With BNPL Growth Decelerating, Apple’s Entry Adds Pressure

The rise of digital commerce that accelerated during the pandemic has turbo-charged growth in the payments industry, particularly the “Buy Now, Pay Later” (BNPL) offering. Yet, after spiking in 2020 and early 2021, trends on the websites of the largest players have begun to decelerate, with more consumers returning to shop in-store.

This slowdown may also be due to increasing default rates and a pullback in consumer spending – from inflation fears and from the lack of another stimulus. The introduction of Apple Pay Later in the fall of 2022 adds a deep-pocketed and formidable new competitor into the space, which could weigh on the performance of legacy players.

Key Takeaways:

- Apple’s move to launch its “Buy Now, Pay Later” (BNPL) service, Apple Pay Later, could pressure incumbent BNPL companies, many of whom are already facing slowing growth on their desktop and mobile web channels

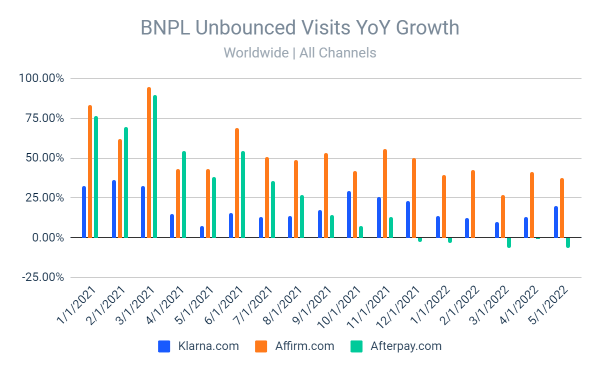

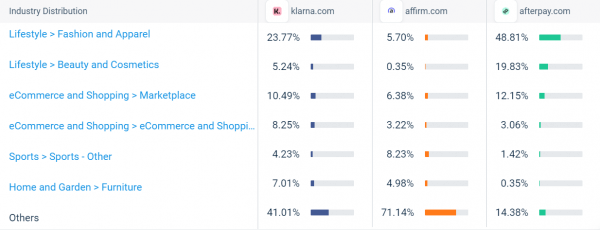

- The growth rate of unbounced visits (visitors who viewed more than one page) for klarna.com, affirm.com, and afterpay.com rose an average of only 16% from Jan 2022 – May 2022 versus 52% in the prior-year period, according to Similarweb estimates, a significant deceleration

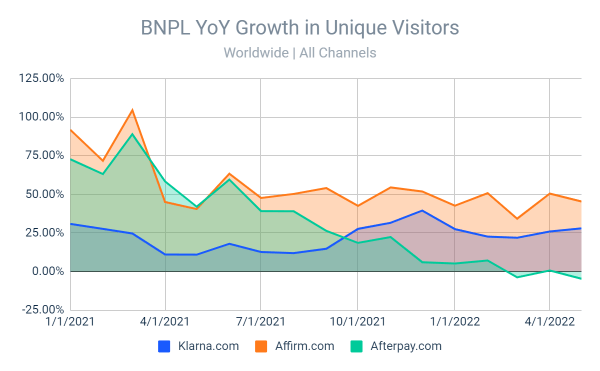

- Unique visitors to BNPL websites have fallen in the last 1.5 years, according to Similarweb estimates, which could imply the likelihood of increasing customer acquisition costs

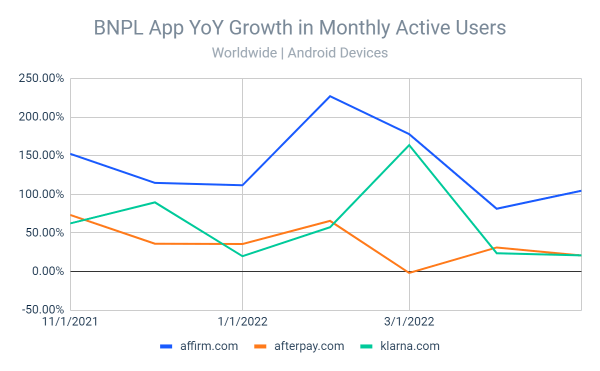

- YoY growth for monthly active users on BNPL apps is weakening in 2Q, but is rising periodically on a MoM basis, according to Similarweb estimates; this suggests consumers are using this type of financing at a growing rate but at a slower pace than during the peak of the pandemic and the initial rise of BNPL options

- Apple Pay Later may accelerate the adoption of BNPL as it takes market share, given weakening consumers’ balance sheets and rising inflation

- Apple’s closed ecosystem and its in-depth knowledge of customer data give it an advantage versus rivals, as it can better assess credit risk and offer more compelling options for consumers

- Apple’s strong balance sheet provides it more flexibility to lend than its rivals, while smaller players may struggle to find funding to finance BNPL purchases

- Penetration of Apple Pay is expected to reach 18.7% in 2026 from 16.2% in 2022, according to eMarketer

- The number of sites referring to BNPL websites declined 20% for Jan 2022 – May 2022 from the prior-year period; total referrals also fell 38%, as transactions decelerated on many eCommerce and shopping sites and marketplaces

Jan 2022 – May 2022 – 28.2M referral visits | 6,000 referring websites

Jan 2021 – May 2021 – 42.6M referral visits | 7,456 referring websites

Read more – The Meteoric Rise of the Buy Now, Pay Later Industry

The Similarweb Insights Newsroom is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer:

All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!