T-Mobile Acquires Mint Mobile – 2022’s Fastest-Growing US Mobile Service Provider

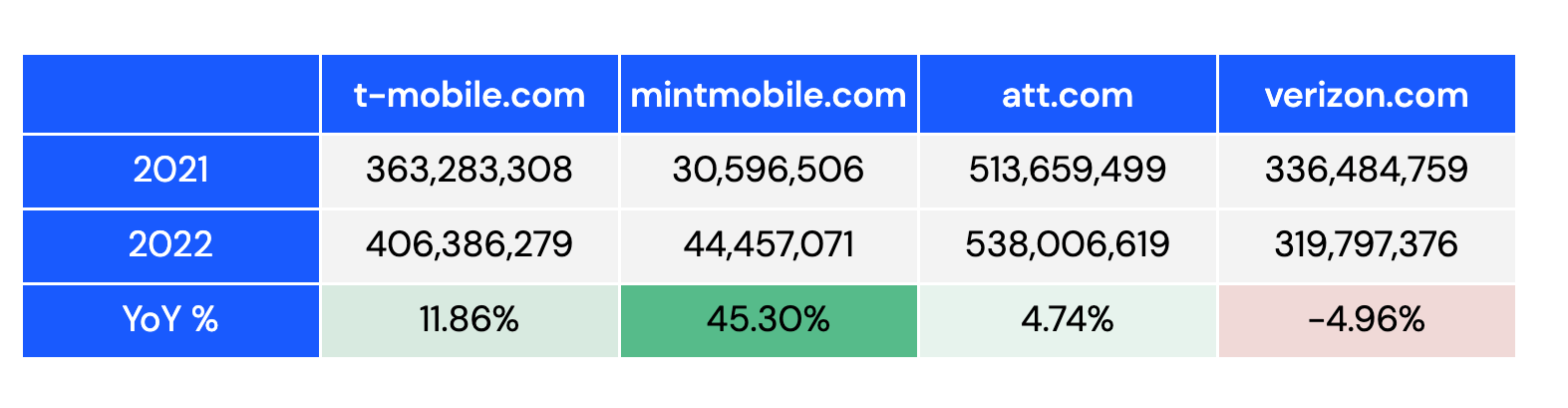

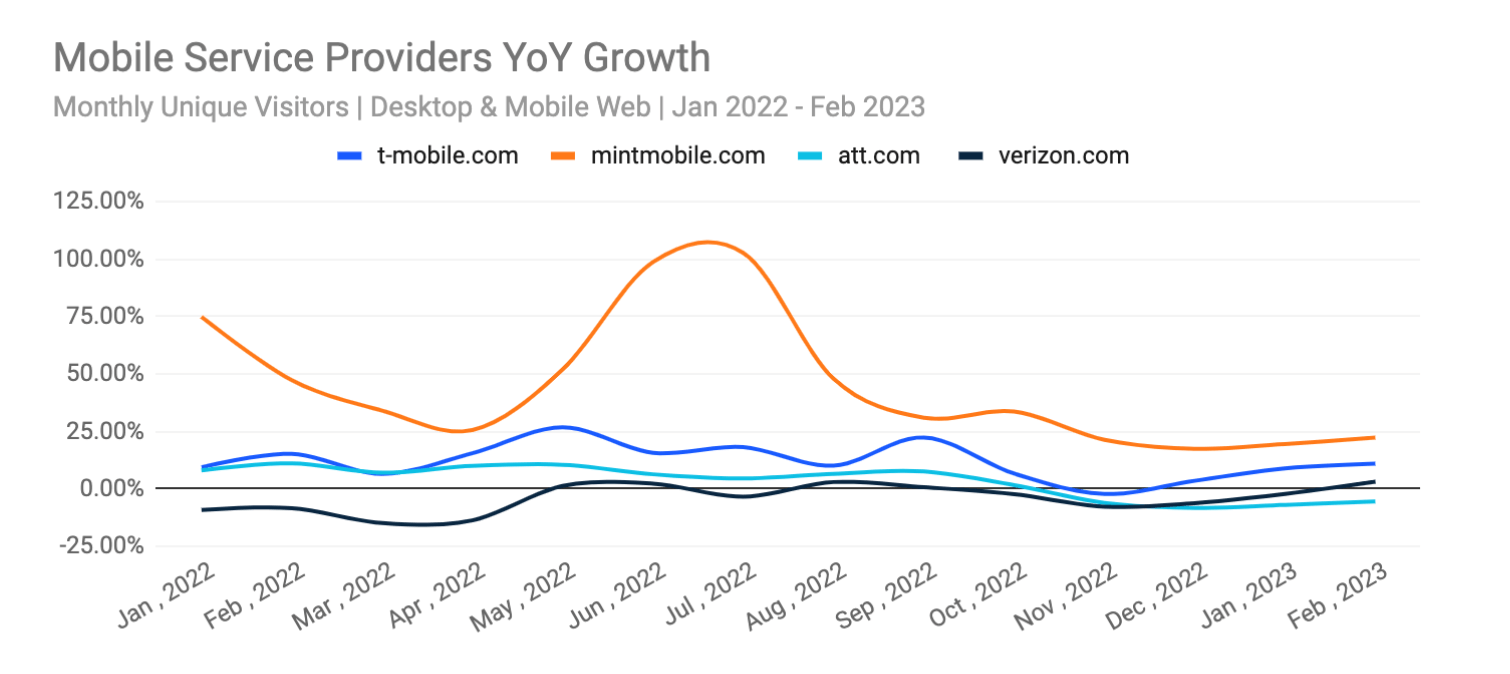

According to Similarweb estimates, Mint Mobile’s digital audience grew 45% year-over-year, while T-Mobile’s audience grew a mere 12% in 2022.

Earlier this month, T-Mobile US, Inc. (NASDAQ: TMUS) announced that it had entered into a definitive agreement to acquire Ka’ena Corporation, its subsidiaries, and brands, which includes Ryan Reynolds’ Mint Mobile LLC., a well-known affordable wireless brand. The addition of Mint Mobile to T-Mobile’s mergers and acquisitions portfolio, which already includes MetroPCS Communications Inc. (acquired in 2013) and Sprint Corporation (acquired in 2020), highlights T-Mobile’s continued success in expanding its offerings.

The “un-carrier”, T-Mobile, applauded Mint Mobile’s success in the digital direct-to-consumer market. Their innovative marketing strategies, including Ryan Reynolds’ trademark humorous advertisements, have contributed to the brand’s success. Mint Mobile’s acquisition is expected to further enhance T-Mobile’s market position and competitive edge, particularly with cost-conscious consumers.

Key takeaways

- Over the last two years, Mint Mobile has solidified its position as the fastest-growing mobile service provider in the US, boasting an impressive 45% year-over-year (Yoy) growth rate in 2022.

- This is a stark contrast to the sluggish growth rates seen by industry giants T-Mobile, AT&T, and Verizon, with YoY growth of just 11.86%, 4.74%, and a concerning -4.96% decline in unique visitors, respectively.

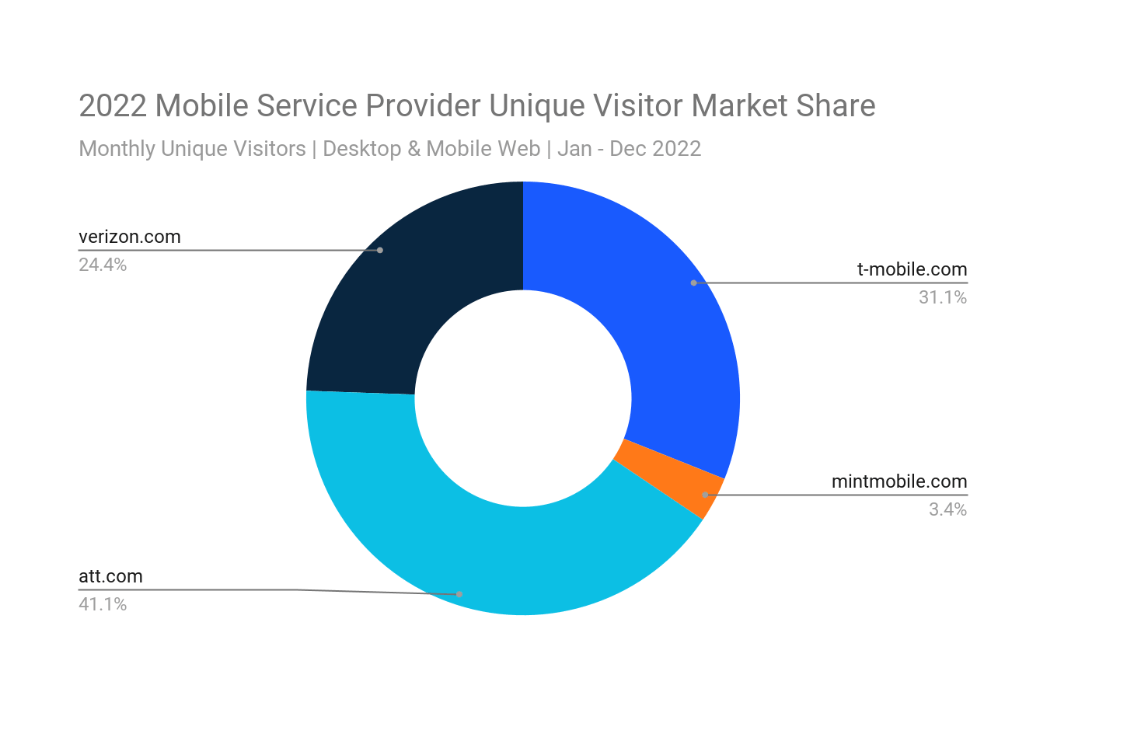

- In 2022, AT&T held a 41% majority of the mobile service carrier market share by unique visitors. In comparison, T-Mobile has held the second largest share since the second half of 2021, continuing to widen its lead over Verizon with a 31.1% share compared to Verizon’s 24.4% in 2022.

Mint Mobile grew faster than the Big 3 in 2022

T-Mobile closes in on AT&T

What’s next? Affordable plans & a D2C digital marketing focus

The mobile services market is dominated by three major players: AT&T, T-Mobile, and Verizon. Cost-conscious consumerism has fueled the existing price wars between carriers and intensified the pressure to compete through mergers and acquisitions to combat sluggish subscriber growth, among other challenges.

By expanding its portfolio and offerings, T-Mobile is well-positioned to capitalize on this trend and emerge as a market leader.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: Sneha Pandey, Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!