Twitter Ad-Buying Traffic Dropped More Than 20% in January

Social media advertising market update for January 2023

In January, Twitter continued to show signs of losing advertiser interest, whether because of concerns over content moderation issues or because competitors are stealing market share. TikTok and Snapchat both showed gains.

Key takeaways

- January traffic to Twitter’s ad portal was down 22% year-over-year and 20% from December’s level, according to Similarweb estimates.

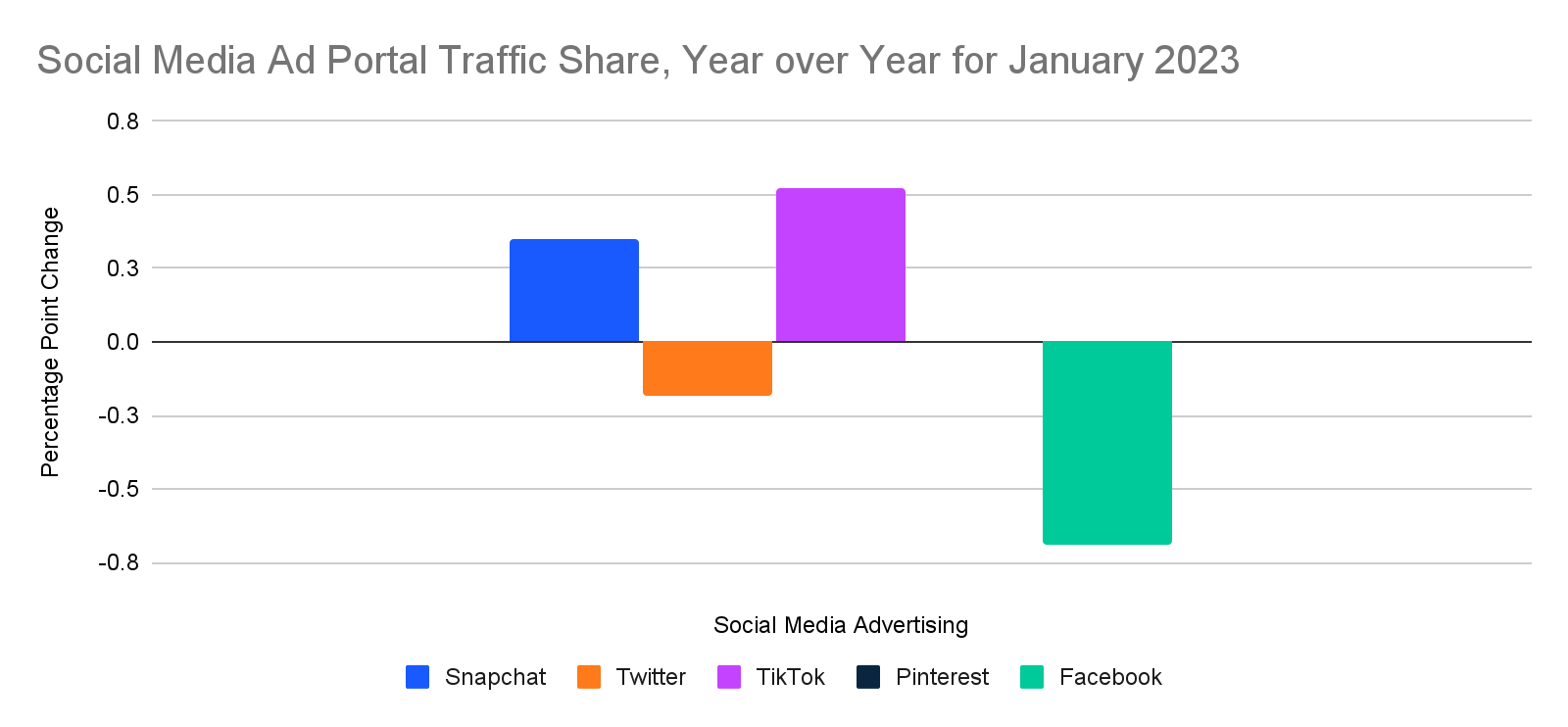

- Facebook and Pinterest saw smaller declines on a year-over-year basis, while Snapchat was up 34.2% and TikTok was up 18.3%.

- Facebook saw the biggest loss in share of traffic within this peer group, albeit by a fraction of a percentage point change (-0.7).

We watch web traffic to ad-buying portals like ads.twitter.com as an early indicator of company growth and revenue. The Similarweb Investor Intelligence team uses these statistics as a starting point for deeper analysis on behalf of clients.

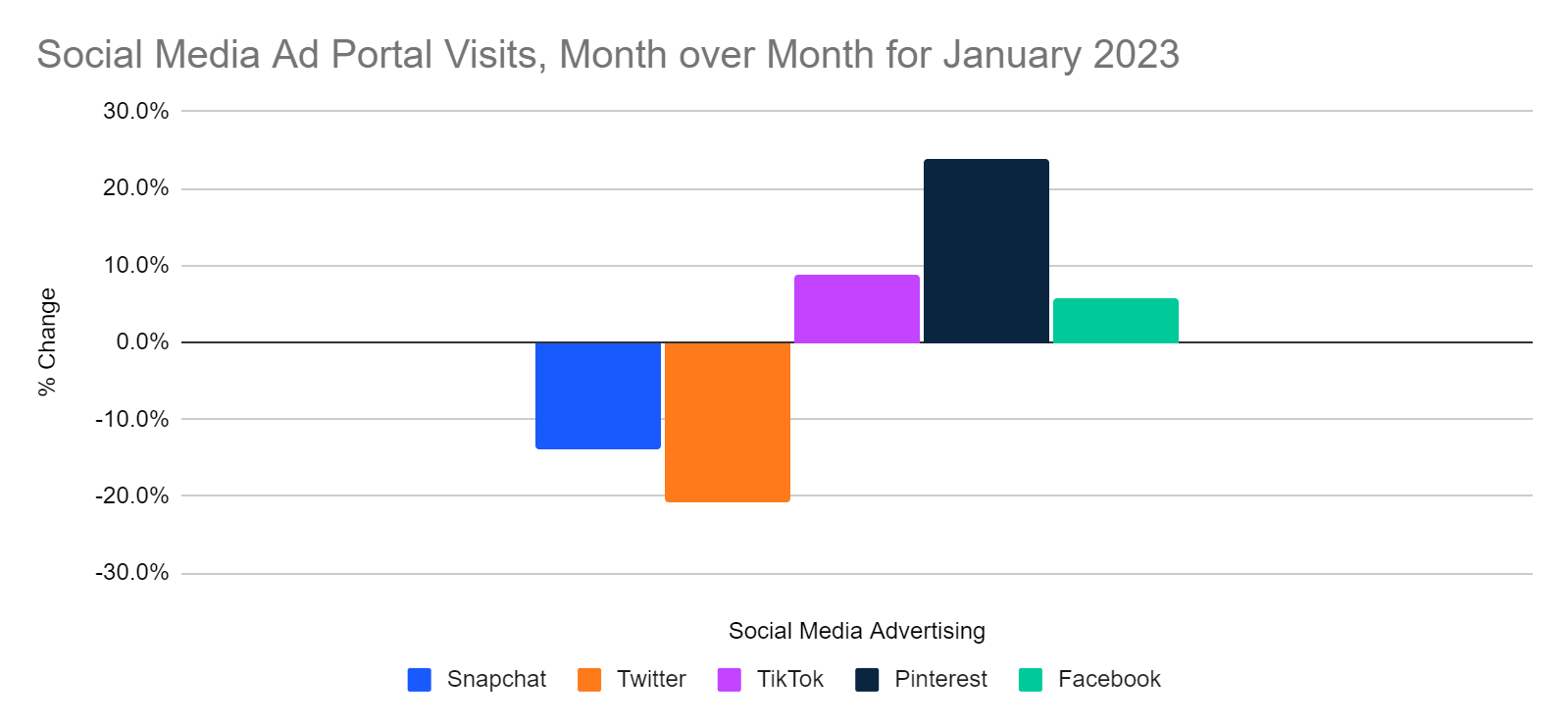

Snapchat showed the biggest gain, Twitter the biggest loss of ad buying traffic

Repeating its performance from December, Snapchat showed the biggest percentage gain (+34.2%) in ad buying traffic, while Twitter showed the greatest decline. TikTok’s ad portal traffic was up 18.3%.

Pinterest saw the biggest month-over-month percentage gain

While Snapchat’s ad portal traffic was up year-over-year, it was down 14% compared with December. The biggest monthly gains went to Pinterest (+23.9%), TikTok (+8.7%), and Facebook (+5.7%).

Facebook’s share of traffic drops

Facebook suffered the biggest loss of traffic share, although dropping 0.7 of a percentage point still leaves it with well over 90% share within this peer group. That traffic is not entirely related to ad buying, since the Facebook business portal (which also serves Meta properties such as Instagram) is used for other purposes such as scheduling and publishing organic branded content.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Image: DALL-E‘s interpretation of “Twitter birds falling from the sky, cartoon”

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!