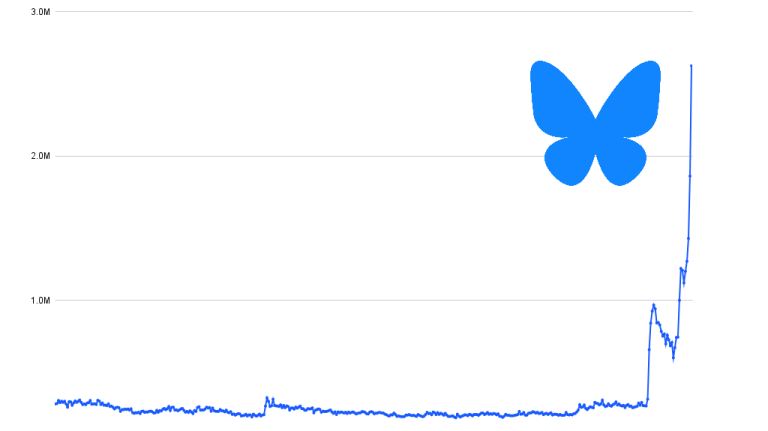

Twitter Ads Traffic Down 18.7% in March, Snapchat Up 127.5%

March 2023 social media advertising update sees continued year-over-year decline for Twitter (although traffic was up 8.6% from February)

Not only did Twitter fail to drive a big volume of subscriptions in March, but ad buyer traffic continued a pattern of year-over-year declines, according to Similarweb estimates. Traffic to Facebook’s advertiser and business portal also continued a pattern of decline, off 2.6% year-over-year. For the quarter that ended March 31, ad buyer traffic was down 17.8% for Twitter and 4.6% for Facebook.

The biggest gainer was ads.Snapchat.com, which has been incrementally winning share from competitors and was up 127.5% year-over-year in March and 125.1% for the quarter.

We monitor and analyze traffic to the business and advertising portals of the major social networks as an indicator of business momentum.

Key takeaways

- Traffic to Twitter’s ads portal was down 18.7%, year-over-year, although it improved by 8.6% from February. Twitter lost 0.2 points in share of traffic from among the competitors we monitor. Twitter CEO Elon Musk has talked about shifting the company’s business model away from advertising, but so far the ad business is eroding and the Twitter Blue subscription service is seeing only modest success.

- The business portal Meta Platforms Inc. uses to engage with advertisers and businesses on Facebook and Instagram has also seen traffic declining, down 2.6% year-over-year in March for a 1.3-point drop in share of traffic.

- Meanwhile, Snapchat has been growing its slice of the pie, with ad buying traffic up 127.5% year-over-year for a 0.8-point improvement in share of traffic. TikTok, which has often been the champion in terms of momentum over the past couple of years, saw a 23% year-over-year gain, and Pinterest was up 30.5% year-over-year.

Ad buying traffic shifting toward Snapchat, TikTok, and Pinterest

The gains by Snapchat, TikTok, and Pinterest were actually more dramatic than the traffic losses for Twitter and Facebook.

The pattern looks very consistent when the sites are compared on a quarterly basis. Versus the first quarter of 2022, Twitter is down 17.8% and Facebook is down 4.6%, while Snapchat is up 125.1%, ads.Pinterest.com is up 34.1%, and TikTok is up 28.8%.

Bouncing back compared with February

Ad buying traffic for all these players except Snapchat was up significantly from February to March, suggesting the return of some advertiser interest. ads.TikTok.com saw the biggest month-over-month gain, of 14.8%, despite the glare of regulatory scrutiny from the U.S. Congress and the White House.

Share of traffic continues to shift away from Facebook

Facebook’s engagement with businesses and advertisers continues to show signs of shrinking in terms of share of traffic.

However, for perspective, Facebook continues to own the lion’s share of the traffic in this category.

The comparison is not an exact one because Facebook’s business portal is used for other purposes like organic social media marketing, which is why we focus on relative measures like change in share or change in comparison with past years and months. Facebook could continue to lose increments of ad traffic share for a long time before it would be in the same league as Twitter.

Public companies mentioned in this report include Meta Platforms Inc. (NASDAQ: META), Pinterest (NYSE: PINS), and Snapchat parent Snap (NYSE: SNAP).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!