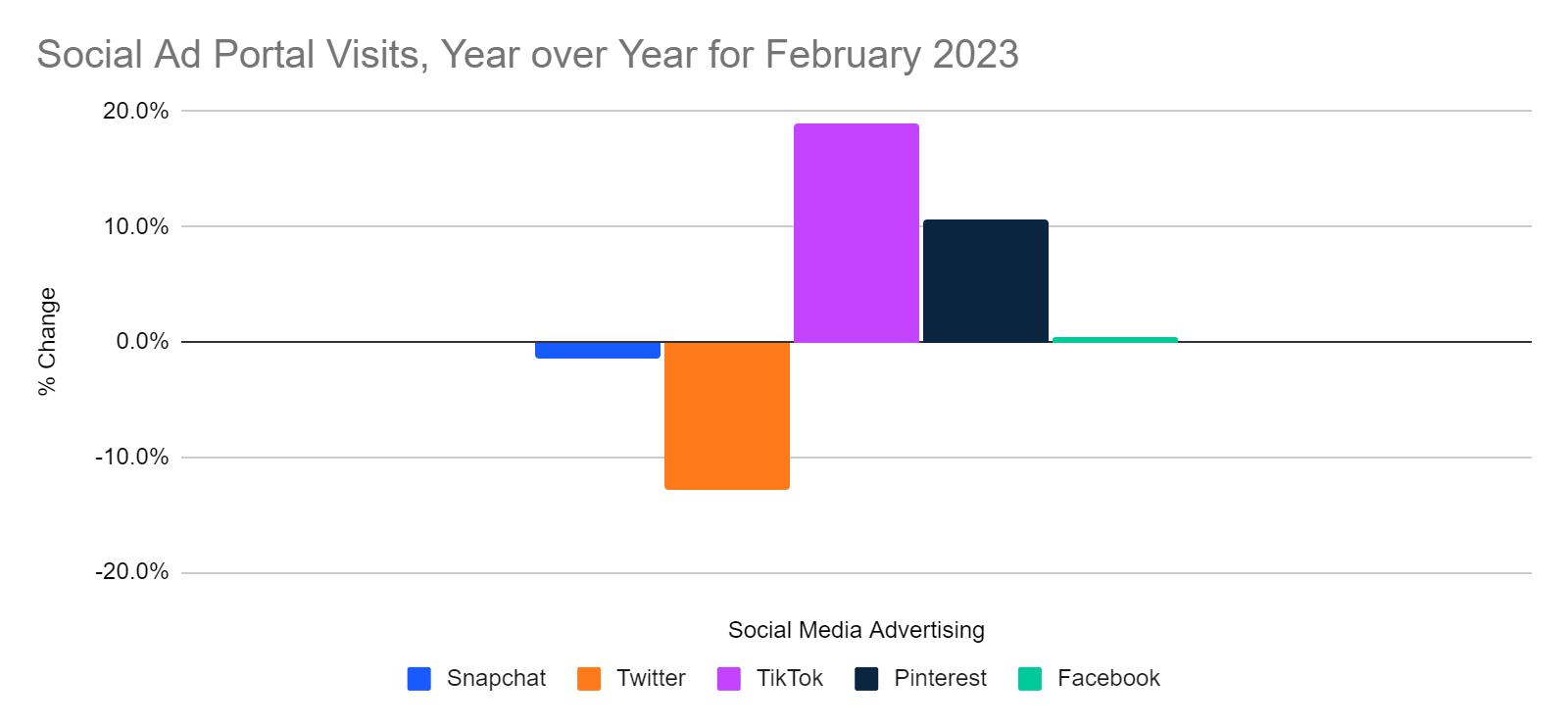

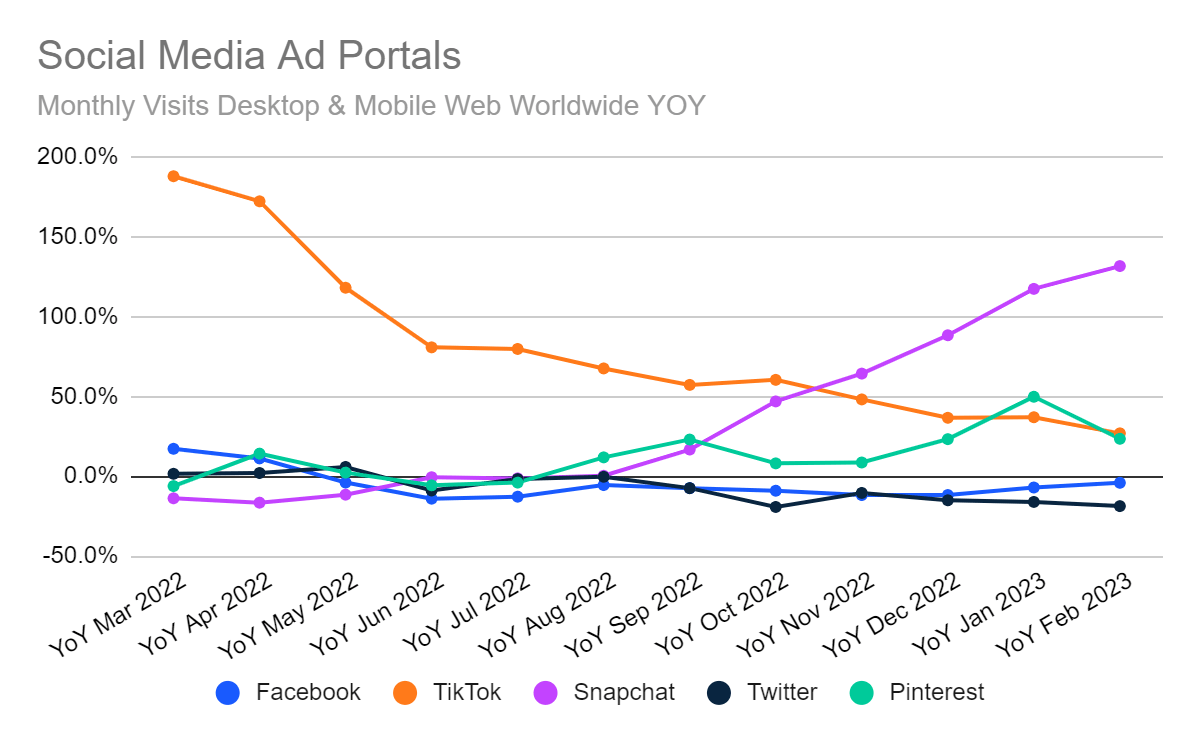

TikTok’s February Ad Buying Traffic Up 18.9% Year-over-Year

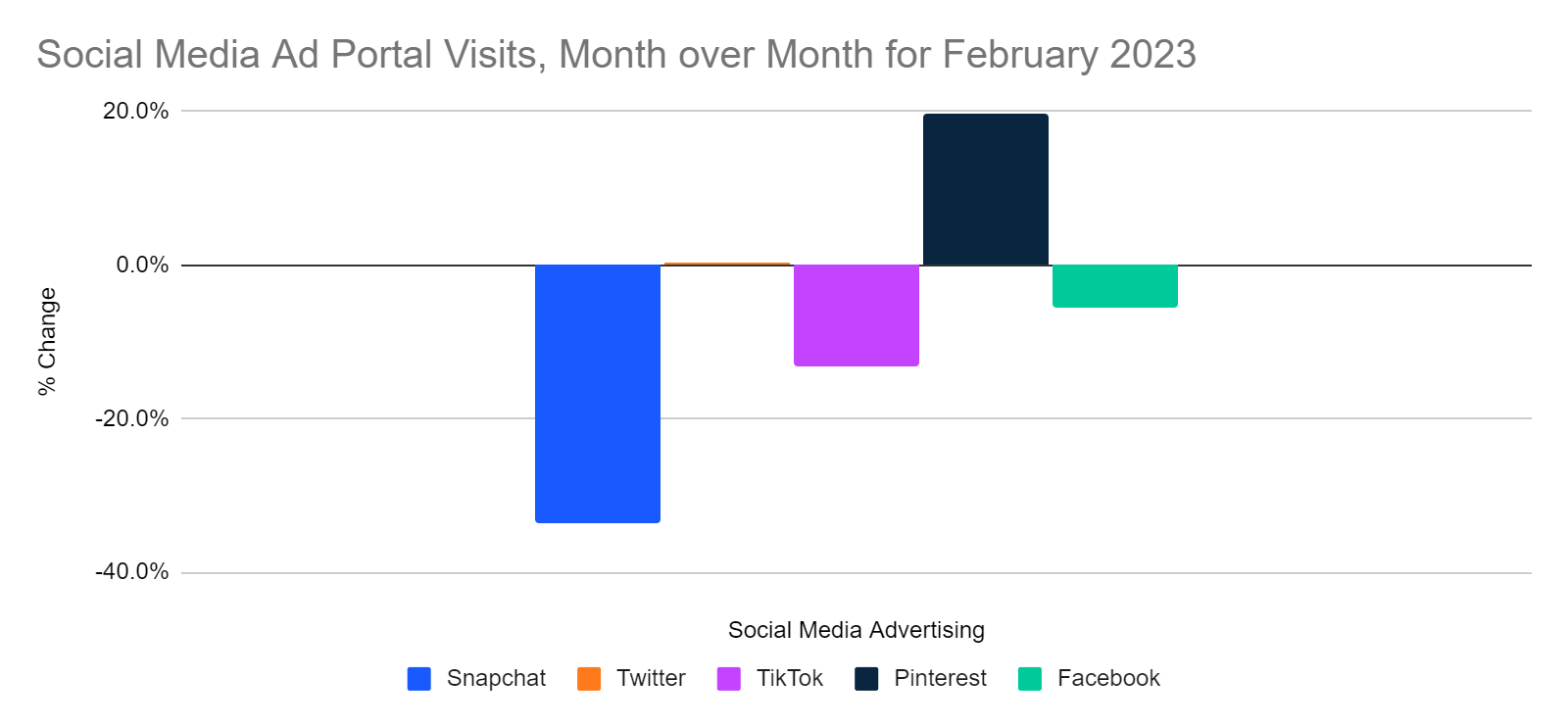

Social media ad market update for February 2023 finds Pinterest also gained, with traffic to its ad portal up 10.7% year-over-year and up 19.7% from January.

TikTok remains a growth machine in both total traffic and advertiser interest, while Pinterest is also showing renewed strength.

Key takeaways

- Total visits from within the United States to the TikTok ads portal were up 18.9% year-over-year, although actually down 13.3% from January.

- Pinterest also gained, with traffic to its ads portal, up 10.7% year-over-year and up 19.7% from January.

- Twitter continued to see erosion in advertiser interest, with visits to its ads portal down 12.9% year over year and essentially flat from where they were in January.

We follow traffic to these ad portals as indicators of momentum for social media companies.

TikTok showed the biggest year-over-year gain

TikTok and Pinterest grew, and Twitter fell, with Facebook and Snapchat showing little movement.

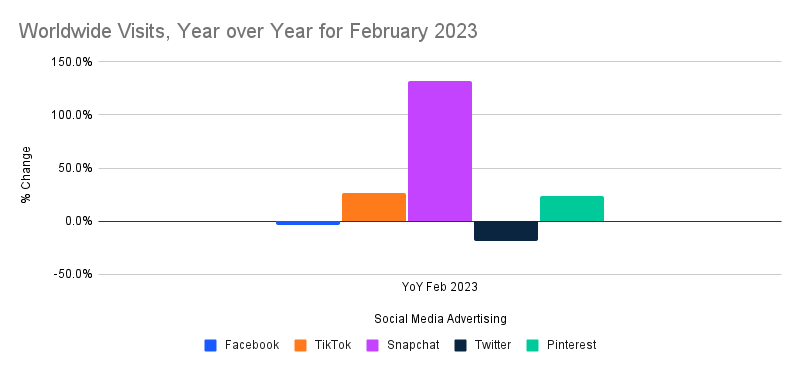

However, although the US market is very important, on a worldwide basis the results look different. Snapchat shows a 131% year-over-year gain, with TikTok and Pinterest showing smaller percentage gains.

The month-over-month comparison makes Pinterest look the best, Snapchat the worst

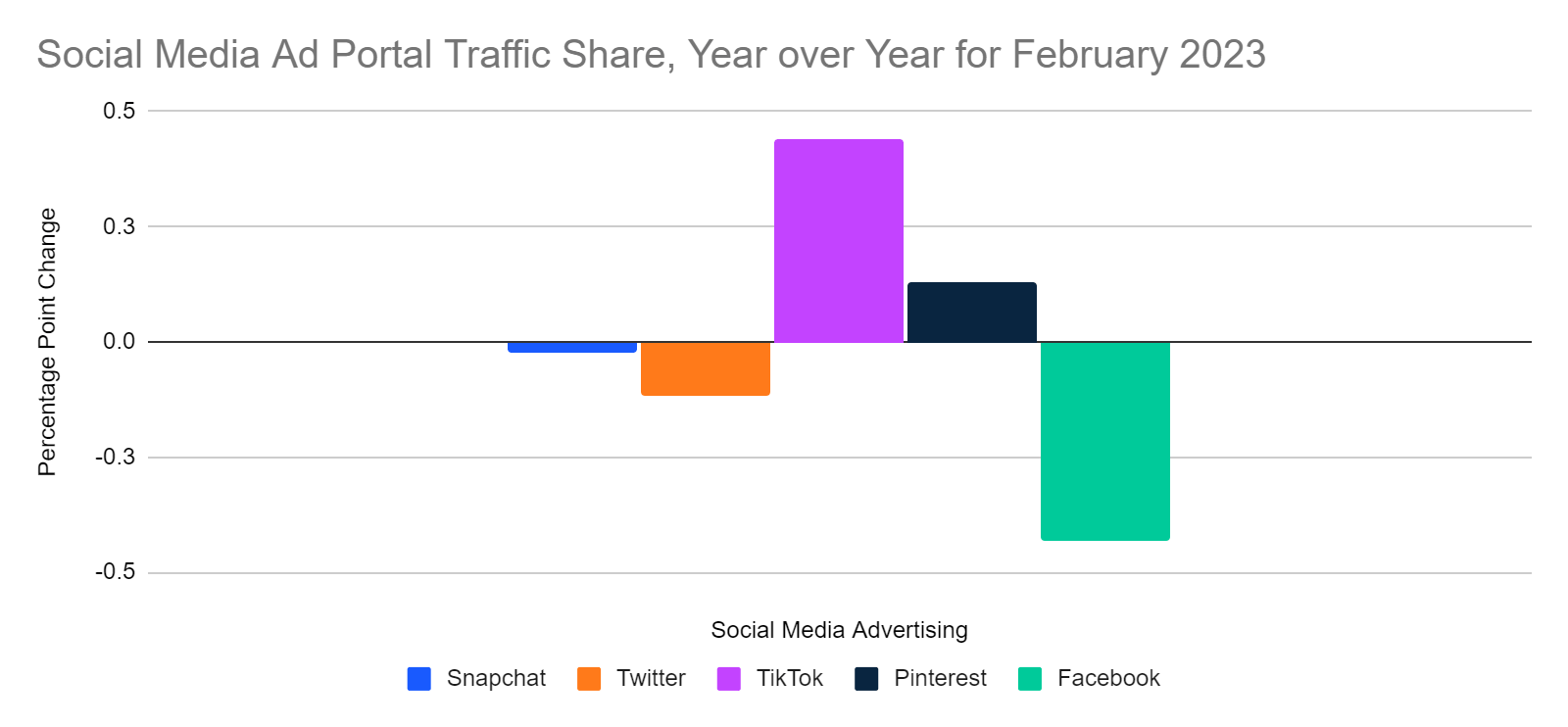

TikTok’s share of traffic grew incrementally

Within this competitive set, TikTok claimed a slightly bigger share of traffic, up four-tenths of a percentage point.

TikTok is no longer growing as fast as it once did

As recently as January 2022, TikTok was seeing year-over-year gains in traffic to its ad portal of nearly 200%. It’s no longer growing quite as fast, but its ad portal now ranks #2 – albeit a distant second – to Facebook’s ads and business service portal, which attracted 27.4 million visits in February, compared with about 848,000 for ads.tiktok.com. TikTok now attracts about twice as much ad buyer traffic as Snapchat and four times as much as Twitter.

The comparison with Facebook isn’t quite apples-to-apples, given that Facebook’s portal is also used by brands for organic social posts and for ads on other Meta Platforms Inc. properties like Instagram, not just Facebook.

Public companies mentioned in this report include Meta Platforms Inc. (NASDAQ: META), Pinterest Inc. (NYSE: PINS), and Snapchat parent Snap Inc. (NYSE: SNAP).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Photo by Aditya Chinchure on Unsplash

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!