If You Build It: Home Depot vs. Lowes 1Q22 Pre-Earnings Insights

If they build it, they will most likely be purchasing materials and tools at Home Depot or Lowe’s. Wandering through aisle after aisle filled with toilets, fixtures, nails, tiles, tools, grout … sorry, daydreaming about all the work my apartment needs.

With the recent decision by the Fed to raise interest rates by 0.50%, buying a home may get easier for some which in turn could prove to be a boon for the home improvement giants.

But for now, we focus on Home Depot’s and Lowe’s pre-earnings insights and how the companies performed in 1Q22.

It’s hammer time

Looking at consumer behavior data provides a powerful signal for brand recognition and loyalty and can set a baseline for traffic share. Zeroing in on the performance of a specific product line, such as hammers, can reveal consumer engagement. Specifically, we looked at the bounce rate for hammers on homedepot.com and. lowes.com in the U.S.

The lower the bounce rate, the longer the user is engaged. Pre-pandemic, pages featuring hammers on lowes.com boasted the win with a 41% bounce rate in February 2020. Homedepot.com’s pages featuring hammers were at 57%. As the timeline transitioned into the pandemic and the 2020 holiday season, homedepot.com’s bounce rate decreased consistently as Lowe’s increased. Until March 2022. Lowes.com overtook homedepot.com once again but only by a single percentage point.

The HD vs. LOW 1Q22 throw down is on.

Who hit the nail on the head?

With 21 pages dedicated to just hammers on homedepot.com and 20 on lowes.com, consumers can shop for hammers all day. But what we want to derive from the data is potential revenue.

In 1Q22, homedepot.com and homedepot.ca generated more than 600 million visits (down 9% from 1Q21) and lowes.com and lowes.ca generated 326 million visits (down from 393 million in 1Q21). Homedepot.com is the obvious winner of traffic share YoY, but what does that look like in conversions?

While the conversion data tracks the same between 1Q21 and 1Q22, the Similarweb data shows homedepot.com coming out on top.

- In January 2022, homedepot.com had over 3.2 million converted visits whereas lowes.com had just over 1.2 million

- February 2022 showed even greater disparity with homedepot.com receiving over 2.6 and lowes.com not hitting the 1 million mark with only 988,000

- March was a better month for Lowe’s with over 1.2 million converted visits, but Home Depot still won the quarter with over 3.2 million

Home Depot seems to be hammering the competition.

Room for growth

Lowe’s trails Home Depot in website traffic and engagement metrics but there’s opportunity. In 1Q22, homedepot.com had 2.4 visits per unique visitor and lowes.com had 2.1 . Lowe’s can bridge the gap. The opportunity may be found in the marketing channels.

The two areas where Lowe’s is coming out on top are search and display ads. Search is an interesting metric here. Broken down by device type, homedepot.com wins desktop traffic share with 40% and Lowe’s wins mobile web with 65%. Let’s drill down further and look at paid search.

- In 1Q22, Home Depot’s PPC spend included 9,973 search ads and Lowe’s had 9,981

- Lowe’s spend included 15,760 paid landing pages where Home Depot included 36,787 in its spend

- Home Depot had 7,644 product ads in its spend and Lowe’s had 6,897

- Lowe’s budget spent in 1Q22 was $13.7 million and Lowe’s was $9.3 million

Lowe’s could consider shifting its PPC budget to include more paid landing pages and product ads to extend its winning streak in this channel.

And the winner is …

This round points to Home Depot. But 2Q22 is well on its way. So let’s take a glance at how the DIY home and garden giants are faring.

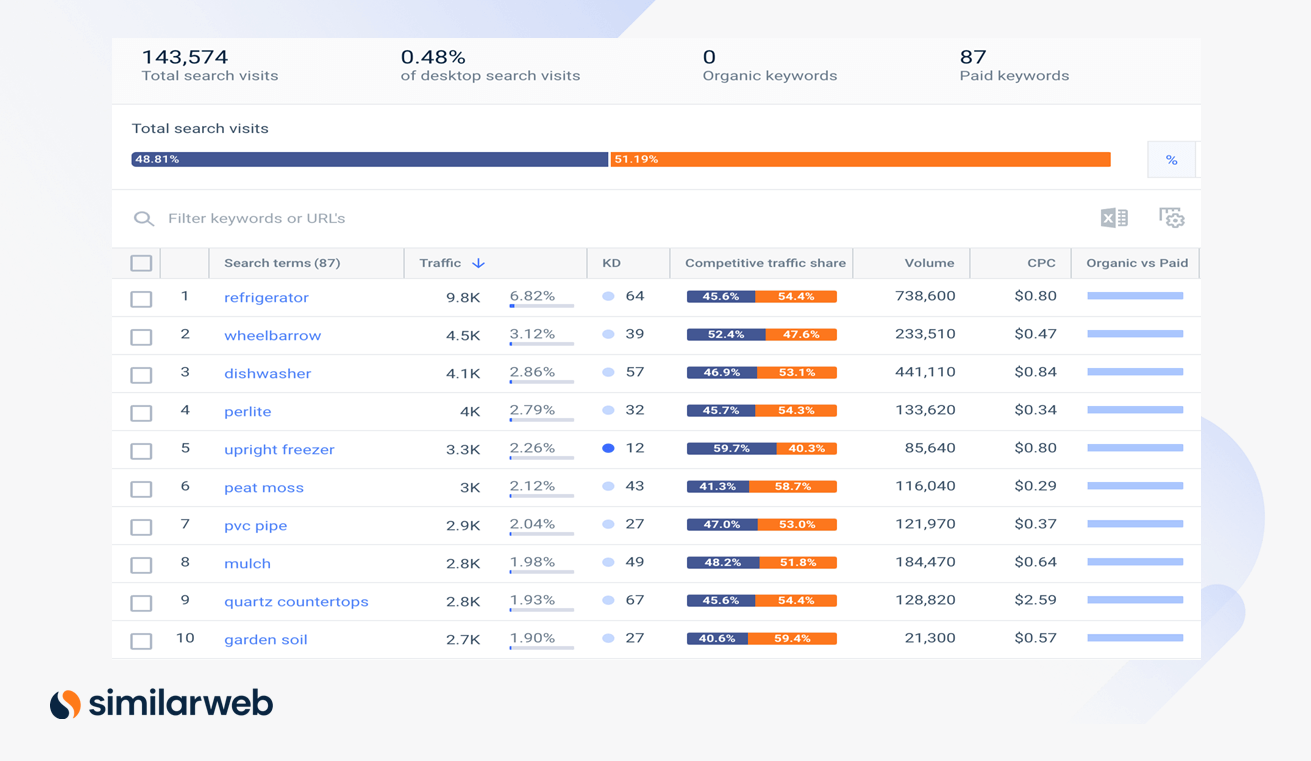

Of the top 10 keyword paid searches worldwide, Lowe’s is dissembling the competition especially when it comes to gardening materials winning almost 60% of the traffic share for garden soil and peat moss.

The bigger picture

Home Depot and Lowe’s aren’t only competing against each other. The home and garden industry has multiple segments, additional key players and numerous factors that affect these DIY giants’ market share, traffic share and quarterly performance.

Similarweb tracks data in near real-time with Investor Intelligence. The result: You don’t have to wait for earnings season to see how a company is performing online.

Invest using the most insightful digital alt data

Leverage data used by 5,000+ companies to improve your strategy