BNPL a Godsend for Consumer Electronics

While conversions dipped for everyone, merchants using BNPL did 16 points better

Buy Now, Pay Later payment options allow online retailers to make sales where consumers might not otherwise think they could afford a purchase, and nowhere is this more apparent than in consumer electronics. These findings are excerpted from Similarweb’s Digital Ecommerce Landscape study.

Key takeaways

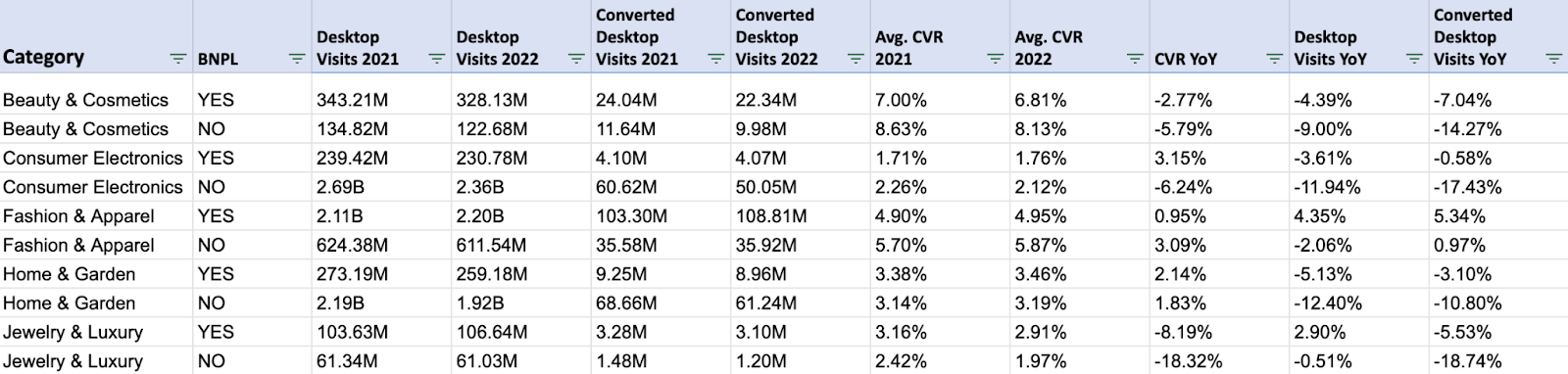

- Converted visits dipped overall but merchants offering BNPL did over 16 percentage points better than those who did not (-0.6% year over year with BNPL vs -17% without it).

- 62% of Gen Z BNPL users who made consumer electronics purchases reported using it to buy gaming consoles.

- 26.7% of consumers who reported using BNPL to purchase consumer electronics said they would not have bought without this financing option.

- As consumer electronics have a longer product life cycle than any other categories, the possibility to take longer to pay was quoted as a top reason (67% of survey respondents) for using it.

Consumer electronics, as well as jewelry and luxury, are top categories for BNPL

The popularity of BNPL for consumer electronics is part of a larger pattern of helping consumers buy products they desire but otherwise might not be able to afford.

Another example was the Jewelry & Luxury category, where BNPL helped retailers minimize the impact of decreased demand. It was the difference between -5.5% year-over-year converted visits vs -19% for sites not offering BNPL.

Part of a broader pattern

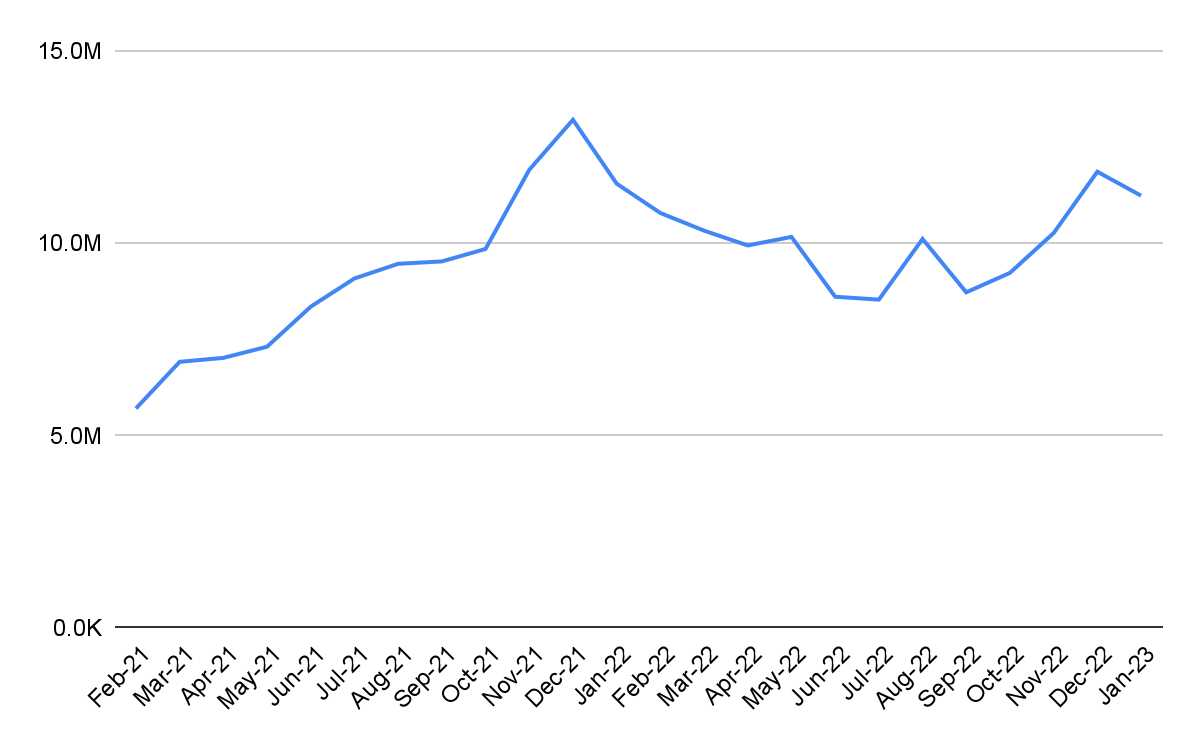

Usage peaked around the holiday season, but overall it was lower during 2022 than during 2021 due to a decrease in consumer spending in the last few months.

Monthly Unique Users for all Buy-Now-Pay-Later Apps combined (Android & iOS)

U.S., App, February 2021 – January 2022

While there is most likely usage overlap between the different BNPL apps available in the U.S., it is clear that they are becoming a popular way for customers to pay for their purchases online and in-store. Combined monthly active users for Klarna, Affirm, Afterpay, Sezzle, Zip, and PerPay rose by over 200% from 5.7M in February 2021 to 11.2M in January 2022.

Read the full report

These findings are excerpts from a detailed report, The Categorical Rise of BNPL, available separately or as part of Similarweb’s Digital Ecommerce Landscape study.

Read more – The Meteoric Rise of the Buy Now, Pay Later Industry

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist