Guide to Investing in IPOs: Everything You Need to Know

No company starts out as a publicly-traded company. Business founders and owners work tirelessly to build a company, using personal funds or capital from private investors. If and when the market conditions are right a company’s management may decide to take it public.

There are a number of routes to taking a company public including via initial public offering (IPO) which has historically been the primary route, as well as via direct listing and special purpose acquisition company (SPAC).

Almost all the stocks currently trading started out as IPO stocks at one point. IPO investments can be a great tool for investors to maximize their returns. But these types of investments don’t come without challenges and risks.

In this article, we will cover everything you need to know about investing in IPOs:

- What is an IPO?

- How to invest in IPOs

- Upcoming IPOs for your watchlist

- Some of the most talked-about IPOs that have come to market recently

What is an IPO?

IPO stands for “initial public offering.” It signals a company’s debut on one of the primary stock markets, such as Nasdaq or the New York Stock Exchange. A company will typically IPO when it wants to raise non-debt capital, and does this by selling a predetermined number of shares in its company. Once the IPO has taken place the company’s status is changed from a private company to a public company.

Investing in IPOs: The challenges

Before making a strategic investment decision you’ll need to do due diligence and thoroughly research the company. However, unlike public companies, information on a private company’s performance, which gives you a reasonable basis for assessing long-term growth, is limited.

So when deciding whether to invest in an IPO where should you start?

How to invest in IPOs

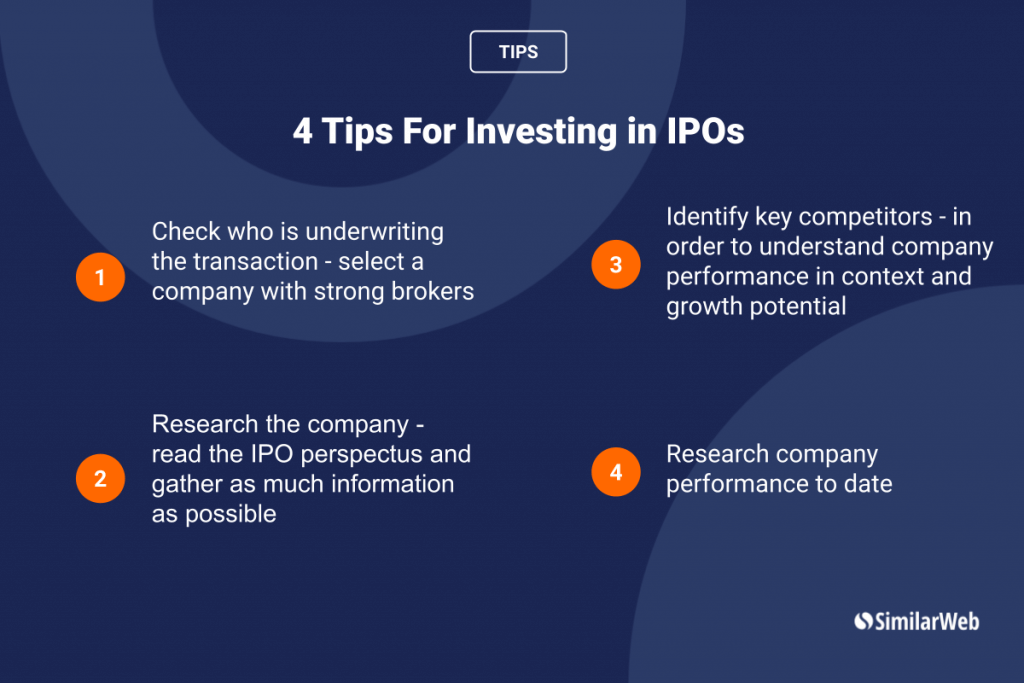

1. Check who is underwriting the transaction

The first thing to do is check which investment bank is leading the company in its IPO.

Equity underwriters are highly skilled financial analysts who work with a company to set the initial offering price of the shares to be made public. Typically, IPO underwriters are staffed to investment banks who conduct a company valuation and guide it through all the regulatory requirements before going public.

Underwriters float the potential IPO throughout their network of investment organizations to gauge interest, which helps set the IPO price. The underwriter has the additional responsibility of guaranteeing the number of shares that will be sold at the initial offering price and purchasing any surplus shares.

Select a company with strong brokers

The reputation of the underwriter is as important as the reputation of the company going public. While there is no guarantee that a well-known brokerage house will deliver on its promise, it’s more likely than a smaller underwriter who might be more focused on trying to build a portfolio. A boutique brokerage has a few advantages, such as their smaller client base allowing individual investors (also known as retail investors) to purchase pre-IPO shares, but you should be cautious. Brokers with a strong reputation and considerable experience in the IPO market are more likely to bring you better long-term results and security.

2. Research the company

Once you are satisfied with the brokers leading the IPO it’s time to do your research into the company.

Read the IPO prospectus

A good place to start is a company’s prospectus, a formal legal document that companies are required to file with the Securities and Exchange Commission (SEC) before going public. The prospectus is often filled with the number of shares being issued in the initial offering but is designed to provide details about the investment offering. The prospectus will provide the following information:

- Company background

- Financial information

- Details of management and key staff

- Target market

- Competitors analysis

- Any pending litigation

- The number of shares being issued in the initial offering

- Anticipated share price

- Existing shareholders

- Names of the banks underwriting the transaction

You’ll also be able to glean some information from the company’s securities registration form (S-1), which is required to be filed with the SEC before going public.

Gather as much information as possible

In addition to a company’s prospectus, there are other sources for information about private companies. To get as much information as possible and make an informed investment decision we recommend the following:

- Do research online. Read all published information about the company. A Google search should turn up all instances of the company’s mention in financial publications, press releases, and consumer-generated content, such as product and service reviews. Press mentions will also include information about the IPO including a potential timeline for the IPO, the expected valuation of the company ahead of the IPO, and more. You’ll also want to find any legal cases or compliance issues involving the company.

- Assess the company’s industry. Is it trending upward? Do analysts predict bumps in the near future? Are there known economic conditions that could result in the company losing revenue?

- Read sell-side reports. If you are an institutional investor and work with brokerage firms, you’re familiar with the recommendations you receive that a stock is “selling strong” or “outperforming” or other descriptions primarily intended to pique your interest in purchasing shares. These recommendations come from sell-side analysts who follow groups of companies in the same industry, providing performance and projection reports for an investment firm’s clients.

- Use alternative data. Data is used to evaluate a company that is outside of the traditional sources mentioned above. There are many types of alternative data sets from digital data to email receipt data and weather data. Digital data providers, like Similarweb, offer exclusive access to information on website traffic, engagement metrics, and much more. As online activity both on desktop and on mobile devices is an increasingly influential part of our lives, this data reveals more about the performance and health of any company with an online presence than ever before.

3. Identify key competitors

Identifying and understanding a company’s key competitors is critical to understanding its performance in context, as well as growth potential. Once you know the company’s business model and have a list of its competitors, you can attempt to determine whether it can outperform its competitors by delivering a superior product or moving into underserved markets.

The company’s prospectus should address its industry and key competitors. Online research can also help you identify key competitors. Check for other companies in the same sphere, noting those that offer similar products or services in the same geographical regions.

4. Research company performance to date

Accessing company performance on a potential issuer is challenging. Data to help you assess the potential for long-term growth is scant. You’ll access some useful information from the SEC filing, but a more effective tool is “alternative data.”

Many hedge funds are utilizing the power of alternative data sources for improved visibility into company performance. Non-traditional data complements the financial and other publicly available data available on publicly traded companies.

Alternative data research and analysis have become a popular tool for investors to access critical information before investing in IPOs and publicly traded companies.

Be ready before everyone else

IPO filings in 2021 are on track to exceed their record-breaking performance in 2020. Investing in IPOs can be a profitable way to maximize your financial returns. However, accessing the information you need to make sound investment decisions is somewhat challenging. Alternative data, online market research, and the IPO prospectus are among the critical tools you should use before making an investment decision.

Invest using the most insightful digital alt data

Leverage data used by 5,000+ companies to improve your strategy