Digital Demand for Clothing Sustained Despite Inflation & Broader Downturn in Ecommerce

Price seems not to be decisive, as mid-market and premium retail transactions rise by 7%

At a time when much of ecommerce retail is struggling, fashion and apparel remain a strong digital market for both premium and fast fashion brands.

The broader picture is that rising interest rates and soaring clothing inflation, alongside financial markets uncertainty, have eroded financial stability and confidence for most Americans, thus drastically impacting consumer spending in the US. According to a recent report from McKinsey, year-on-year spending has declined for the second month in a row.

Yet research from Similarweb’s latest US Consumer Spending Report on 2,251 ecommerce players in the US shows that fashion retailers were among the least affected major online industry. Fashion retailers are still capturing digital demand, with converted visits growing 4.4% YoY (Nov ‘22-Apr ‘23). Converted visits are website visits that result in a sale.

Mid-market and Premium Fashion propel growth (but it’s just part of the story)

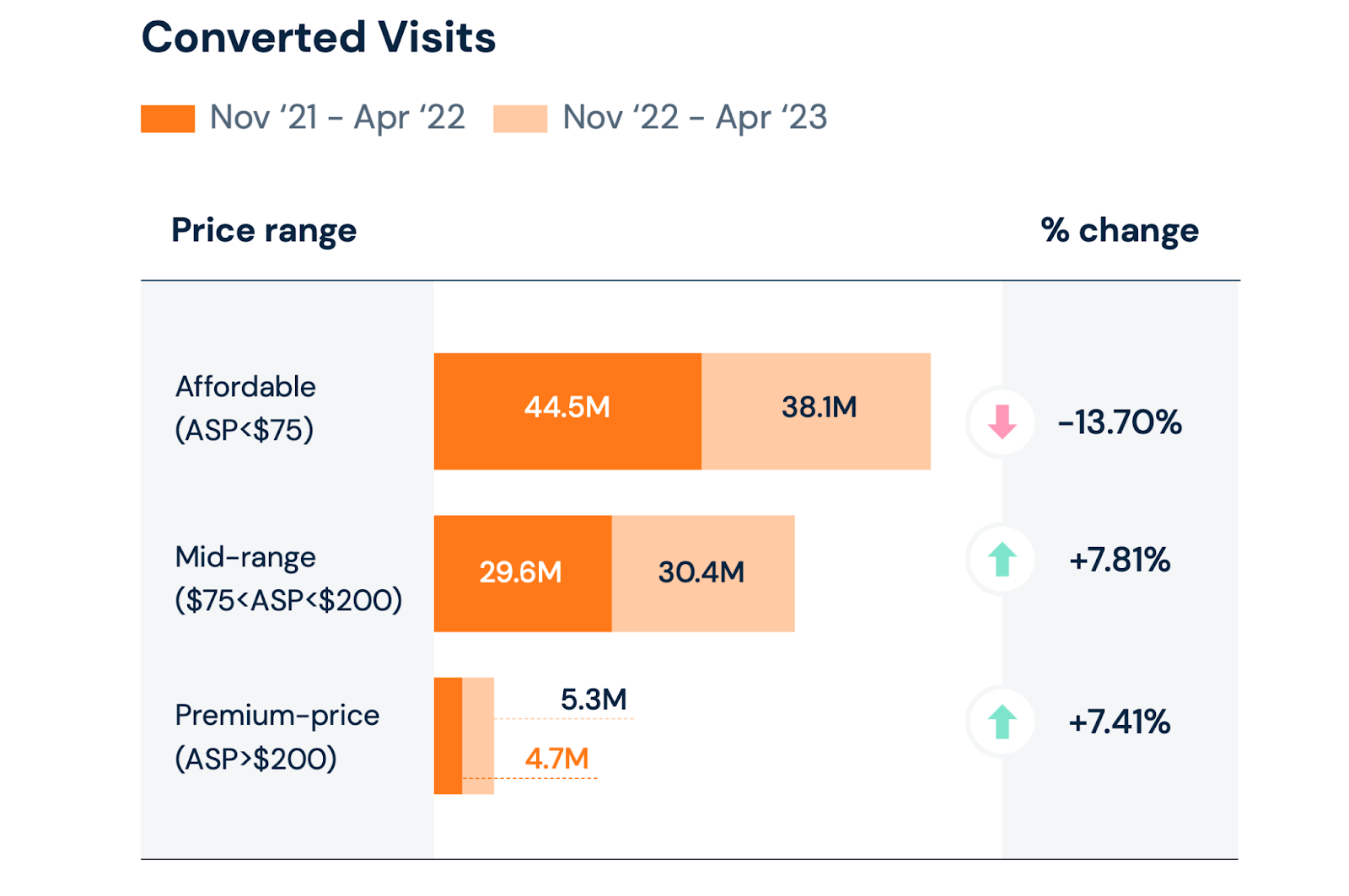

Conversion dynamics for the top 67 US fashion retailers showed that the majority of converted visits between November 2022 and April 2023 came from affordable fashion sites, with an Average Selling Price (ASP) of less than $75. However, consistent with what Ralph Lauren’s CEO Patrice Louvet told CNBC in a recent interview, we also found consumers are gravitating towards higher-price items in fashion.

Why? Amidst a recession, consumers may prefer to invest in longer-lasting, quality pieces and, according to Ralph Lauren’s CEO, in brands they trust.

Younger consumers are the driving force for the increase in demand for higher-priced Fashion brands

According to Similarweb’s survey about consumer sentiment on a panel of 2,507 US consumers revealed that 46% of Gen Z (18-24 years old) respondents reported having “a little more or a lot more” spare money than last year as of January 2023.” For Millennials (25-34 years old), that figure was 44%.

The survey answers match digital audience analysis data: these demographics tend to over-index in mid-range to premium brands’ viewership, in comparison to older age groups. Those in the younger age groups are more likely to be single and not responsible for children, which impacts some customers’ savings. In fact, under 35 years old make up over 57% of online visitors to premium brands and retail sites.

Reasons for this enthusiasm for higher-priced clothes include a greater interest in longer-lasting clothes (in opposition to super fast-fashion), and consumers wanting to “flex” and dress like their favorite celebrities/influencers.

How does it look like at the brand level?

If younger generations suffered less than middle-aged and older adults from the cost of living crisis, or have a different attitude to spending and thus tend to visit more expensive fashion sites, not all can afford a purchase.

