Cruise Lines Show Strong Digital Growth and Momentum

Overall, traffic to cruise websites is up 9% year-over-year and 32% from pre-pandemic levels – MSC, Virgin, and NCL show the strongest sustained growth

Cruise vacations have been growing in popularity and in digital engagement for cruise line websites. Cruise passengers often book over the phone, rather than online, but they plan, research, and dream about future voyages online, making web engagement a leading indicator of where business is headed.

Key takeaways

- In October, most cruise domains gained worldwide traffic on a year-over-year basis, with msccruisesusa.com up 60.4% and virginvoyages.com up 58%, according to Similarweb estimates. However, the flagship sites of two leading cruise companies, Carnival and Royal Caribbean, were down: carnival.com (-5.2%) and royalcaribbean.com (-9.2%). That might be just a tough comparison with last year, when both showed strong gains (royalcaribbean.com +57% and carnival.com +44%).

- Using a trailing 12-month analysis – the total of the last 12 months of traffic versus the prior year – we see more sustained growth across the major brands. For their aggregated domains, Norwegian Cruise Lines is up 43.9%, Royal Caribbean is up 27%, and Carnival Cruise Lines is up 18.9%. Smaller but fast-growing and budget-friendly MSC Cruises nearly doubled its traffic, with a 96.5% increase.

- For individual cruise websites, trailing 12 months analysis shows Norwegian Cruise Lines’ ncl.com up 47.2%, royalcarribean.com up 20.2% and carnival.com up 9%. Smaller brands still posted stronger growth, for example msccruisesusa.com up 114% and virginvoyages.com up 89.6%.

- In aggregate, across 14 cruise domains studied, traffic is up 29.8% over the trailing 12-month period and 32.2% compared with October 2018, before the challenges of the pandemic.

The October figures quoted in this report are preliminary estimates, based on 30 days of web traffic records.

Best sustained digital growth: MSC, Virgin, and NCL

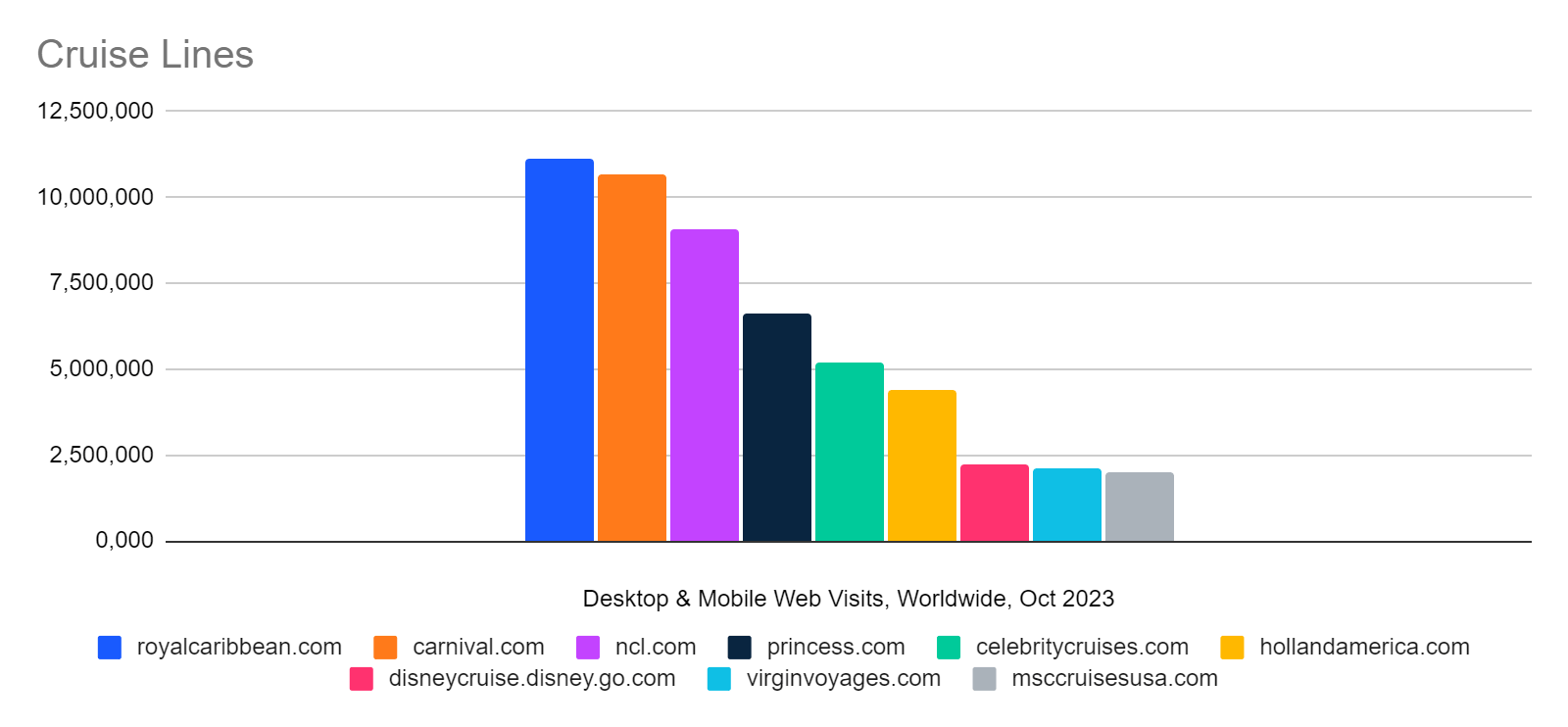

In October, royalcaribbean.com and carnival.com had the most worldwide traffic, but were down year-over-year while other brands (including smaller properties of those companies like Royal Caribbean’s celebritycruises.com) were demonstrating greater growth.

The digital growth chart below is almost a mirror image of the ranking by size, with MSC, Virgin, and Celebrity in the lead, and NCL also up 22.5% year-over-year. For this ranking, we’ve excluded some of the smaller brands showing a large percentage growth from a small base (like Carnival’s aida.com boutique brand, up nearly 1,000% year-over-year).

If we zoom out to look at the longer-term trend, MSC, Virgin, and NCL are the growth leaders, followed by Celebrity and Princess.

Across multiple brands, MSC, NCL, and Royal Caribbean are the fastest growing by digital engagement

While the individual cruise line websites have their own brand identities, we also looked at how they add up into the digital presence of the big cruise line companies. Carnival is the biggest if we aggregate all its many brand websites (including princess.com, hollandamerica.com, cunard.com, seabourn.com, costacruises.com, and aida.com), but NCL is growing faster among the major cruise operators and MSC is coming on fast.

MSC nearly doubled its traffic, according to our trailing 12-month analysis, while NCL is up 44%, Royal Caribbean is up 27%, and Carnival is up 19%. Aggregated traffic to 14 top cruise line domains we examined was up nearly 30% over the period.

MSC and Virgin growing fastest in the US

MSC Cruises, which operates in the US primarily through the msccruisesusa.com domain, is the growth leader in the US, followed by Virgin Voyages, and Celebrity, up more than 100% in our trailing 12-month analysis. In part, this is a factor of smaller websites having more room to grow.

Grouped tightly together in the next tier down are celebritycruises.com (+51.6%), ncl.com (+47.4%), and princess.com (+43.6%).

Celebrity is growing into a major brand under the Royal Caribbean banner, while Virgin and MSC are still working to establish themselves at the lower end of the rankings. Meanwhile, Carnival’s venerable Princess brand demonstrates a strong combination of scale and growth, as does NCL.

Back above pre-pandemic levels, overall

If we compare October 2023 with October 2018 – five years ago and before the shocks of the pandemic – traffic is up about 30%, overall, with Royal Caribbean showing the strongest growth among the major brands over that time period, up 81.5%. The small but growing MSC Cruises grew traffic to its two main domains by more than 200% over the same period.

However, this is one comparison where Carnival does not look so strong, with traffic to the websites of its brands down 2.4%.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!