What is Competitive Intelligence: Importance, Types & More

Navigating today’s dynamic business landscape requires more than just a keen eye for opportunity. It demands a deep understanding of your competitors and the broader market environment. Competitive intelligence is your strategic 🧭 compass, guiding you through the complexities of industry trends and competitive pressures.

According to the Strategic Consortium of Intelligence Professionals (SCIP), a staggering 62% of businesses are increasing their investment in competitive intelligence. Why? Because in a world where consumer preferences are evolving rapidly, and new technologies are disrupting industries, staying ahead of the curve is no longer optional. Armed with insights into your competitors’ strategies, market trends, and emerging threats, you can make informed decisions that drive growth and ensure long-term success.

But competitive intelligence isn’t just about spying on your rivals. It’s about gathering and analyzing information from a variety of sources. Sources of competitive intelligence include everything from financial reports and news articles to app performance data and social media buzz. With this intelligence, you are more equipped for data-driven decision-making and can adjust your strategies in a proactive way rather than just reacting to what’s happening around you.

What is competitive intelligence?

Competitive Intelligence is the practice of gathering, analyzing, and applying information about your competitors, clients, and market trends. It’s not just about knowing what your rivals are doing – it’s about conducting a competitive analysis that gives you a comprehensive understanding of the entire environment you operate in, which allows you to make informed, strategic business decisions.

While competitive analysis focuses specifically on direct competitors, competitive intelligence offers a broader view. It includes industry trends, market changes, and external factors that might affect your business, giving you a fuller picture of your competitive landscape.

Competitive intelligence vs. competitive analysis

Competitive analysis hones in on a competitor’s strengths and weaknesses, examining products, pricing, and marketing strategies. In contrast, competitive intelligence encompasses a wider scope, including industry dynamics, technological advancements, and customer preferences. This broader perspective helps businesses make more informed and strategic decisions.

For example, while competitive analysis might reveal that a competitor is gaining market share due to a new product feature, competitive intelligence digs deeper. It identifies the market trends driving the popularity of that feature, predicts how long the trend will last, and suggests strategic moves to either adopt or counter the feature based on broader industry and economic insights and trends.

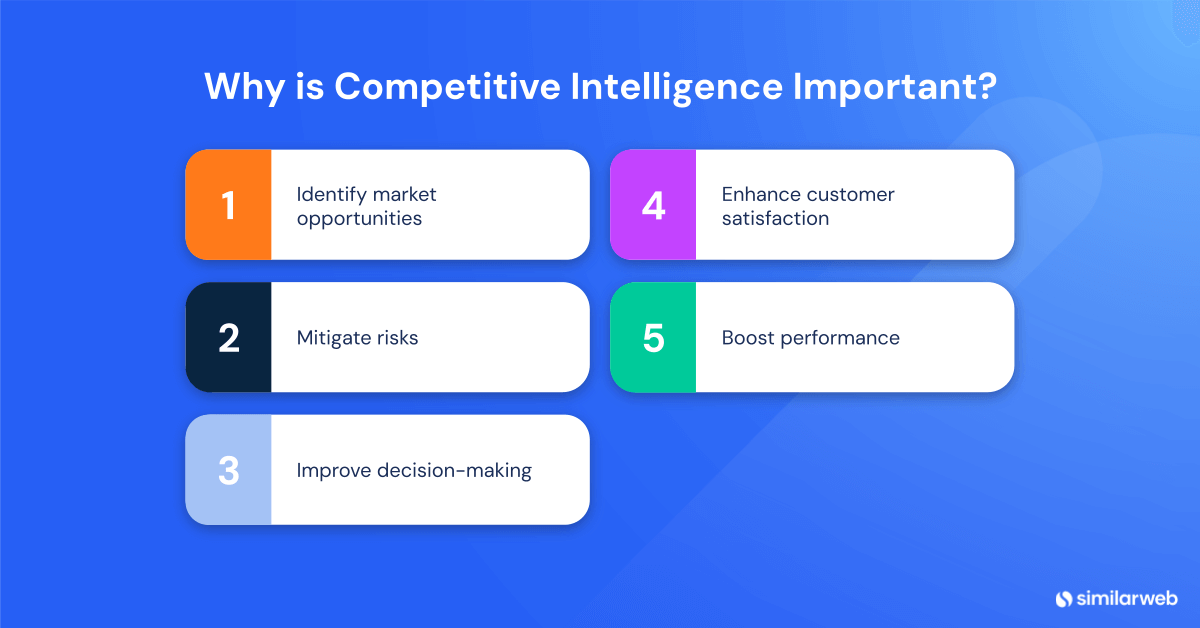

Why is competitive intelligence important?

Competitive intelligence is a crucial component of any business’s day-to-day operations and is essential for staying ahead in rapidly changing business environments. Here’s why:

1. Identify market opportunities

Competitive intelligence helps you spot gaps and new trends in the market, allowing you to capitalize on them. Whether it’s an underserved customer segment or a shift in consumer behavior, competitive intelligence enables you to craft targeted marketing strategies that drive growth.

For example, by identifying an underserved customer segment or responding to shifts in consumer behavior, companies can create focused marketing strategies that directly address these opportunities, ultimately improving their market position and fostering 📊growth.

2. Mitigate risks

Understanding the competitive landscape enables you to foresee potential threats and develop robust counterstrategies. Regular competitive intelligence activities allow businesses to identify disruptors or shifts in market dynamics early, so they can take proactive measures to minimize risks and maintain stability.

3. Improve decision-making

Basing business decisions on data-driven insights from competitive intelligence leads to better, more sustainable, and feasible results. When you rely on solid market or consumer data rather than gut feelings, you are able to make more accurate and impactful decisions. This approach helps you allocate marketing, product, and sales resources more effectively, allowing you to tackle market challenges with greater precision.

4. Enhance customer satisfaction

By understanding what your competitors excel at – and where they fall short – you can refine your products or services to better meet customer needs. Continuous monitoring of competitors enables you to make ongoing improvements, which in turn enhances customer satisfaction and loyalty.

5. Boost performance

Regular competitive benchmarking – against both your closest competitors and the top players in your industry – allows you to track, monitor, and compare performance and make necessary adjustments to your digital domains to maintain a competitive edge. By staying informed about competitor activities and industry trends, you can continuously optimize your marketing operations and campaigns – and stay ahead in the long run.

Types of competitive intelligence

There are two main types of competitive intelligence: strategic and tactical.

Strategic competitive intelligence

Strategic intelligence focuses on long-term planning. It involves in-depth research into industry trends, technological shifts, and macroeconomic factors, enabling your organization to identify new market opportunities and prepare for potential threats.

For example, strategic intelligence might highlight future technologies, such as AI developments, that could disrupt your industry. By staying ahead of these changes, you can adapt and remain competitive.

Tactical competitive intelligence

Tactical intelligence, on the other hand, is about short-term, actionable insights. It involves monitoring competitors’ activities, pricing strategies, marketing campaigns, and operational efficiencies to improve your current operations and capture market share.

For example, through tactical intelligence, you might be able to reveal a competitor’s successful organic search strategy that you could adapt to enhance your own efforts during peak sales seasons like the Black Friday Cyber Monday (BFCM) weekend.

How to do competitive intelligence research

Effective competitive intelligence research involves five key steps:

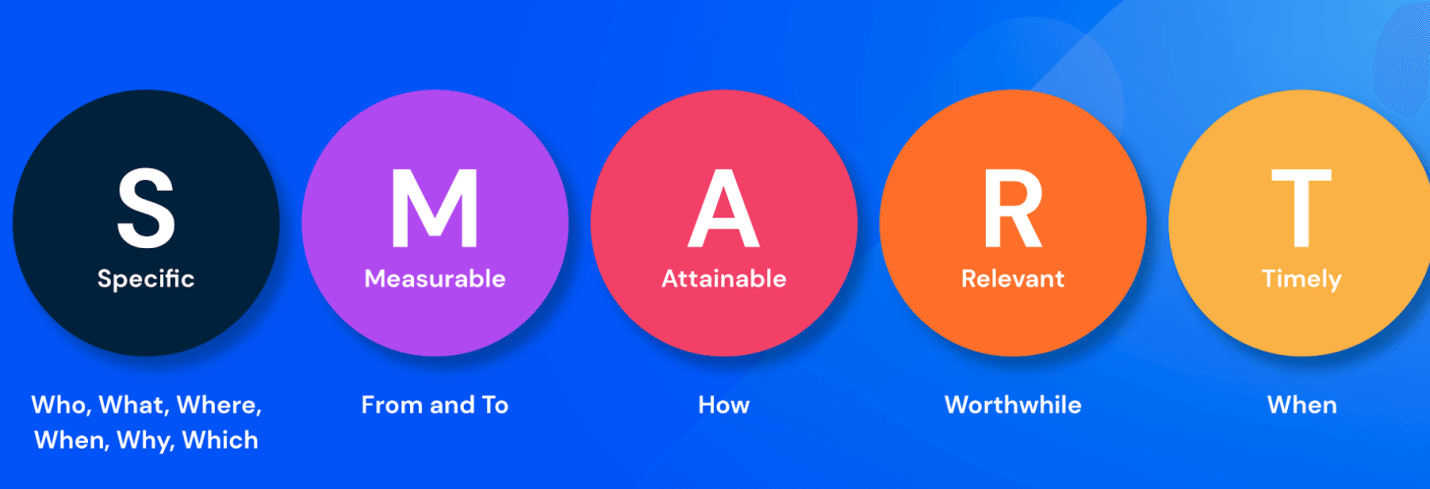

Step 1: Define your goals

Begin by clearly defining what you want to achieve with competitive intelligence. Whether it’s identifying a new market opportunity, improving a product, or benchmarking against competitors, well-defined goals will guide your research process.

To ensure your goals are effective, make them SMART:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Step 2: Identify your competitors

Identify your competitors – both the direct and indirect ones. These are businesses selling or delivering the same products or services that you are offering and those targeting the same customers but with different solutions. Knowing how to separate already established competitors from new entrants will help set focus areas and proper allocation of your resources.

Step 3: Collect high-quality data

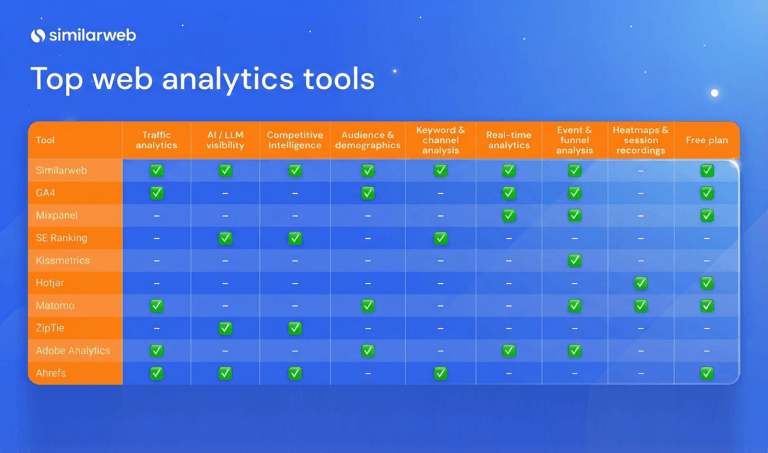

The backbone of effective competitive intelligence is high-quality data. Market research platforms like Similarweb offer a range of tools and features to help you gather this data:

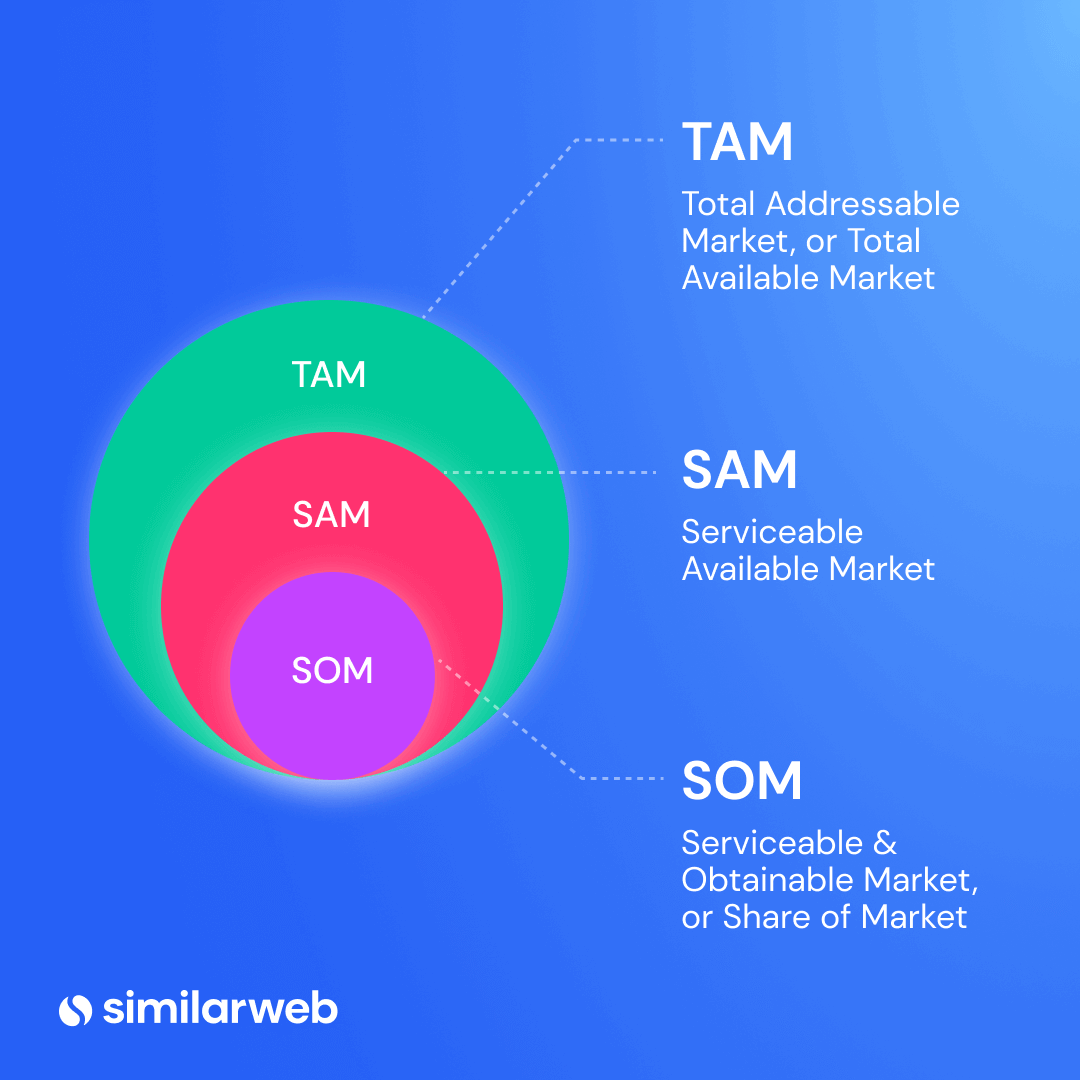

Market sizing

Using the Market Performance feature to gauge market size, Similarweb makes it easy for you to measure the following:

- Total Addressable Market (TAM)

- Serviceable Addressable Market (SAM)

- Serviceable Obtainable Market (SOM)

These metrics are invaluable for understanding the market as a whole and segmenting the most achievable parts.

- TAM measures total demand within a market;

- SAM focuses on the portion of the market most interested in your product or service; and,

- SOM narrows it down further to what is realistically obtainable, considering competition and distribution constraints.

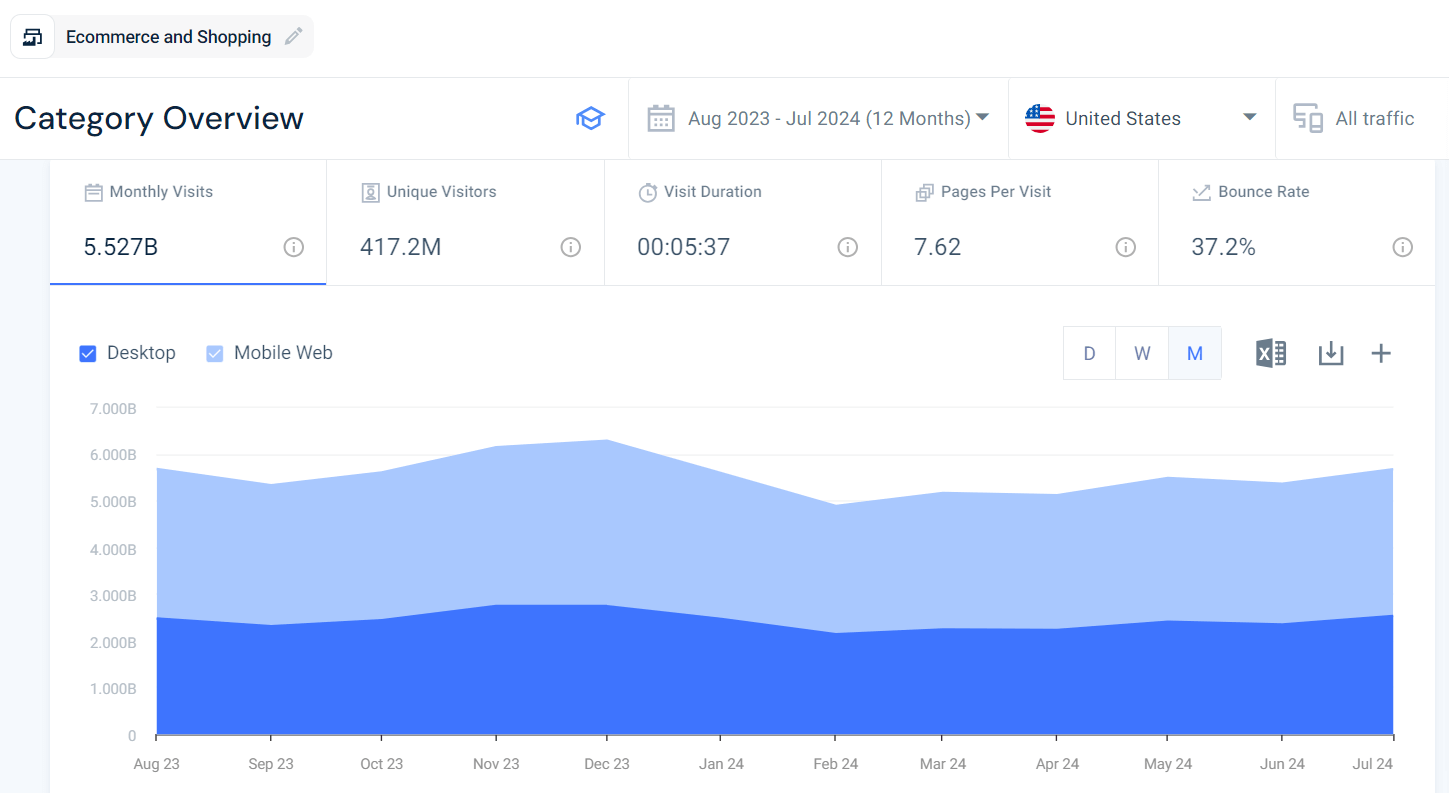

Market difficulty

The Market Overview tool measures how saturated a market is, focusing on factors like market loyalty, market consolidation, and PPC spending. It also reveals details about market dynamics and competitive pressure. Understanding the difficulty level of a market is crucial when entering a new market or launching new products.

Market segmentation

Similarweb’s Market Segmentation tool provides detailed insights into various market segments, helping companies tailor their strategies to specific sub-categories. This granular analysis ensures that available resources are used effectively.

Segmentation can be based on demographics, geography, or customer behaviors to identify high-potential niche markets. Targeted marketing and product development strategies can then be designed to meet these segments’ needs. Effective market segmentation results in higher customer satisfaction and increased market share.

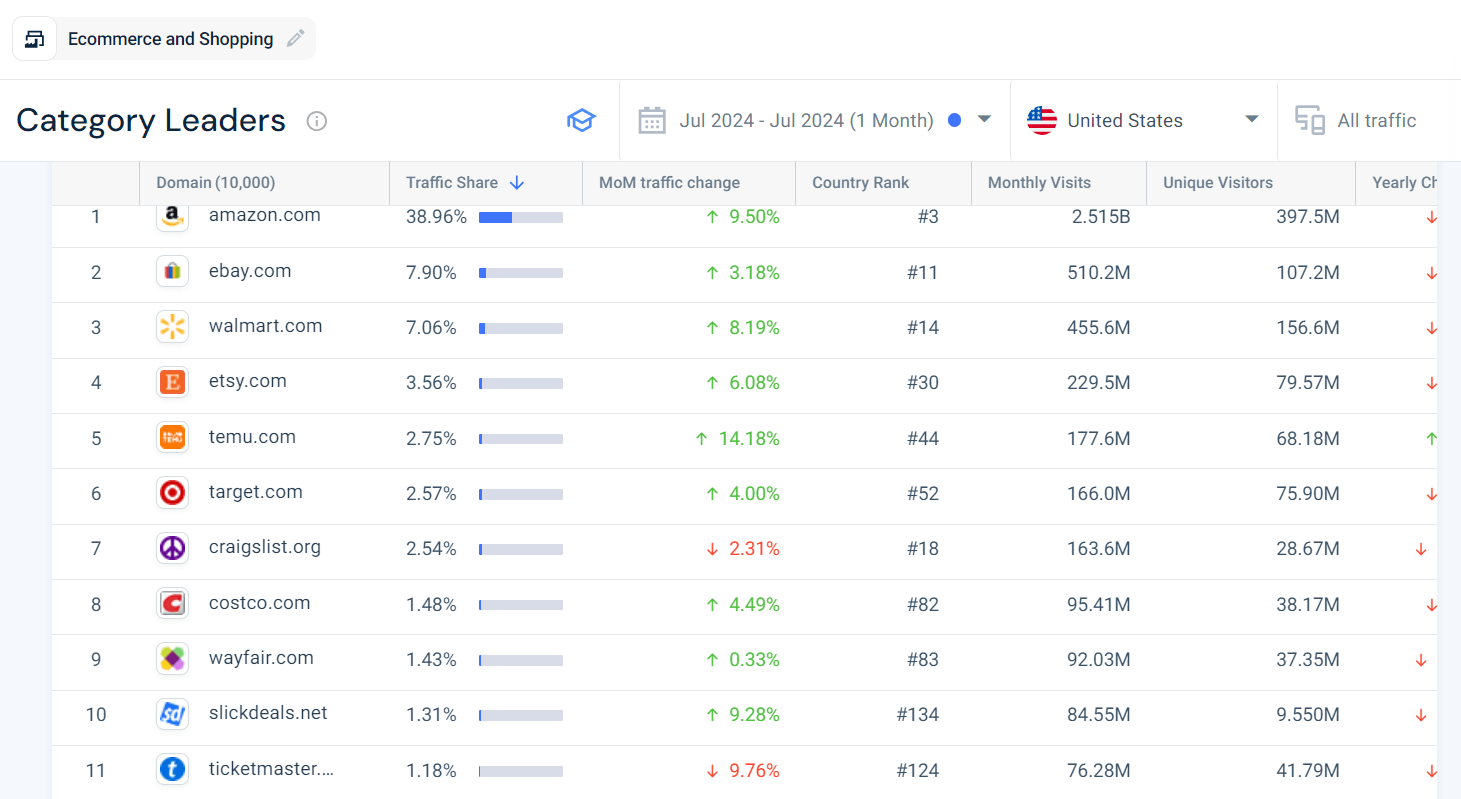

Market leaders and players

The Industry Leaders and Market Players features help identify top sites and market leaders. These insights can be used to benchmark performance or uncover successful strategies. Understanding industry leaders provides a sense of best practices, emerging trends, and potential weaknesses.

Demographic audience analysis

With Similarweb’s Website Demographics, another important market research tool, you can gain detailed insights into your competitors’ audience demographics, including:

- Age

- Gender

- Geographical location

This advanced audience research enables you to create personalized marketing messages and product offerings tailored to the needs of your target group. The demographic audience profile helps refine your marketing efforts for greater effectiveness, improving customer engagement and conversion rates.

Step 4: Moving from gathering data to intelligence

After gathering data, it’s time to analyze it and turn it into 🌟actionable insights. You’ll want to look for patterns, trends, and correlations that give you a deeper understanding of the competitive landscape. For example, analyzing traffic sources and user behavior on competitors’ websites can reveal effective digital marketing strategies and areas for improvement. The goal is to derive real-user insights from competitive intelligence to drive strategic decisions and ultimately strengthen your competitive advantage.

Step 5: Track your performance

Understanding where your business stands compared to competitors is crucial for ensuring continuous improvement and maintaining market leadership.

With Similarweb’s Market Research tool, you can track business KPIs as often as needed—ideally, on a regular basis. Continuous monitoring allows companies to respond swiftly to market changes and competitor actions, adjusting strategies based on near real-time data. By analyzing website traffic, social media engagement, conversion rates, and customer feedback, you can identify areas needing improvement and adapt your strategies accordingly.

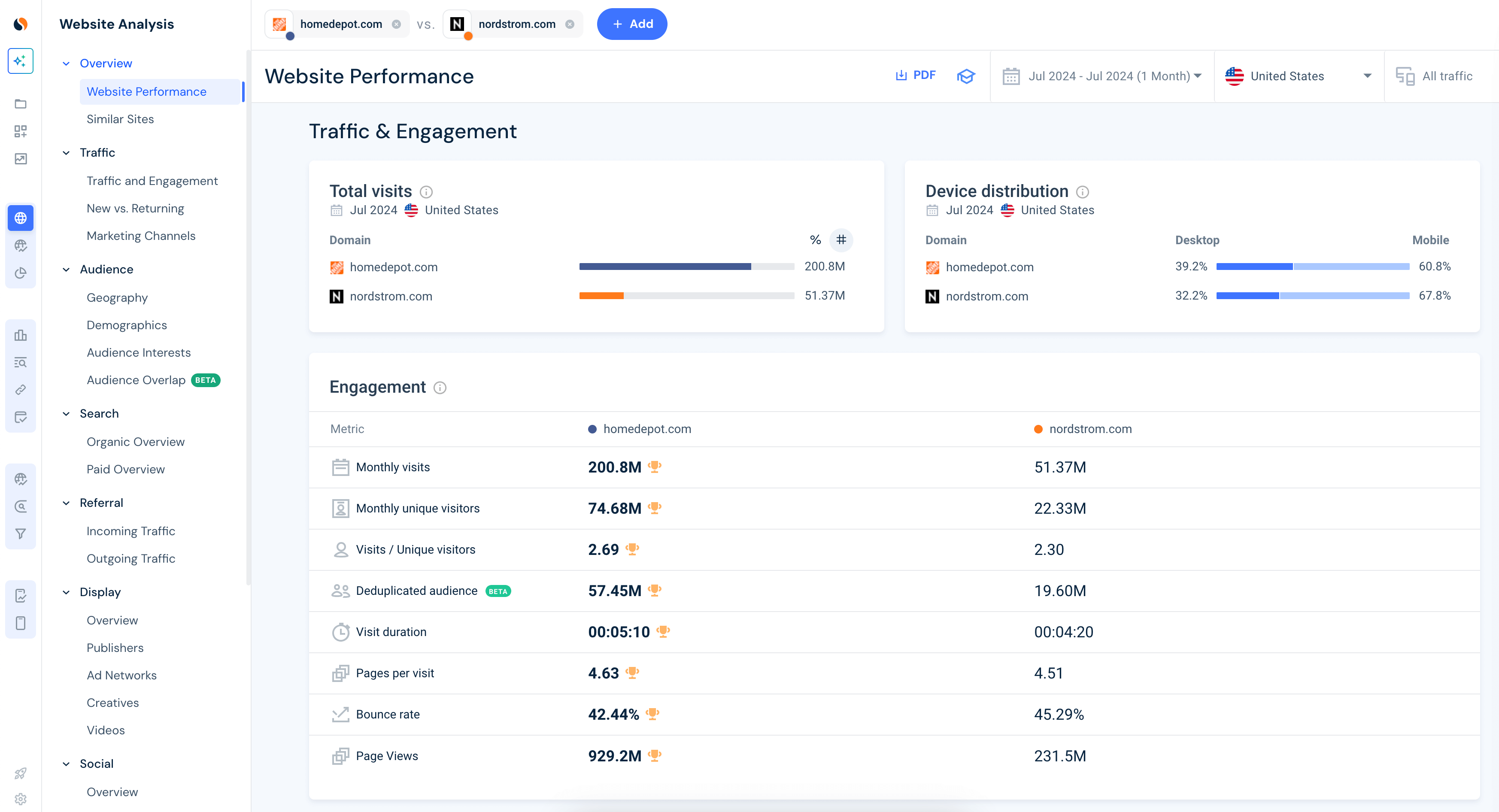

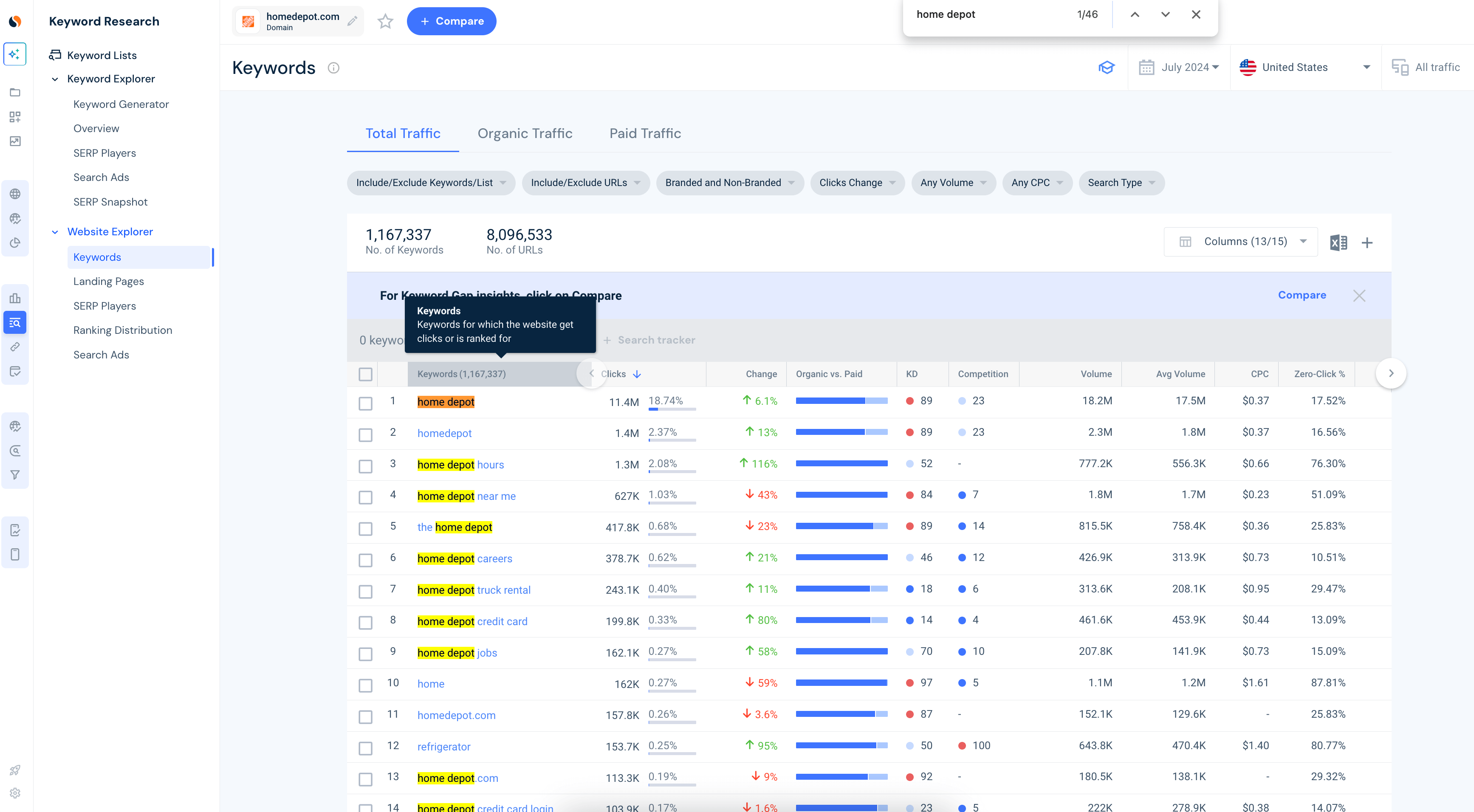

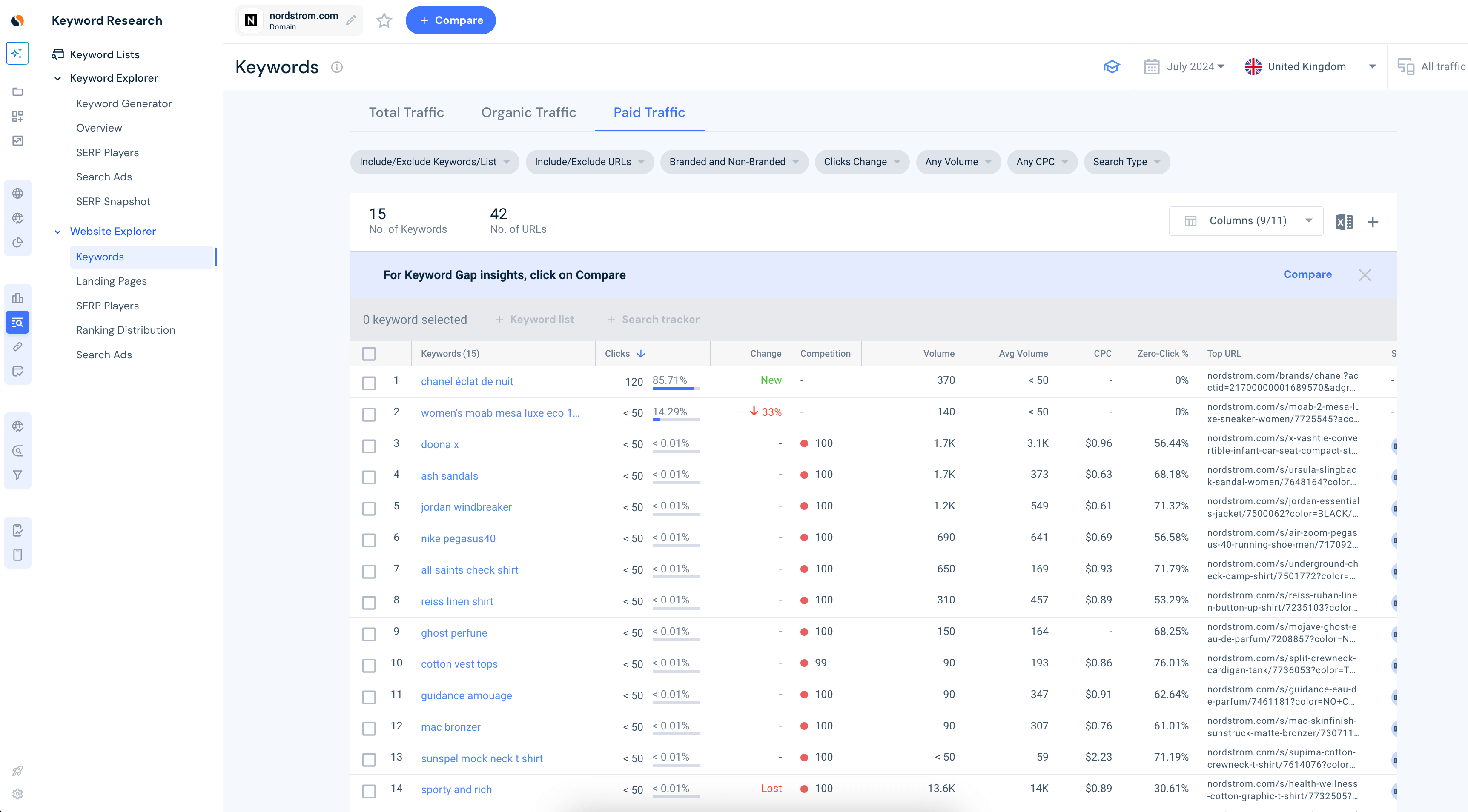

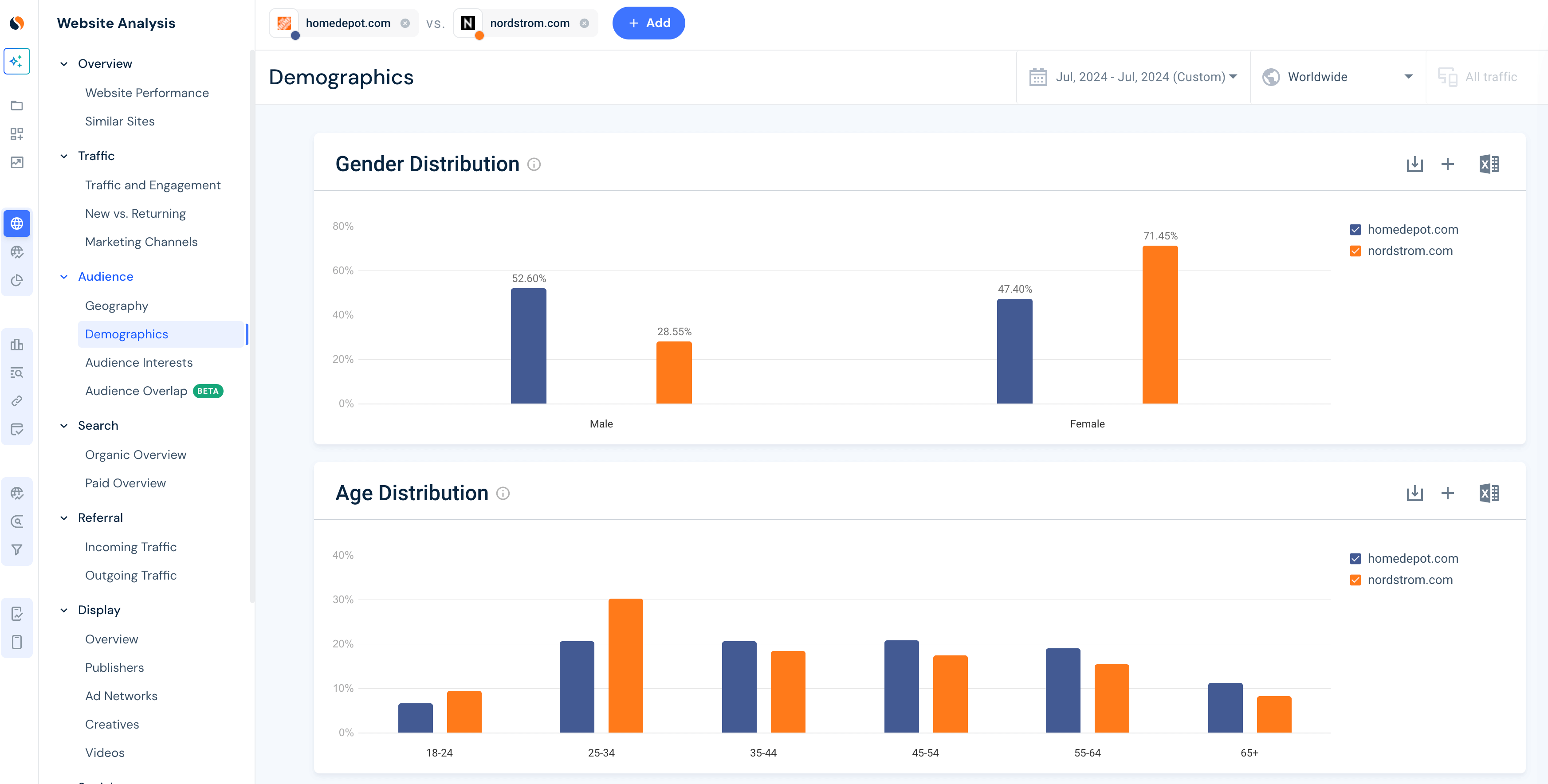

Competitive intelligence example: Home Depot vs. Nordstrom

To see competitive intelligence in action, let’s dive into a real-world comparison using data from Similarweb’s Website Analysis of homedepot.com and nordstrom.com in July 2024. These two retail giants operate in two very different sectors – Home Depot in home improvement and Nordstrom in fashion – but both excel in leveraging their online presence.

Here’s what the data reveals:

Home Depot attracted a substantial 200.8 million visits, far outpacing Nordstrom’s 51.3 million. Interestingly, a higher percentage of Nordstrom’s traffic (67.8%) came from mobile devices, compared to 60.8% for Home Depot. When it comes to user engagement, Home Depot also had the upper hand, with visitors spending an average of 5 minutes and 10 seconds on their site, compared to Nordstrom’s 4 minutes and 51 seconds. Both companies had similar bounce rates – 42.4% for Home Depot and 45.2% for Nordstrom – suggesting that while they’re good at capturing user interest, there’s still room for improvement.

Market Position and Share

Home Depot dominates the home improvement sector, capturing a massive 95.39% of traffic share in the US market. Meanwhile, Nordstrom is a major player in the UK fashion retail industry, holding a 43.4% market share. This contrast highlights how each company commands its respective market, though in very different geographical regions.

Advertising and Search Strategies

When it comes to search, Home Depot excels in organic traffic, drawing 30.67% of its visitors through branded phrases like “home depot” and “home depot careers”.

Nordstrom, on the other hand, leans more heavily on paid search, investing in keywords like “chanel éclat de nuit,” “women’s moab mesa luxe eco 1trl,” and “doona x,” which together drive 9.01% of their traffic.

Examining the demographics of these retailers reveals further insights. Home Depot’s audience skews male (52%), while Nordstrom’s traffic is predominantly female (74%). Both retailers attract similar age groups, with their main audiences being 25-34-year-olds and 35-44-year-olds.

These insights show how each company tailors its online strategies, using a blend of organic and paid search tactics to attract and engage customers, ensuring a competitive edge in its key market.

Track, monitor, and outpace your competitors with confidence

In today’s complex market landscape, competitive intelligence is essential. It enables companies to spot opportunities, mitigate risks, and make data-driven decisions that propel success. With a powerful tool like Similarweb, you can outperform competitors, boost customer satisfaction, and establish a sustainable growth path for your business.

Platforms like Similarweb’s market research and audience insights tools provide the critical data you need to improve your digital marketing efforts. Our competitive analysis tool equips you with real-time market and consumer trends, enabling you to create and optimize winning digital strategies.

Make competitive intelligence a core part of your strategy. It’s the key to unlocking your business’s full potential and staying ahead in an ever-changing market.

FAQs

How does competitive intelligence differ from market research?

While both are valuable tools for businesses, they have distinct focuses. Competitive intelligence is about understanding your competitors—their strategies, tactics, and performance. It helps you stay ahead of the curve and identify opportunities or threats in the marketplace. Market research focuses on understanding your customers and the overall market. It helps you tailor your products or services to meet customer needs and identify new market segments. In essence, competitive intelligence looks outward at the competition, while market research looks inward at your customers.

How can I use competitive intelligence in a small business?

Competitive intelligence isn’t just for big corporations—small businesses can benefit too. Start by identifying your key competitors and gathering information through publicly available resources. Tools like Similarweb can help you analyze market trends and competitor strategies, giving you the insights needed to make smart, strategic moves.

What ethical issues should be considered while conducting competitive intelligence?

Ethics are key in competitive intelligence. Make sure all your information collection is legal and ethical. This means sticking to publicly available or legally permissible sources and steering clear of any activities that could be considered industrial espionage. Integrity matters in business and ethical practices will keep your reputation intact.

Can competitive intelligence help me enter new markets?

Absolutely! Competitive intelligence can be your guide when entering new markets. It offers valuable insights into market conditions, potential competitors, and customer preferences, helping you craft a well-informed entry strategy that maximizes your chances of success.

What challenges might I face when conducting competitive intelligence?

Conducting competitive intelligence isn’t without its challenges. Common hurdles include data quality issues, information overload, and the fast pace of market changes. However, by setting clear goals and using reliable tools, you can overcome these challenges and ensure your competitive intelligence efforts are effective and focused.

Your full marketing toolkit for a winning strategy

The ultimate solution to help you build the best digital strategy

![GEO Framework For Growth Leaders [+Free Template]](https://www.similarweb.com/blog/wp-content/uploads/2026/02/attachment-growth-leader-geo-decision-framework-768x429.png)