Research Intelligence

Research Intelligence

Competitive Matrix Types: Which Is Right For You?

A well-crafted competitive matrix can help companies make informed decisions about their positioning and pricing strategies, enabling them to stay ahead of their competition and increase their market share.

Have you ever found yourself sifting through the same competitive data report over and over – understanding the numbers but unable to generate the insights you need?

You want the big picture, but you also need the granular view. Sifting through countless rows of data can be frustrating, it’s time-consuming, and you can’t even be sure of the outcome.

A competitor matrix can help you make sense of what feels like a data overdose.

This article will explain how to make the most of a Competitive Matrix and how to use it to gain a competitive advantage.

What is a competitive matrix?

A competitive matrix is a visualization of your competitive analysis data or a specific aspect of it.

Using a competitive matrix makes it easy to recognize competitive advantages and discover market opportunities so you can develop or innovate products, services, and market strategies aligned with your business plan.

There are many types of competitive matrices – which type you choose depends on the scope of the comparison or benchmarking and the answers you seek. The competitive analysis matrix can be a simple features comparison table, a scorecard, or a grid.

For a one-on-one comparison of features, listing them in a table does the job. To evaluate your position in the market, plot each relevant player in the competitive landscape on a sophisticated grid.

Let’s look at some common examples of popular competitive matrices and when to use them.

Why a competitive matrix analysis is so important

A competitive analysis matrix is a key part of your competitor analysis that involves collecting data about your competition and translating it into insights that answer your market research questions.

The competitive matrix allows you to organize the data in a way that makes it easy to discover the insights you need.

Got a ton of randomly collected competitor data? Turn chaos into order with a competitive positioning matrix. Or, opt for a matrix that focuses on a specific query and collects only the relevant data set.

Whether you start with the data or with the matrix, the tool lets you compare characteristics of competing brands in your target market or niche and hone in on a specific angle. You can even identify less-obvious competitive advantages, detect trends, and spot weaknesses in your competition.

Benefits of using a competitive matrix

With a competitive comparison matrix, you can:

- Identify the uniqueness of your brand, product, or service

- Evaluate competitors by their strengths and weaknesses

- Hone in on the competitive landscape of market niches and segments

- Uncover market opportunities and threats to your position

- Find gaps in your market or market niche

These understandings enable you to:

- Optimize your offering, marketing, and content

- Support the development of new tools and features

- Review and improve your pricing strategy

- Develop a long-term growth plan

To maintain your market position and move up among the competition, you can’t rely on the one initial business advantage that got you there. It’s only a matter of time until someone beats you at this point, and then you’re out.

For example, if price is your main advantage, someone will find a way to do what you do at a lower cost and charge less. If you offer a unique feature –- think of Amazon’s overnight delivery –- competition will quickly realize your advantage and find a way to catch up. It’s the nature of competition; they’re always on the lookout to match and improve what you offer.

A competitor analysis matrix allows you to zoom in on areas you’re ahead of the competition and discover which brands are catching up and pose a threat to your market positions (and which are falling behind). Identify the areas where you can improve, detect discrepancies between demand and supply in the target market, and get ideas for something new you could offer to stay on top.

7 competitive matrix examples to meet your goals

You’ve set your goals and collected your data for the competitive analysis. Or maybe you’ve collected competitor data without a definitive plan, but you’re aware of the company’s overall business goals. Now’s the time to define the type of competitive landscape matrix that suits your needs.

Have a look at these common examples to understand the benefit of each type of matrix:

SWOT Analysis

Hello, old faithful: SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It evaluates the most important factors for business growth. Strengths and weaknesses generally refer to self-evaluation or internal evaluation, whereas opportunities and threats aim at identifying external factors impacting the business. Ringing any bells?

In many situations of life, business or non-business, we do a SWOT assessment naturally in our heads. Regardless of the goal we want to achieve – convince a friend to join an adventurous trip, win a cooking competition, or land a business deal – we need to make ourselves aware of the SWOT.

In a complex business environment or competitive market, this type of analysis is beneficial when entering a new market or introducing new features, or simply as an ongoing market monitoring tool.

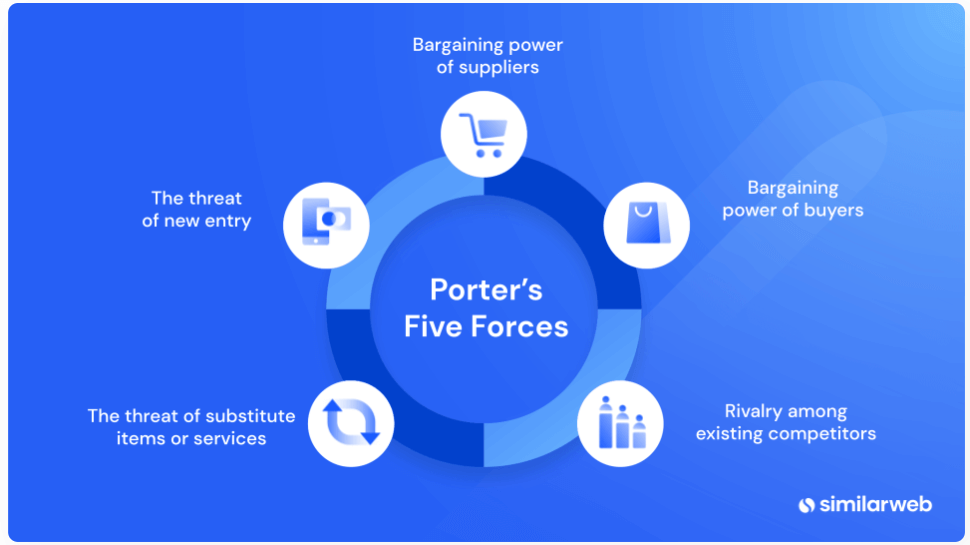

Porter’s Five Forces

This model was developed by HBU professor Michael E. Porter and focuses on five forces that impact the level of competition in an industry. By applying this model, you can identify profit potential and detect new lines of business. It’s particularly useful when developing a go-to-market strategy for your brand.

These are the five forces:

- New entrants. How easy is it for newcomers to enter the marketplace? The easier it is, the higher the level of competition.

- Existing rivals. How many rivals are in the target market, and how active are they? The more established the opponents, the greater the competition. Identify leaders.

- Substitutes. How likely is it for a new product on the target market to cause a decrease in sales of existing products? You want to understand if the newcomer will replace and not shift competition much or be an addition to the existing products and increase competition.

- Suppliers. What’s the bargaining power of the industry suppliers? Are there many suppliers for many resources or few supplies for few resources? Few suppliers for few resources mean high competition and high prices, many suppliers for many resources mean low competition.

- Buyers. What’s the consumers’ bargaining power? A strong bargaining position affects profitability.

Gartner’s Magic Quadrant

Gartner’s Magic Quadrant provides the basis for a competitor analysis visualization in a specific market or a niche. It gauges companies according to their ability to execute and their completeness of vision. That sounds pretty abstract, but you’ll understand when you look at the grid.

The model divides the market into four groups: niche players, visionaries, challengers, and leaders. Leaders have an all-inclusive vision for the company and are able to execute that vision effectively. Visionaries are still at a stage where they lack the ability to carry out what they envision, and challengers have less of a vision, but are good at accomplishing their goals. By doing so, they challenge the leaders.

This methodology can help you identify your closest competitors and set your goals more realistically. The quadrants don’t necessarily place a value on the parameters you analyze, but rather, help you find your and other companies’ place in the grid. Not everybody needs to strive to be a market leader. Some need to remain visionaries, some challengers, and others niche players.

Competitive positioning matrix

Often, you want to determine your market position in a specific area, for example, price-quality relation of traffic-engagement connection. In this case, you can create your own matrix of quadrants and position each competitor in the correct place.

If you’re analyzing price and quality, you’ll place low price and low quality on the lower left, and high price and high quality on the upper right. The other two quadrants will be low price and high quality, and high price and low quality. Still with me?

This type of market mapping lets you view the market from a specific angle and as such, inspect a particular aspect. You can place any two important factors on the axis to determine how they relate: For example, the amount of traffic and conversion rate or product range, company size, and more.

Growth-share matrix

This matrix, also called the product portfolio matrix as developed by the Boston Consulting Group in the 60s, focuses on the evaluation of product lines. The chart is still relevant today, and companies use it to decide where to focus their efforts and resources to stay competitive.

The model builds on the principle that each product has a natural life cycle and moves through several stages of potential, popularity, and profitability. Companies with a large portfolio should tap into this tool to monitor and reevaluate their product lines by dividing them into these four categories:

- Star – the top products or brands of a company, such as Oreo cookies for Mondelez

- Question mark – new or trial products of which you don’t know how well they’ll do yet

- Cash cow – profitable products that have the potential to be stars

- Dog – products that are neither profitable nor growing in popularity; companies hold onto them for sentimental reasons (aww)

Strategic group analysis

Another way to categorize competitors is by similarities in their business or marketing strategies. Compare their marketing channels, pricing policies, and target audiences and see where you fit in. Then narrow the focus down to the companies with a similar approach to yours.

This gives you a more granular view of your position and lets you pinpoint your efforts where they’re most needed.

G2 Crowd Grid

G2 Crowd has developed a grid similar to the four quadrants that allows companies to determine their position based on reach and customer feedback. Market presence is measured on the vertical axis and customer satisfaction on the horizontal. The model divides the market into Niche, High Performers, Contenders, and Leaders. Similarweb is proud to feature highly on the G2 platform.

You can see how this leans on the Gartner quadrants with the niche in the lower left and the leaders in the upper right. However, since they collect data from customer feedback and engagement, the quadrants represent how the audience perceives companies, and the positioning might therefore be different.

This type of competitive analysis helps you understand audience preferences in your target market and perceive popularity, rather than profitability.

Simple comparison chart

For a one-on-one comparison, this method is often the most insightful. Also, when comparing features in a variety of competing products, simply listing them helps you identify your unique points.

How to create a competitive matrix using Similarweb

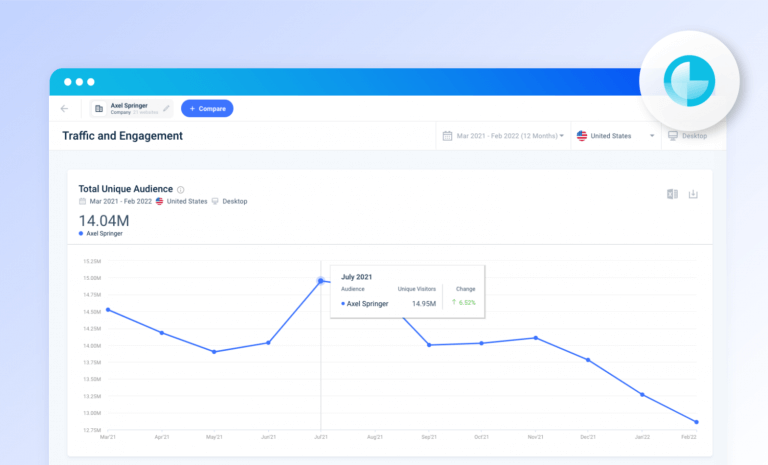

The first step in your competitive analysis is to identify your top competitors in the market. You can use Similarweb’s competitive analysis tool like the Competitive Landscape overview to collect the most compatible companies and then hone in on specific brands you want to dig deeper into.

You can also choose the companies that are closest to yours in industry rank or country rank. Similarweb provides you with a competitive matrix that visualizes where you stand compared to these companies for a selected measure, such as monthly visits, visit duration, bounce rate, and more.

For a more advanced competitor matrix, define the specific purpose of the analysis and set metrics that represent the insights you need. This will also affect the type of matrix you use to visualize your findings.

Let’s say you wanted to evaluate the first of Porter’s Five Forces. You could look at the companies with the biggest increase in traffic share over a substantial period and see if newcomers are able to grow quickly.

If part of your analysis involves evaluating the effectiveness of marketing channels, you can easily get an overview and specific data on competitors from the Channels Overview page.

To evaluate the effectiveness of marketing channels, add various engagement metrics and weigh the amount of traffic against engagement by placing the data on the relevant spot in your competitor benchmarking matrix.

FAQ

What is a competitive matrix?

A competitive matrix or competitor matrix is a way to visualize your competitor data to help you understand the competitive landscape better and faster. There’s a large variety of competitive matrix models designed to provide specific perspectives on the market to gain insights.

How do you create a competitive matrix?

A competitive matrix is part of your competitive analysis. Depending on the goal, there are two ways to approach it. 1. Collect competitor data and organize it on a competitive analysis template. 2. Define a specific query and create a matrix that will provide the desired answers. Then, gather the relevant data and plot it on the grid or in the table.

How can a Competitive Matrix help a business?

A Competitive Matrix can help a business gain a better understanding of its position in the marketplace. It can also be used to inform pricing strategy and product or service positioning decisions, enabling companies to stay ahead of their competition. Additionally, a well-crafted Competitive Matrix can provide valuable insight into customer preferences and buying behavior, helping businesses tailor their products and services to meet customer needs.

Why is a competitive matrix useful?

A competitive matrix gives you a comprehensive overview of a specific topic and helps you compare the market. You can focus on one aspect of performance, i.e., organic traffic, and map your competition in this particular area to help pinpoint growth opportunities and facilitate strategizing.

What is competitive intelligence in business?

Competitive intelligence is the data you gather about your competitors in a market. This includes digital data, company information, and insights into the audience. You collect and analyze to evaluate your chances of business success or failure.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist