Creating A Marketing Agency Pitch For FMCG Brands: Kraft Heinz

Kraft Heinz, the popular consumer goods brand, recently issued an RFP for its $600M global media business. It plans to cut the number of agencies it works with by half while boosting media spend by 30%. With four of the six biggest agencies expected to craft pitches, we used Similarweb data to explore which factors every pitching agency needs to consider when pitching to an FMCG brand. The four pitching are WPP, Omnicom, Publicis and Dentsu, while Havas and Interpublic are said to be holding out. Additionally, Starcom Worldwide is reported to be pitching to defend its position as its contract with Heinz expires this year.

This blog will focus on the Heinz UK offering and potential partners, but by using Similarweb this process can be replicated across countries to build geo-specific brand strategies by agencies worldwide.

Identifying Digital Retail Partners

Since Heinz doesn’t sell on its site, its success is dependent on finding the best grocery retail partner sites and promoting its products on their platforms. As such, any FMCG pitch must be focused on its potential partners across relevant geographies.

The top grocery retailers in the UK include asda.com, tesco.com, and sainsburys.co.uk. Looking at traffic to these retailers, we see asda.com and tesco.com win almost identical traffic volumes at around 25M monthly visits, while sainsburys.com comes in third with almost 10M fewer monthly visits.

While website traffic is a strong indicator of a potentially successful partnership, it is also crucial to look at engagement stats to understand the quality of traffic won. As seen in the chart below, iceland.co.uk and ocado.com have some of the best-in-class engagement numbers, including low bounce rates, very high visit duration and pages per visit count.

There’s one last big name food retailer that also needs to be explored – Amazon UK. Amazon’s expansion into groceries has opened up an additional channel in this space that cannot be ignored. However, after reviewing traffic into Amazon’s “Food Cupboard” category, we find that it isn’t the biggest player in the British market, winning slightly less desktop traffic than aldi.com. Note that while Amazon isn’t the top British supermarket, it is more competitive in other geographies, so agencies should still explore this avenue when creating their pitch.

Finally, identifying worthwhile potential partners also means looking beyond the biggest retailers and finding sites that are growing in this space. For example, in general British food stores, we find that souschef.co.uk and hancocks.co.uk have each grown by about 70% YoY. We can also identify trends in online food shopping preferences, like the growth of specialty food retailers – particularly specialty butcher shops and farm fresh retailers. These growing retailers may be potential partnership opportunities for Heinz in the UK.

The last important question to address is, which sites convert better? In other words, where is my prospect’s product, Heinz ketchup, most likely to be sold? We obtained this insight using Similarweb’s funnel analysis tool. This analysis allowed us to understand not only which sites are the most popular, but which ones have the best conversion rates. Interestingly, for Heinz in the UK, while argos.co.uk and tesco.com lead in traffic volumes, smaller players actually convert traffic best.

Ocado, an online-only supermarket, has the highest conversion rate at 21.7%, followed by Amazon’s drinks category, Tesco and Sainsbury’s – each of which has more than 15% of site visits end in a purchase.

Focusing on Strategies that Work

Another crucial detail to understand about each potential partner is which user acquisition strategies have historically worked for them. Heinz should also work to promote the grocers they work with and help their retailers obtain high-quality traffic that is likely to convert.

A review of the top channels for grocery retailers reveals that a strong brand name is key as 42% of traffic is direct. Similarly, organic search drives the majority of traffic (43%), with branded search comprising 90% of that, indicating some things never change and brand is still king. Less critically, paid search makes up 8.2% of traffic won, while all other marketing channels weigh in at 2% or less.

To understand which marketing channels win engaged audiences, we reviewed the top 5 grocery retailers in the UK. Unsurprisingly, we found that while direct and organic search drive the highest volumes of traffic, direct and email claim the top spot for visit durations clocking in at approximately 9.5 minutes and 10.5 minutes, respectively. At the same time, direct has the lowest bounce rates at 18%, followed by paid search with 26%.

From our marketing channel analysis, it appears that utilizing a wide variety of tactics, including a solid SEO strategy, affiliates, email campaigns, and well-chosen paid search campaigns, are effective options for media planning. Those efforts should be accompanied by brand promotions; Heinz should also promote its partner grocery retailers.

Understanding Product Demand

Beyond knowing which retailers to work with, it is absolutely crucial to understand the market trends that affect your prospects’ product lines. One way to do that is to review which sites and keywords that potential Heinz customers use to find recipes, and how those terms have changed over time.

Using Similarweb’s Keyword Research Tool, we found trending keywords related to “recipe” across time frames for every country. For Heinz, understanding popular food-related searches can help inform product ideation and ad placement by answering questions like, what are my customers likely to buy, that I don’t currently carry, and which recipe sites should I invest my advertising.

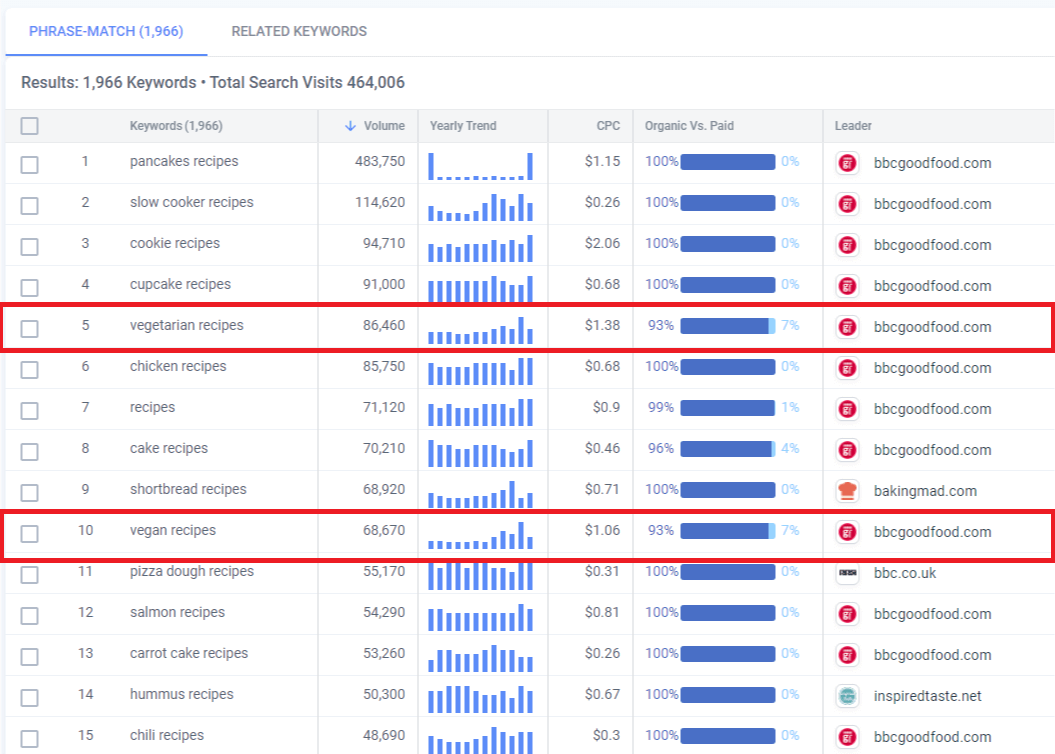

For example, using the seed keyword “recipes” in our Keyword Generator set to the last 28 days, we identified foods that are currently trending, including pancakes, slow cooker recipes, cookie recipes, cupcake recipes, and others. Trending foods are the most likely to produce a wide audience, so cross-referencing those terms with Heinz product lines can inform ad placement on recipe sites.

One rising trend is the definitive increase in interest in vegetarian and vegan recipes. These categories have been trending upward in search volume over the last year and are potential focus areas for Heinz, as many of their product lines can be adapted to vegetarian and vegan living.

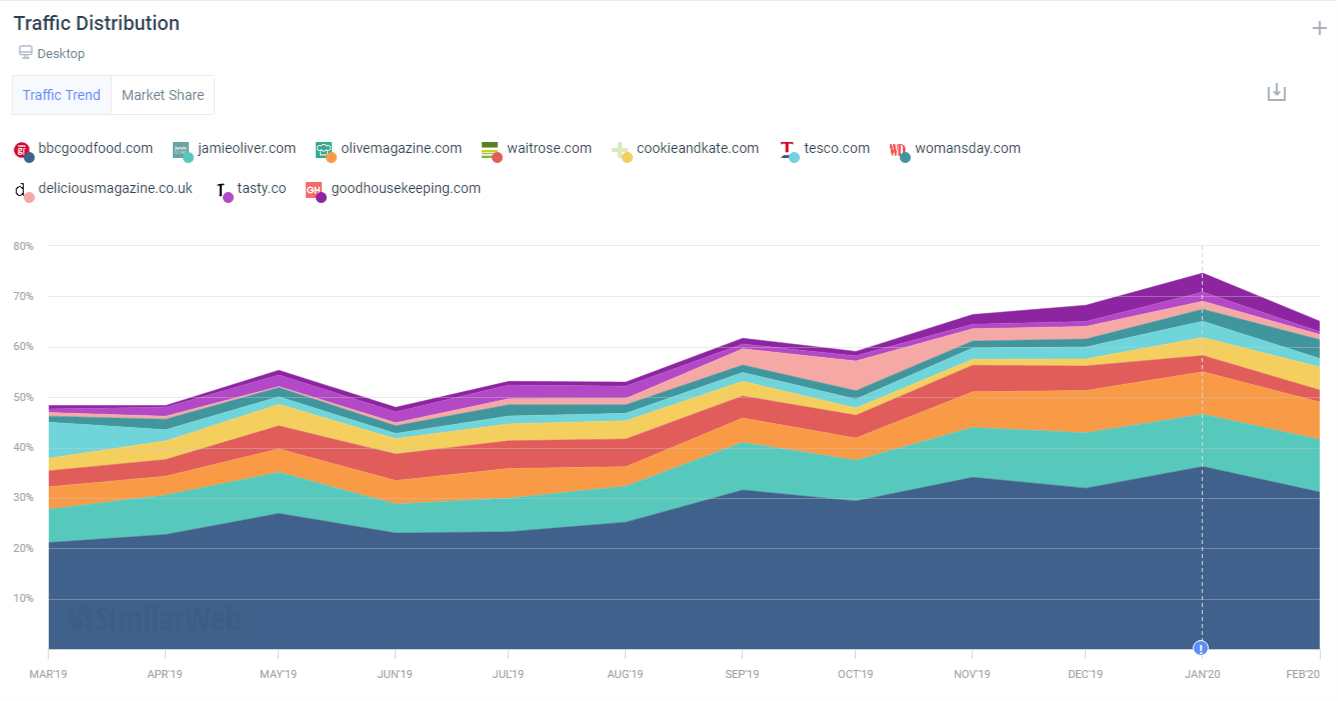

Using keywords derived from the phrase “vegetarian recipes”, we identified interest trends and potential partners that are worth working with in this space. The keywords we analyzed won an average of 300K searches monthly between March and August, and then increased dramatically, peaking at 750K searches in January. A large proportion of these keywords’ searches end in a click, meaning that audiences actively enter sites to find recipes.

The goal of this process is not to drive traffic to Heinz.com, but rather to find who is receiving the traffic from these keywords, with the intention of forming partnerships. Moreover, it is to understand consumer interest in vegetarian cooking, providing insight into how Heinz should craft its messaging.

For this specific target market, traffic related to “vegetarian recipes” is mostly won by bbcgoodfood.com, with traffic share ranging from 25% to 35% throughout the year. Jamie Oliver’s site, jamieoliver.com is a growing player in this space, once acquiring just 6% of traffic, it is now receiving 10.5%.

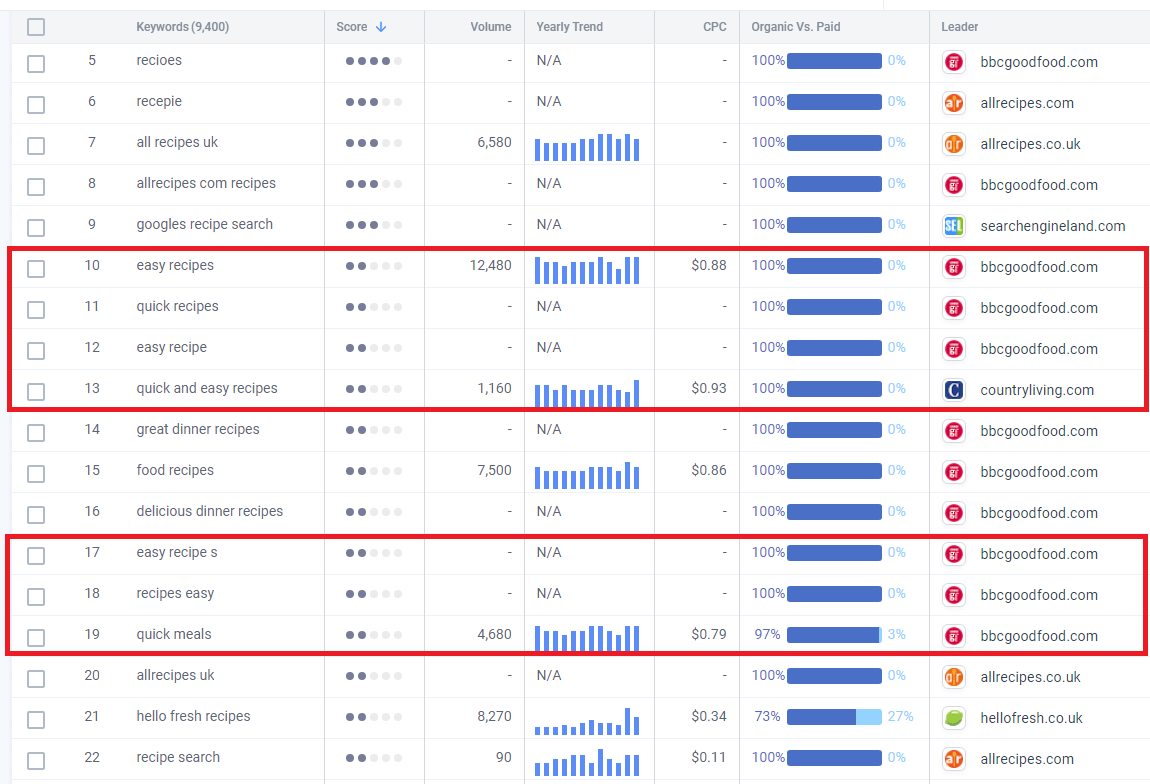

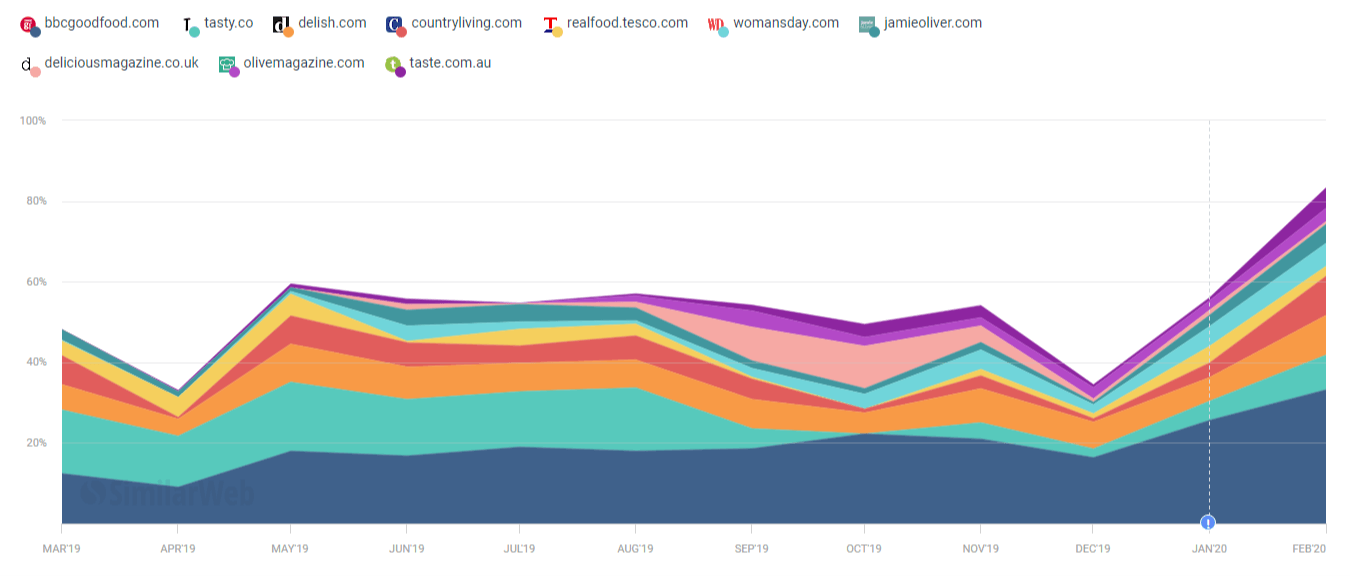

Another keyword trend we identified in our 28 day filter on similar keywords, is that British audiences are seeking cheap and easy meal options. This could also inform Heinz’s media strategy by focusing its messaging on how their product enhances cheap, easy recipes.

Relevant potential partners for this messaging include bbcgoodfood.com (again), delish.com, tasty.co, countryliving.com, and womansday.com, which indicates that this messaging is geared towards a family audience. Jamie Oliver’s site, which ranked in second place for vegetarian cooking, only comes in at 7th place for these queries.

Notably, tesco.com is actively winning search traffic from recipes of this nature – 4.4% of search traffic from this keyword group is scooped up by the grocer’s recipe site, its Real Food subdomain.

Conclusion

As many agencies are facing tough competition to work with Kraft Heinz, digital metrics can be a powerful tool to understand market trends and key players in the grocery space, identify consumer food preferences, and discover possible affiliate partnerships. While the FMCG space doesn’t sell directly online, using digital markers can help agencies craft informed strategies – both digitally and offline.

Learn more about how to use Similarweb insights to craft a perfect pitch in our guide below.

The #1 ad intelligence tool - get started

Give it a try or talk to our marketing team — don’t worry, it’s free!