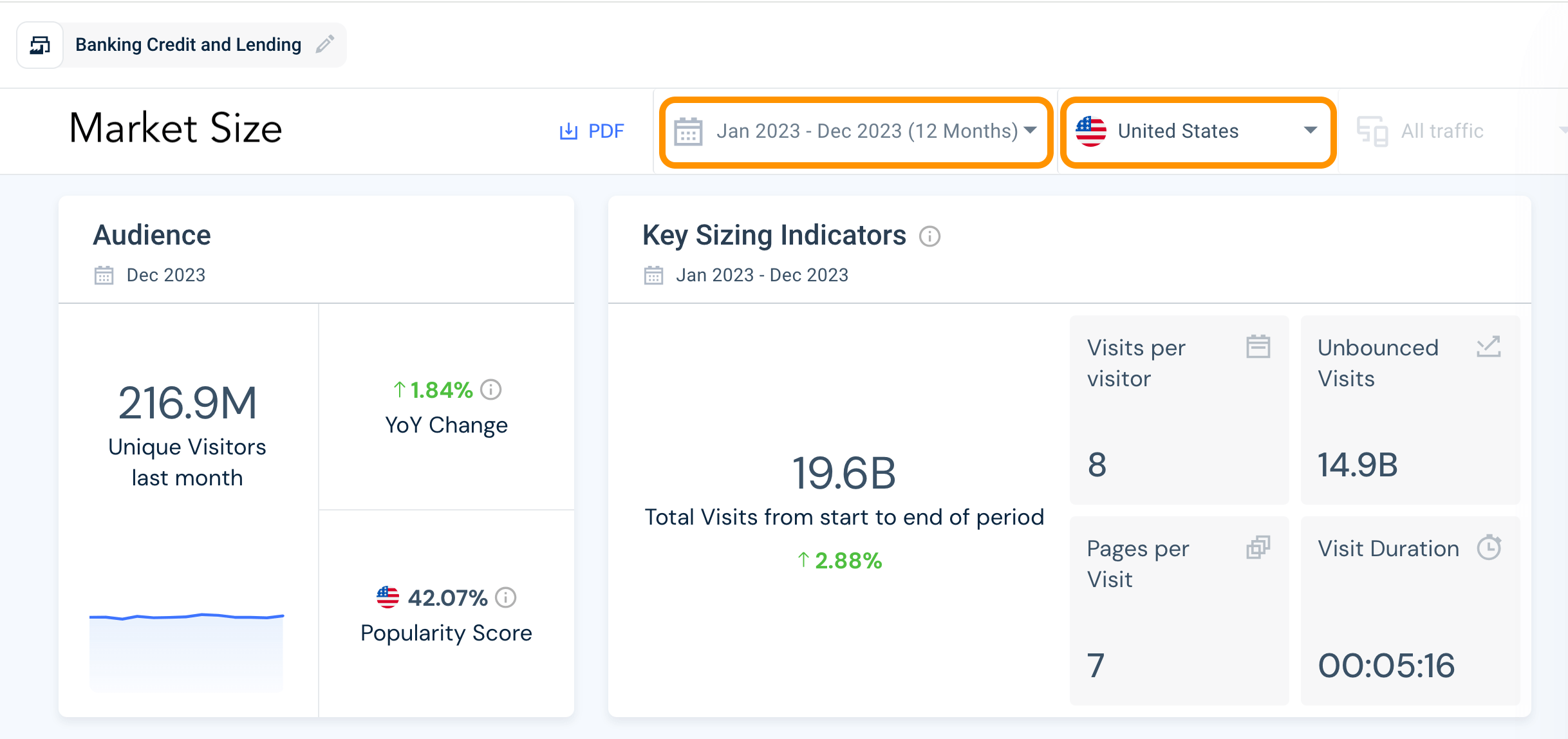

The total website visits in the industry went up by +2.9% YoY to 19.6B visits in 2023, and in December, Unique Visitors experienced a year-over-year (YoY) growth of 1.8%.

On average, each visitor looked at 7 Pages Per Visit and stayed on the websites for 5:16 minutes, returning to each site 8 times per month. These metrics suggest the industry has a relatively loyal and engaged audience ready to invest time in its goals. Quick insights like these can inform your teams’ marketing and content strategies.

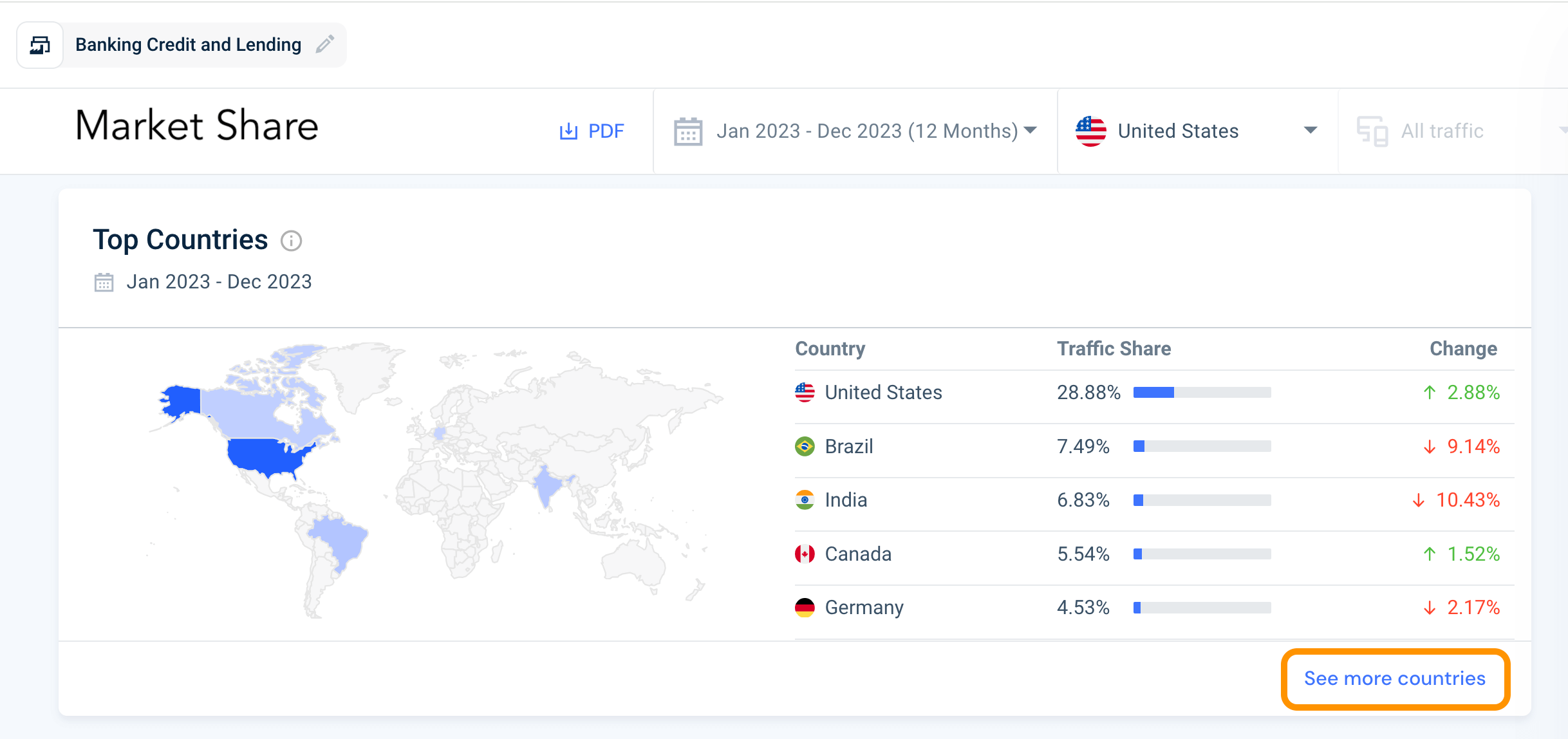

By looking at the market share breakdown, you can discover opportunities for expansion into new territories. For example, Canada also saw an uptick in traffic share in 2023.

By clicking the “see more countries” button, you can get more granular insights into the top countries for the industry. You can also set the period to the last two months to obtain more timely data for immediate industry trends.

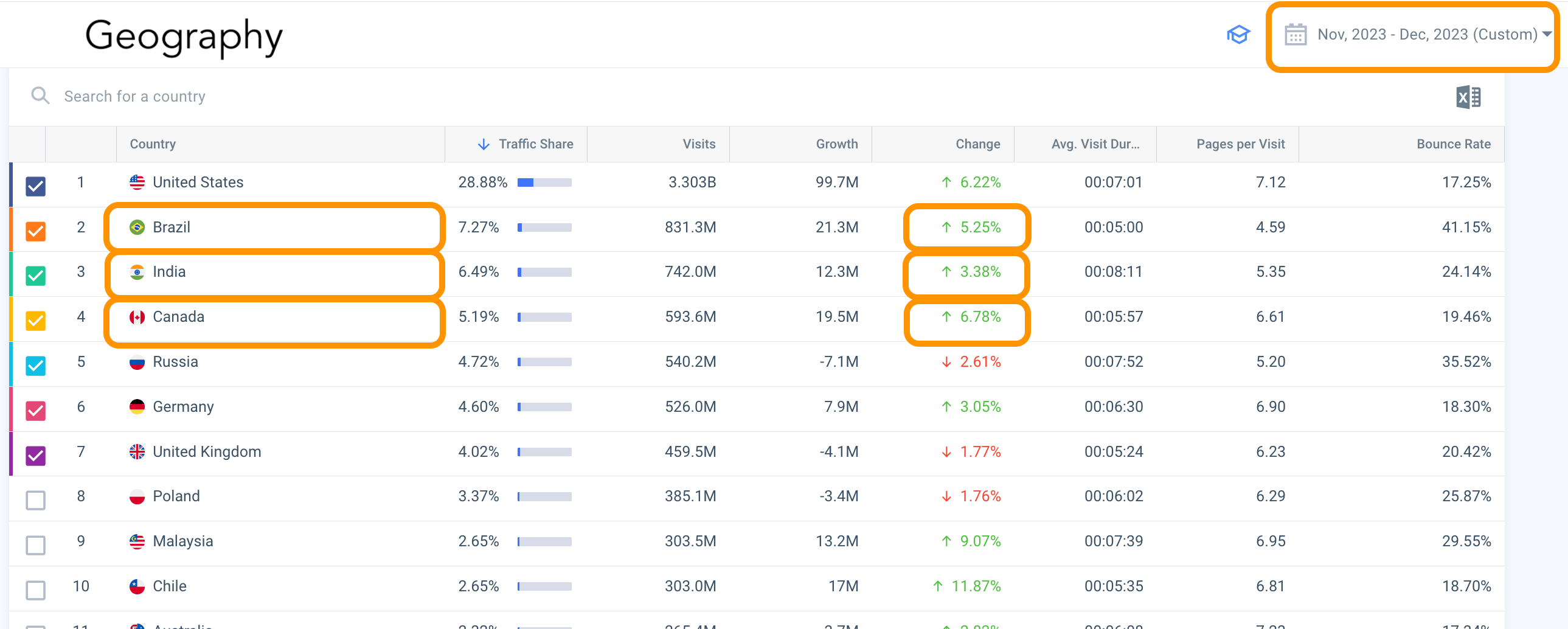

Between November and December of 2023, Brazil, India, and Canada experienced an increase in market share YoY.

If you wanted to expand into a new territory, your business would have to invest time and resources to adjust its offering and learn the market. So, before making that kind of decision, it’s crucial to understand the market difficulty for that specific territory.

You can use Similarweb’s Market Research tool to understand the market difficulty and answer questions like:

- What is the size of this market, and is the competition from its top brands too fierce for us to enter?

- How loyal is this target market to its current brands and retailers, and is it open to trying out quality newcomers?

- Will we see good ROI for our PPC spend, or should we focus on other ways of capturing audience interest?

Let’s look at the market difficulty you’d face in the three potential new territories and compare it to your home base, the US.

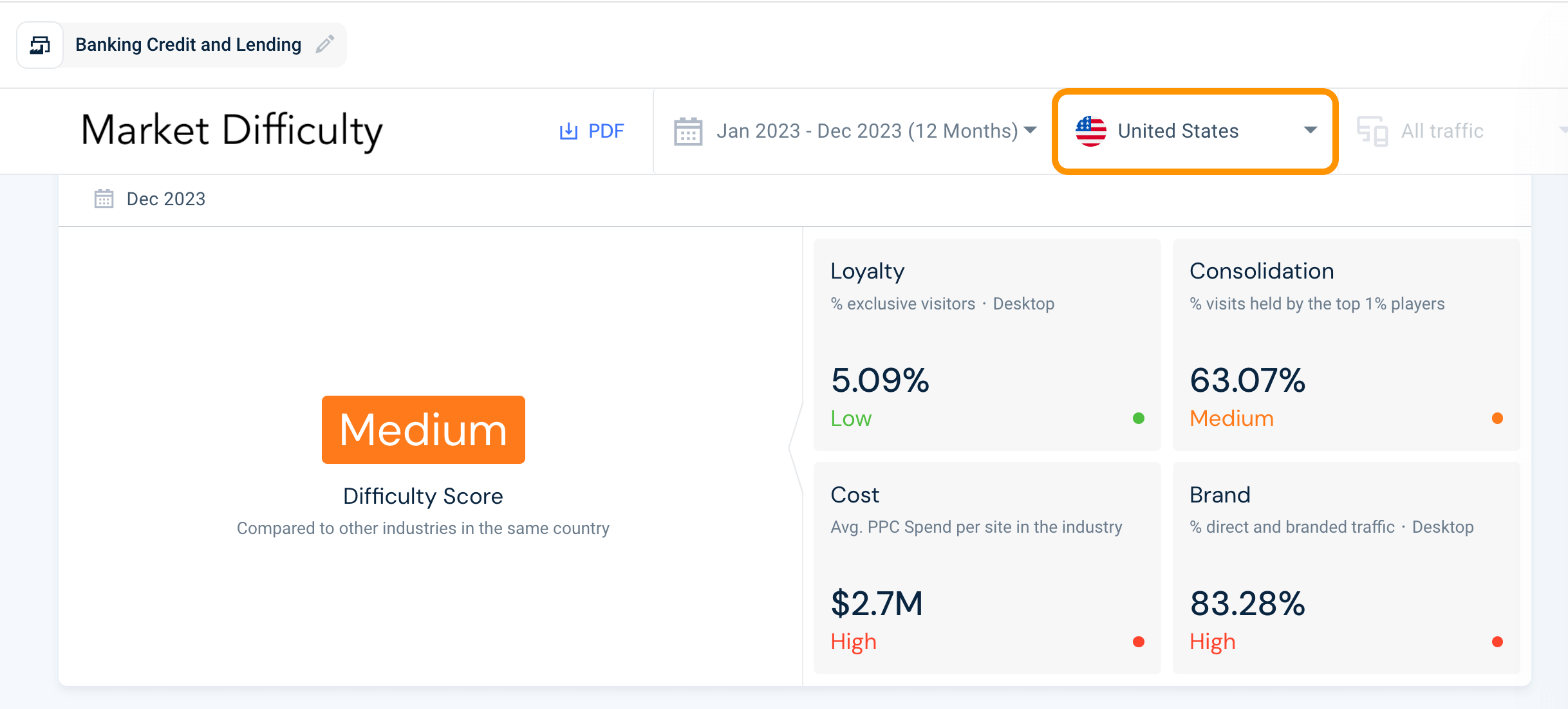

You can filter the market difficulty tool by country of interest and gain fast insights. The US market data reveals that:

- Audience loyalty is low, with only 5.1% exclusive visitors per website, meaning consumers investigate other sites.

- The consolidation metrics are medium; the top 1% of players hold 63.1% of visits.

- There is, however, very high consolidation at 83.3%, with market dynamics influenced mainly by key players.

- Moreover, the industry’s substantial investment in paid advertising ($2.7M average) escalates the market challenges.

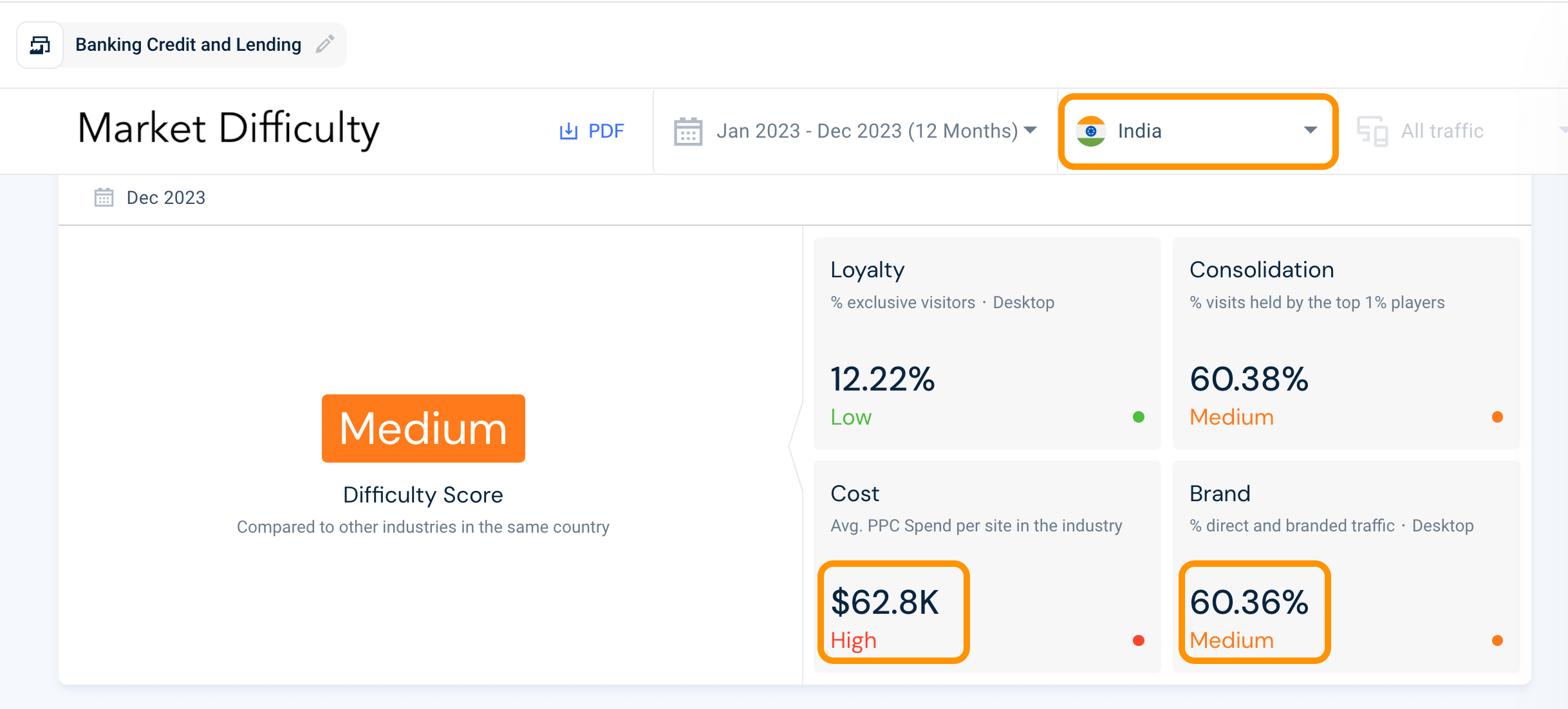

The US has a medium difficulty score, while Brazil and Canada have a high score, making them less appealing as first territories for expansion. India, however, achieved a medium difficulty score, so let’s take a closer look at the data for the Indian market and compare it to the US.

While the market difficulty in India is also medium, the individual factors differ slightly:

- Audience Loyalty is low at 12.2%, meaning consumers are open to discovering new opportunities.

- The consolidation percentage is slightly lower in India than in the US at 60.4% vs. 63.1%.

- The percentage of direct and branded traffic is also much lower in India, affording opportunities to newcomers.

- The average spend on paid advertising in India is considered high for the country, but it’s only 2.3% of the average spend in the US market.

This data suggests that expanding into India could be a successful venture, with an audience that is open to checking out newcomers and a low average PPC investment, which would help you build up brand awareness. This is especially encouraging when considering that India is the third-largest market in the industry.

2) Segment your industry into sectors

Within each industry, several (sometimes many) sub-categories have a smaller competitive set. By segmenting the data into these sectors, you can gain more granular insights to inform your business plan and help optimize your product and marketing strategies.

For example, the Banking Credit and Lending industry saw +5.61% YoY growth in 2023. This could be an opportunity for you to bolster your offering in a particular segment and expand its market share.

By using Similarweb’s Segmentation Tool, it’s easy to spot that the Insurance (+12.1%) and Financial Planning and Management (+8.4%) segments experienced the most YoY growth in the industry.

These insights might motivate you to optimize your insurance-related products or, at the very least, adjust their marketing strategy to drive traffic to the products that are currently in demand.

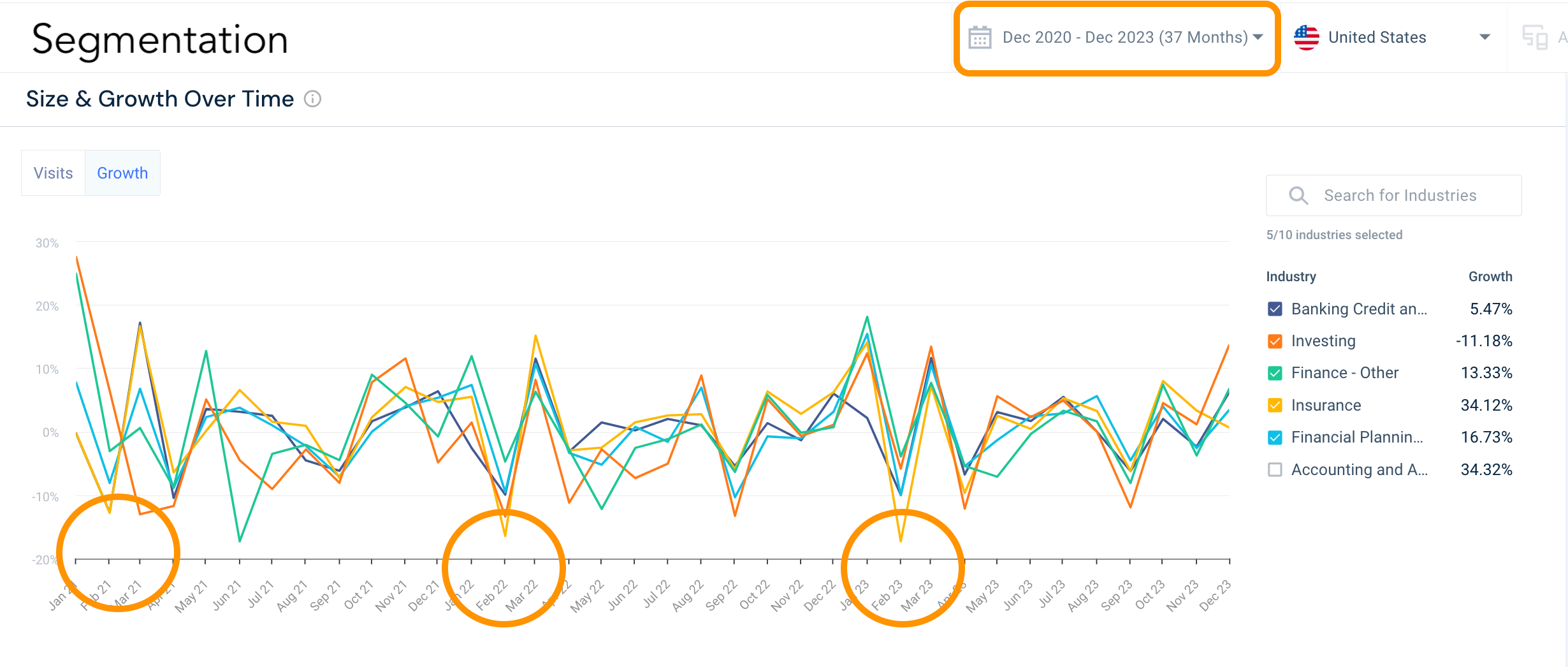

By looking at the size and growth of these segments over 37 months, you can spot seasonal changes and trends that would inform your launch plan and marketing strategy.

For example, while the Insurance segment experienced the most YoY growth in 2023, February has consistently seen a lull in audience traffic over the last three years. Therefore, when launching a new Insurance product or a marketing campaign around it, you should consider holding off until March, when traffic to the segment peaks.

3) Benchmark against the competitive landscape

Now that you’ve got an overall understanding of your industry, examined different territories, and dug into granular insights in your various segments, it’s time to examine and understand your competitive landscape.

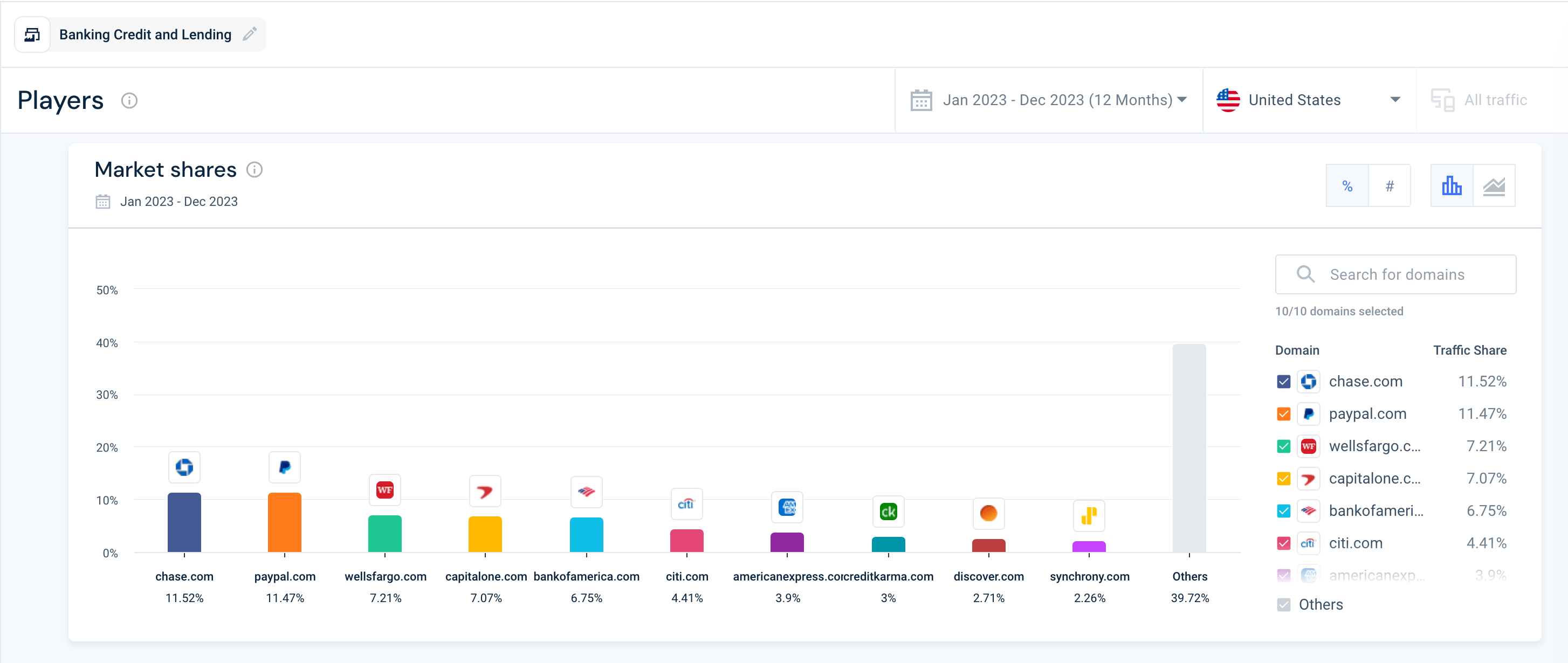

Firstly, let’s look at market share.

Select the top ten players in the industry or your top ten competitors, and uncover their market share.

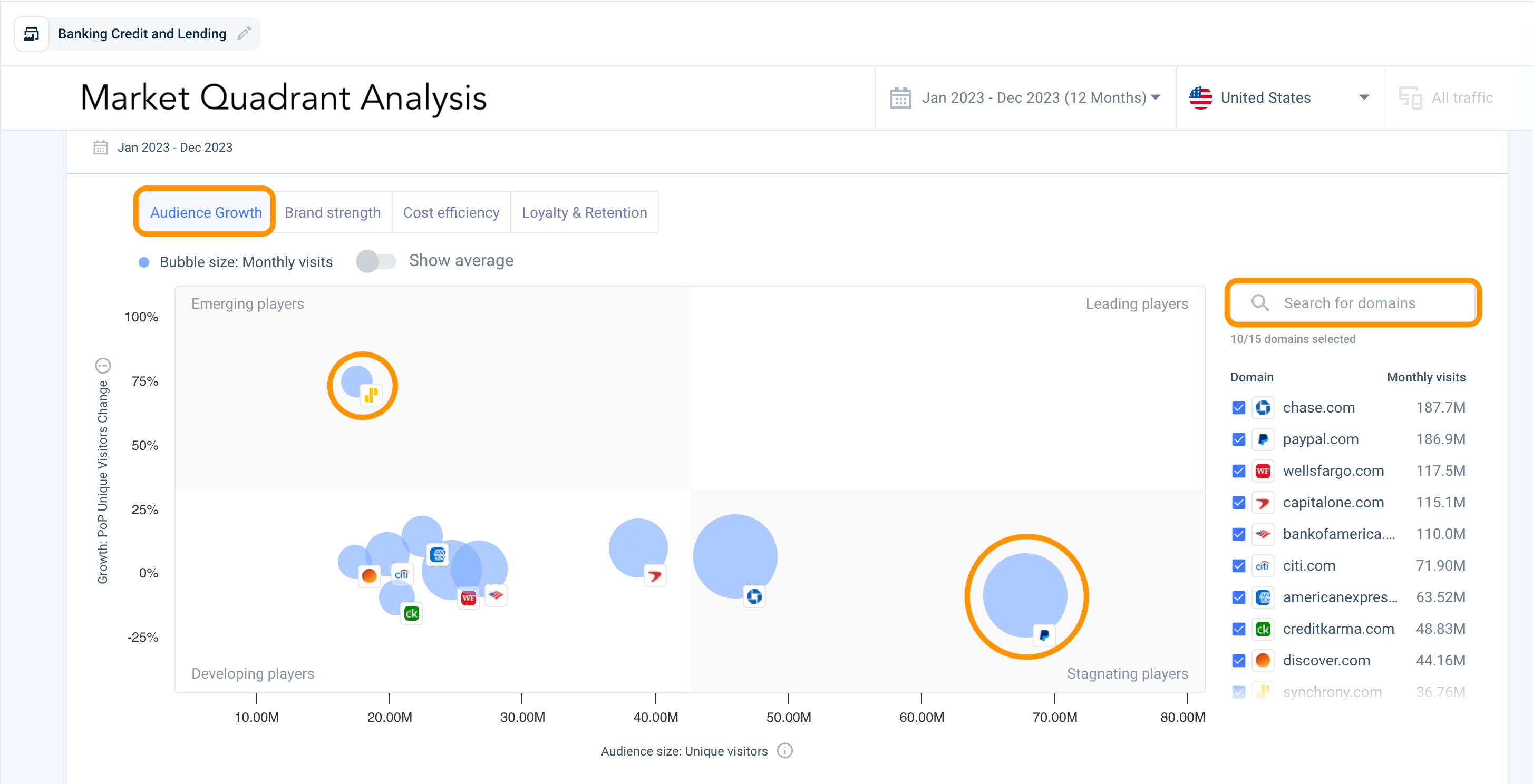

Let’s benchmark your business performance using Similarweb’s Market Quadrant Analysis Tool. Choose from pre-defined industries and benchmark against the leading players in the market, or create your own competitive set.

The Audience Growth Tool measures your Unique Visitors metrics and allows you to spot emerging players, such as Synchrony, so that you can analyze their growth strategy. You can also see the developing, leading, and stagnating players like PayPal.

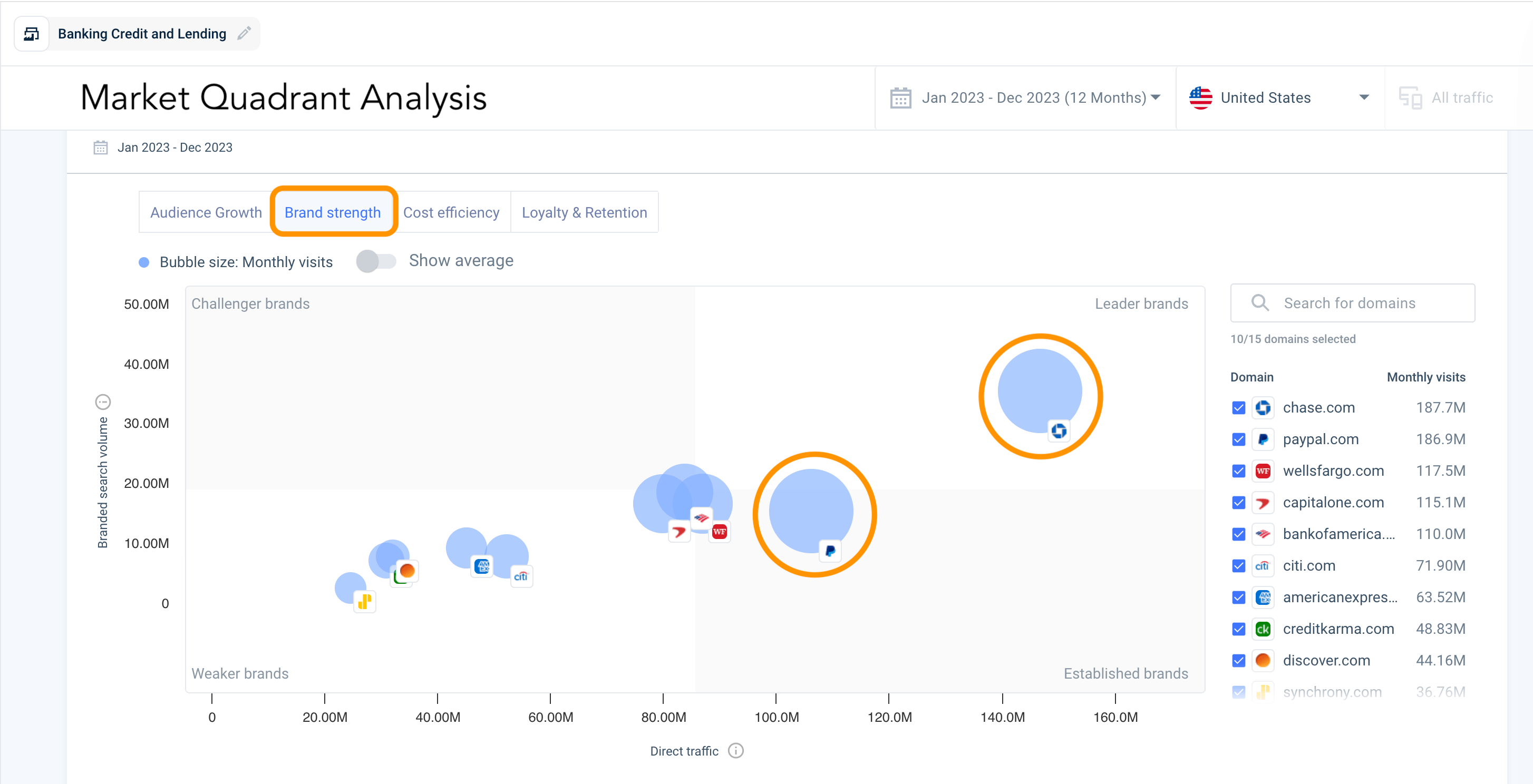

Delving deeper using the Brand Strength Tool, you can quickly spot that while PayPal’s audience is not growing, it is still one of the leading brands with relatively high direct traffic and brand search volume, bested only by Chase.

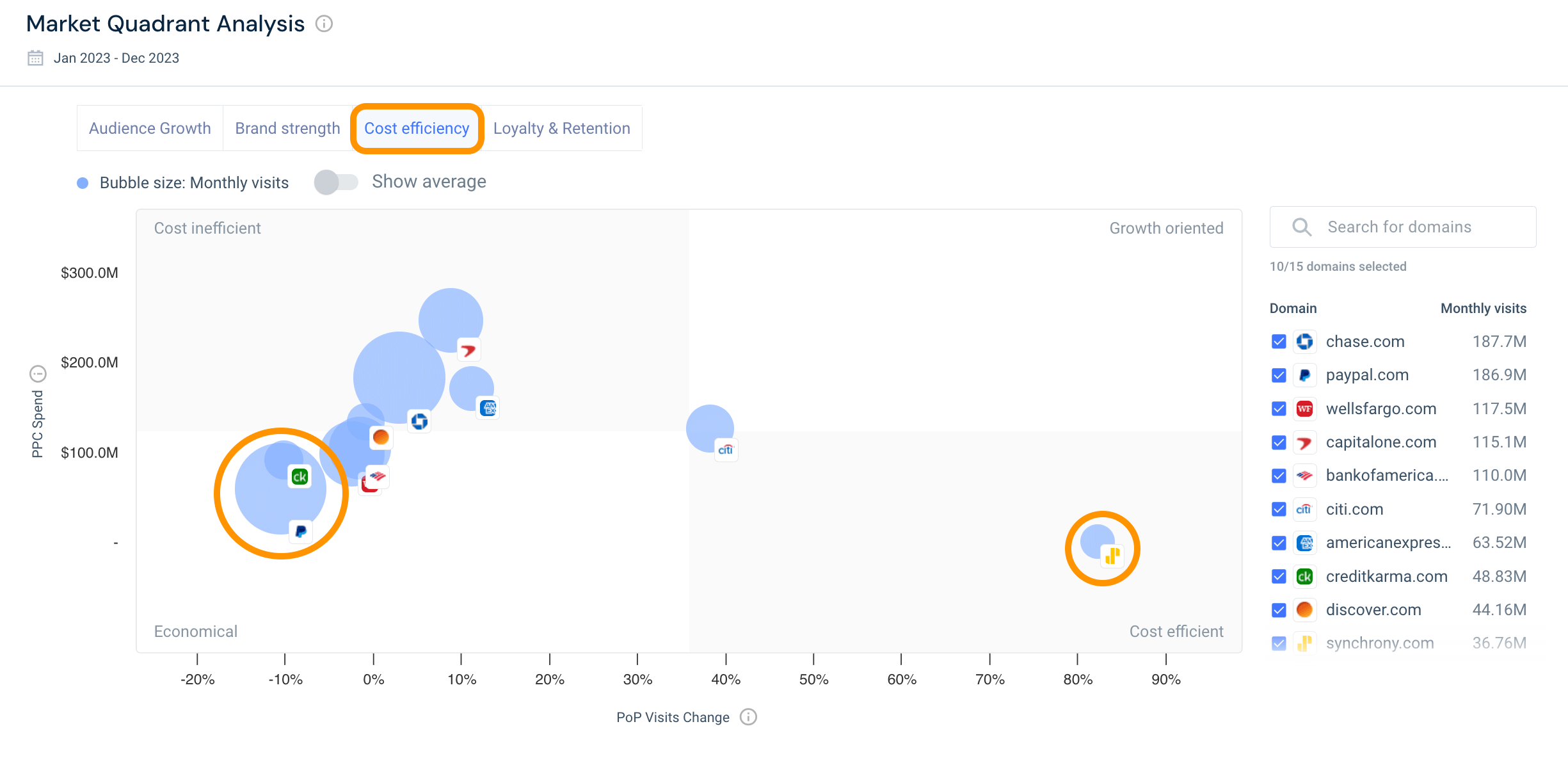

Toggle over to the Cost Efficiency Tool, and it’s clear that Synchrony’s paid ad strategy is paying off with a high period-over-period (PoP) visit change, while PayPal is more economical with its PPC investment.

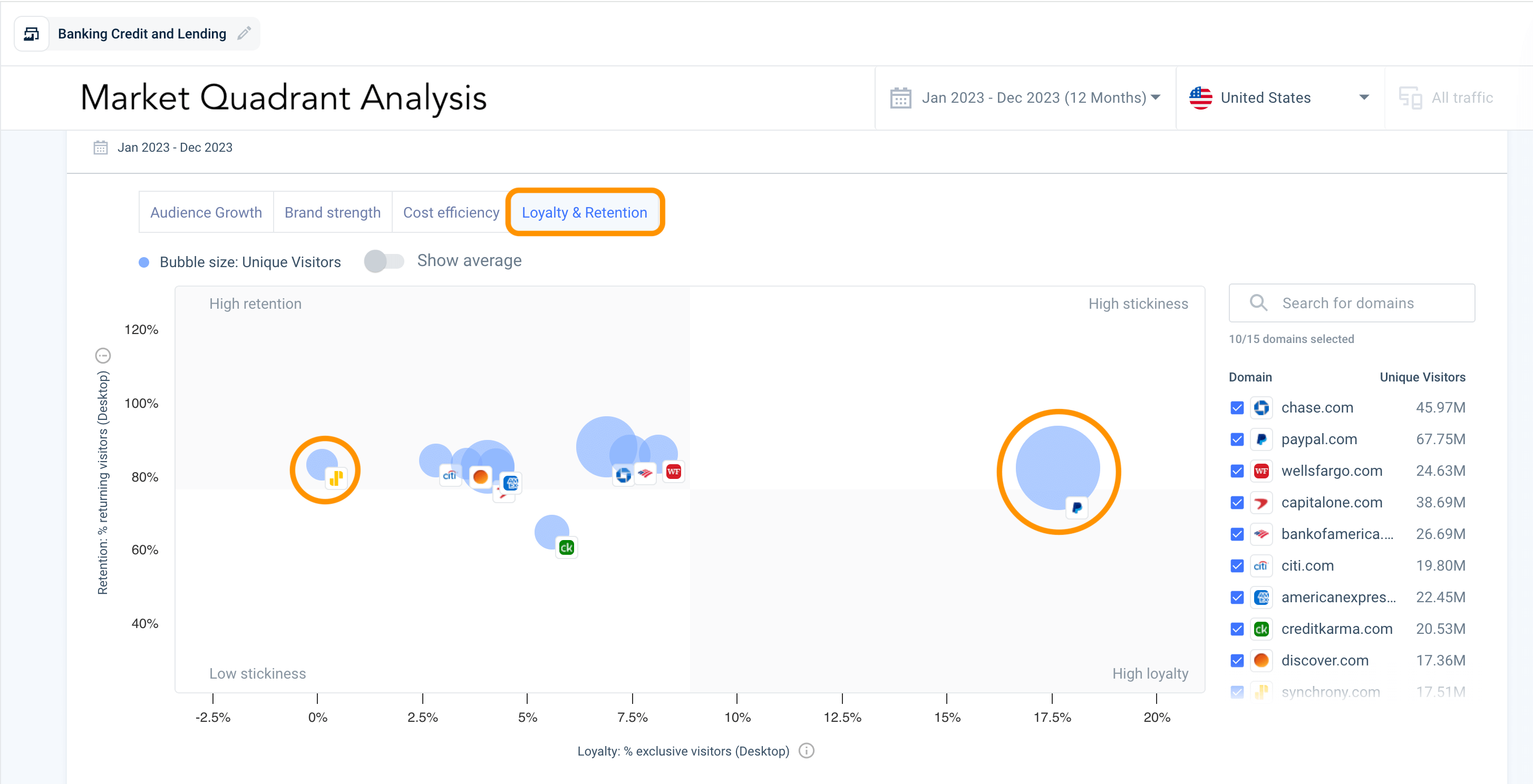

Using the Loyalty and Retention Tool, you’ll spot that while Synchrony has been successfully investing in its paid ads strategy and seeing audience growth, the company’s loyalty and retention metrics are low – perhaps indicating a need for loyalty programs and a better customer journey. At the same time, PayPal, which is relatively low in the audience growth and paid strategy quadrants, has achieved high stickiness.

By seeing what works and what doesn’t within your competitive set, you can optimize your strategies to attain data-backed success.

4) Analyze your audience demographics

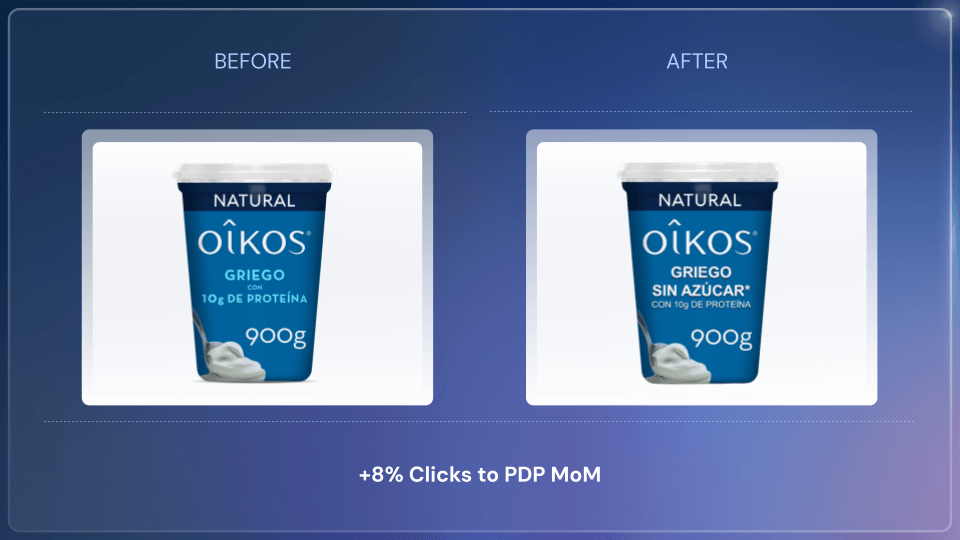

Understanding your audience is a critical part of your industry research and can inform your product, distribution, and marketing strategies, helping you spot untapped opportunities – as seen in the Danone example above.

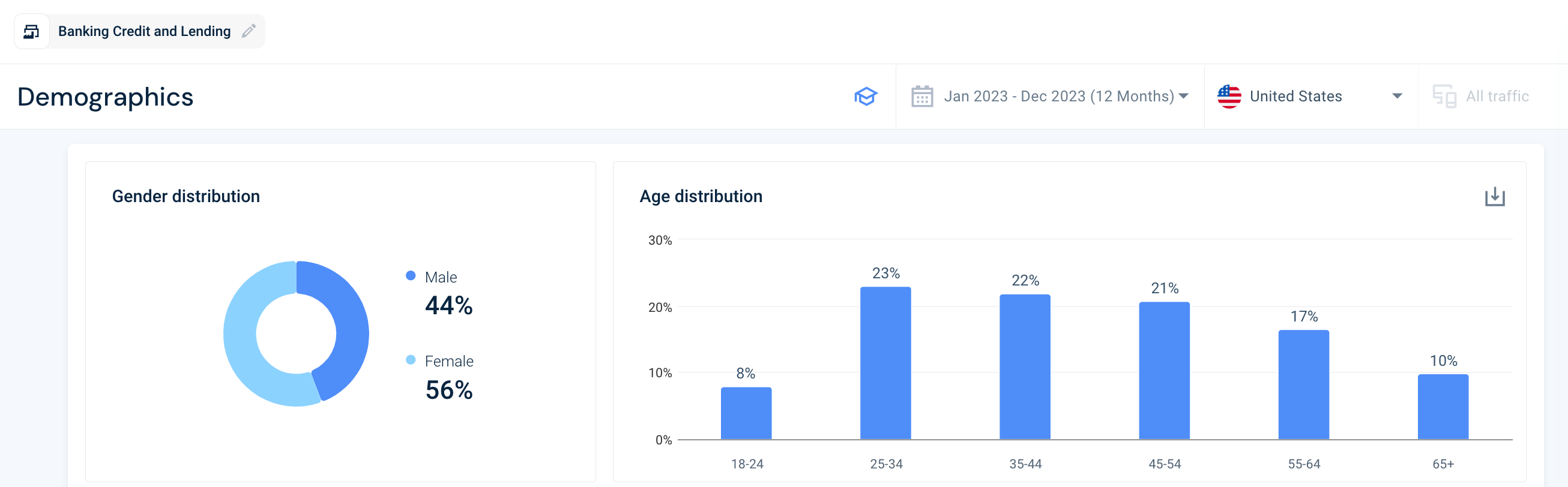

In the Banking Credit and Lending industry, knowing that your biggest age demographic is 25-34 (23%) might entice you to develop an initiative for first-time home buyers or small business loans.

Discovering whether your audience is primarily male or female per age group could inform your marketing and content strategies, answering questions such as:

- Which marketing channels will appeal to my audience?

- What should the visual language be?

- What should be the ads’ style, content, and voice?

You can also examine your competitors to discern their main age demographic and research the products and marketing strategies of those with an audience cross-over.

5) Spot and monetize consumer demand

Analyzing search trends gives your business a more granular understanding of consumer demand and can even unearth emerging trends you can monetize before your competitors.

Consumer preferences are changing constantly, but with the right intelligence, you don’t have to guess which coming trends are likely to sweep your industry.

Rather than relying solely on first-party data or panel-based research, which is often time-consuming, real-user digital data can enrich your current research strategies. With timely insights into keyword trends, you can uncover what your consumers are searching for right now and spot untapped opportunities before they pass.

Let’s look at the car insurance segment and see which micro-consumer trends we can identify in today’s market.

Leveraging Similarweb’s Demand Analysis tool, you can analyze what customers in your industry searched — in the last month or up to 12 months — by creating a keyword list or using the automated list function.

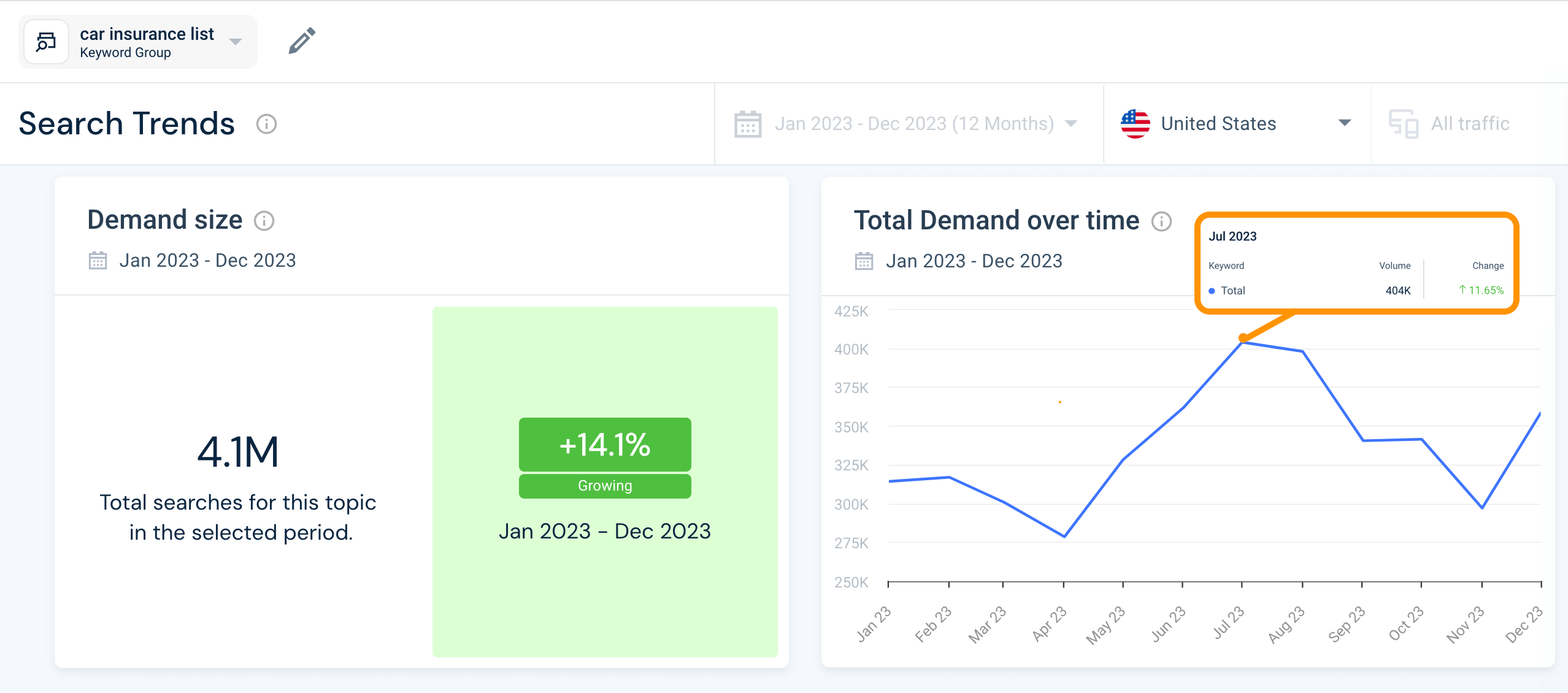

In 2023, the demand for car insurance increased, with a +14.1% growth year-over-year, peaking in July 2023 with 404K searches in the US.

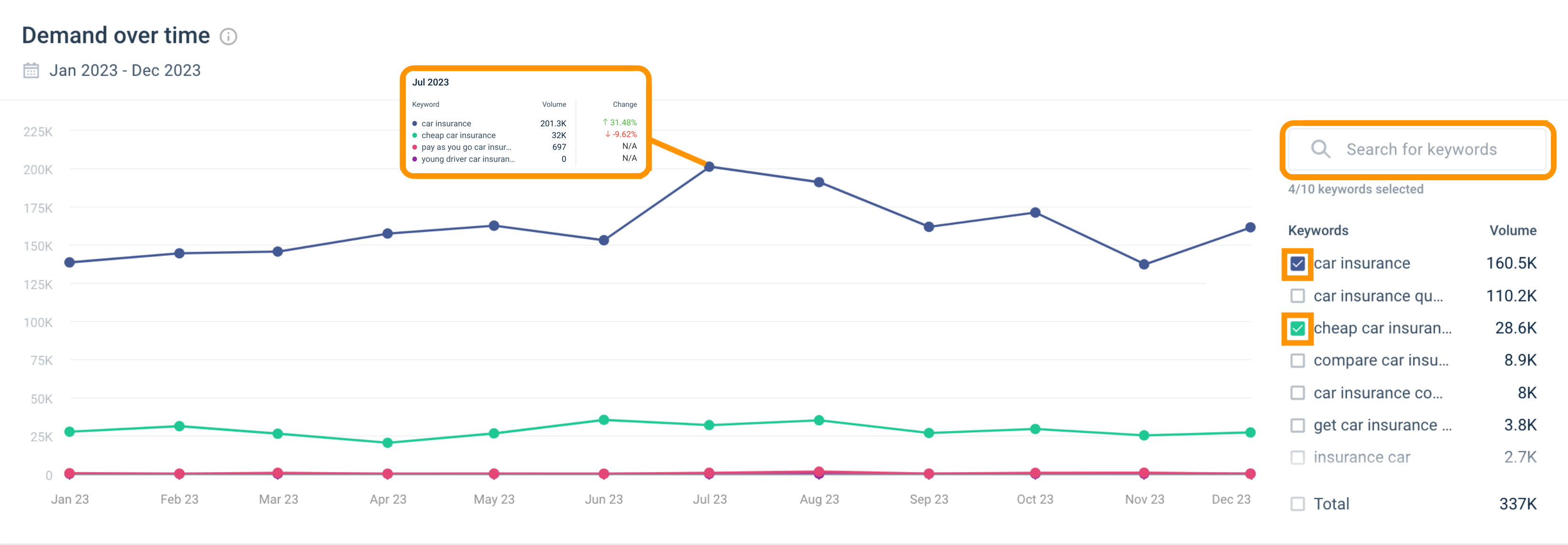

Utilizing the demand over time tool, you can select up to 10 keywords to benchmark. In July 2023, there was a +31.5% spike in “car insurance” searches, but drivers were not necessarily concerned with pricing because searches for “cheap car insurance” dipped by -9.6%.

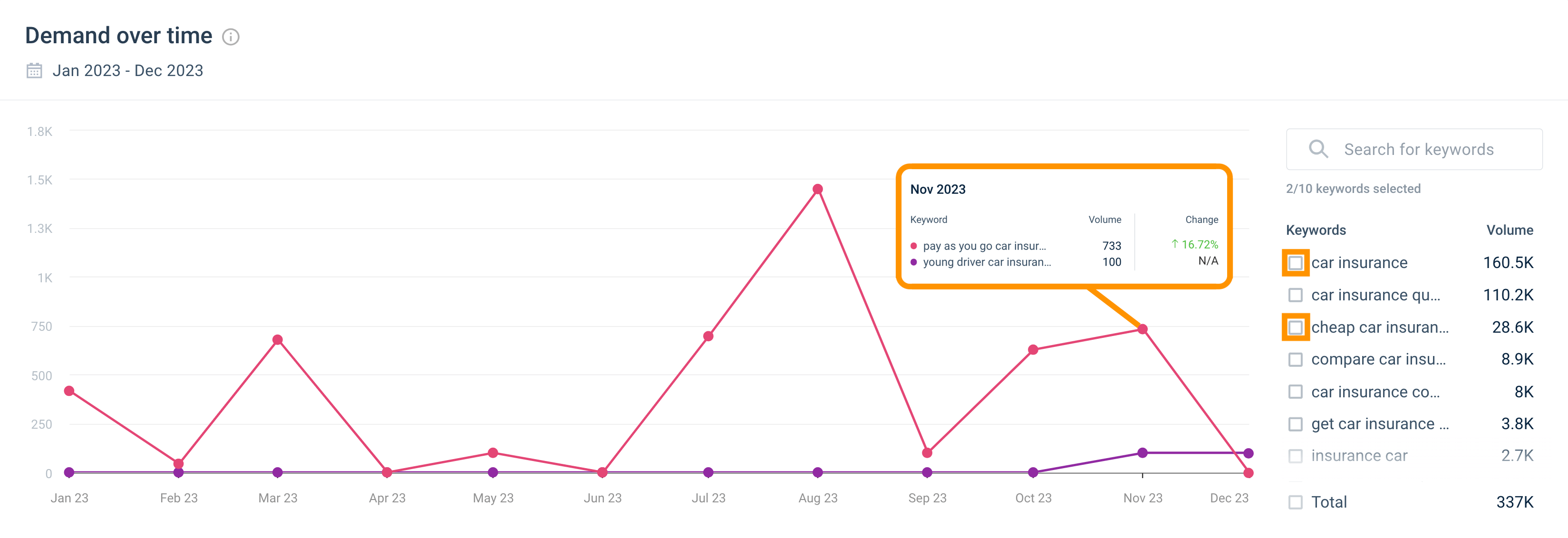

By changing your selection and removing the top keywords, you can analyze less common keyword phrases and find emerging trends. For example, In November 2023, “pay as you go car insurance” saw a +16.7% increase in traffic, and “young driver car insurance” started gaining traffic.

By spotting and tracking these emerging trends, you can launch new offerings or optimize your current product and marketing strategies.

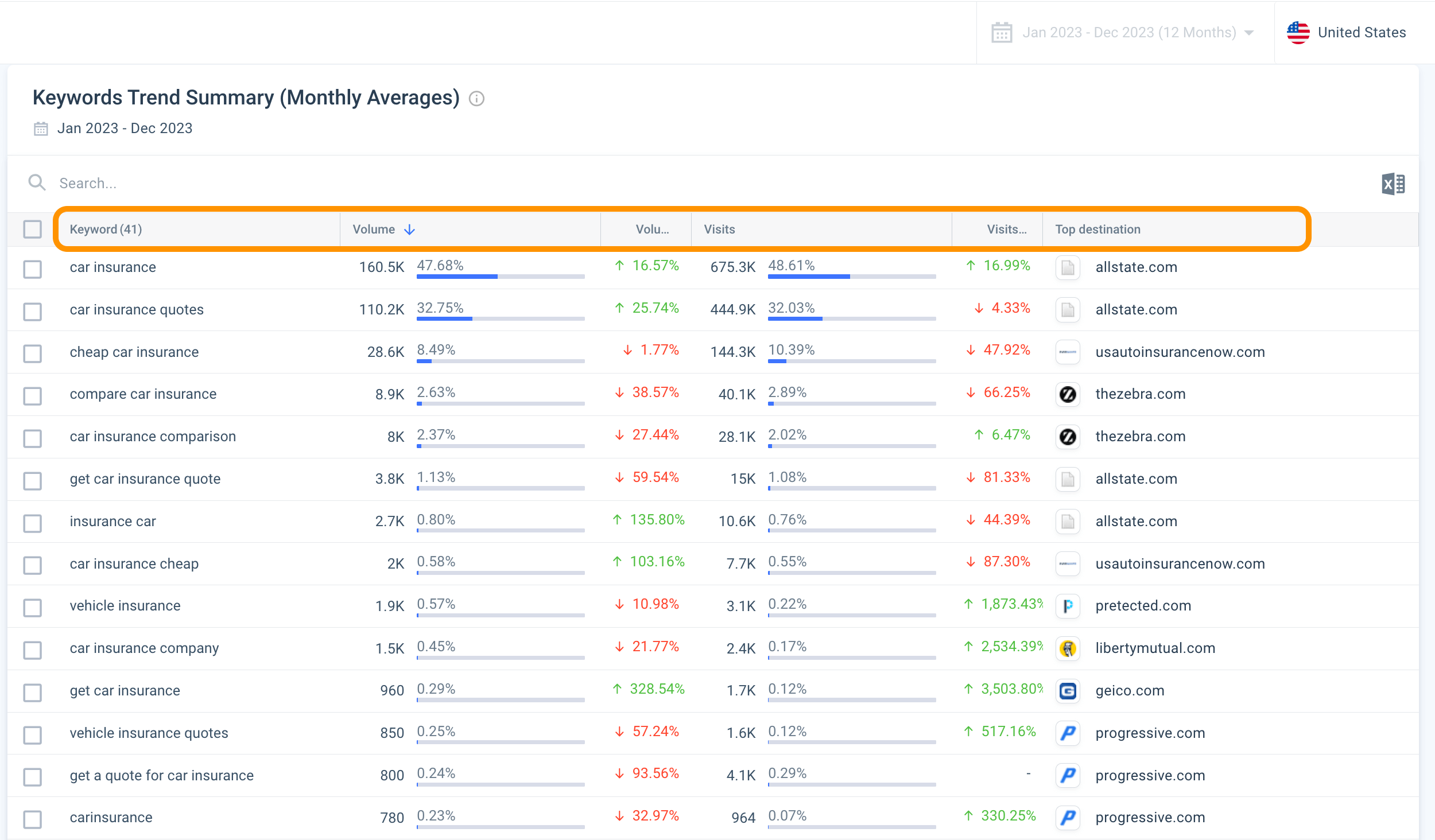

Analyzing the keywords separately lets you discover which keywords are on the rise and find the websites that are gaining the most traffic for them. You can then examine and learn from your competitors’ content and marketing strategies.

We live in a fast-changing economy, and consumer needs are evolving just as quickly. With timely real-user insights into what’s trending in the last two months or even the last 28 days, you can be first to market with new offerings that capture consumer demand.

How Danone Leveraged Similarweb Digital Data

Danone, the French multinational food-products corporation, was looking for a way to stand out from the crowd with its yogurt products. The company had a clear goal for its industry research and wanted to leverage digital intelligence to increase sales.

Using Similarweb Digital Data, the company discovered that 90% of the traffic for the yogurt category originated from searches. People were not browsing for yogurt; they searched explicitly for it. Danone needed to focus its investment on on-site search to maximize its findability.

By digging into search behavior, the company also learned that consumers were searching the term ‘greek’ for Greek Yogurt and that there was no need to pay for expensive keywords like ‘greek yogurt’ when the company could bid on ‘greek’ and enjoy a much higher ROI.

By exploring complementary keywords, Danone found that ‘no sugar’ was the best keyword to bid on, with a much higher volume and conversion rate than ‘protein,’ which was the brand team’s original strategy.

Danone also wanted to expand its market share in Mexico. Global consumers are driven by local trends depending on their country, so examining the different consumer interests for each geography is critical.

Using Similarweb Digital Data, Danone’s branding team validated that over the last few years, awareness around sugar consumption in Mexico has been on the rise. This informed the Greek Yogurt products’ packaging strategy, which now clearly states that the yogurt is sugar-free.

By leveraging timely digital intelligence, Danone optimized its marketing strategy and product packaging to capture consumer demand and increase sales.

The future of industry research

Navigating your industry landscape and pinpointing how to capture consumer demand may seem daunting and time-consuming, but it doesn’t have to be. Whether launching a new product or expanding into new territories, leveraging digital intelligence enables your business to comprehend current consumer interests and take action swiftly.

With real-user data on what consumers are doing online, you can enhance your first-party and survey data to adapt strategies and capture evolving consumer demand, especially in the fast-paced dynamics of an on-demand economy.

For industry researchers and data analysts, Similarweb’s Market Intelligence Add-On serves as a critical tool, providing access to exclusive digital signals for any industry. Armed with timely insights, you can make informed, data-driven decisions, uncovering efficient growth opportunities to effectively navigate through and win in your industry.

To learn more about utilizing Similarweb Digital Data for industry research, click below.

FAQ

What is industry segmentation?

Within each industry, many sub-categories have a smaller competitive set. By segmenting research data into these sub-categories, you can gain more granular insights and spot micro-trends that inform your business plan and help optimize your product and marketing strategies.

How does digital intelligence enhance your industry research?

Integrating timely digital intelligence that analyzes and tracks the competitive landscape gives businesses a deeper understanding of what consumers are actively searching for now, allowing you to spot emerging trends and pinpoint overlooked opportunities in the market.

How does Similarweb optimize your industry research?

Similarweb streamlines industry research by providing a wealth of data and analytics to empower your competitive analysis of the global and local markets, delving into industry trends and opportunities, audience demographics, keyword analysis, mobile app analytics, traffic sources and channels, and more.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist