Top 3 Digital Strategies For Financial Services Companies

The COVID-19 pandemic prompted the greatest acceleration of digital banking in history. According to Fidelity National Informations Services, mobile banking registrations jumped 200% in April. Bankers like Mike Mayo, a Wells Fargo analyst, explains, “What’s taken place over the last few months may have taken place over two to 10 years if the pandemic had not come along.” The result: All eyes are on financial services trends and strategies for the top players.

To better understand the modern banking landscape and improve your company’s performance, we highlight top digital strategies for financial services providers based on insights from Jamie Drayton, our lead finance industry consultant:

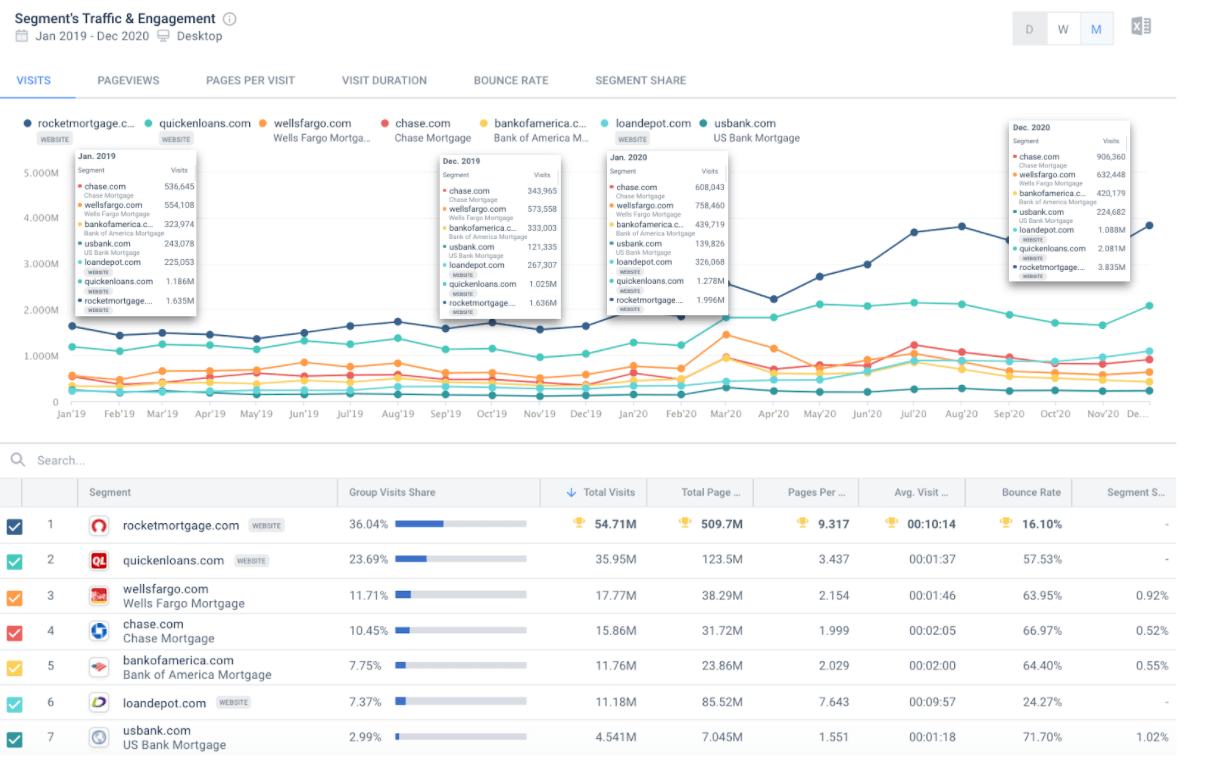

Traffic to mortgage sites soared

Traffic to mortgage sites grew 71% year-over-year (YoY) – triple the rate of overall financial services (+25%) in 2020.

Why?

A powerful combination of low-interest rates and surging interest in homeownership due to the pandemic. The growing number of people looking to buy homes in less crowded suburbs generated web traffic to lenders.

What were the top mortgage websites?

In the mortgage websites space, Rocket mortgage won the highest share of voice (SOV) – nearly a third by year’s end. It also had the highest traffic share (92%), nearly doubling from June, and widening gaps between competitors.

Of its competitors, Loan Depot experienced the most digital growth, +173% (YoY). It also doubled its SOV to 9.17%

Among more traditional banks, Chase’s mortgage segment grew 97%, exceeding the industry average. Wells Fargo experienced the least growth among competitors pictured.

Traffic to financial services sites: Rocket Mortgage had the highest traffic share; Chase’s mortgage segment exceeded industry growth

Direct and organic traffic propel banking’s digital strategy

Direct channels drove Chase’s traffic growth with more than half of its clicks coming through chase.com. This also indicates the highest brand awareness among banks.

Organic search helped boost runners-up Bank of America and Wells Fargo, which received 66% and 80% of traffic through organic search, respectively.

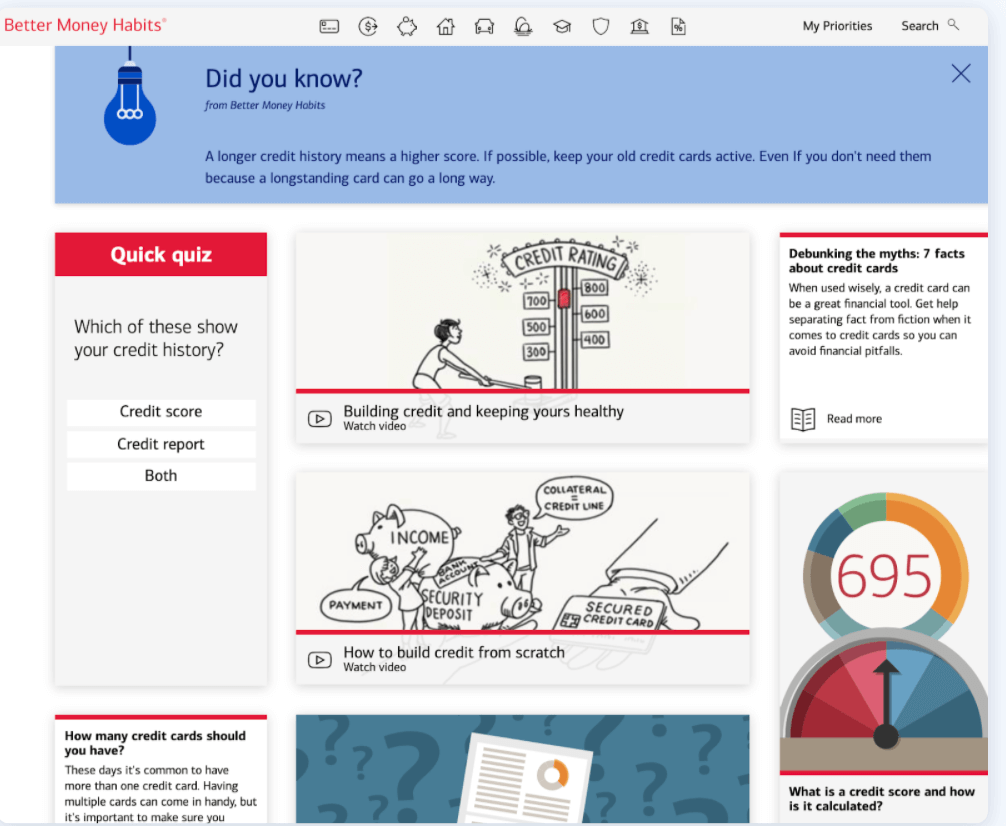

Which organic search campaigns highlight the bank’s digital strategy?

Bank of America focused website content on financial literacy, which attracted traffic. Among the top five banks in the U.S. (which also includes Chase, Citi, Wells Fargo, and U.S. Bank), bankofamerica.com received 45% of all clicks from educational-related queries.

The top questions driving traffic to Bank of America’s site relate to budgeting, saving money, mortgages, and taxes.

Want to learn more about the impact of financial literacy on banks’ web traffic?

How mortgage industry disruptors are gaining

Own Up, which saw a 154% traffic surge in 2020, outpaced the growth of the mortgage industry by targeting consumers who are just beginning to think about purchasing a home. Through focusing on consumers this early in the funnel and providing helpful educational content, Own Up is dedicated to establishing a brand synonymous with an easy home buying process.

Instead of going up directly against the big banks by purely focusing on content and keyword related to mortgages, Own Up invests in long-tail question queries.

Want more details on Own Up and other industry disruptors’ strategies?

Looking for more financial services insights?

Although this is just a quick snapshot of mortgage and banking industry insights, we invite you to watch Jamie Drayton’s webinar, “Banking & Mortgage Disruptors: Performance and Predictions” for more learnings.

See you there.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist