Private Equity Data Analytics in Sync: A Case Study

How many alternative data sources does it take to get to the center of an investment strategy? One? Two? Three? More. As an example, let’s look at Filament AI and how its platform implements and optimizes external market intelligence datasets, like Similarweb’s web traffic and engagement data.

Building the AI platform for private equity data analytics

When I founded Filament AI in 2016 with Doug Ayres, we didn’t intend to court the investment sector. We launched it as a specialist in Natural Language Processing (NLP) and Machine Learning (ML). The artificial intelligence (AI) industry was still a fledgling one, but we knew there were a host of powerful applications of NLP and ML in the enterprise market, and we set about helping clients to take advantage.

Then big names like HSBC and Deutsche Telekom came into the picture to work with Filament and establish their AI capability. But it wasn’t until 2018 that we turned our sights on Private Equity. The early movers in private equity were beginning to embrace digital alternative data that enhances deal sourcing and investment processes. We were seeing companies like Similarweb offer these firms a competitive edge and decided to specialize in addressing this market opportunity.

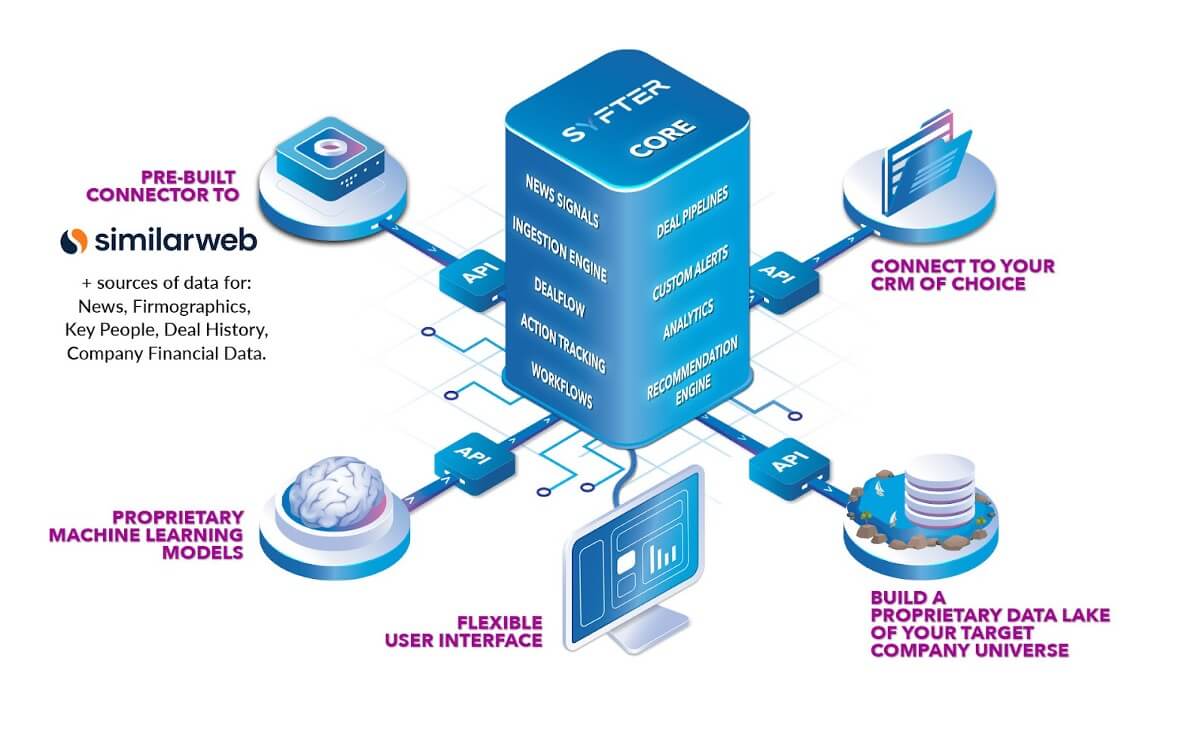

I have subsequently spent the last 4 years advising PE and corporate finance firms on how to leverage data and proprietary AI. In the process, we developed an integration platform called Syfter, which is deployed into PE firms’ IT environment and helps collate and process the data that fuels decisions. Integrating a variety of data and running NLP and ML techniques gives these companies a 360 view of the target company.

Over the last year, the market exploded with interest. PEs using data science strategies to boost their portfolio IP and valuation are now applying that to internal processes. Many PEs are hiring data scientists and data engineers and filling leadership roles to drive the transformation. This pressure comes from the funding source, with limited partners now demanding a sophisticated approach to data management.

AI platform + data source =

Most PE firms have 6 or more third-party data subscriptions providing market insight. In the traditional model, investment analysts perform the hard yards to stay on top of market insights and originate opportunities for attractive deals.

Filament helped many of these firms automate active and passive market interrogations. Beyond known relationships in the CRM, we help track and source prospective relationships from the wider company universe, typically up to a million firms they might want to engage in the future.

The Syfter architecture integrates Similarweb with a host of other structured and unstructured market data sources.

This gives immensely valuable real-time market insights for research, origination, and deal management. It also provides added value to the portfolio companies and tracks the ecosystem of competitors, acquirers, and partners. Every solution relies on structured financial data (EBITDA, employee growth, etc.), and the complete 360 view is only achieved by delving into the gold mine of alternative data sources, such as company news and media activity signals, and then classifying that data into various categories (e.g. board management changes, M&A rumors, etc.). But more often now, PE firms are turning to insights provided by a company’s online behavior as a key differentiator.

Adding Similarweb’s web traffic and engagement data

As a result of the pandemic lockdowns, a higher percentage of business transactions moved online, providing a company performance data trail that can be accumulated and interrogated by investors. Similarweb data provides the window into the world of online data analytics, and our PE clients are reaping the rewards. They use Similarweb’s Investor Intelligence to gain a real-time view of a company’s performance, risk, and positioning in the market. Our data science team helped them pull increasingly subtle insights within a number of key use cases:

- In-year revenue prediction by aligning in-year web traffic performance with financial performance

- Company GTM intelligence provides a deep understanding of how a firm positions itself, wins business and makes money

- Passive alerts that signal investors about dramatic increases in web traffic, a change in positioning, or stakeholder profile

- Portfolio optimization helps PE firms support portfolio operations by finding new markets, analyzing and benchmarking the customer journey, and improving marketing efficiency

- Portfolio acquisitions enhance buy and build strategies to find acquisition targets that fit the firm’s investment strategy

PE firms adopting these approaches cite an edge in their operations and efficiency with actionable insights for current portfolio companies and future deals.

The accumulated data provides streamlined market intelligence and a rich back catalog of target market insights. This allows retrospective analysis of market trends to inform and validate investment theses. This curated data also bottles the proprietary intelligence of the investment team, making the PE firm less vulnerable to employee churn.

In an increasingly competitive PE market, the edge is all important.

Filament AI is focused on helping PE firms build proprietary AI platforms. Their Syfter platform has productized the enabling database and ML technology that every PE firm needs. By white-labelling Syfter and engaging Filament professional services, PE firms can get a proprietary system operational in weeks, not years. With this approach, the configuration effort and budget can be focused on the true competitive edge: that is the unique data and the unique ML algorithms tuned to their investment thesis.

Invest using the most insightful asset research

Leverage data used by 5,000+ companies to improve your strategy