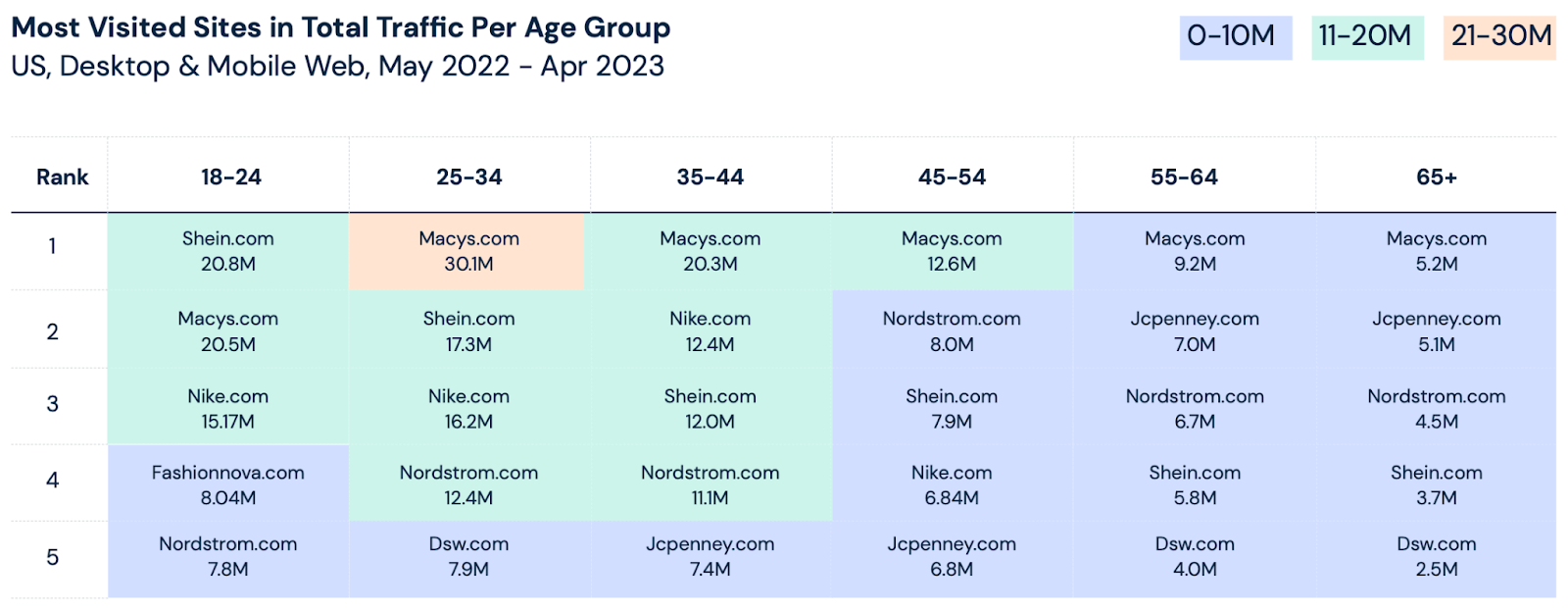

Most Visited Sites in Total Traffic Per Age Group

US, Desktop & Mobile Web, May 2022 – Apr 2023

- Shein.com remains the top retailer based on traffic for 18-24 years old, and ranks in the top 5 of most visited fashion sites for all generations, reaching beyond its original youth demographic. Gen Z consumers also make up almost a third (32%) of Shein Android app users.

- For all other demographics, macys.com cater to all wallets, holding the top spot in total visits.

However, for the two youngest demographics, brands on which they represent the highest share of traffic differ from the top brands in total traffic:

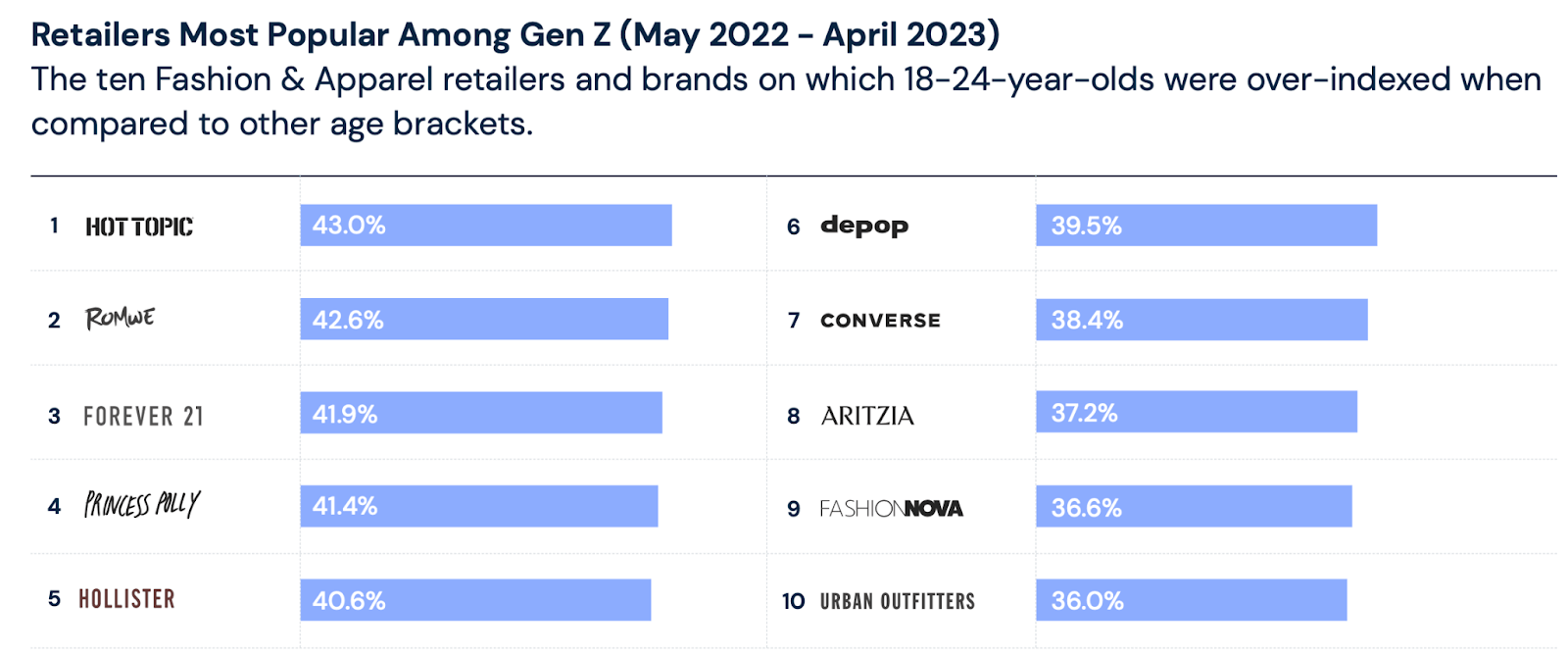

Although Gen Z consumers reported having more money to spare than they did last year, they still over-index on fast-fashion players such as hottopic.com (43% of its audience), romwe.com (42.6%), and forever21.com (41.9$%). Most of the brands in this top 10 have a strong footprint on Tiktok too: princesspolly (533M views), romwe (757M views), forever21 (1.1B), and hottopic (1.8B views)

The Millennial audience is prominent among brands and retailers for whom pricing is typically in the medium to premium range. This is not surprising, given that 44% of US consumers in this age bracket declared having more spare money than last year. They are likely to have small households and/or no children but are also more advanced in their careers than Gen Z, and as a result, they can afford quality, long-lasting clothing items.

Moreover, 60% of the 25-34-year-olds who reported having less money to spend than the previous year said that increasing expenses was the reason. Continuing to spend on more expensive brands could be a factor.

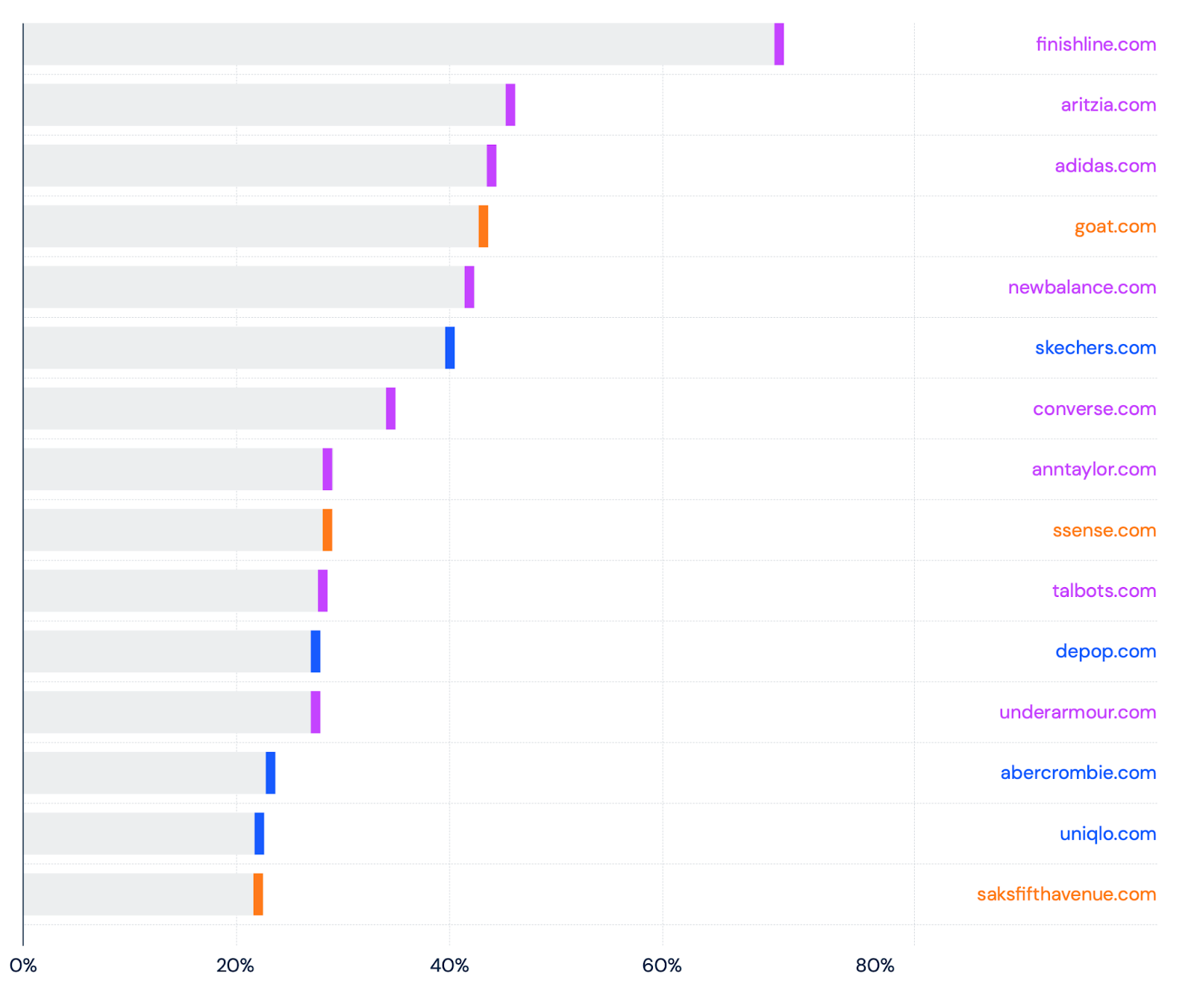

The top brands experienced rapid growth due to the high number of conversions from consumers aged 35 and under

- Most of the fastest-growing brands rely heavily on younger audiences, who are more likely to spend on fashion than older generations

- Under Armour (44%), Ann Taylor (41%), Skechers (28%), and Talbot (25%) have a higher share of customers under 35 years old than other brands

- On average, the fastest-growing brands sit within the mid to premium price range, with the exceptions of Sketchers, Uniqlo, Abercrombie, and Depop

Dupes: despite the popularity of premium brands, consumers are still trying to save money on clothing through dupes

Even if dupes, or copycats, were originally more popular for beauty goods, consumers are increasingly looking for dupes of trendy brands and designer clothes, especially those viral on social media. Popular fashion dupes include those for Reformation (98M views on Tiktok), Aritzia (1.6B), and sleeper pajamas. Some of these brands, including Aritzia, are not even in the high price range but in the mid-range.

Key takeaways for fashion brands and retailers

- The Fashion industry is more inflation-proof than other ecommerce segments, as it is directly tied to people’s appearance and egos. Fashion is doing better than consumer electronics retailers, for example, whose converted visits dropped by 7% YoY

- If your brand offers affordable clothing, your focus should be on capturing older generations and larger households that are struggling more financially and thus cannot afford to splurge on expensive clothing

- Premium and sustainability-focused brands should target young millennials and emphasize the quality of their clothing, as quiet luxury is now a major trend for this demographics

- Even if high clothing prices persist, we don’t expect demand for premium clothes to go down in the next months. However, these brands should monitor the dupes trend on Tiktok. Competitors, seeking to appeal to cash-strapped customers, may be tempted to create copycat affordable products

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist