How to do Market Analysis in 6 Easy Steps

Knowing how to do market analysis is pivotal for many roles, benefiting any organization, regardless of its size, scope, or sector.

Regular market analysis levels up your individual ability to spot potential opportunities, stay on top of current trends, and gives you insights into the competitive landscape.

This article will cover why you need to analyze a market frequently and shows you how to do a basic market analysis in 6 straightforward steps.

What is a market analysis?

Market analysis is the process of gathering data about a target market. It examines the competitive landscape, consumers, and conditions that impact the marketplace.

The benefits of market analysis

Here are eight reasons why a regular market analysis is beneficial:

- Understand the competitive landscape

- Spot trends in your market

- Uncover opportunities for growth or diversification

- Reduce either risk or cost for launching new products or services

- Develop a deeper understanding of a target audience

- Enhance marketing efforts or discover ways to change

- Analyze business performance within a market

- Identify new segments of a market to target

Why you should conduct a market analysis

Aside from the benefits we’ve already listed, reviewing and redoing your market analysis regularly is important. Here’s why.

- Markets shift

- Consumer behaviors change

- New players enter existing markets

- Disruptive technologies and enhancements to rival offerings can shift the landscape

- External events impact market conditions that drive changes

If you already know how to do market analysis, ask yourself how frequently you undertake the task: is it annually or quarterly? And consider the time it takes and the tools you used to obtain your information.

With this in mind, we’ll walk you through the most effective market analysis methods. Showing you the steps to take, with market analysis examples, to bring these steps to life.

How to conduct a market analysis

These six steps break down how to analyze a market into easy-to-follow, digestible stages.

Before you start: Use a framework to record your findings. There are plenty of visualization tools, but a basic excel sheet will be fine if you want to keep it simple. Why? Because when you return to review this analysis and repeat this exercise, you’ll want to have everything recorded in a single place. It will save you time and make any future comparisons easier.

Step 1 – Market segmentation

What: Whether you want to enter a new market, launch a new product, or simply assess opportunities for an existing business, this first step in the market analysis process is crucial yet often overlooked.

Why: Market segmentation helps you identify the core segments of a market to target. By identifying the portion of a market your products will be suitable for, you can accurately define the market size and better understand your potential customers’ specific needs and preferences.

How: There are multiple ways you can segment a market, and the right approach will depend on your product, its customers, and its target profiles.

Here, we can see how a segment is built using Similarweb’s website segment feature. I specifically want to view the credit card sector in the US, a market made up of pure players (think Amex or Visa) and individual players with credit card lines as one of their segments (think Wells Fargo or USAA). By splitting up a market like this, I can analyze the areas of business I care about more for my market analysis.

So, instead of viewing data that encompasses the other lines of business the likes of Wells Fargo and the USAA handle, such as loans, I get to hone in on their credit card segments only.

This is just one example of market segmentation. You can also segment a market based on consumer needs, ideal consumer profiles, regions, and other demographic data.

Step 2 – Market sizing

What: Market sizing determines your target market’s potential volume or sales revenue. It’s an essential component of market analysis that uses either secondary or primary research to explore the actual size of the market you are in or wish to enter.

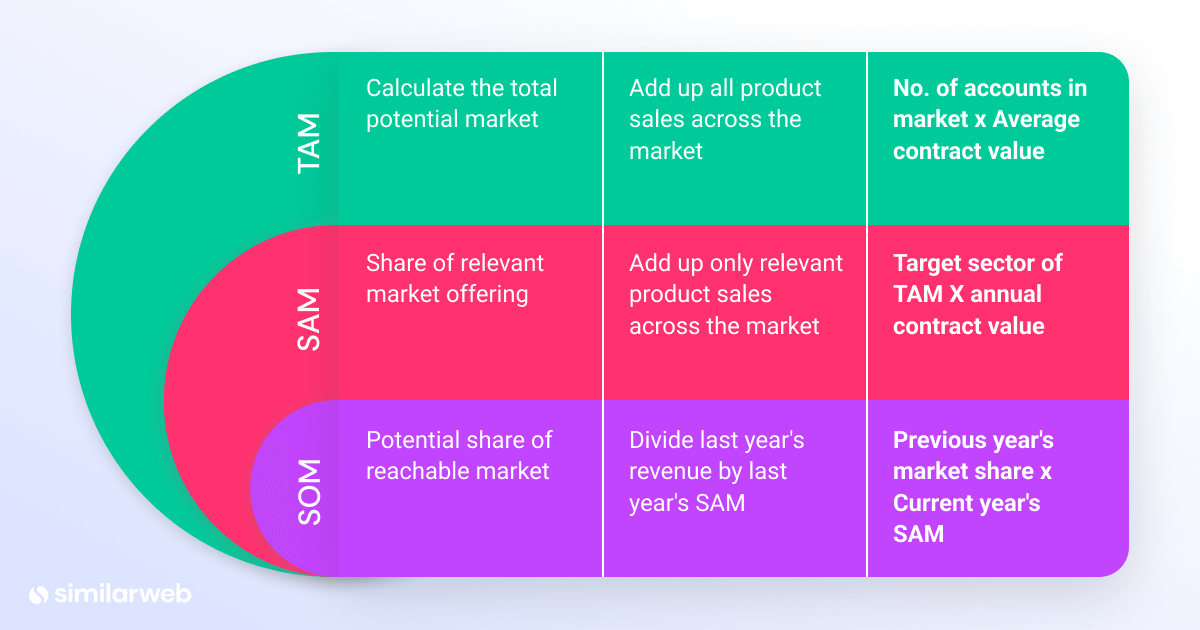

Total Addressable Market (TAM) – This gives you the complete value of the overall market and the first step in the market sizing process. Let’s say we want to analyze the US credit card market, the TAM would account for the whole of this market.

Service Addressable Market (SAM) looks at potential audience volumes for a product or service in a target region. Sticking with the credit card sector example, this could be the total value of the credit card business that specifically targets the ‘poor credit rating’ segment of this market.

Share of Market (SOM) – Also known as ‘service addressable market,’ it represents the proportion of your SAM that you are likely to achieve. SOM is always lower than SAM, taking a range of estimates based on the previous year’s performance or current market share + project growth to arrive at this figure.

Why: Market sizing helps businesses understand the size of their opportunity. By understanding the size and scope of a market, companies can better assess the potential profitability of the market. Tracking market share over time can also show who wins or loses at any given time.

How: First, you need to define the market boundaries, such as its geographic region, customer type, or the products or services being measured. With this data, you can use secondary resources to estimate your market size.

Market analysis example: market sizing

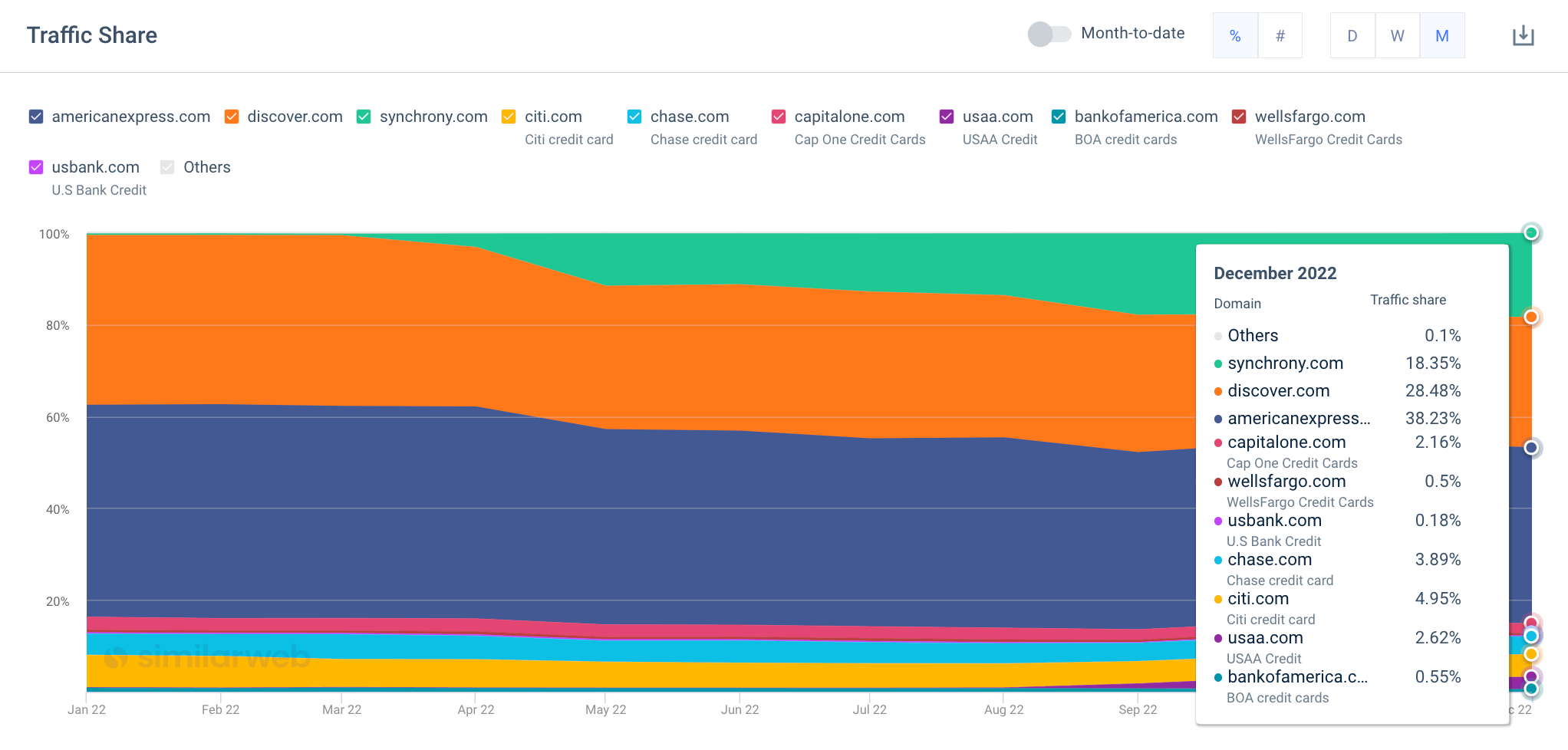

Using a metric known as traffic share, we can estimate the potential market size by showing the total reachable audience you have or could have with a product or service.

Using Similarweb Industry Analysis, I can see a real-time snapshot of my market’s performance. With it, I can see the total number of people in a market (unique visitors) and establish how much of that share I have or will target this year.

When sizing a market, it’s easy to fall into the habit of analyzing the market quarterly or annually. But often, the best insights are dynamic in nature. They appear to show shifts, sometimes unexpectedly or can indicate growth and changing behaviors as the year progresses. This is why we place a high emphasis on continuing a market analysis throughout the year.

Here, we’re looking at traffic share changes over time using Similarweb’s market trends. You can see the impact of Snychrony’s growth (in green) as they gain traction, along with USAA (purple). At the start of the year, these two players had no impact on the market. By the end of 2022, they’re showing gains and would be two key competitors to track when you reach step 4 of the market analysis process.

Those analyzing a market annually would miss out on key insights that show the rise of these two emerging players. At the end of the year, they’ve already grabbed a chunk of the market and, if they continue on the same trajectory, will continue to do so in 2023.

With the right tools, you get a dynamic view of the market data you need, allowing you to change tactics when markets shift.

Step 3 – Market trends

What: Reviewing current trends is key to any good market analysis. As we all know, trends can rise and fall at a moment’s notice. This is why this activity, in particular, is one you should routinely perform.

Why: Keeping a finger on the pulse can help you adapt and flex, at the right time, in the right way. Market trends give you insights into the current market situation and potential opportunities and challenges. Doing so can help you identify areas for growth, spot potential risks, and plan effective strategies. Market trends can also provide valuable information about customer preferences, competition, and economic and technological developments. By monitoring these trends, businesses can stay ahead of the curve and make informed decisions that will benefit their bottom line.

You may have heard about ChatGPT in the press; this is an example of a highly-disruptive technology that has the potential to completely shift an entire market; many, in fact. It managed to gain over 1 million users within its first week on the market. And it’s a great example of why regular market trends analysis should occur.

How: There are lots of ways new market trends can surface. Consumer behavior, economic trends, technological advancements, and the competitive landscape can impact how markets behave. Legal and regulatory changes can also influence trends and changes too.

Staying up to date with industry news and legislation changes is useful. But it takes time, and it’s not always the most effective way to know when consumer sentiment changes.

Market research surveys are one way to understand customer attitudes and needs and how they shift over time. However, it’s not the most effective way to inform your market analysis. Particularly when you want real-time market intel.

Market analysis example: trend detection

Similarweb analyzes billions of data signals daily to deliver game-changing insights about any market, region, or individual company. So, as we look at how to do market analysis, I wanted to share a practical example of how clients use Similarweb to spot trends in a market.

Wonderbly, a global business, provides personalized books, serving over 6 million customers. To grow its business, it conducts regular market analysis. As part of this process, they analyzed seasonal trending keywords within Similarweb. Let’s look at what it found out and how it impacted the business.

Wonderbly was able to spot an emerging category (anniversaries and weddings) that was not currently catered for within its own product set. In addition to being able to capitalize on seasonal trends in its market, it achieved a 69% revenue in books purchased by a more mature demographic and a completely new audience for its business.

Read more: Wonderbly’s market analysis success story.

Step 4 – Competitive analysis

What: A competitive analysis involves collecting and reviewing data about key industry players, rivals, or emerging stars in your market. It unpacks and tracks their activities and successes, letting you see what’s working, how they go to market and the various marketing strategies they use to attract and retain customers.

Why: Regardless of your size or scope, understanding the competitive landscape is key. Your target audience knows your competitors and will likely size up the pros and cons of buying from thesm before considering whether to do business with you. A robust competitive analysis can help you refine your own offerings, make informed pricing decisions, show where you can beat out your rivals, and identify areas for improvement or diversification.

How: A tried and trusted tool for this process is the well-known SWOT analysis. It lets you map and view what and how each competitor takes its products to market. Considering things like pricing, positioning, marketing, services, and more. A competitive matrix is another tool used to visualize data about rivals in a market.

To do it, download our free competitive analysis framework. Then, pick five competitors in your market to track. Complete each section, and analyze the results to discover your biggest opportunities.

Step 5 – Develop strategies

What: Use the results of your market analysis to make data-driven decisions.

Why: When you read a post about how to do market analysis, the chances are you’ve got a goal in mind. Perhaps you want to explore a new market before deciding if it’s ripe for entry. You may want to introduce a new product or service or acquire an existing company. Whatever your goal is, ensure you put the insights and data you’ve obtained to good use.

How: Create a list of potential opportunities, then build strategies around each. Here, you might evaluate potential ideas based on project costs or timeframes. Once you’ve clearly mapped out each opportunity, and understand the potential impact it will have, along with associated costs and timeframes, you can think strategically about which ideas to move forward with from both a short and long-term perspective.

Pro Tip: Use a framework to record, capture, and review the data you’ve collected about market segmentation, size, trends, and key competitors. You can draw inspiration from our downloadable competitive analysis frameworks. However, what’s key is that you systematically record your findings and review them regularly.

Step 6 – Monitor the market

What: Keep track of your market and its key players; monitor changes over time.

Why: We know markets shift, whether they’re impacted by consumer behaviors, external factors, or something else. So, it’s important to monitor changes over time.

How: We may be a little biased, but Similarweb gives you a real-time bird-eye view of your market. Letting you dive into the details and unpick changes and tactics whenever you need. With it, you can track key growth metrics, marketing channels, emerging players, trending topics, and much more.

Using the Industry Analysis tab in Similarweb Research Intelligence, I can identify the market leaders and rising stars quickly. Here, I immediately see a company to track, Synchrony. As an emerging player showing exponential growth (2700%), I’ll take my market analysis a step further by investigating their successes later.

Similarweb shows me key insights, such as website traffic, the marketing channels it’s getting traffic from, audience demographics, geography, organic search insights, and more. As part of any good market analysis, the ability to spot rising players and unpack their successes can be crucial, particularly when they’re showing such growth.

Analyzing a market: Conclusions

Learning how to do market analysis is the first step. Aside from analyzing the results and making key strategic decisions, the ability to track changes over time is key. Similarweb makes it easy to segment, size, and analyze a market fast. With it, you can spot opportunities, benchmark your performance, and monitor shifts and changes as they happen, not a month or quarter later.

FAQs

What are the 4 types of market analysis?

The four types of market analysis are market segmentation, market sizing, market trends, and competitive analysis.

What are the five components of market analysis?

The five components of market analysis are: customer segmentation, customer needs and trends, competitors, market size and trend, and pricing.

What makes a good market analysis?

A good market analysis should include accurate, up-to-date data, clear objectives, and a thorough market and customer needs analysis.

Is market analysis the same as a SWOT analysis?

No, market analysis and SWOT analysis are not the same. While a SWOT analysis evaluates an organization’s strengths, weaknesses, opportunities, and threats, a market analysis focuses on the external environment, such as customer needs, market trends, and competitors.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist