Temu: Analyzing Europe’s Ecommerce Rising Star

Temu launched in Europe during a highly opportune time. Rising inflation across the continent, fueled by global conflicts, drove consumers to seek out the lowest prices possible

Temu capitalized on this trend by offering deeply discounted goods, quickly establishing itself as a major player in the European market. However, whether Temu can maintain its momentum in the long term remains uncertain.

Disrupting the status quo

Temu’s launch was a major success across Europe

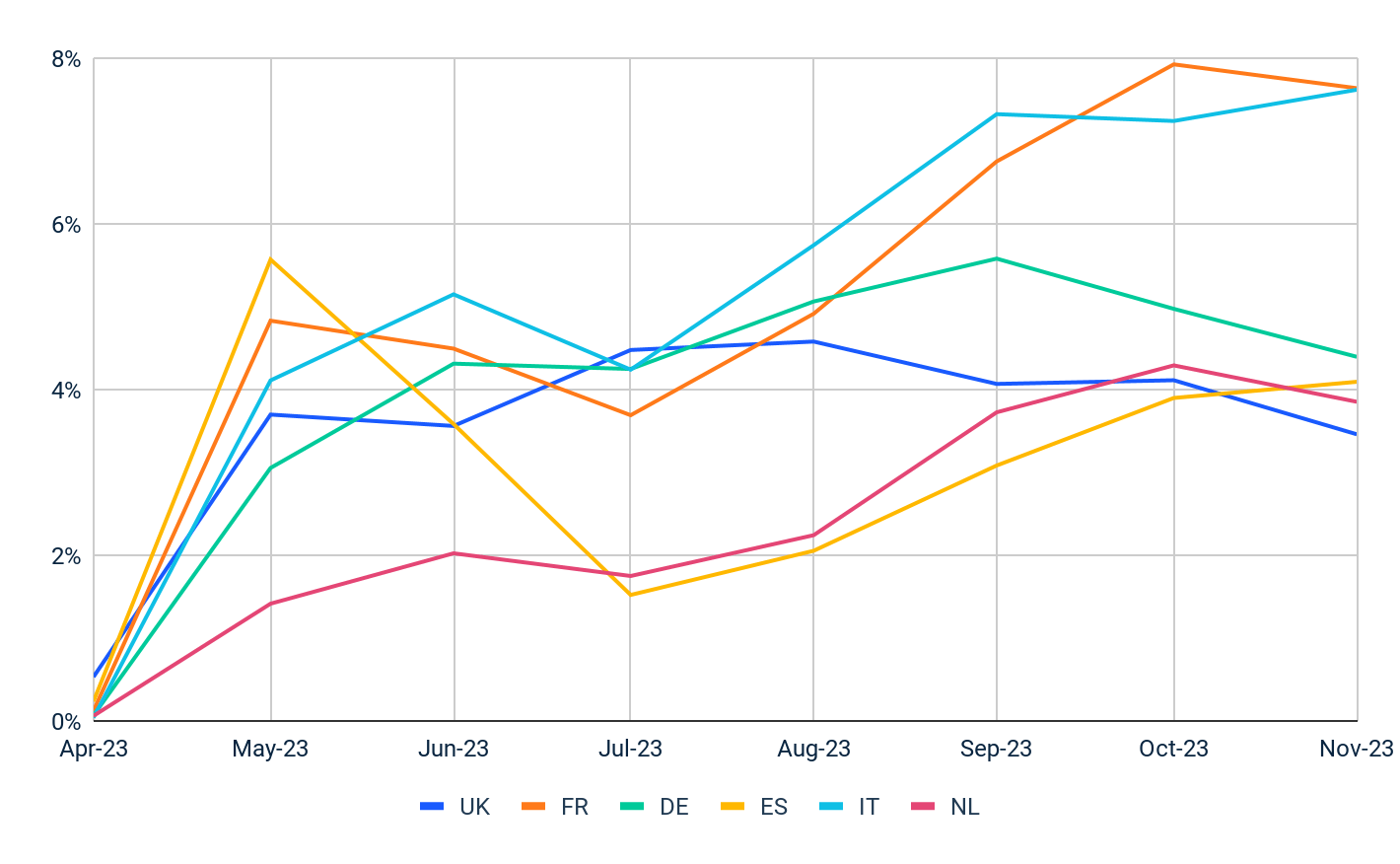

Commanding significant share in the opening months of its launch, Temu’s traffic share is showing signs of stabilizing in some markets. It will be interesting to see how this plays out in the coming months – if investment into customer acquisition continues or the focus switches to retention. However, the Chinese player continues to gain momentum in France and Italy, where Temu grabbed close to an 8% market share of the top 10 multi-category retailers.

Temu.com – Traffic Share of Top 10 Multi-category Retailers

Desktop & Mobile Web, Apr 23 – Nov 23

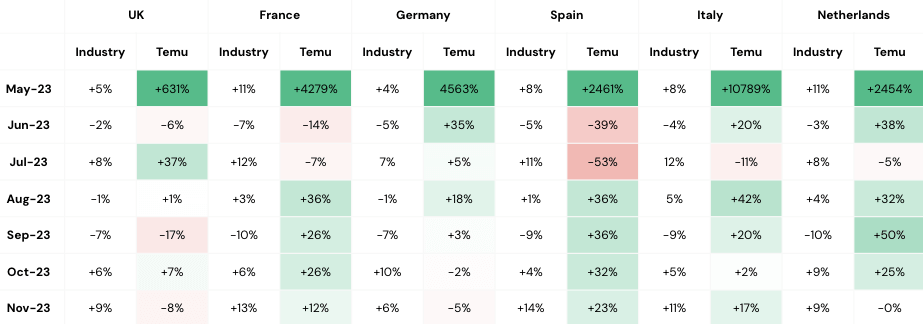

Since its launch towards the end of April, Temu’s traffic growth has shown little signs of slowing down, regularly outperforming the Marketplace industry

Visits MoM Growth – Marketplace Industry vs. Temu.com

Desktop & Mobile Web, May 23 – Nov 23

Owing to its success in the US market, Temu received some visits prior to official launch from curious consumers

Temu has made significant gains in all European markets in a short space of time

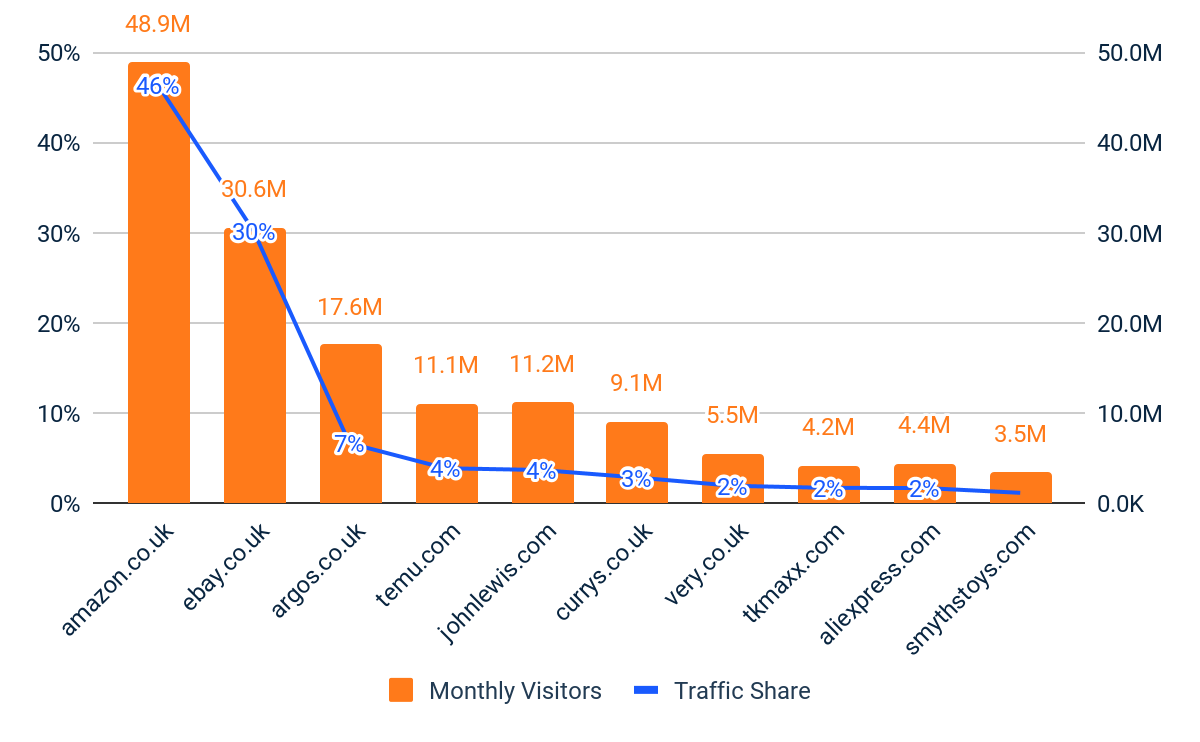

In both the UK and France, Temu has become one of the top 5 retailers:

-

- In the UK, Temu is on par with John Lewis, surpassing 11M monthly visitors

Top 10 Multi-category Retailers – Unique Visitors & Traffic Share – UK

Desktop & Mobile Web, Sep 23 – Nov 23

-

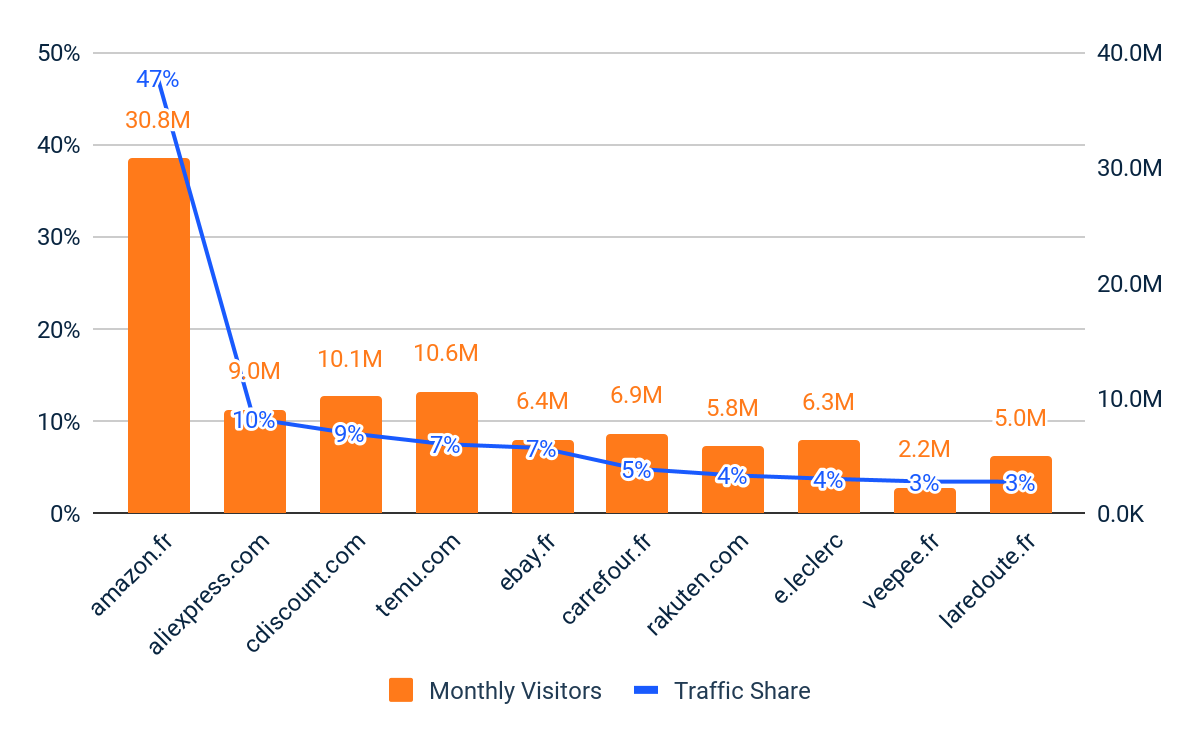

- In France, Temu commands more visitors but less traffic share than its rival AliExpress

Top 10 Multi-category Retailers – Unique Visitors & Traffic Share – France

Desktop & Mobile Web, Sep 23 – Nov 23

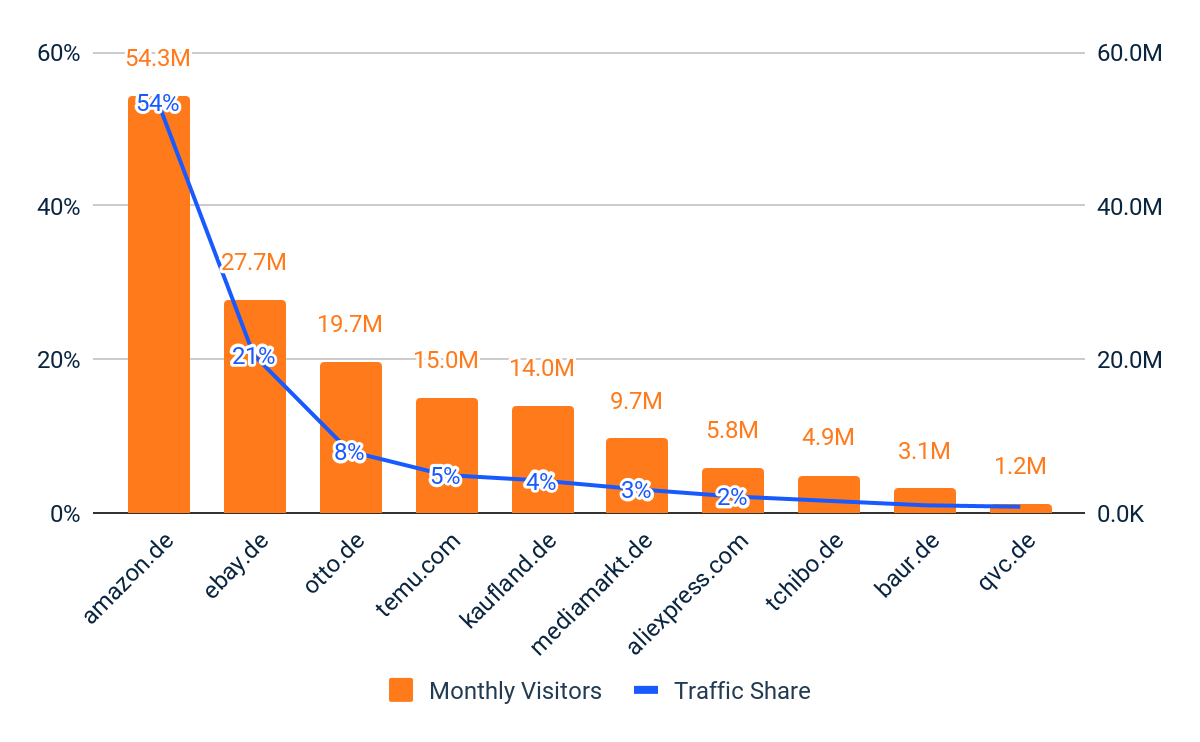

Temu has also broken into the top 5 in both Germany and Italy:

-

- In Germany, Temu has 15M monthly visitors, surpassing 5% traffic share

Top 10 Multi-category Retailers – Unique Visitors & Traffic Share – Germany

Desktop & Mobile Web, Sep 23 – Nov 23

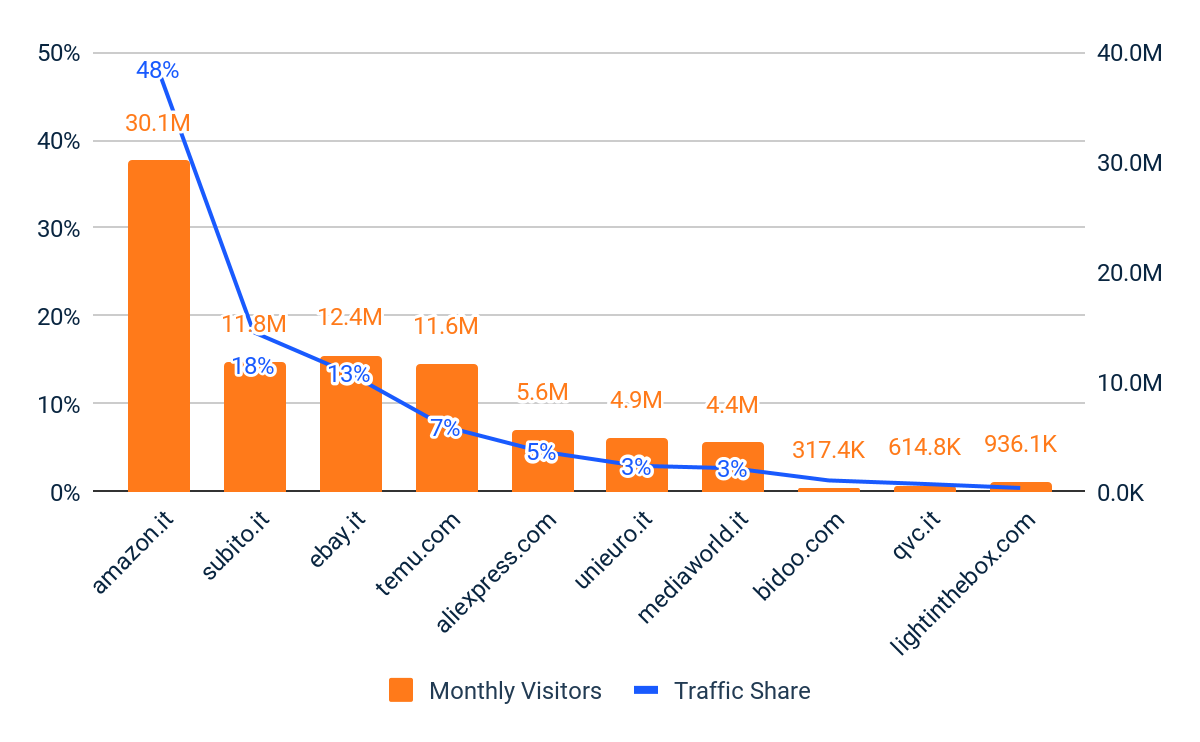

- While in Italy, Temu is in the midst of overtaking Subito and eBay in visitors

Top 10 Multi-category Retailers – Unique Visitors & Traffic Share – Italy

Desktop & Mobile Web, Sep 23 – Nov 23

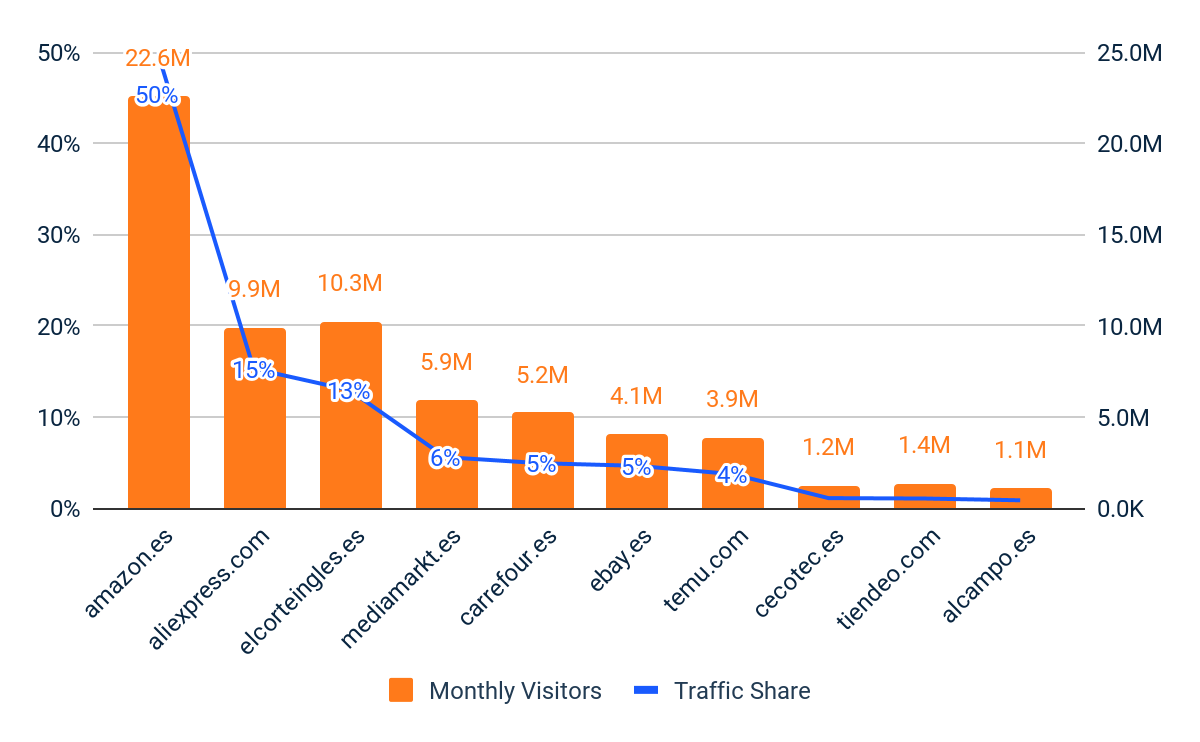

Meanwhile in Spain and the Netherlands, Temu still has retailers to surpass before they reach the top 5:

-

- In Spain, Temu is trailing behind AliExpress but has still made impressive ground

Top 10 Multi-category Retailers – Unique Visitors & Traffic Share – Spain

Desktop & Mobile Web, Sep 23 – Nov 23

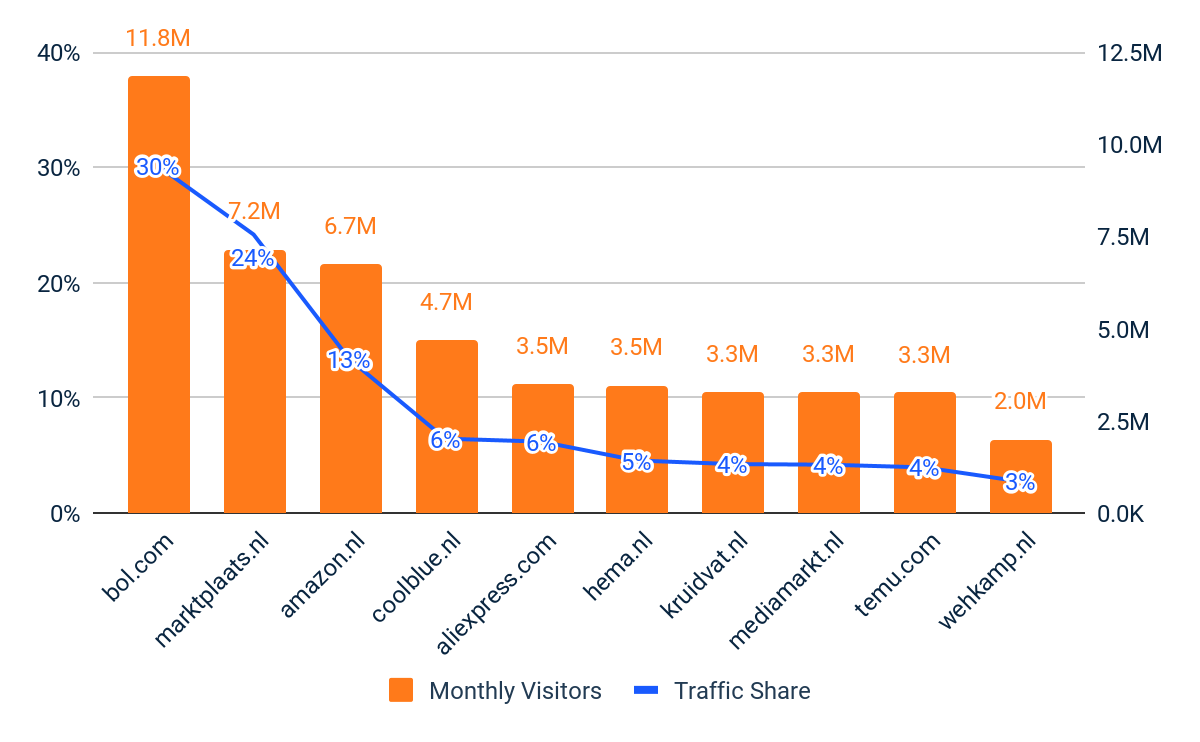

- In the Dutch market, Temu attracts similar engagement to big local brand Hema.

Top 10 Multi-category Retailers – Unique Visitors & Traffic Share – Netherlands

Desktop & Mobile Web, Sep 23 – Nov 23

An in-depth look at Temu’s performance in the UK

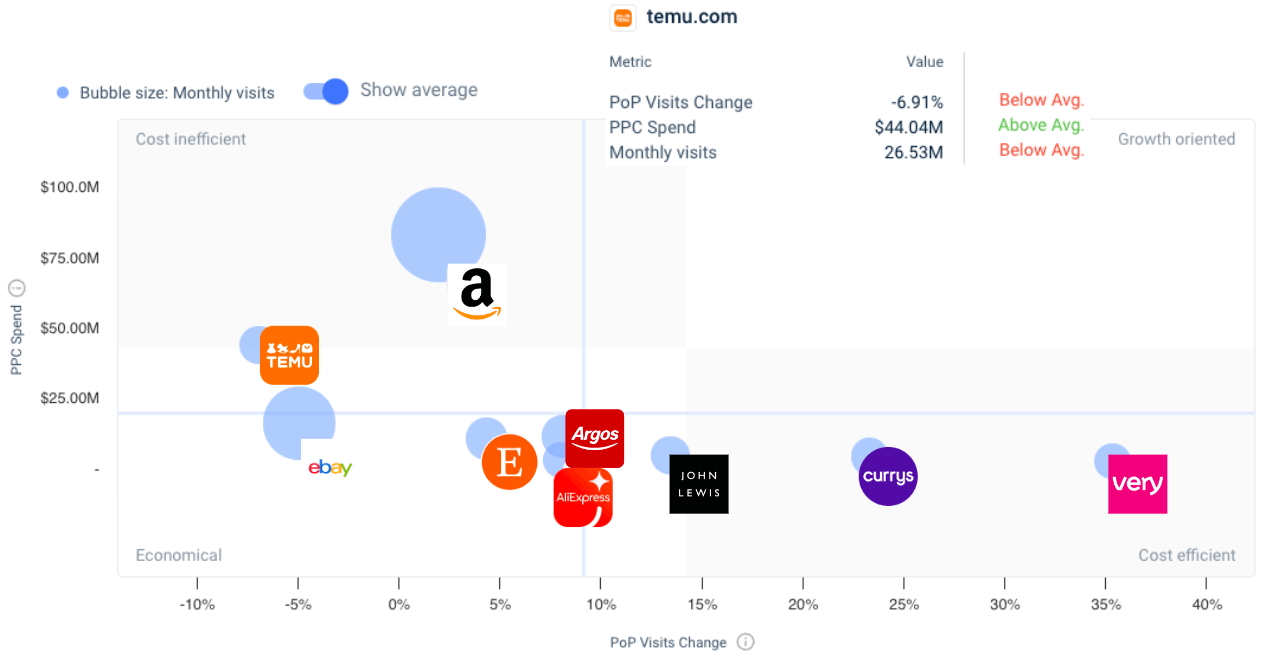

In its efforts to bring in new customers, Temu is spending significantly more on PPC in the UK than any competitor other than Amazon

Temu vs. Competitors – Cost Efficiency – UK

Desktop & Mobile Web, Sep 23 – Nov 23

This strategy is working, with Temu establishing itself in the UK market

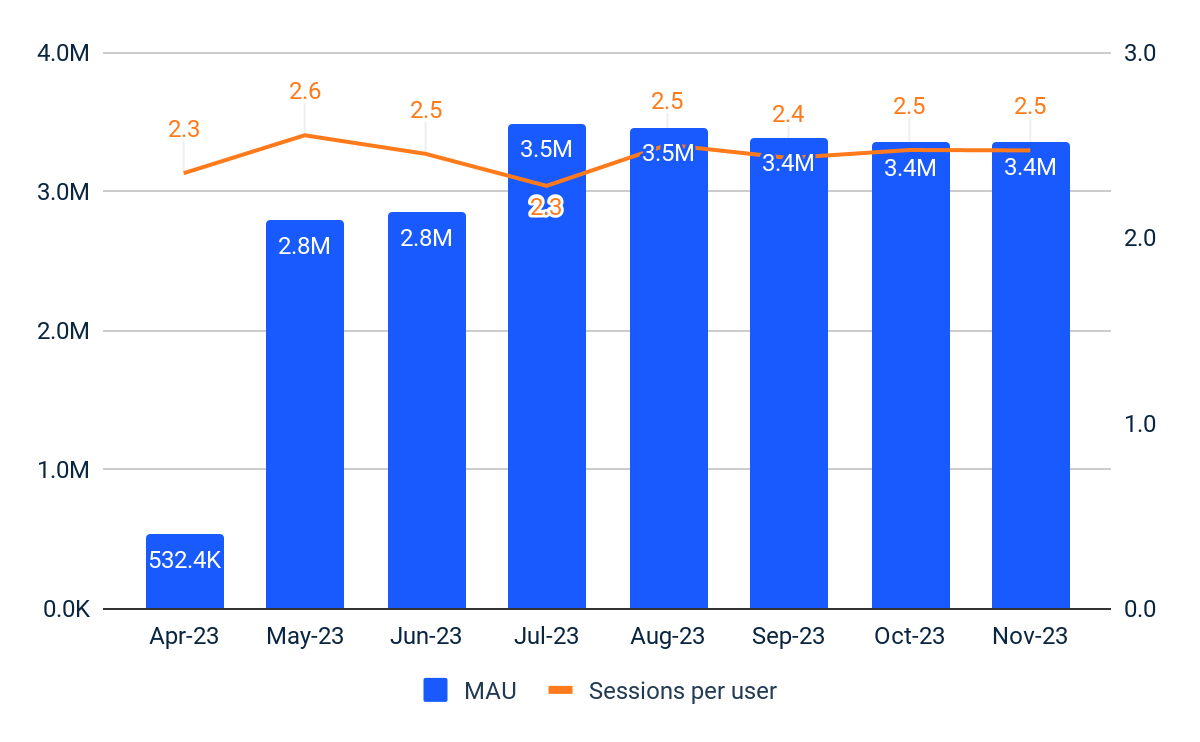

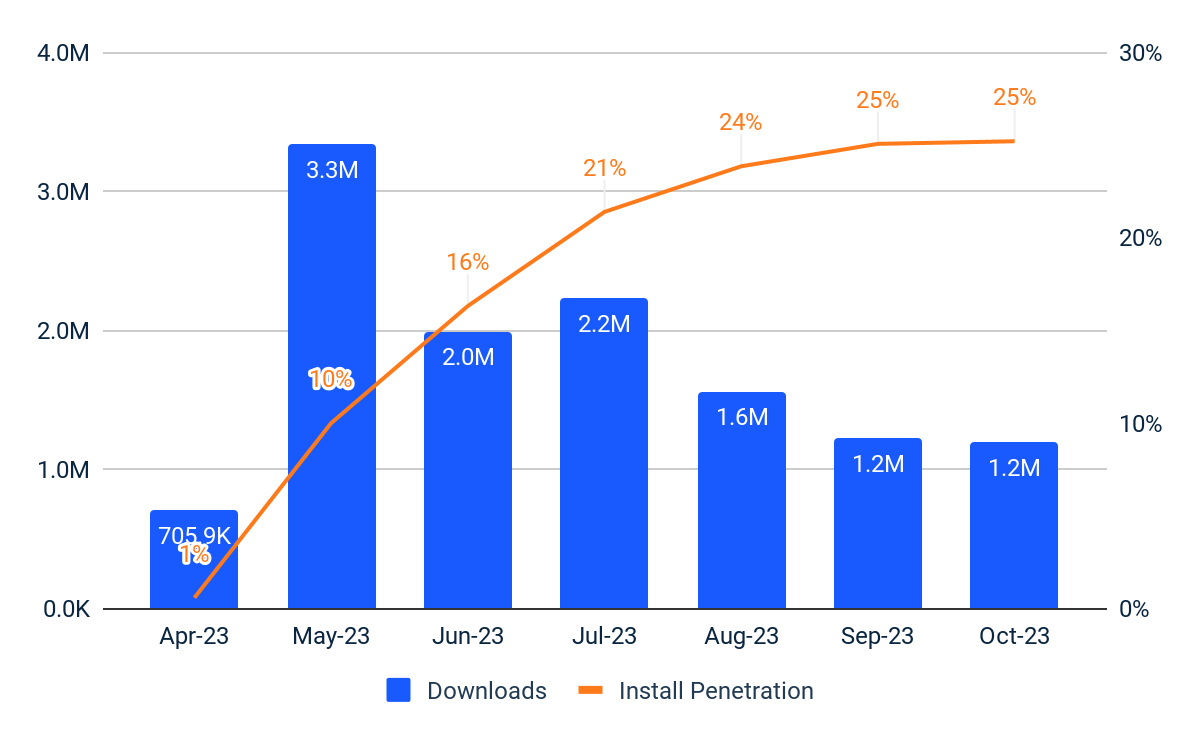

Having its app installed on 25% of all Android devices in the UK and seeing in excess of 1.2M downloads a month, Temu’s incredible launch shows little signs of slowing down and the company looks to secure itself as a major player in the UK. Engagement also remains stable, averaging around 2.4 sessions per user each month.

Temu – Monthly Active Users & Sessions Per User – UK

Android Devices, Apr 23 – Nov 23

Temu – Monthly App Downloads & Install Penetration – UK

Android Devices, Apr 23 – Nov 23

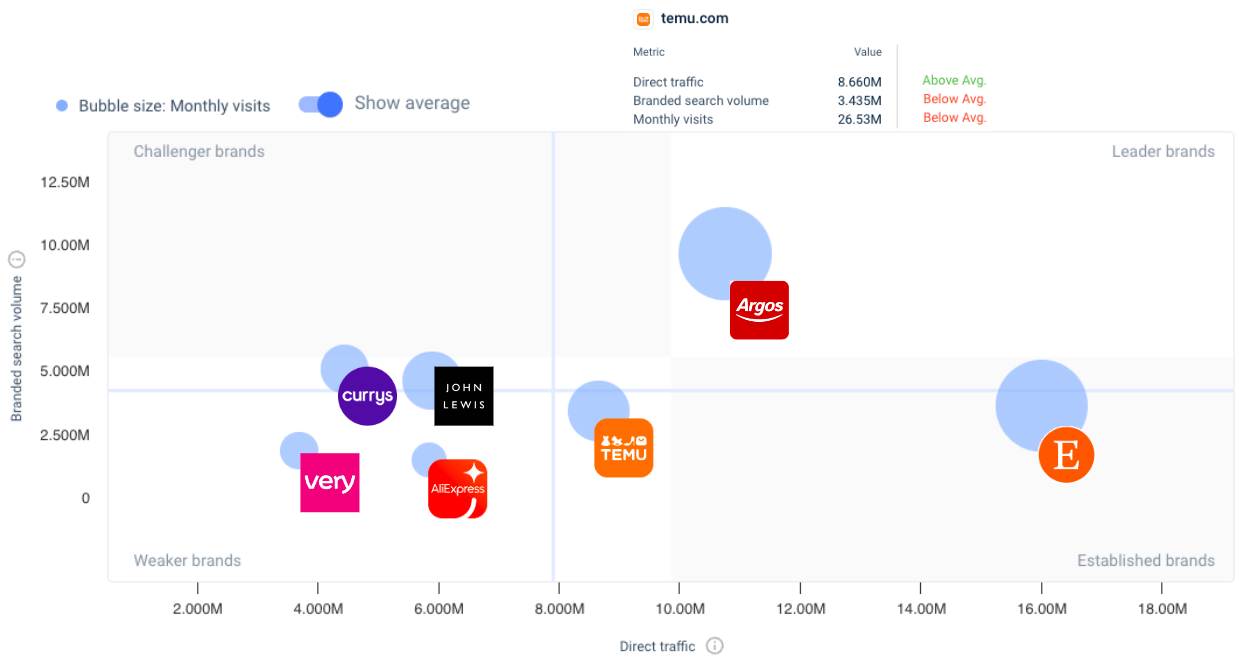

Temu’s brand strength is still weaker than that of eBay and Amazon

However, Temu sees more direct visits than established local players Currys and John Lewis, indicating a higher proportion of returning users

Temu vs. Competitors* – Brand Strength – UK

Desktop & Mobile Web, Sep 23 – Nov 23

*eBay & Amazon removed

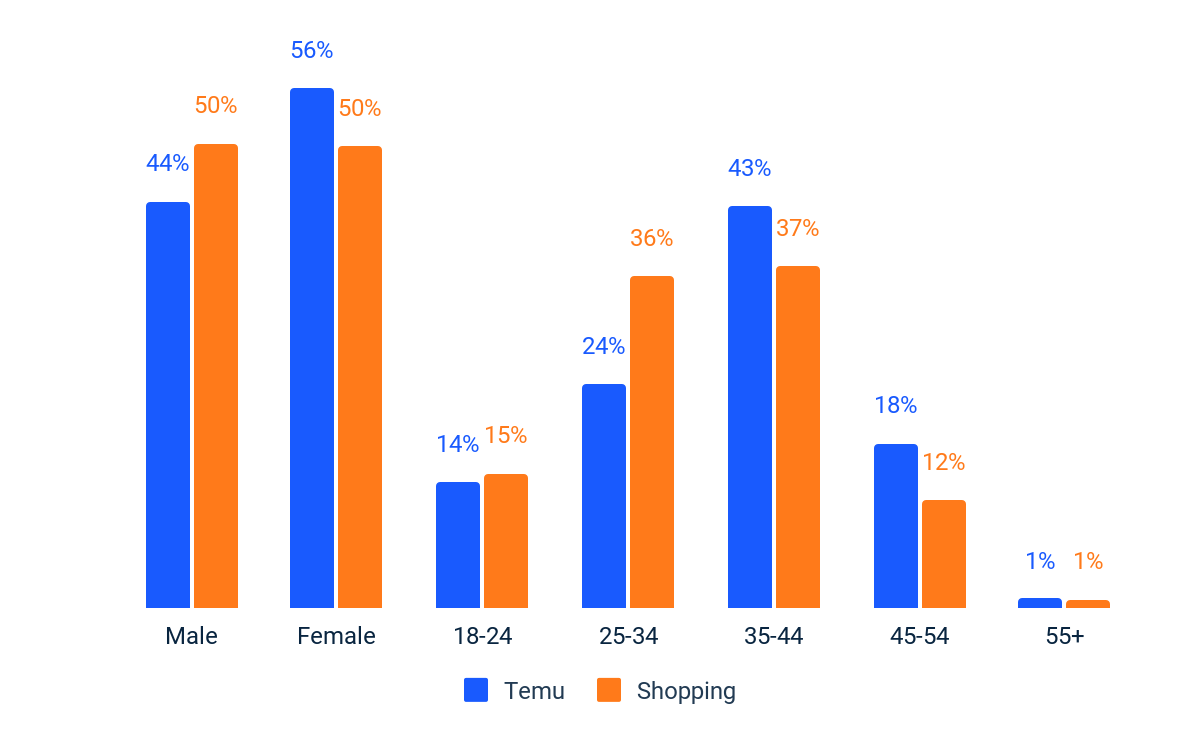

Temu appeals to an older, female, cost-conscious consumer

While its user base skews both older and more female than app users within the Shopping category, Temu’s top overlapping apps are competitors in the ultra-low-cost landscape. Shein, AliExpress and Wish all offer ultra-low-cost at the expense of longer delivery times while there are also bargains to be had on eBay.

Temu vs. Shopping App Category – Demographics – UK

Android Devices, Oct 23

Top Overlap Apps of Temu Users – Shopping – UK

Android Devices, Apr 23 – Oct 23

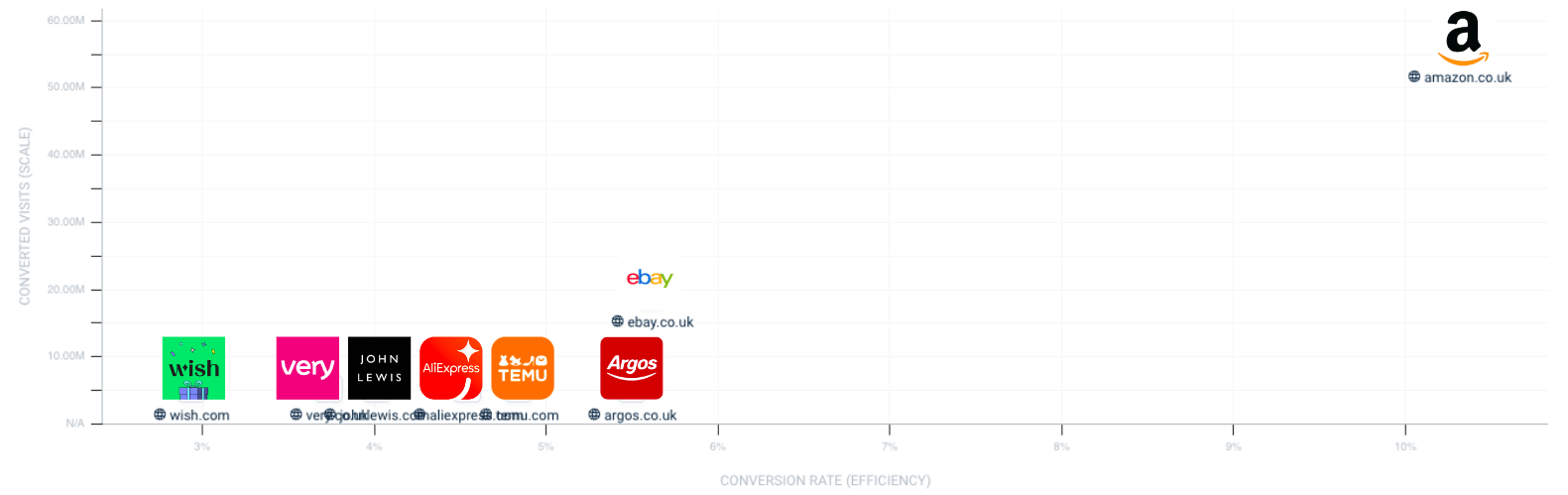

Temu’s conversion rate is better than their closest low-cost rivals

Managing a better conversion rate than the majority of it’s rivals – notably higher than AliExpress & Wish – Temu can be proud of how it entices consumers to make a first purchase on site. They are only surpassed by established players like local retailer Argos and those with global recognition, eBay and Amazon.

Temu vs. Top Competitors – Conversion Rate & Converted Visits – UK

Desktop, Aug 23 – Oct 23

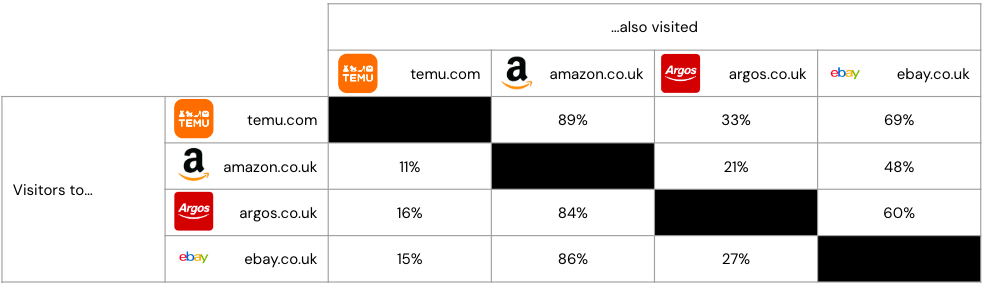

But, Temu has yet to acquire its own unique customer base

Temu has not yet developed a loyal base with a large proportion of visitors also visiting the likes of Argos and eBay. Yet the big players must still be aware of the threat that Temu poses with over 1 in 10 visitors to the top 3 retailers also visiting Temu – given the massive scale they have managed to acquire in such a short period, this proportion is only likely to increase as consumer awareness of Temu as a brand increases.

Temu vs. Top Competitors – Audience Overlap – UK

Desktop, Sep 23 – Nov 23

What is Temu’s strategy?

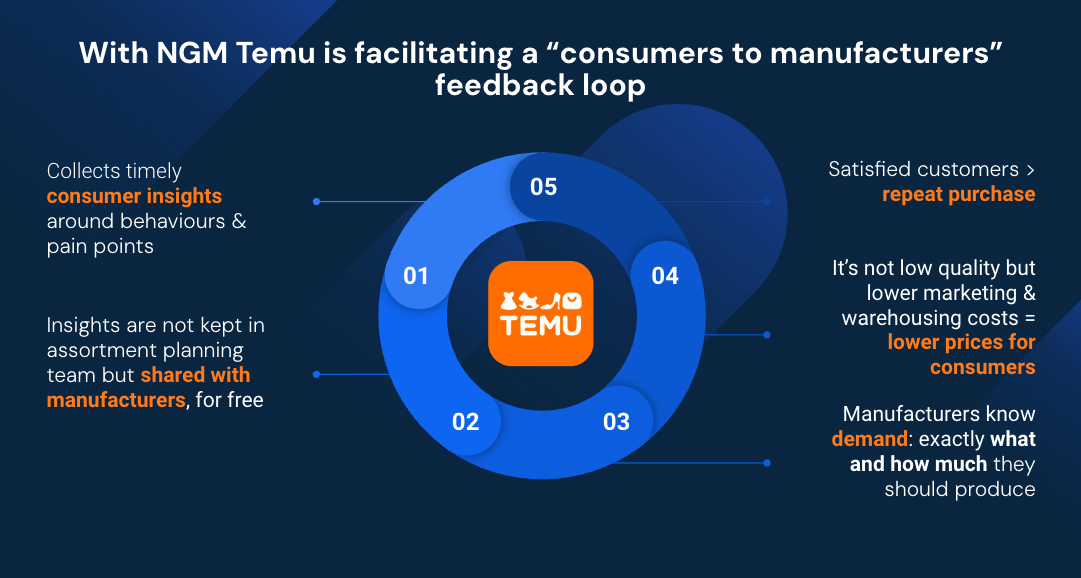

One exceptional aspect of Temu’s strategy is its Next Generation Manufacturing model.

NGM uses technology and timely consumer insights to optimize manufacturing processes.

They also incorporate gamification elements into their platform.

By introducing games into its app experience, Temu is able to offer free items and discounts to its users as a reward for increased engagement.

Influencer collaboration is also a key part of their business expansion.

Temu offers influencers a direct route to sign up and promote its hauls, and in return receive Temu credit to help build their following.

A lot of emphasis is placed on customer acquisition

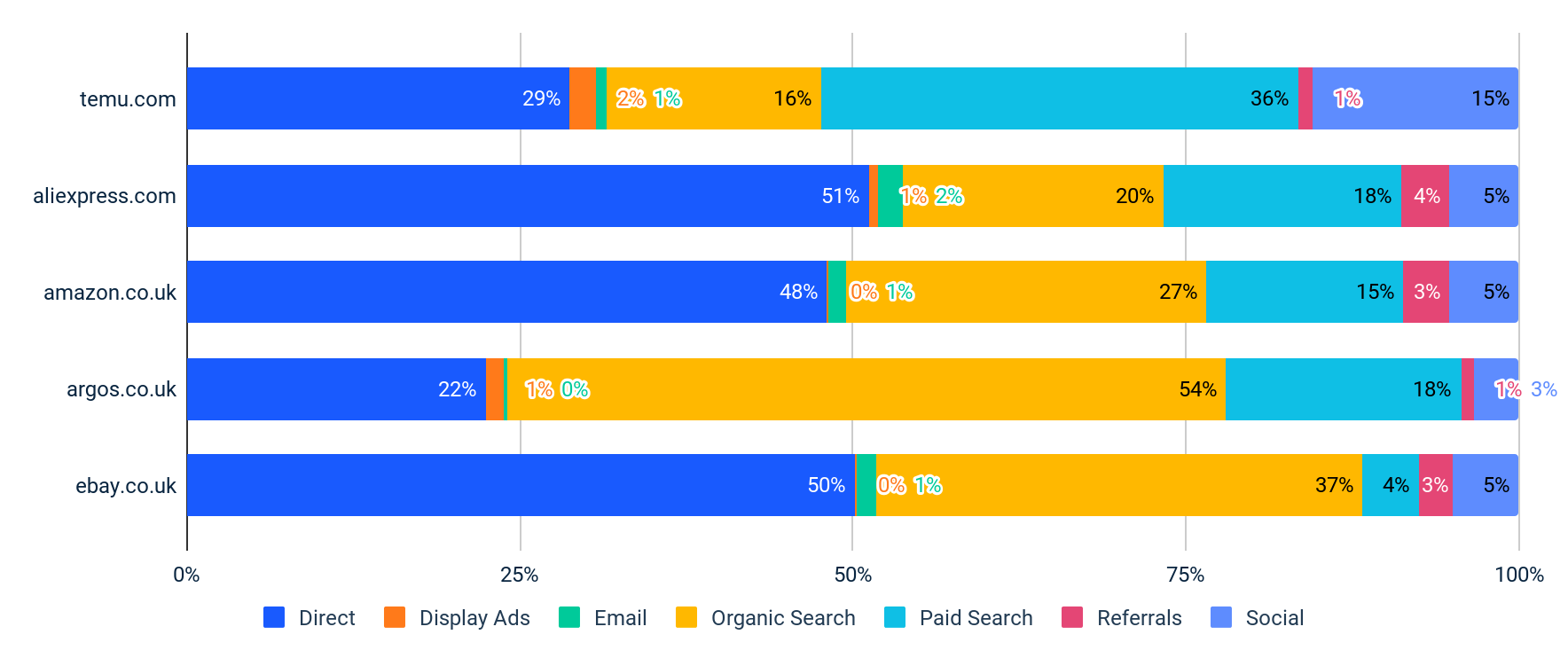

Compared with its top competitors, a much larger proportion of web traffic comes via both Paid Search and Social as Temu looks to invest large sums of money into customer acquisition.

Temu vs. Top Competitors – Marketing Channels in Traffic Share (%) – UK

Desktop & Mobile Web, Apr 23 – Nov 23

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: Daniel Reid, Senior Insights Analyst

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!