Top 5 Canadian Banks and the Trends Driving Their Digital Growth

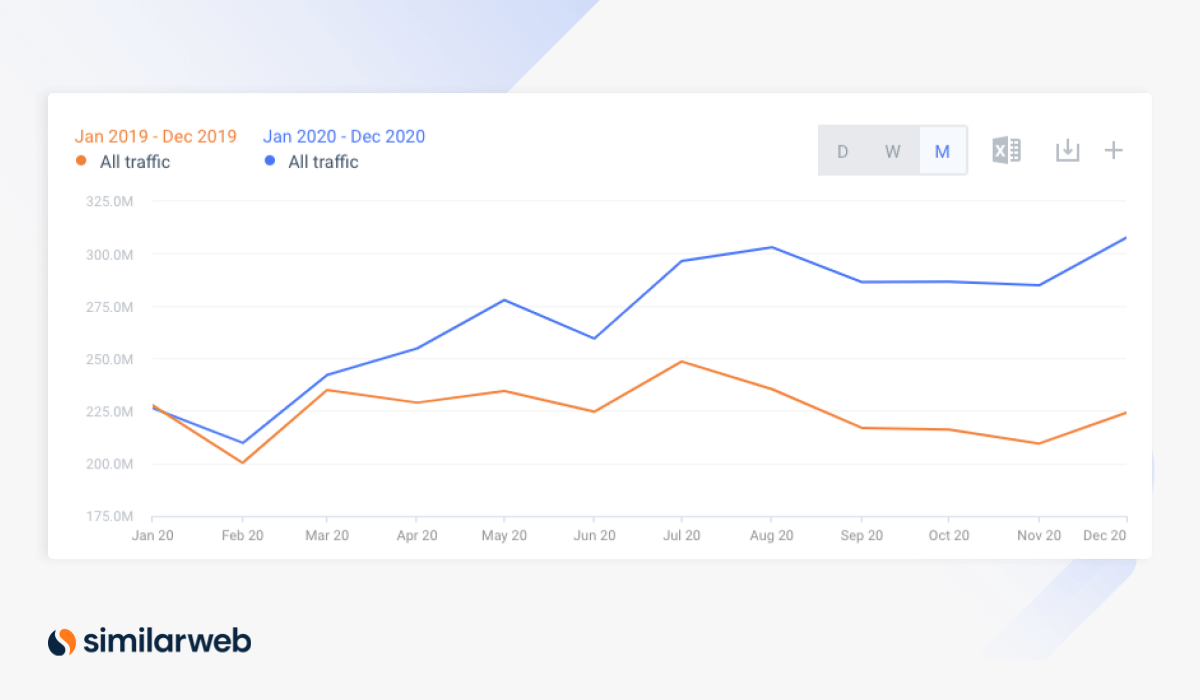

Like most of the world, the COVID-19 pandemic accelerated digital adoption across industries. The financial service industry in Canada was no exception. According to Similarweb data, web traffic to the Banking, Credit, and Lending category within the country increased 20% in 2020. In this article, we’ll use our Research Intelligence solution to hone in on the digital trends impacting the performance of top Canadian banks (known as the “Big 5”), and share lessons learned from the winners.

Web traffic 2020 vs. 2019: Banking, Lending, and Credit category, Canada

1. Biggest Canadian banks boom from digital adoption

With physical branches closed at the onset of the pandemic, consumers began replacing their neighborhood banks with online portals, generating growth among Canada’s “Big 5” banks – TD Bank, Royal Bank of Canada (RBC), Scotia Bank, BMO, and CIBC – in 2020 and the first half of 2021.

Digital dividend: Web visits grow across the board

Desktop and mobile web visits to all “Big 5” banks grew year-over-year (YoY) in 2020. Traffic gains (in descending order) for this group include:

- CIBC (+28.2%)

- TD Bank (+21%)

- Royal Bank of Canada (RBC) (+14.4%)

- Scotia Bank (+11.3%)

- BMO (+11.3%)

Though CIBC’s nearly 30% growth is greater than the others, it also started with the least yearly visitors (165.6 million). This smaller user base gives it more room to capitalize on consumers’ shift to online banking.

TD Bank, however, started with more than twice the yearly visitors (363.4 million) and ranked second for the most visitor growth, 7 percentage points (PPTs) behind CIBC. Its new visits (+80 million) were the most among the competitive set, highlighting its leadership in the Canadian market.

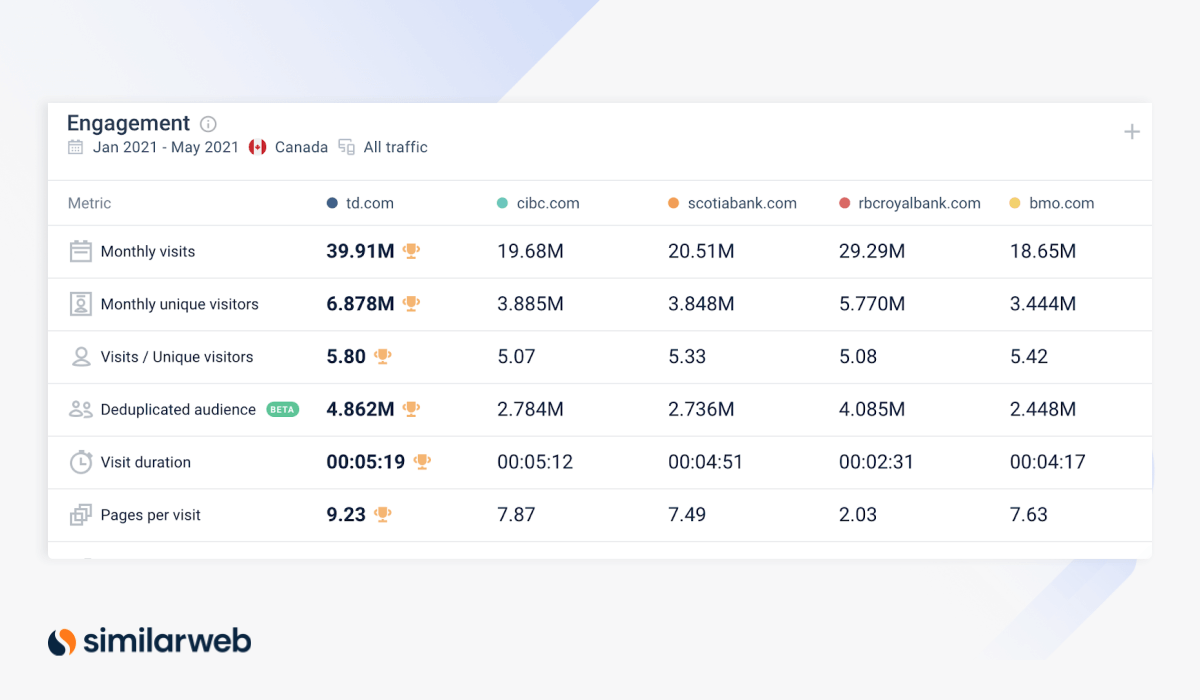

Online presence and reach is a two-legged race

TD Bank, also, along with another top Canadian retail bank, RBC, had the greatest overall web presence and reach. In 2020, these top two banks accounted for 56% of total visits among Canada’s largest domestic banks.

While 2021 brought continued growth for all banks in the competitive set (each bank received more average monthly visits in the first months vs. the same timeframe in 2020), TD Bank continued its leadership, outperforming all peers across all desktop and mobile web engagement metrics.

In 2021, TD Bank and RBC have the largest web presence among Canada’s top banks

Key takeaway

Even as more banks reopen with the lifting of pandemic restrictions in 2021, it’s clear that consumers demand digital and banks need to ensure that they deliver an optimal online experience to achieve success.

To do so, banks can focus on improving their digital user experience (UX). This may include tactics like: chatbots, a WhatsApp chat option, one-click connections with banking accounts, and digital payment providers like Paypal and Venmo.

2. Organic search: top channel for largest Canadian banks

Organic search was the top marketing channel for the top five Canadian banks. Again, TD Bank outpaced its peers, with a 55% increase YoY in organic traffic, which contributed to its overall strong 2020-2021 performance.

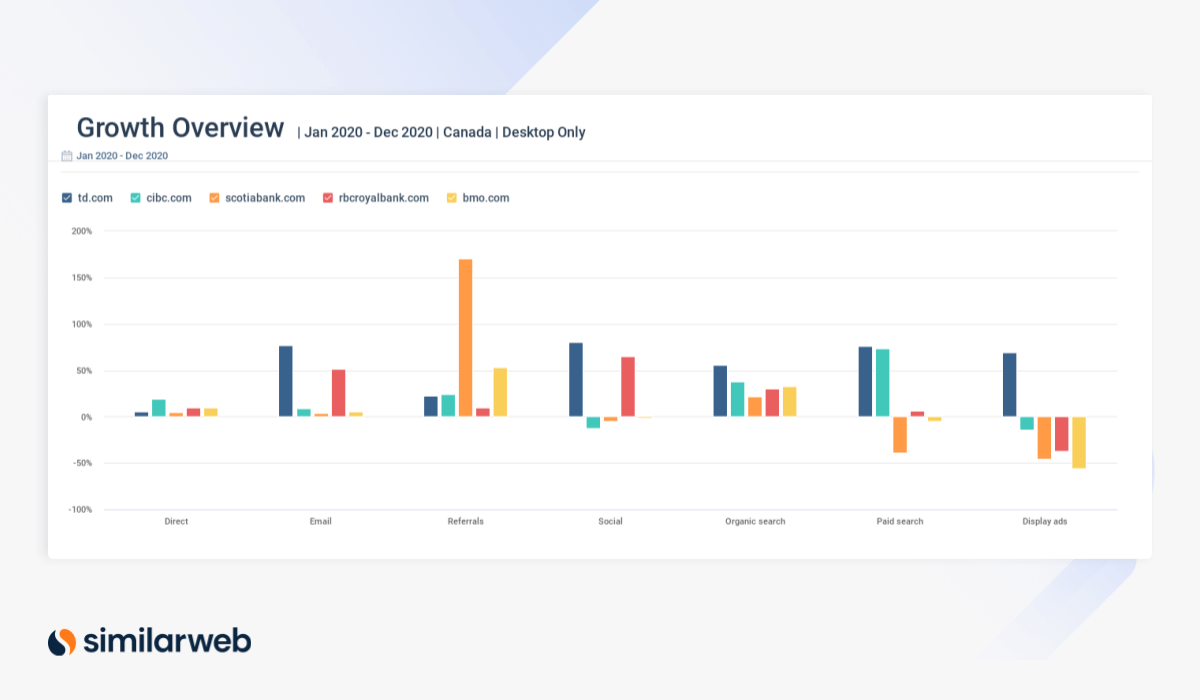

TD Bank outpaced its peers for growth across most marketing channels, including 55% YoY organic traffic

Search behavior across all top banks shows strong brand awareness and loyalty. TD Bank leads the pack with the greatest share of branded traffic (92.6%), followed by BMO (90.9%), and CIBC (86.2%).

Key takeaway

Search is a critical channel to promote brand awareness in the modern, digital age. Banks need to ensure that their websites and mobile apps are optimized for search engines (as well as Apple’s App Store and Google Play). This can be done by integrating the right keywords through search engine optimization (SEO) tactics, and producing highly engaging content for users through blogs, portals, and other formats.

Among top U.S. banks that also rely heavily on organic search traffic, Bank of America does a great job building a financial literacy portal to meet consumer queries and drive traffic to its site.

3. Mobile adoption accelerates

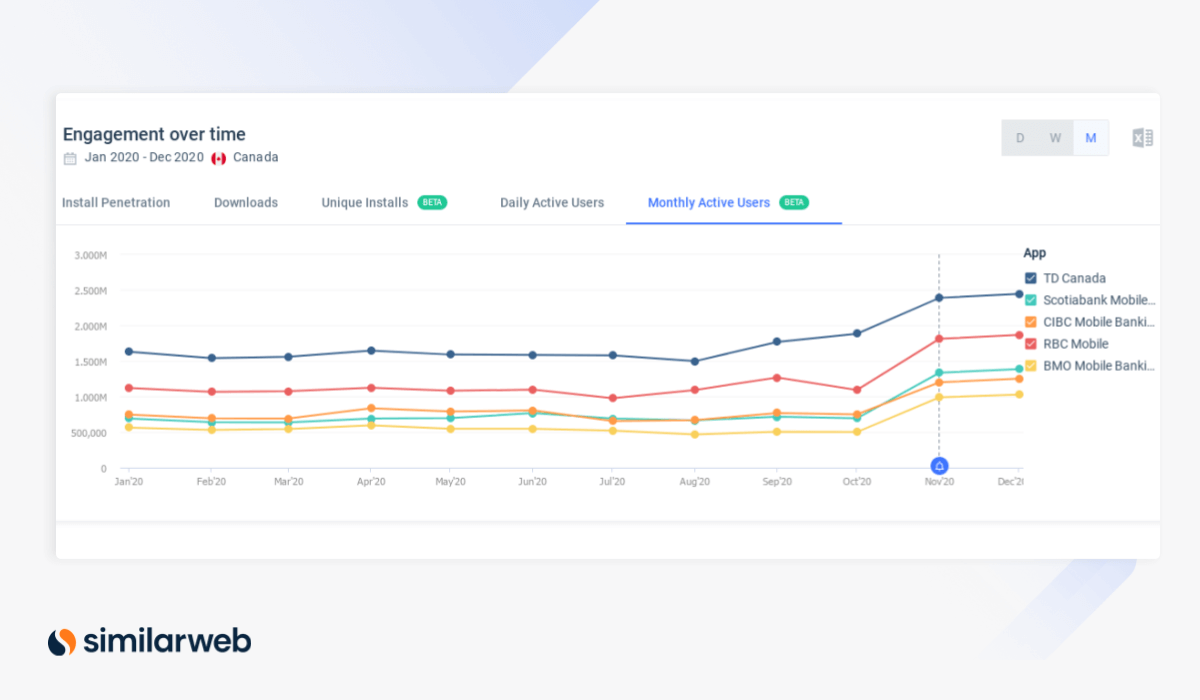

Despite lockdowns, install penetration (the percentage of the population with a given app installed on their phone) steadily rose on an average of 11.8% in 2020 for the top five banks, signaling greater mobile adoption by retail consumers.

Monthly active mobile users increased in 2020 for top Canadian banks

Mobile banking engagement metrics also accelerated in the second half of the year, as consumers were able to resume more on-the-go lifestyles.

Key takeaway

Banks should focus on mobile. We expect mobile adoption to continue to rise, particularly as people go “out and about” more and as banking customers become younger and more smartphone savvy.

Focusing on mobile adoption is particularly important as it’s a strong indicator of user “stickiness,” or customer loyalty. More so than mobile web and desktop sites, once consumers have committed to an app, they are more likely to increase their engagement and less likely to leave for another bank, resulting in lower attrition.

Bank on more insights

This is just a glimpse of trends driving Canada’s banking industry and its main players. For exclusive data and insights on the topic, check out our other articles on the financial services industry here.

Also, if you aren’t already using it, get your own custom insights by signing up for a free trial of Similarweb’s Research Intelligence, which is used by top financial services companies across the globe to get actionable insights and increase market share.

Get ahead of game-changing consumer trends

Contact us to set up a call with a market research specialist