Stock Market Terms: The Ultimate Glossary of Investor Terms

Whether you are a newbie at investing or a veteran, keeping up with all the financial lingo can sometimes be a challenge. It’s easy to get lost in the sea of terms and acronyms that often sound familiar but don’t always mean exactly what we think. Ever wondered what the difference is between EBIT and EBITDA? We’re here to help.

We created the Complete Investor Terms Dictionary to help you keep track of all the key investor terms in one easy-to-access place. Find their definitions here, along with examples, and further informative resources.

Quick Tip: Bookmark this page for reference and look up words as needed.

Stock Market Terms A – D

A

Alpha

An indicator used to inform investors of the performance of stocks, bonds, and mutual funds. Alpha is also known as risk measurement. For instance, if alpha is zero, it means that the return on investment is precisely as anticipated according to the risk. Alpha higher than zero indicates that the investment outperformed the known risks in the market.

ARR

Short for annual recurring revenue. ARR is a key metric used by SaaS or subscription businesses that have term subscription agreements. This means there is a defined contract length, and it is calculated like this: ARR = (Overall Subscription Cost Per Year + Recurring Revenue From Add-ons or Upgrades) – Revenue Lost from Cancellations. Read more about ARR here.

Asset

An item or group of items owned by an individual or company that can be valued in monetary terms. Real estate, equipment, inventory, cash accounts, and investments are examples of assets. A typical balance sheet will show assets and liabilities. Assets such as brand recognition and customer base improve a company’s performance. However, since they cannot be measured in currency, they are not included on the balance sheet.

B

Balance Sheet

One of the principal documents used to evaluate the financial health of a business or individual. The balance sheet provides a snapshot of assets, shareholder equity, and liabilities for a given period, such as annually or quarterly. A balance sheet is sometimes referred to as a statement of net worth.

Bear Market

A bear market denotes an extensive and sustained downward trend in the stock market. Stock prices must fall at least 20% from their peak price before it’s called a bear market. Loss of consumer confidence and pessimistic economic forecasting leading to stock sell-offs can trigger a bear market.

We experienced the shortest bear market in history back in March 2020 after the stock market cratered 33%- with the coronavirus the immediate trigger for plunging prices. However, the bear market only lasted for one month before global stock markets re-entered a bull market in April.

Beta

Beta measures a stock’s volatility versus the market. The S&P 500 has a beta of 1.0, so a beta over 1.0 indicates a stock is more volatile than the market. Beta can also be used to indicate risk as high beta stocks are seen as offering higher risk, but with greater return potential.

Blue Chip

An investment term that derives from poker, blue chip is a company with a reputation for profitability, reliability, and consistent profitability. Examples of blue-chip stocks include Disney, Coca-Cola, and Intel.

Bond

A bond is an investment security issued by a government or business for a specified length of time, with a promise of fixed interest payments. When the bond matures, the issuer returns the investor’s money. The most common example of this type of security is government bonds sold to finance major infrastructure projects. Some investors prefer bonds because they tend to carry a lower risk than stocks.

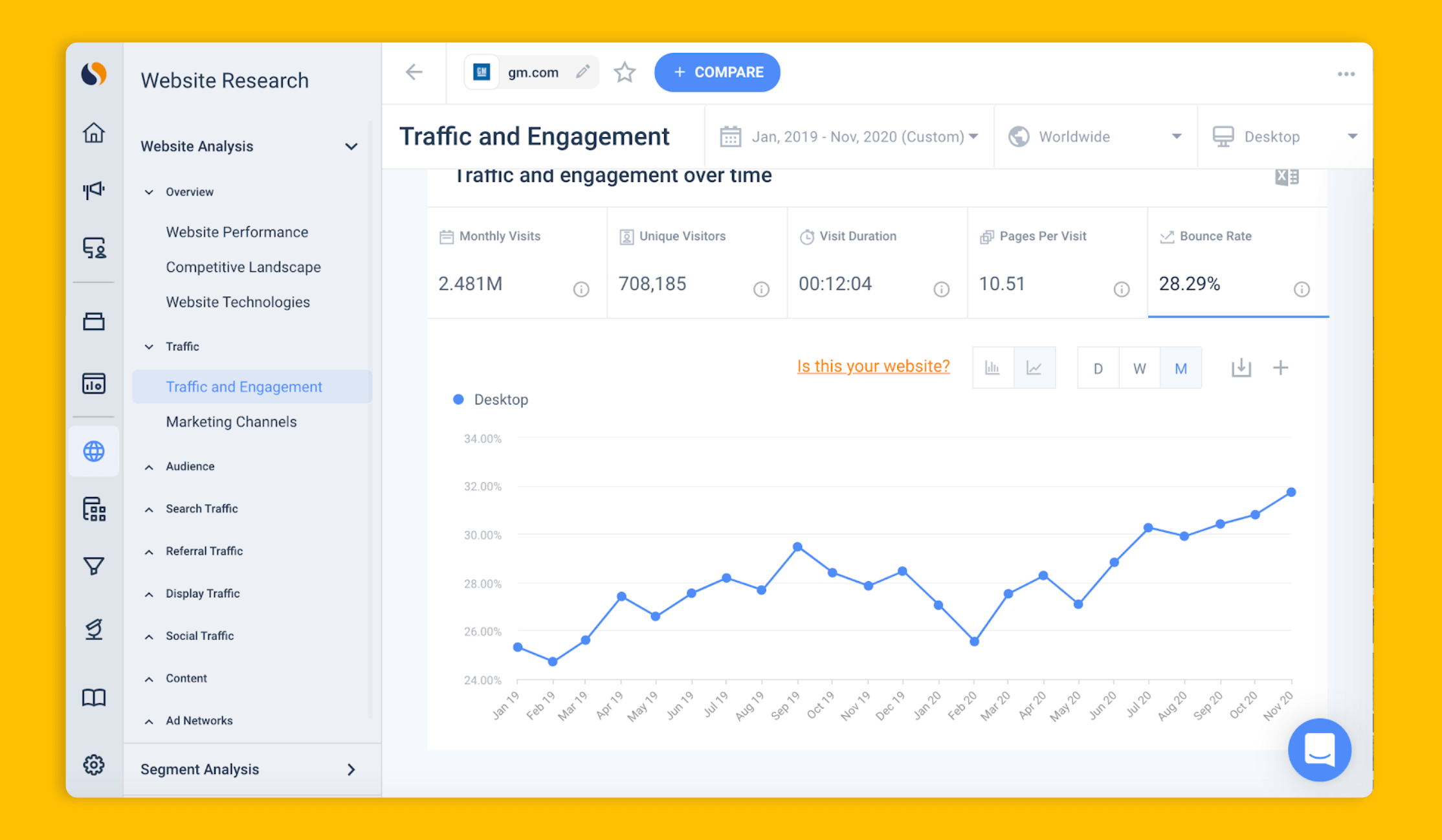

Bounce Rate

The percentage of visitors who enter a site and then leave after visiting only one page. Bounce rate is a key data point for understanding how well a site is retaining traffic sent from different traffic channels. Similarweb calculates bounce rate by dividing the single-page sessions by all sessions. To learn more, see ‘Bounce Rate: Understanding, Measuring, and Tracking for Growth?‘.

Broker

A broker facilitates transactions, serving as an agent between the stock market and investor. A broker can be an individual or a company and must be licensed. An investor entrusts the broker to offer professional investment advice and act in his best interests. Brokers usually earn a commission based on a percentage of the deal’s value, or in some cases, they earn a flat fee based on performance.

Bull Market

In opposition to a bear market, a bull market describes a time when the economy is healthy, and stock prices are steadily rising, with all indicators pointing to continued improvement. Investor confidence leads to more buying, boosting stock prices. Economists look for stock prices to rise at least 20% above their most recent low before calling it a bull market.

Investors have just enjoyed the longest bull market in modern history, from 2009 to March 2020. During these 10+ years, the S&P 500 rose a whopping 330%.

C

Capital

All durable resources owned by a business that can be used to generate revenue are defined as capital. This includes tangible items such as buildings, equipment, land, machinery, stocks, cash, and intangible items such as patents and trademarks. Capital can also refer to a business’ wealth defined by subtracting total liabilities from its total assets.

CAC

Short for the customer acquisition cost. CAC is the total cost of acquiring a new customer. It should generally include things like advertising costs, salaries of your marketers and salespeople, costs of selling, etc., divided by the number of customers acquired.

Churn Rate

The rate at which customers stop doing business with an entity. To calculate a company’s churn rate, do the following equation: (customers beginning of the month – customers end of the month) / customers beginning of the month = churn rate.

Consumer

Person or entity who consumes a product or service.

Conversion Rate

Measures the effectiveness of a company’s website at converting traffic into transactions. Conversion rate is an essential metric to track because it feeds directly into revenue. The higher the conversion rate, the better the company is generating value from its website traffic– which should make its business more sustainable in the long run.

Cross-Selling

Sales technique used to get a customer to spend more by purchasing a product that’s related to what is being bought already.

Customer Lifetime Value

The total worth of a customer over the period of the relationship. To calculate it, you need to calculate the average purchase value, and then multiply that number by the average purchase frequency rate to determine customer value. Then, once you calculate the average customer lifespan, you can multiply that by customer value to determine customer lifetime value.

D

DAU

Short for Daily Active Users. The number of users who engage with an app or website daily. The metric shows the average number of daily active users in a given timeframe. DAU reflects a company’s growth potential and indicates the stickiness of its product or service.

Demographic

The study and statistical recording of the population in a given area, which, in web analytics, is usually a website or app. In website analysis, the metric measures engagement rate parameters, such as gender and age within the group.

Direct Listing

A direct listing, also known as a direct placement or direct public offering, enables a company to go public without holding an IPO. This means that the company does not have to hire banks to underwrite the transaction. Did you know that a recent ruling by the SEC now allows companies to list new shares via direct listing, rather than just existing shares? You can read more about this controversial new ruling here.

‘This is a game-changer for our capital markets, leveling the playing field for everyday investors and providing companies with another path to go public’ stated

NYSE President Stacey Cunningham on December 22, 2020, after the SEC announced its decision.

Dividend

Dividend refers to a company’s distribution of earnings to its shareholders, paid out in cash, stocks, or another form of monetary value. This is the return on investment for those who have funded a business or financial entity’s operations. Large dividends indicate a healthy operation, which in turn attracts more investors. Dividends are usually paid quarterly or semi-annually.

Dow Jones Index

Among all the indexes used to measure US stocks’ performance on the New York Stock Exchange, the Dow Jones Index is the best known and most used. Named for its creator, Charles H. Dow, the Dow, also known as the Dow Jones Industrial Average (DJIA), indexes 30 companies in the technology, financial, transportation, communications, healthcare, food & beverage, transportation, and consumer sectors.

Stock Market Terms E – K

E

Earnings

Simply put, earnings are the net profit of a business. It is derived by subtracting the total operating expenses, taxes, and the cost of sales from total revenues. Earnings are an important indicator of a company’s profitability and stock value.

At Similarweb, we provide traffic data for every company and industry that has an online presence. We use this data to generate valuable insights into a company’s key metrics before it reports earnings.

For example, we can use Facebook’s website traffic to analyze whether its Monthly Active Users (MAUs) have increased or decreased during the quarter. We can also look at visits to its ad page to drive insights into how the company’s ad sales performed vs the previous quarter and on a year-over-year basis.

You can check out some of our latest pre-earnings insights here.

EBITDA

Short for Earnings Before Interest, Taxes, Depreciation, and Amortization. EBITDA is an alternative formula used to assess a company’s financial performance. Discretionary factors such as capital structure and debt financing are removed from the calculation, focusing on the performance of the company’s core operations.

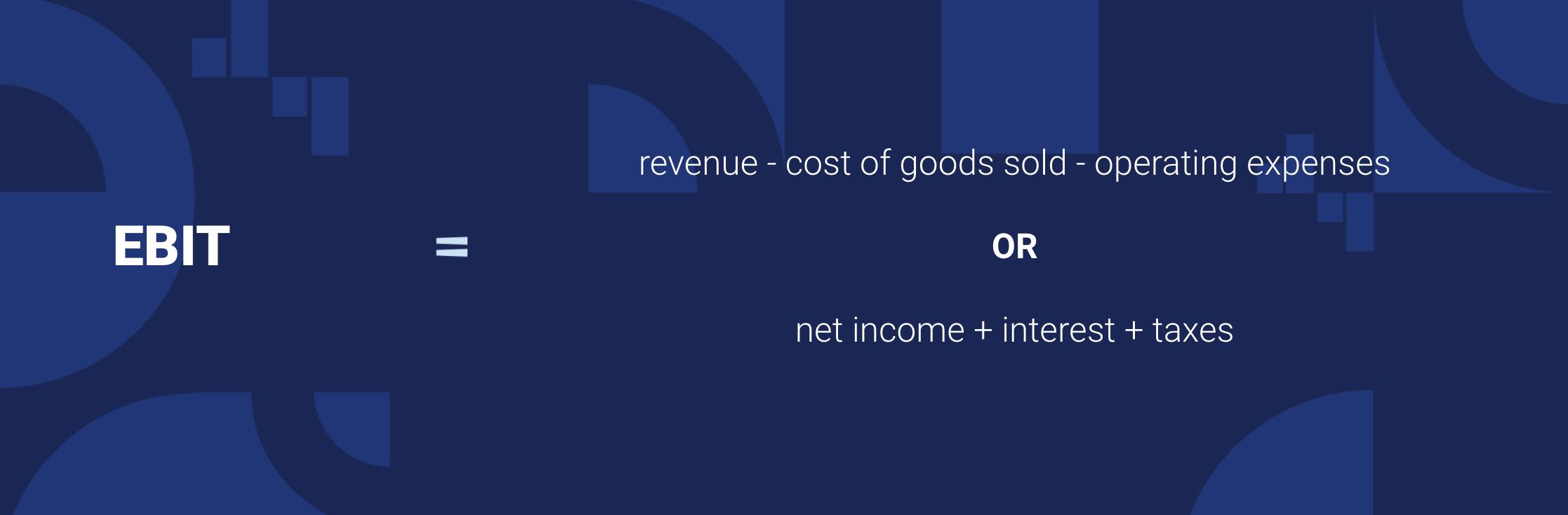

EBIT

EBIT refers to Earnings Before Interest and Taxes. EBIT usually shows up just before “net income” on a company’s income statement. Often referred to as “operating earnings,” the formula excludes taxes and interest payments to calculate a company’s profitability.

EPS

Here we have EPS, or Earnings Per Share. EPS is one way to measure a company’s profitability and future growth potential. EPS is typically calculated by subtracting preferred dividends from the company’s net income and dividing that by the total share outstanding in any given period.

ETF

Short for Exchange Traded Fund, ETFs are similar to mutual funds in that they are an investment basket of bonds, stocks, and other financial assets. However, unlike mutual funds, ETFs can be traded on the stock market throughout the day, rather than waiting until the market closes. ETFs usually use the S&P Composite Stock Price Index.

Equities

Similar to shares or stocks, equities are units of ownership in multiple companies. However, unlike stocks, equity value is calculated after subtracting liabilities.

Ex-Dividend

Refers to the time between when an investment payment is published and when it is received, usually a difference of one business day. Investors buying stock on or after the ex-dividend date will need to wait until the next cycle before receiving a dividend payment.

F

FAANG

An abbreviation for the top five US tech companies: Facebook, Amazon, Apple, Netflix, and Google. It’s a popular acronym used by investment advisors when recommending high-yield tech stocks.

FCF

Stands for “free cash flow” i.e. the cash a company has available for distribution. It is calculated like this: cash from operations – capital expenditures.

Federal Funds Rate (Fed Funds Rate)

When banks borrow from each other, the interest they charge each other is set according to the feds fund rate. The Federal Reserve influences the interest rate charged on mortgages, credit cards, personal loans, and other types of borrowing.

Federal Reserve Board (The Fed)

The Fed Reserve is an agency of the US government tasked with setting monetary policies, ensuring the nation’s financial system’s stability, creating mechanisms to ensure transparency in currency markets and banking practices, and protecting consumers and community development. All segments of the economy follow the actions of the Fed Reserve.

Fund

Refers to the pooling of money from a group of investors, intending to maximize returns for the Fund’s benefit. The most common examples are mutual funds, equity funds, Hedge funds, money-market funds, Index funds, and real estate investment trusts (REITs). Funds are managed by expert investment advisors or brokerage houses.

Forecasting

The process of estimating future sales. Accurate sales forecasts enable companies to make informed business decisions and predict short-term and long-term performance. Companies can base their forecasts on past sales data, industry-wide comparisons, and other external factors such as economic trends.

G

Growth Stock

Company shares that exceed market expectations based on the average performance in the industry are known as a growth stock. Typically, businesses will reinvest the earnings from growth stock back into their operating capital. This strategy empowers them to scale their business operations more quickly and provide better returns to their shareholders.

H

Hedge Fund

A vehicle for investing, similar to a mutual fund, but riskier. Hedge Fund membership is typically restricted to investors with higher income levels because of the risk and expensive management fees. Hedge funds are established as a limited liability company or a limited partnership and are managed by licensed investment advisors.

Read More – Alternative Data for Hedge Funds: The Competitive Edge to Investing

Stock Market Terms I – N

I

Industry

Individual companies are generally classified into an industry based on their largest sources of revenue. Examples of industries can be ad tech, B2B software companies, logistics, payment, etc

An industry trend is a general, identifiable direction or course within an industry sector. A trend can refer to prices, costs, sales, marketing methods, popularity, and consumer habits.

Index (and Index Fund)

Index refers to a benchmark used to measure the health and performance of the securities market. The S&P 500 is an example of an index. Index Fund refers to an investment vehicle through which a pool of investors’ money can be used to purchase stocks and other securities that reflect a certain Index. The Vanguard 500 Index Fund is an example. An index fund can be an exchange-traded fund (ETF) or a mutual fund.

Inflation

When the price of goods and services across all industrial sectors gradually increases to the point of depressing consumers’ purchasing power, the economy is considered to be in a period of inflation. It is also referred to as a rising cost of living. Periodic inflation is healthy but left unchecked, it can flatten a country’s economy.

Interest Rate

The cost of borrowing money or earnings received from lending money. For example, banks pay interest to savings accounts and certificates of deposit holders. Lenders charge interest to borrowers. The interest rate fluctuates according to several factors.

IPO

Short for Initial Public Offering. The first time a privately-held company trades its share on the stock exchange, it’s called an IPO company. An IPO is one way for a company to raise capital quickly. Employees and investors who already held stock benefit from the ability to trade their shares on the market.

Find our coverage of the market’s hottest upcoming IPOs here.

L

Large Cap

A designation is given to companies whose market capitalization exceeds $10 billion. Large-cap stocks are issued by well-established, mega-size companies that can weather disruptions in the economy. Large-cap stocks are a safe investment, though returns tend to be smaller.

LSE

Stands for London Stock Exchange, the third-largest exchange in the world. More than 3,000 companies from across China, Europe, Africa, Asia, and Latin America are represented on the LSE.

Logo Retention

The percentage of customers retained over a given period of time.

M

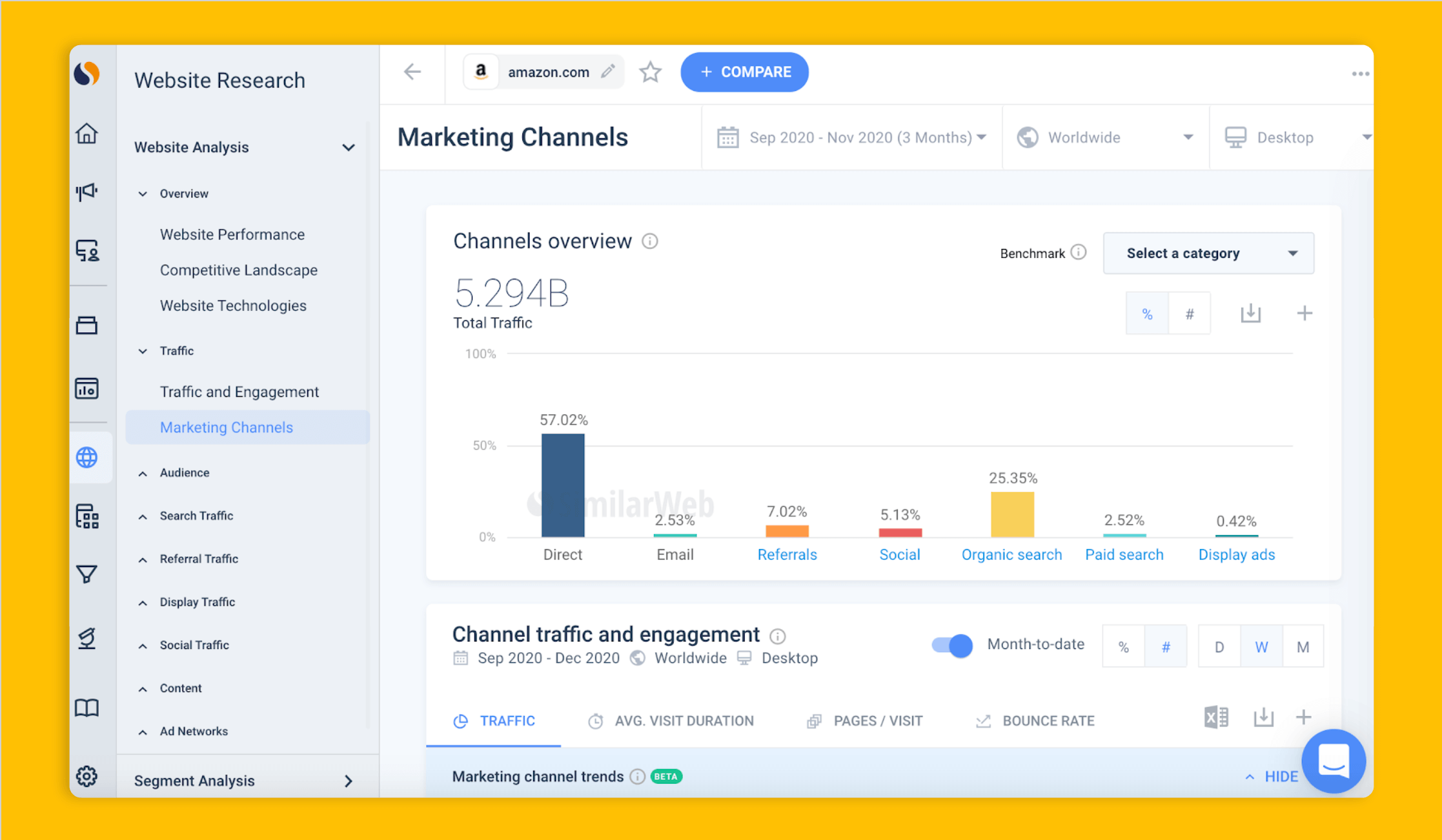

Market Channels

The channel sources that generate traffic to any website. This data can quickly reveal a site’s desktop and mobile traffic acquisition strategy.

For example, direct traffic will often come from people with an awareness of, or affinity for, a given site. This means that visitors from Direct are likely to be amongst some of the website’s most loyal and engaged users. So you can use this metric to assess a website’s brand strength (awareness and demand).

Mid Cap

Companies whose market value falls between $2 billion and $10 billion are referred to as Mid-Cap companies. These companies have not yet made it to the big leagues, but they have established a foothold in their industry and exhibit growth potential. Mid-cap stocks fall between large-cap and small-cap.

Mega Cap

A designation is given to any company whose market capitalization exceeds $200 billion. Mega cap stocks are also known as blue-chip stocks. Mega cap stock prices are among the most expensive on the market, excluding small investors. However, they enjoy the best price stability due to their popularity with mutual and hedge funds.

MRR

Short for monthly recurring revenue. MRR is income that a business can count on receiving every single month, predictable revenue. To calculate MRR, multiply your total number of paying users by the average revenue per user.

Mutual Fund

A mutual fund is a vehicle for easily investing in the stock market. The mutual fund pools investors’ money. A professional fund manager is retained to manage the portfolio, making purchasing decisions based on the type of fund, such as a growth stock mutual fund. It is one of the most popular vehicles for investing because it doesn’t require a lot of money to get involved.

MUV

Short for monthly unique visits i.e. the sum of devices visiting the analyzed domain, within the country and time period analyzed. Use Unique Visitors to assess the actual reach of a website and compare Monthly Unique Visitors to Daily Unique Visitors to see how often users visit a website throughout the month.

N

NASDAQ

Launched in 1971, the National Association of Securities Dealers Automated Quotations (NASDAQ) has become the best known and second-largest stock exchange in the world. It was the disrupter of its day, creating the first electronic stock market, consolidating trading activities that previously took place informally.

NI

Short for net income. NI reveals if the company’s revenue exceeds its expenses, making it potentially a good investment. Also known as net profit or net earnings, NI is what remains from total earnings after subtracting all costs of sale, taxes, interest, and operating expenses.

NOI

Short for net operating income. NOI is calculated by taking gross income and subtracting total operating expenses. NOI is a more reliable indicator of a company’s potential profits or losses. Loans, income taxes, and non-operating income, such as interest revenue, are not included when calculating NOI.

Nowcasting

Borrowed from meteorology, it’s a contraction of now and forecasting, a prediction of the future and the present based on an assessment of economic conditions. Key variables such as GDP growth are updated in real-time, making it possible to create short-term predictions of asset performance.

Read our blog post on nowcasting here.

NRR

Short for net revenue retention. NRR takes into account the total revenue minus any revenue churn (caused by departing customers, or customers who have downgraded) plus any revenue expansion from upgrades, cross-sells or upsells.

NYSE

Short for New York Stock Exchange. The NYSE holds the distinction of being the largest and most prestigious stock exchange in the world. Founded in 1792, it was the first to use an electronic system to buy and sell stocks. Today, it hosts more than 70 of the world’s most significant corporations and 82% of the S&P 500.

Stock Market Terms O – R

O

OTC

Short for over-the-counter. Securities traded directly between the buyer and seller, without the use of a formal securities exchange is known as OTC. Over-the-counter securities are not listed on the stock market and trades are handled through emails, telephone, or digital platforms.

P

Page Views

A pageview (or pageview hit, page tracking hit) is an instance of a page being loaded (or reloaded) in a browser. Pageviews is a metric defined as the total number of pages viewed.

P/B Ratio

Refers to price-to-book ratio. P/B ratio is calculated by dividing a stock price by book value per share. The P/B ratio is key data when comparing stocks. P/B can lead an investor to the best value at any given moment in time.

P/E Ratio

Refers to price-to-earnings ratio. P/E ratio is formulated by taking the stock price and dividing it by the stock’s earnings. It can also be calculated using the average stock price over a specific time period. A higher P/E ratio indicates the stock is more expensive relative to what it earns. If the P/E is lower, it indicates the stock is less expensive.

Portfolio

Refers to a collection of investments, such as stock, bonds, securities, commodities, currencies, real estate, etc., mixed between low-risk and high-risk, owned by an investor and designed to maximize short-term and long-term returns.

Preferred Stock

A kind of stock that does not confer voting rights and pays dividends according to a set schedule. It’s known as a hybrid between a bond and common stock and is preferred by investors seeking a consistent income from their investment.

Profit

What’s left from income after all expenses have been deducted is profit. There are several types of profit, such as operating profit, gross profit, and net profit. Each one is calculated a little differently.

Q

Quant Fund

The next generation of investment analysis, Quant Funds are investment funds chosen by advanced quantitative analysis rather than the intellectual analysis of investment experts. The fund manager continues to monitor the quantitative analytical model as it makes investment decisions for the portfolio.

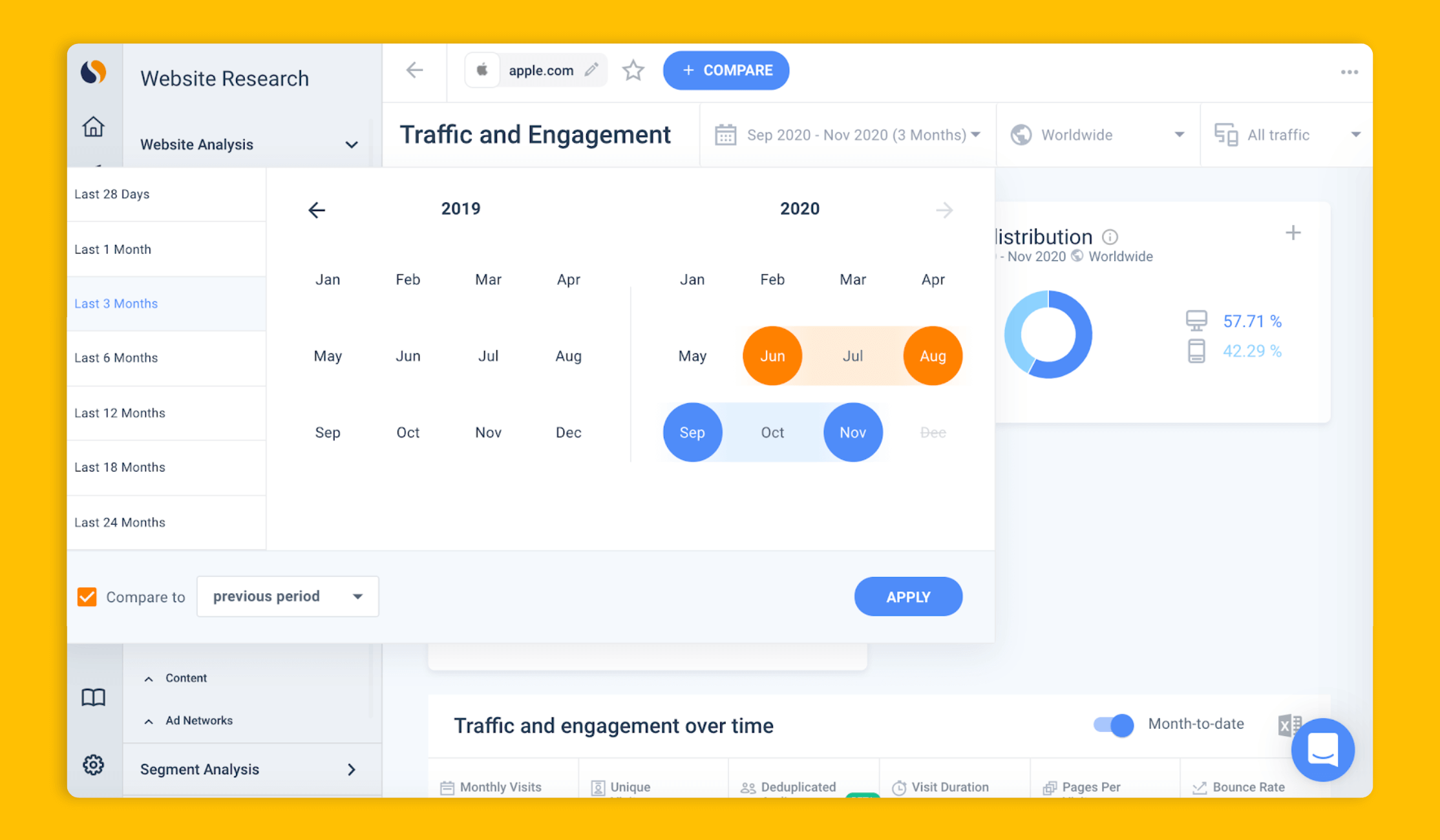

QOQ

Short for Quarter on Quarter. The term is used when comparing performance in one quarter to the previous quarter. For instance, a company’s earnings in Q3 as compared to earnings in Q2. It’s a way to capture short-term changes in performance. Here we can see how to use the Similarweb platform to compare two-quarters of web traffic:

R

Recession

When there is a decline in gross domestic product for at least two quarters, economists will announce that the country has entered a recession. Consumers will experience an increase in unemployment, engage in less spending as confidence in the economy dwindles, and observe a general downturn in production and sales.

REIT

Short for Real Estate Investment Trust. A REIT is an alternative way to invest in real estate without needing to buy individual properties. REITs acquire and develop a portfolio of properties that are managed for long-term profit.

ROI

Stands for Return on Investment and measures the profit or loss generated from an investment. A high ROI indicates a high yield relative to the investment.

ROIC

Short for Return on Invested Capital. ROIC is a way to calculate profitability or return on investment. The formula used is net operating profit (after taxes) divided by invested capital. Invested capital is the amount spent to purchase shares in the company.

Stock Market Terms S – Y

S

SaaS

Short for software as a service. SaaS is a software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted online. It is sometimes referred to as “on-demand software”.

Check out our post on – How To Evaluate SaaS Companies in 3 Steps?

SAM

Short for the serviceable addressable market. SAM is the share of the total market that can be fulfilled or served by all businesses that offer a particular product, or service. For its IPO, Airbnb estimated that its SAM stands at $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for experiences.

Check out our post on – Market Sizing: Measuring Your TAM, SAM, and SOM

Sector

A way of organizing the economy and providing an easier way for investors to measure performance. Economists have created four sectors in the economy, within which are housed industries. For example, within the Tertiary Sector are the financial, retail, and entertainment industries. The Secondary Sector houses all industries involved in producing finished goods, such as manufacturing and construction.

SEC

Short for Securities and Exchange Commission, an agency of the US government. Founded more than 85 years ago, the mission of the SEC is to protect investors and the public’s trust in securities exchange markets. It completes its mission by enforcing securities laws, regulating markets, and investigating investor fraud.

Sharpe Ratio

Another way to measure portfolio earnings. The Sharpe ratio considers the issue of risk. In other words, the return achieved is measured against the risk taken. The higher the ratio, the riskier the investment strategy. For investors looking for safer investments, the Sharpe ratio provides some guidance.

Small Cap

Unlike big-cap stocks, small-cap stocks are owned by companies whose market capitalization is no more than $2 billion, with a minimum of approximately $300 million. A younger company with less operational overhead can be an attractive investment since there is more room for significant profits down the road. On the other hand, small-cap stocks are a bit riskier.

SMB

SMB means small and medium-sized businesses (as opposed to SME which stands for small and medium-sized enterprises). Gartner defines small businesses as organizations with fewer than 100 employees and under $50 million in annual revenue. Midsize businesses have 100-999 employees and make between $50 million to $1 billion in annual revenue.

Note that SMB is also short for ”small minus big.” This refers to one of three factors in a French stock pricing model that suggests that over the long term, smaller companies will outperform larger companies.

SPAC

Also referred to as “blank-check firms”, SPAC stands for “special purpose acquisition company.” As the name indicates, this is a company that does not carry out its own commercial operations but is set up to raise capital through an IPO in order to acquire an existing company.

Check out our post on – SPACs vs. IPOs: Your Ultimate Guide

According to data compiled by Bloomberg, SPACs raised a record $78 billion in the US in 2020- about 45% of the year’s $177 billion IPO volume. For further information on the booming SPAC market, you can check out the Bloomberg article here.

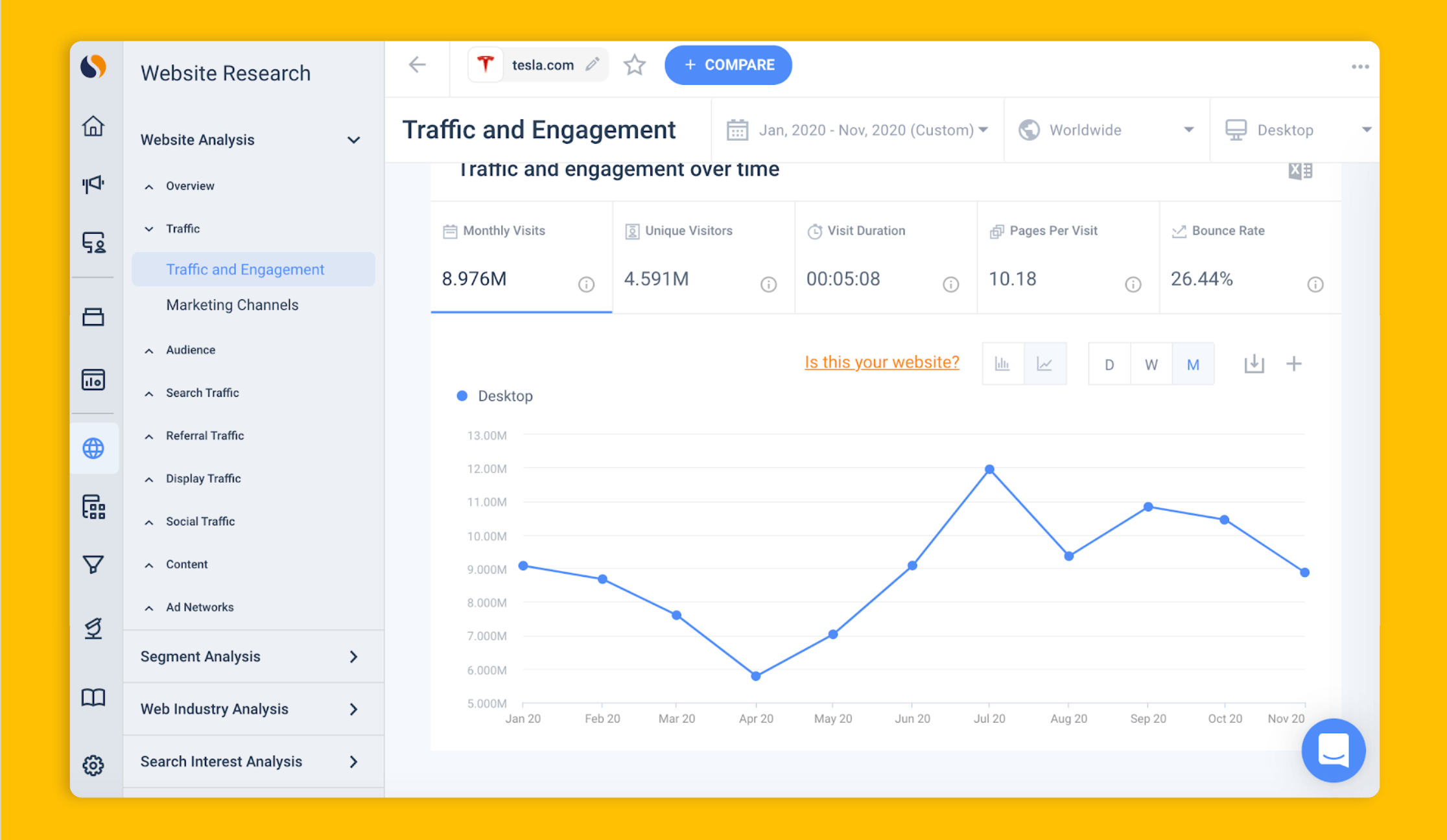

S&P 500

One of the best-known stock market indexes in the world. Launched in 1957, the S&P 500 assesses the performance of the 500 largest US companies, those with a market cap in excess of $10 billion. Companies included in the index are selected based on industry, liquidity, and size. Tesla, for example, made its official debut in the group in December 2020- one of the most expensive companies ever to join the S&P 500.

Track Tesla’s latest digital traffic trends with the Similarweb Pro platform now:

Stock

Stock is security resulting in ownership of a company. It’s also referred to as equity. When an investor purchases stock in a company, he or she gains equity in that company and is entitled to a percentage of the company’s profits. These investors are called stockholders or shareholders. Stocks are traded on the stock exchange.

T

TAM

Short for total addressable market. TAM is the revenue opportunity available for a product or service. For instance, Airbnb estimates its TAM at a staggering $3.4 trillion.

Total Return

The total amount earned from an investment over a given period of time, typically a year. Total return includes dividends, interest, change in asset value, and capital gains earned during the 12-month period. It is usually expressed as a percentage of the purchase cost.

TTM

Short for “trailing twelve months.” On a financial statement, it means that the data provided is coming from the previous 12-month period, ending on the last month of the statement. This is different from an annual report which follows the calendar year, or a company’s fiscal year.

U

Up-Selling

A technique where a seller invites the customer to purchase more expensive items, upgrades, or other add-ons to generate more revenue.

Use Case

Description of how a person using a product or service will accomplish a goal.

V

Valuation

Refers to the specific process of calculating the worth of an asset. Valuation is a subjective process that considers the value or selling price of an asset, based on fair market value. Businesses frequently conduct a valuation before pursuing mergers or acquisitions.

Value Investing

An investment strategy that focuses on long-term investment in undervalued stocks. The current market price is given less weight. Value investing assesses a company’s position in the marketplace, operational efficiency, and cash flow to determine if it’s a good investment purchase. One of the most famous investors on the planet, billionaire Warren Buffett, is frequently described as a ‘value investor.’

Venture Capital

A type of non-debt financing typically used by startups. In exchange for funding, investors receive an ownership stake in the company. Venture Capital is most often used to help tech companies scale up.

Visits Per Unique Visitor

The average number of visits per unique visitor in the given time frame. This is calculated by dividing the number of total visits by the number of unique visitors. Can be used to analyze engagement rates on a website and understand how many times each visitor visited that website.

VIX

Dubbed the “fear index”, the CBOE Volatility Index (VIX) measures the estimated volatility of the market. It is calculated in real-time by the Chicago Board Options Exchange (CBOE) based on the expected price fluctuations in the S&P 500 Index options over the next 30 days.

Volatility

Simply put, volatility is a measure of price swing (range and speed) over a given period of time. Certain assets are naturally more volatile. Financial analysts measure the market, securities, and index volatility when evaluating investing strategies.

Y

Yield

The return on an investment, minus capital gains. Yield is stated as an annual percentage, calculated based on the purchase price of the security. Generally, one takes the dividends or interest received over a period of time and divides it by the original amount invested. Alternatively, the current price might be used. Knowing dividend yield is an important factor to consider before investing in stocks.

YOY

Short for year-over-year. It is a way of analyzing performance by comparing financial data in one period to the same period the previous year. The period can be a quarter or a month. YOY is a useful way to measure true growth because it eliminates seasonal fluctuations.

YTD

Short for year-to-date. This is an accounting period used to analyze trends in the market. The portion covered starts at the beginning of that year and concludes on the date the report is prepared. YTD can be the company’s fiscal year, the calendar year, or some other preferred period.

Have we missed an important investors term? Let us know at investors@similarweb.com and we’ll add it!

Now that you have got to grips with all the relevant stock market terminology, it’s time to put your new skills into practice. At Similarweb we track over 100 million websites, and 4.7 million apps. The result: we can provide traffic data for every company and industry that has an online presence.

Generate unique insights into market-moving events.

We also have glossaries for sales terms, eCommerce terms, digital research terms, market research terms, AI marketing terms, and digital marketing terms, SEO glossary

.

Invest using the most insightful digital alt data

Leverage data used by 5,000+ companies to improve your strategy