Ticker Mapping: Unlocking Alpha with Alternative Data

In the investment world, there are tens of thousands of publicly listed companies that are traded on hundreds of stock exchanges worldwide. Each of these publicly traded companies is tied to a tremendous amount of data that includes sector and industry classifications, subsidiaries, unique numeric identifiers, and, of course, ticker symbols.

This data is crucial information for investors to track, monitor, and assess portfolio companies and new investment opportunities. When each data point points to its publicly traded company in a single location, it makes for much easier analysis. This is known as ticker mapping.

Pair ticker mapping with unique alternative data metrics, and investors gain the ability to surface signals and craft custom insights that can track sector trends and company performance and drive investment strategies.

First, the basics.

What is ticker mapping?

Ticker mapping is a form of data integration – the process of extracting and combining data from multiple sources into a consumable format that can be put to use for a variety of decision-making purposes. It involves integrating a publicly traded company with all its relevant online information.

- Firmographics: the characteristics of organizations used to segment and analyze business-to-business (B2B) markets

- Ticker symbol: a unique, alphabetic code used to identify publicly traded companies and their issued securities

- Primary exchange the company is traded on

- ISIN number: a unique code that identifies specific securities on a global scale

- CUSIP: a unique identifier assigned to securities in the US

- GICS classification: a standardized system used to categorize companies into sectors and industries

- Subsidiaries

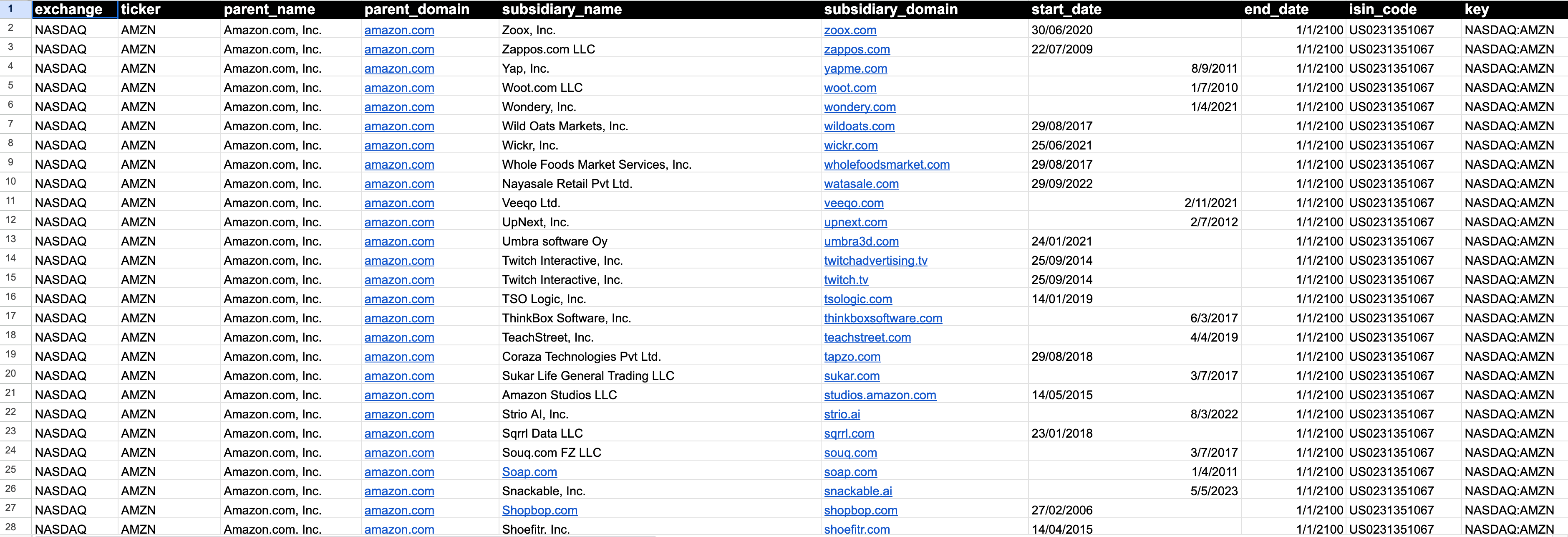

A typical ticker mapping schema will look something like this:

Ticker mapping then becomes the foundation for building models and signals and can be ingested two ways:

- The data feed is delivered directly to a company’s cloud storage or data warehouse for easy integration

- The data is available via an easy-to-use SaaS platform or dashboard

Who uses ticker mapping?

Typically, a systematic quantitative hedge fund is an example of a company that would integrate ticker mapping into its investment strategy. A systematic quant fund uses mathematical models and algorithms to build trading strategies and to create consistent portfolio outcomes, balance risk and return, and target investment outcomes.

A fundamental or discretionary hedge fund, which uses a wide range of strategies, including leverage (borrowed money) and the trading of nontraditional assets, to earn above-average investment returns, may also utilize ticker mapping even without a data science team when available in other formats, like on a SaaS platform.

Ticker Mapping with Similarweb Stock Intelligence

Ticker mapping is the cornerstone of Similarweb Stock Intelligence. It maps 60,000 tickers across 144 global exchanges, which were matched to more than 300,000 domains and 50,000 apps. This includes seven years of historical data, which is paramount for building investment strategies, and point-in-time mapping, which provides key historical data and insights for precise modeling, including corporate structural changes, M&A activities, and brand launches.

The methodology

The Ticker Mapping methodology developed by Similarweb ensures precision and accuracy through a 4-step process:

1. Collection

The data collection includes unifying important company data:

- Internal firmographics: Pairs the main domain with company name, subsidiary, brand, and regional domains

- Web scraping: Pairs ticker and company name, main domain, and company name, app and company name, ticker and subsidiary, subsidiary and domain, and index constituents

- External provider: Purchased data that provides ticker and exchange, ticker and company name, ticker and subsidiary, subsidiary and main domain, GICS sector classification, ISIN codes, point-in-time events

2. Synthesis

The data synthesis processes and blends the different datasets and then matches the different entities into a structured schema:

- Get all parent domains, subsidiary domains, and regional domains into a single database with the ticker and subsidiary names.

- Remove duplicates.

- Add a unique identifier for each domain.

- Map tickers to ISINs, adding a synthetic ISIN to stand in for a missing code.

- Add a start and end date for point-in-time events for each subsidiary and brand.

3. Analysis

On a monthly basis, Similarweb’s research analysts:

- Review the raw file

- Clean the data

- Remove duplicates by applying logic based on the relationship between domain and subsidiary and by applying Levenshtein distance and string matching

4. Data pairing

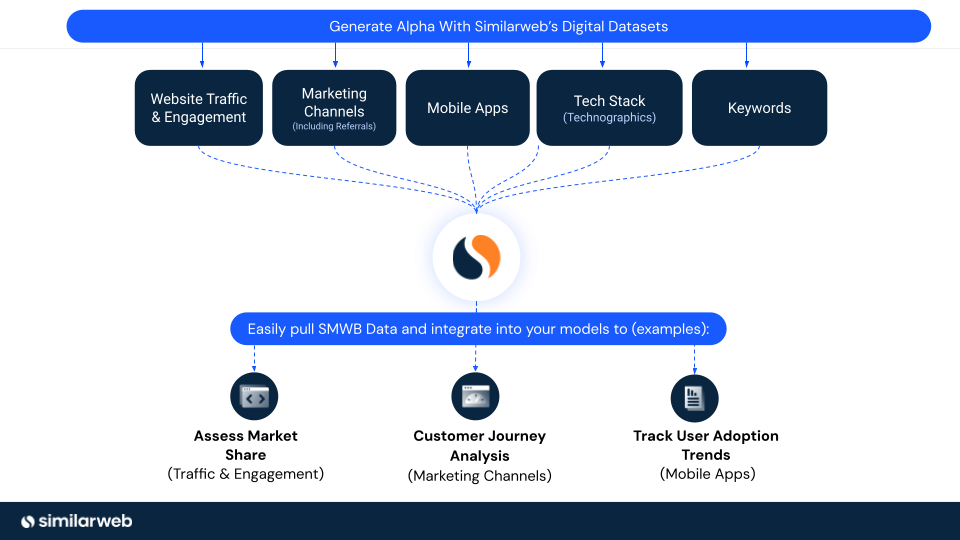

The ticker mapping feed is then paired with Similarweb’s datasets, including Total Visits, Unique Visits, Bounce Rate for domains, and Monthly, Weekly, and Daily Average Users for apps, and aggregated by stock.

The data

It can be an impossible task trying to sort out which domains and apps belong to which company and to stay on top of M&As to keep the data up to date. As of 3Q23, there are 359 million domains online, 1.96 million apps available through the Apple store, and 2.87 million apps available in the Google Play store. Similarweb’s Ticker Mapping gives investors a clear path into the digital world. Then, Ticker Mapping + Similarweb Digital Data surfaces signals and drives insight into company performance with daily, weekly, or monthly granularity.

The data is also customizable so that investors see only the data pertinent to their models, whether for a specific exchange (NYSE, NASDAQ, S&P, LSE, TSE, SSE) or a specific region. Then, add the most valuable Similarweb datasets to scale up analysis.

With Similarweb’s Data-as-a-Service (DaaS) option, Systematic quant funds can easily integrate the data, aggregated by ticker, into algorithmic trading strategies through API feeds or files sent directly via Amazon, S3, or Snowflake.

It’s a bit different for fundamental hedge funds. Because they might not normally have a data science team to consume and analyze data feeds, a SaaS platform becomes the tool of choice to analyze and generate insights around target companies.

The Similarweb Stock Intelligence platform, powered by Ticker Mapping, has all data aggregated by ticker and gives investors a holistic view of companies of interest. They also have the option to select the domains and apps of these companies in order to generate the insights needed to monitor performance and support investment strategies.

Ticker Mapping = alpha

Making sense of the digital world can be challenging. But with Similarweb’s Ticker Mapping, publicly traded companies’ online footprints are constantly monitored and documented, including M&A activity, to ensure all mapped domains and apps stay current. This is crucial for hedge funds monitoring portfolio companies and researching target companies.

Then, just add Similarweb’s Digital Data to your Ticker Mapping feed. By examining robust traffic, engagement, and app data throughout the quarter, you can uncover signals and derive insights that help forecast stock performance and provide a deeper understanding of company dynamics—generating the alpha your investment strategies need.

FAQs

What is ticker mapping?

Ticker mapping aligns a publicly traded company with its key information, including firmographics, ticker symbol, primary exchange, ISIN number, CUSIP number, GICS classification, and subsidiaries.

Who uses ticker mapping data?

Systematic quant funds use the data feed to enhance their algorithmic investment strategies, while fundamental hedge funds can leverage it through SaaS platforms.

How can I access Similarweb’s ticker mapping data?

You can access Similarweb’s Ticker Mapping data through a direct data feed or by using the Stock Intelligence platform.

Invest using the most insightful asset research

Leverage data used by 5,000+ companies to improve your strategy