Earnings Season: How to Leverage Stock Intelligence for Alpha

It’s Earnings Season! Does that mean presents? A bottle of wine? A puppy? A new car? Ooh, I know: alternative data. The kind that helps you surface the signals and insights needed to generate the alpha that drives your investment strategy forward. Whether you’re tracking stock performance or analyzing trends, alternative data can unlock the edge you’re looking for.

Recent surveys by leading research firms show that 98% of participants indicated that alternative data is crucial to boosting alpha (Deloitte), 77% already use two alternative data sources (AIMA), and 75% plan to increase budgets to purchase alternative data (Lowenstein).

So, the perfect gift… Similarweb Stock Intelligence, alternative digital data tailored for public market investors. It helps uncover new opportunities, track target companies, and conduct earnings forecasts— analyzing expected stock performance using digital data insights.

It’s everything you could want for earnings season and for those in-between periods, too.

Earnings season comes but 4 times a year

Tis the season. Companies start reporting earnings about two weeks into the start of every quarter. There is no official end to earnings season, but it does start winding down after about six weeks as these companies start the paperwork for next quarter’s earnings.

Earnings season is important to investors because it provides key financial information like revenue, profit, earnings per share, and an array of other pertinent metrics that provide key insights into a company’s performance and financial health. These investors and analysts then closely examine the numbers.

Some companies are scrutinized even more closely because they are thought to represent the overall health of the stock market.

The earnings season gift that is Stock Intelligence

Similarweb Stock Intelligence takes the best digital data and tailors it for investors, delivering accessible and actionable insights. The data includes:

- Sector intelligence: Comprehensive coverage across Consumer, Ecommerce, SaaS, TMT, and Travel & Entertainment

- Web performance: Traffic & Engagement, Marketing Channels (web traffic sources), and Mobile Apps

- Client growth and performance: Web page level data (segments), tech stack data (technographics), and website structure data (subdomains & folders); and

- Top line tracking: Backtested models, built by a team of internal analysts, with proven accuracy

With this, investors gain a 360-degree analysis of every target company’s digital landscape.

Custom Web Traffic Heatmaps

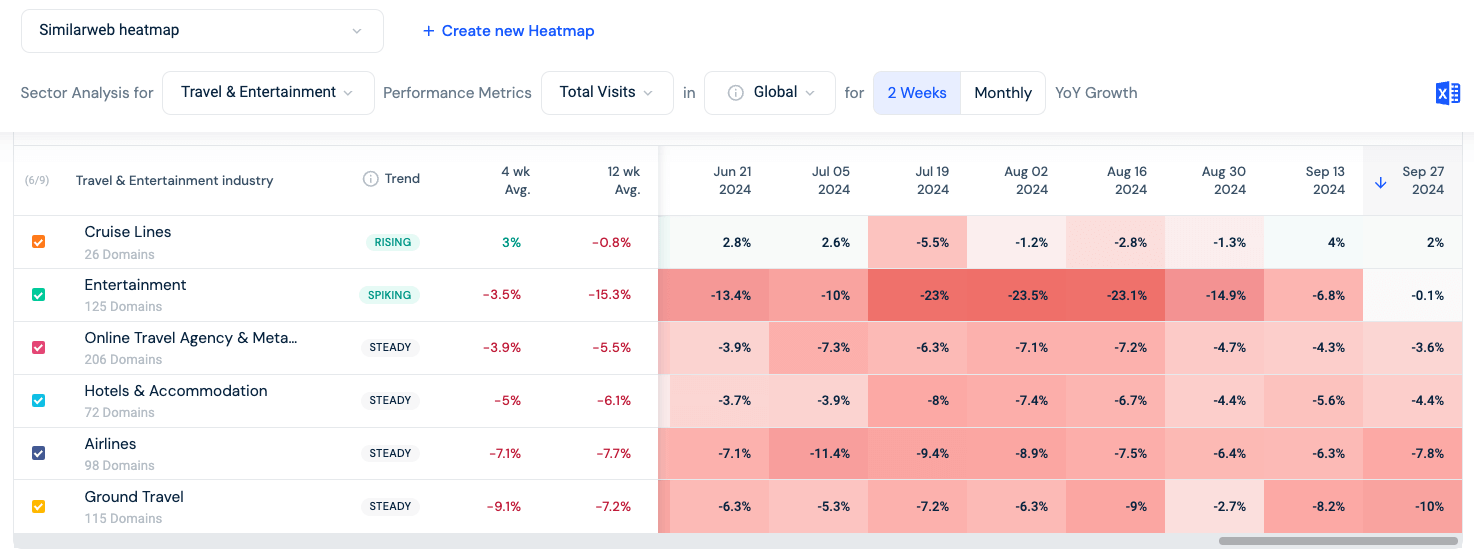

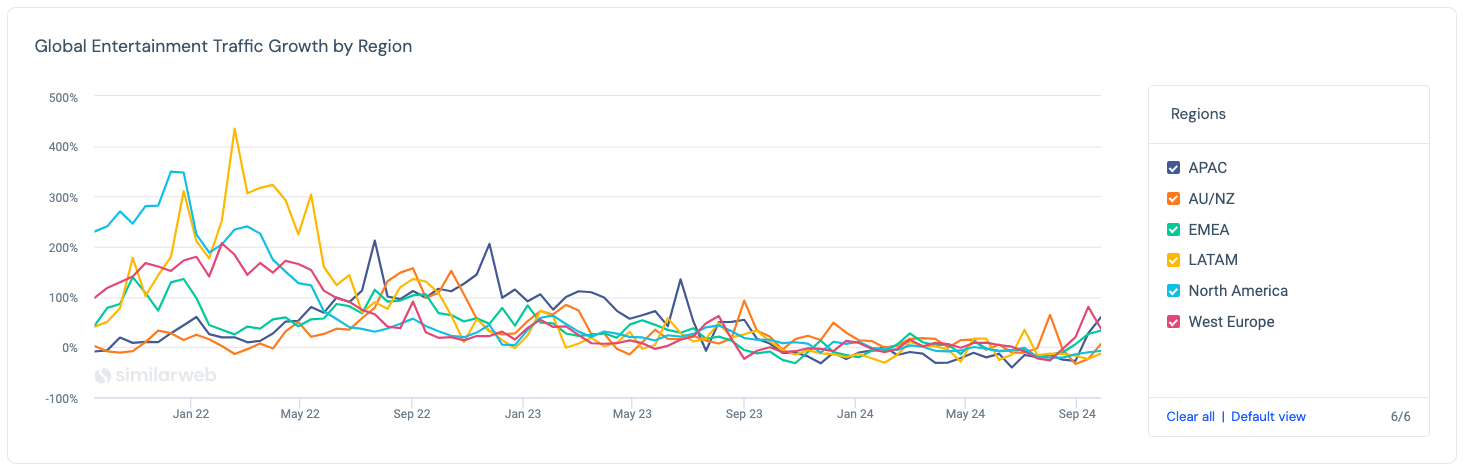

Sector macro trends are essential for understanding how portfolio companies may perform over a given quarter and offer insights into what might feature in earnings reports. The “how” and “why” of consumer and business spending are key to this analysis. One way is to look at traffic to a sampling of websites across a selection of industries in a specific sector.

Stock Intelligence standard web traffic heatmaps cover millions of domains across 130 industries and 28 sectors, allowing investors to spot emerging trends quickly. The Travel & Entertainment sector is a good example.

Comparing 4- and 12-week trends, Entertainment industry traffic has surged by 11.8%, covering websites like Ticketmaster, Live Nation, Eventbrite, StubHub, SeatGeek, and AXS.

Are these companies not in line with your investment strategy? Don’t worry. Heatmaps are the gift that keeps on giving. Build a custom heatmap to track your portfolio and explore new opportunities, leveraging alternative data for investment decisions.

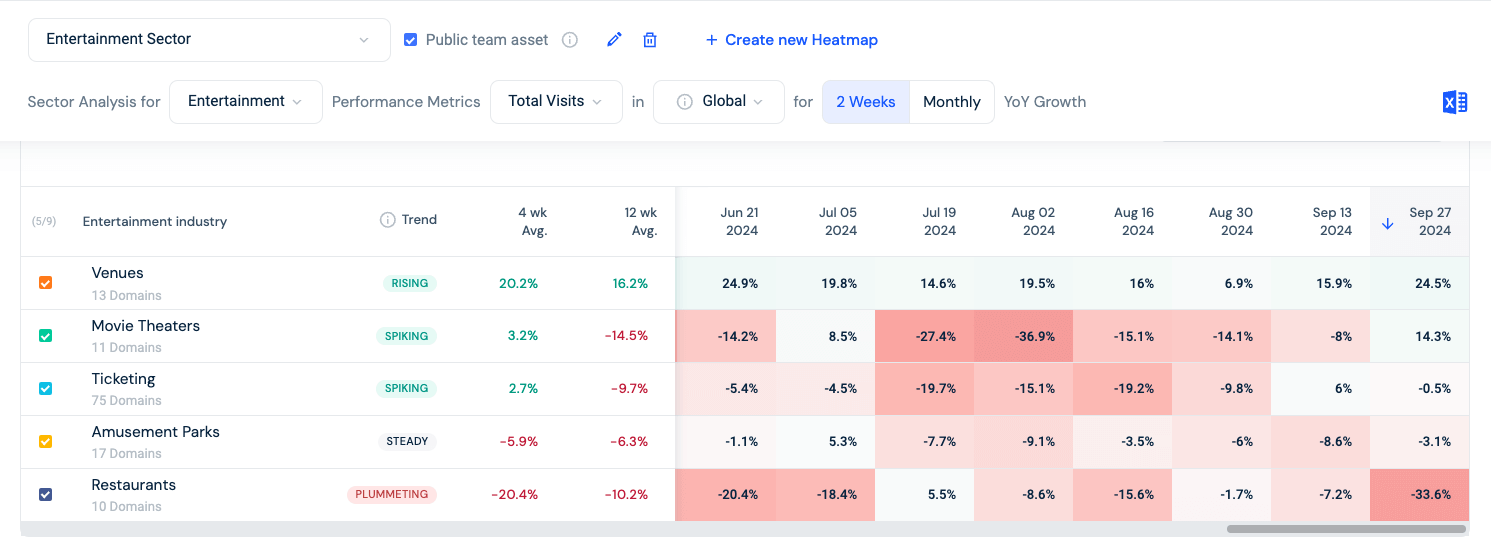

With a tailored heatmap, you can treat Entertainment as its own sector and add industries like event ticketing, amusement parks, movie theaters, restaurants, and venues—whatever suits your strategy.

Based on selected domains, global traffic for Movie Theaters and Ticketing has risen by 22.3% and 6.5%, respectively, over the recent two-week period. In entertainment, consumer interest is clear, especially compared to restaurant traffic, which is down 26.4% during the same period.

This is just the beginning of sector analysis. You can track each industry by:

- Region: APAC, EMEA, LATAM, AU/NZ, North America, and Western Europe

- Domain: See which domains account for the majority of the traffic in the sector

- Granularity: Display two weeks vs. one month with 4- and 12-week visit averages and three years of history

Need to incorporate the data into standing reports? Downloadable Excel files are at the ready.

Mobile app data

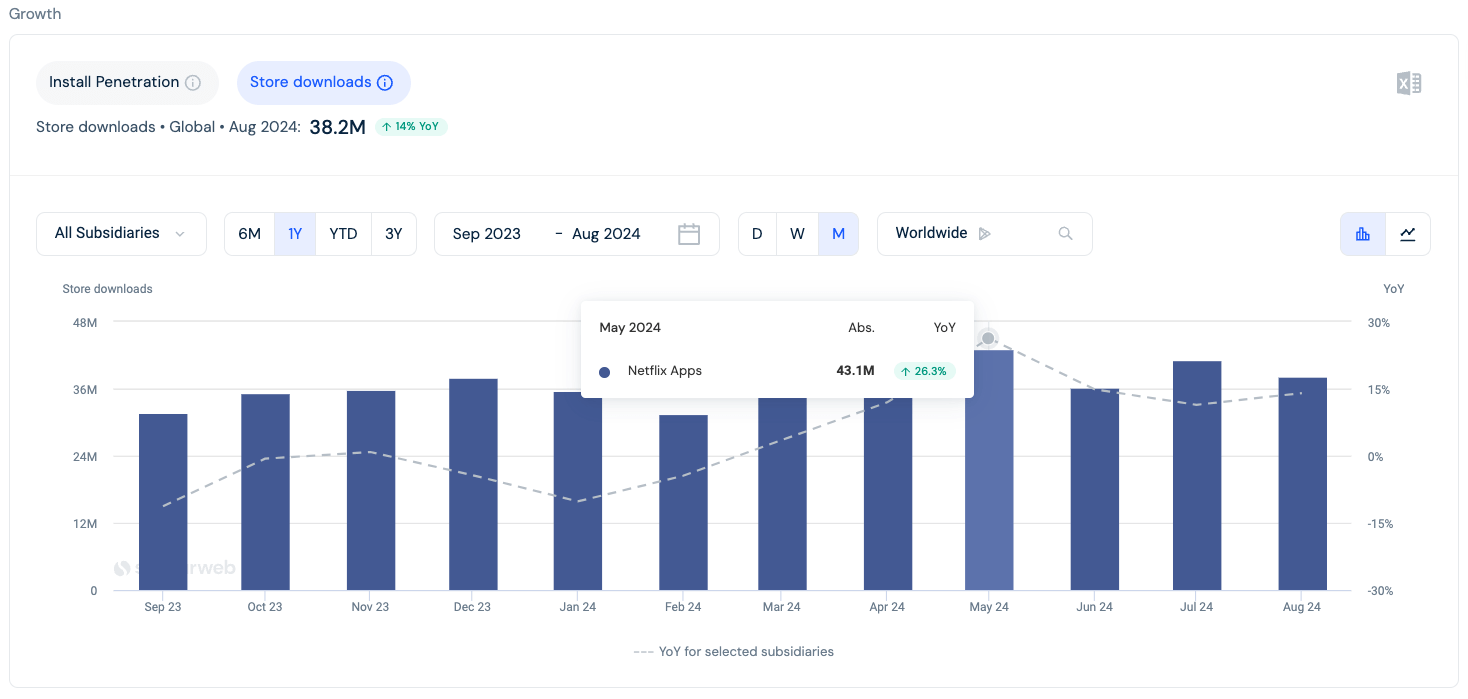

Apple’s App Store launched in 2008, and by 2009, the tech giant coined the phrase, “There’s an app for that.” Today, mobile apps have transformed business operations, often driving revenue growth. Without mobile app data, you miss out on a complete view of a company’s performance, leaving gaps in your analysis. That’s why this data is included in Stock Intelligence.

Our mobile app data comes from the two largest app stores: Google and Apple. The metrics are divided into three key categories:

Growth

- Install Penetration (average market penetration rate across devices in a defined market)

- Store downloads

Why is this important? Tracking new app growth can help predict a company’s actual growth versus what’s reflected in app stores.

Engagement

- Daily Active Users (DAUs)

- Weekly Active Users (WAUs)

- Monthly Active Users (MAUs)

Why is this important? Tracking DAUs and WAUs helps anticipate a company’s performance before its earnings report.

Usage

- Sessions per user

- Average session time

- Total session time

Why is this important? Tracking usage metrics provides a clearer view of user engagement, helping predict revenue trends before official earnings reports.

That’s a considerable amount of data you can track. Here’s a data-backed example of how it works:

Over the course of a year, unique visits to netflix.com were between 233M and 257M each month. During that same time frame, app downloads were positive year-over-year (YoY) over the last 6 months. May 2024 was up 26.3% YoY, and August 2024 was up 14% YoY.

Globally, aside from slight increases in February, April, and June, app installation was down YoY over the last 12 months, reaching its low in August 2024, down 2.4% YoY. You can take the analysis a step further and look at Install Penetration regionally during August 2024:

- Japan: 📈 up 1.1% YoY

- India: 📉 down 2.3% YoY

- Mexico: 📈 up 1.6% YoY

- UK: 📉 down 2.9% YoY

- US: 📉 down 3.5% YoY

The company reported an increase of 8M subscribers in 2Q24 and could post a similar result in 3Q24.

EasyDash

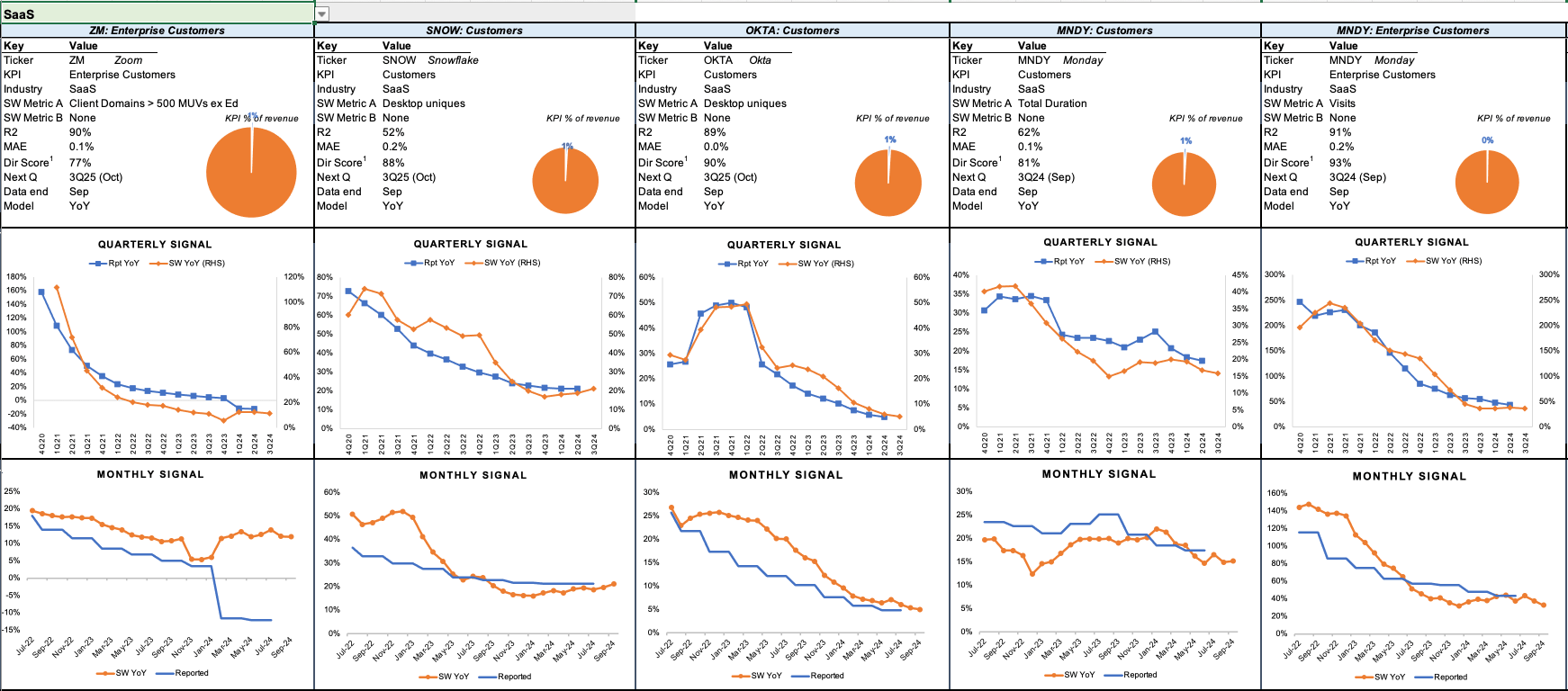

Stock Intelligence covers over 200 tickers with built-in signals, curated based on digital datasets that strongly correlate with reported KPIs and earnings. Each ticker has a detailed dashboard, and now there’s a unified dashboard called EasyDash, updated monthly.

This dashboard offers top-line tracking with ready-to-use, backtested models, boasting an average R2 of 96%. You can access curated signals that indicate what happened during the current quarter and forecast what will happen next quarter by filtering through options for trending data, consensus magnitude, and industry-wide comparisons.

EasyDash has five different views:

- KPI dashboard: View of a single KPI for the specified ticker

- Company KPI breakdown: View all the KPIs for the specified ticker

- Industry KPI breakdown: Displays all KPIs for a given industry

- Industry watch: Displays index trends within an industry segment and expected surprise for that KPI, rank-ordered

- Screener: Enables custom filtering for the entire universe of tracked KPIs

Within the KPI dashboard, company KPI breakdown, and Industry KPI breakdown, there are six signals:

- KPI

- Quarterly signal

- Monthly signal

- Acceleration/Deceleration Tracker

- Directional Tracker

- Backtested Growth Model

For each KPI, the Screener displays:

- Directional Call-Out and Confidence

- Variance Call-Out and Confidence

- Index Trend ( 3 vs. 6 months)

- Next 3 months’ comps

- R2

- Mean Absolute Error (MAE)

- Beat/Miss score

- Stock Runup

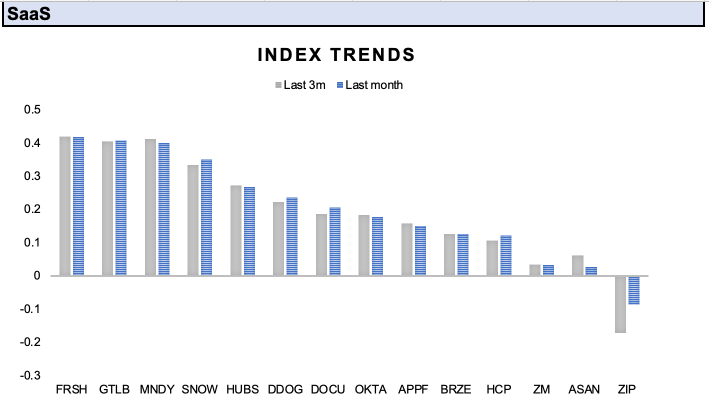

All of that data in a single dashboard. Let’s use the SaaS sector as an example to see how it works.

Snowflake (SNOW), the cloud-based data warehouse and platform that helps businesses store, analyze, and share data, has three KPIs tracked by Stock Intelligence by specific metrics that indicate performance:

- Product Revenue ↔️ Desktop Unique Visits

- Customers ↔️ Desktop Unique Visits

- Remaining Performance Obligation ↔️ Aggregate Duration

Each of these KPIs represents a percentage of the company’s revenue, and you can track monthly and quarterly performance.

Since the beginning of 2023, the Similarweb Signal has tracked in line with SNOW’s reported numbers:

- Monthly Signal: The reported Product Revenue KPI in July 2024 was up 30% YoY, and the Similarweb Signal, tracking Desktop Unique Visits, was up 32%

- Quarterly Signal: The reported Product Revenue KPI and the Similarweb Signal tracking Desktop Unique Visits were even, up 30% YoY in 2Q24.

Do you want to know how SNOW compares to its competitors? No problem. This is built into EasyDash for ease of analysis.

Over recent quarters, neither Zoom (ZM), Okta (OKTA), or Monday (MNDY), saw a dramatic increase or decrease in its current customer engagement with their websites. SNOW, however, did see a slight uptick in usage in 3Q24, where the others stayed relatively stable.

The Similarweb Index, comparing the most recent month with the last three months, dives into how SNOW has performed against other big names in the SaaS sector and reveals current sector trends.

A gift that keeps on giving

Earnings season brings a wave of revenue numbers, performance data, management outlooks, and next-quarter projections. This information is crucial for understanding sector trends and analyzing company performance. Add Stock Intelligence to the mix, and you gain access to unique insights powered by built-in signals, Similarweb backtested models, and industry trends – perfect for generating the alpha that will elevate your investment strategy.

What more could you ask for? The answer is nothing (though who wouldn’t love a puppy).

Happy Earnings Season!

Ready to get more out of your investment analysis? Similarweb Stock Intelligence delivers the insights you need to stay ahead during earnings season.

FAQs

What is earnings season?

Earnings season is the time each quarter when publicly traded companies release their earnings reports.

When is earnings season?

Earnings season usually begins two weeks after the start of the new quarter. There is no specific end date, but most companies will report within the first six weeks to start preparing for next quarter.

How can investors use Stock Intelligence during earnings season?

Public market investors leverage Stock Intelligence to uncover new opportunities, monitor target companies, and forecast stock performance.

3 Sources

- Dannemiller, D., Bhuta, M., Wilkinson, J., & Motiani, M. (2023, November 23). Fueled by better information: Why investment management should embrace alternative data. Deloitte Insights. https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2023/embracing-alternative-data-for-investment-decisions.html

- Aima. (n.d.). Casting the net. https://www.aima.org/educate/aima-research/casting-the-net.html

- Alternative Data is Now Mainstream; AI Could Be Next: A Special Report from Lowenstein Sandler’s Investment Management Group. (2024, March 6). Lowenstein Sandler. https://www.lowenstein.com/news-insights/firm-news/alternative-data-is-now-mainstream-ai-could-be-next-a-special-report-from-lowenstein-sandler-s-investment-management-group

Invest using the most insightful asset research

Leverage data used by 5,000+ companies to improve your strategy