Nowcasting: Using Alternative Data to Predict the Present

The value of predicting the future has always been rather obvious. Knowing what will happen next is a major advantage in all aspects of life, and particularly in the fields of economics and money management.

Nowcasting is a relatively new term, originating from meteorology, where it provides short-term forecasts of weather conditions. The term made its way to economics over the last twenty years. A portmanteau of “now” and “forecasting,” nowcasting is the prediction of the present.

In this article we will discuss nowcasting in more detail, and how investors can leverage alternative data in nowcasting models.

What is nowcasting?

Nowcasting is essentially a way to monitor conditions in near real-time. Many define nowcasting as a prediction of the present, or very near future.

Economists and other finance professionals need to make decisions based on current conditions. To do this, they use nowcasting economics in order to understand the current state of the economy, or the present economic performance of a certain company or business.

Alternative data for nowcasting

A key element of nowcasting is the availability of present data. Without the data, you have nothing to base your models off. However, unfortunately, official data releases are often delayed, sometimes to an extent where data is released long after the timeframe in question has passed.

Some data, such as retail sales, is available on a monthly basis, which allows for only a monthly revision of nowcasting models.

How do we get around this? Alternative data.

The near real-time availability of alternative data takes nowcasting a step further by allowing investors to perfect nowcasting models with a constant flow of new near real-time information.

For example, at Similarweb, our web and app traffic data is available within three days, much faster than most indicators. This data can potentially allow us to nowcast different indicators, such as jobless claims and earnings reports.

Read more about alternative data-sets and how to integrate them into your investment process.

Nowcasting in practice

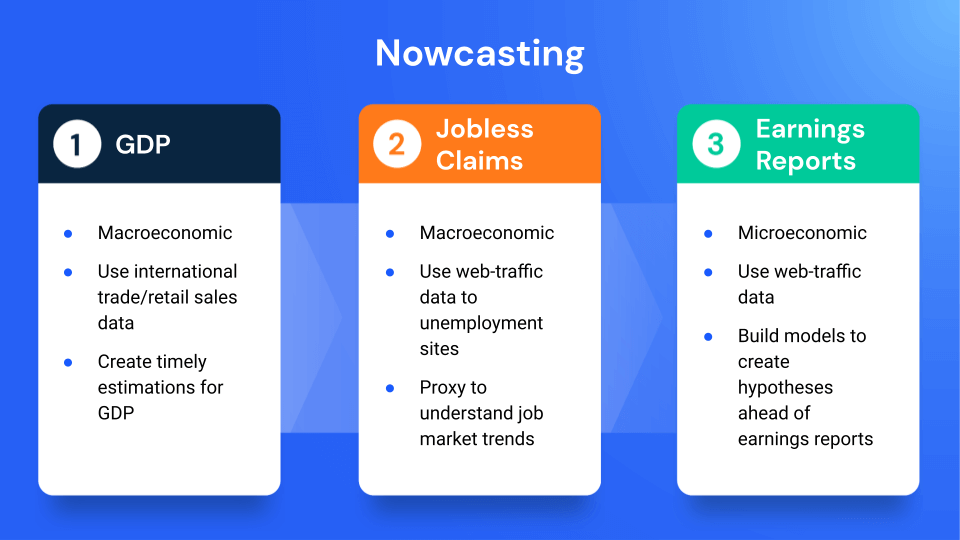

Nowcasting economics is used in a number of different contexts both macro and microeconomic, below we will discuss a few.

Nowcasting GDP

The most famous economic indicator that is often nowcasted is the gross domestic product (GDP). Official GDP estimates are released only after the quarter’s end, with the final reading available only a full three months after the quarter’s end.

In a fast-paced world of split-second decision-making, waiting three months for a data release is an anomaly. In order to get more timely estimates, economists at the Atlanta federal reserve bank built GDPNow, a model that estimates real GDP growth for the current measured quarter based on statistical models and more readily available macroeconomic data, such as international trade or retail sales. Still, it is not an official forecast of the Atlanta fed.

GDPNow

Nowcasting Jobless Claims

Recently, investment professionals and professional forecasters have started to rely on alternative data providers, such as Similarweb, to provide real-time economic signals.

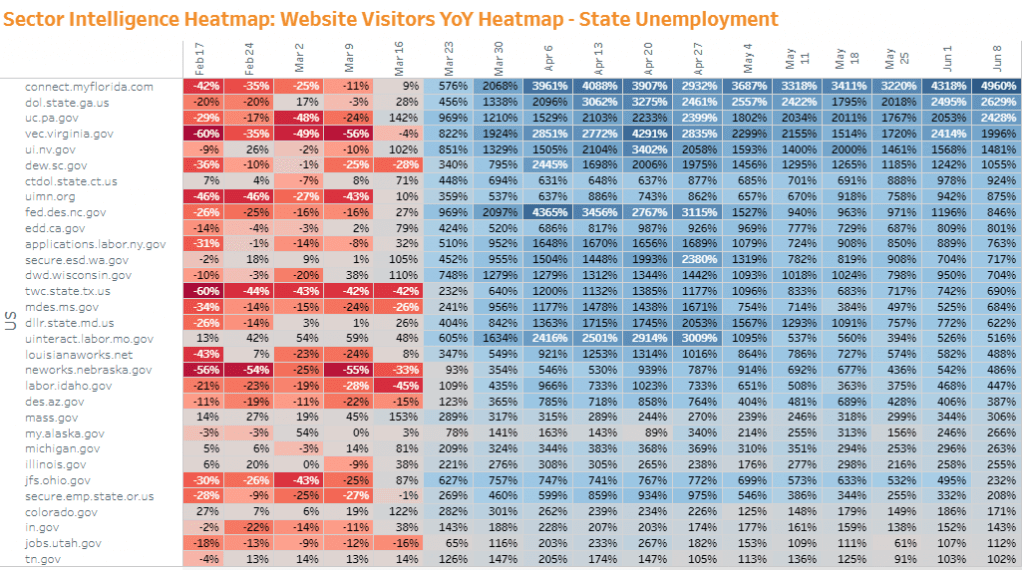

Web traffic data allows us to measure the changes in traffic to state unemployment sites on a daily basis. Since citizens can now file for unemployment online, it serves as a useful proxy to understand recent trends in the job market, long before the official data release, or before the period that it pertains to ends.

Using this near real-time data, it is possible to instantly identify changes in unemployment, and this data can be used in nowcasting models.

Nowcasting Earnings Reports

The use of nowcasting isn’t limited to economic indicators. On a microeconomic level, nowcasting can be used to determine the performance of a given company during a given timeframe.

Say you are a public investor, you can use a nowcasting model to understand a company’s quarterly performance, and how this fits in with analysts’ earnings forecasts. This can give you a serious advantage to either go long or short, before the market reacts to the company’s official earnings report.

Like jobless claims, you can use web-traffic alternative data to build nowcasting models as a proxy for earnings reports.

For example, since the beginning of COVID-19 lockdowns, Similarweb’s web-traffic alternative data indicated a massive increase in traffic to web conferencing websites, such as Zoom, in near real-time.

To finish

As we surveyed the different applications of nowcasting, there is little doubt that the ability to identify shifts in real-time and to incorporate them into nowcasting models is immensely useful to investors.

Nowcasting FAQ

What is nowcasting used for?

To predict present, or very near future.

What is the difference between nowcasting and forecasting?

Nowcasting is a portmanteau of “now” and “forecasting,”. Forecasting focuses on the future.

Invest using the most insightful asset research

Leverage data used by 5,000+ companies to improve your strategy