Twitter Ad Traffic Down Another 20% in June as Musk Concedes 50% Ad Revenue Drop

Facebook ads portal traffic drops 10% in a sign of why Meta needs Threads

Twitter owner Elon Musk just changed his story about Twitter’s relationship with ad buyers, after telling a BBC reporter in April that “almost all” advertisers had come back to the platform and that the company was roughly break-even for cash flow. He now says the company is far from cash flow positive and acknowledges a 50% year-over-year drop in ad revenue – which is more like what we would expect from tracking visits to social media advertising marketplaces.

Key takeaways

- Traffic to ads.twitter.com, a portal for businesses buying ads, was down 20% year-over-year in June.

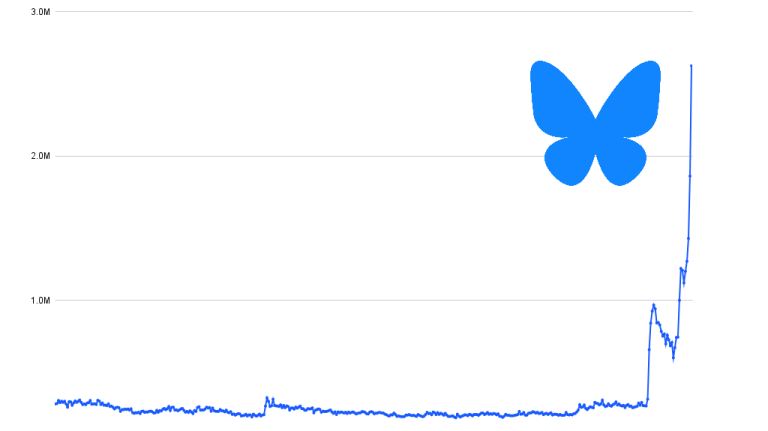

- Web traffic to twitter.com, the main public website, has been down every month this year, by 4.2% in June. Over the past week, as interest in Threads surged, twitter.com web traffic was down 11% year-over-year.

- Meta Platforms appears to have a hit on its hands with Threads, despite a drop from peak activity. Yet if Threads is to be Meta’s new moneymaker, it can’t happen too soon: traffic to business.facebook.com, the business portal shared by advertisers on Facebook, Instagram, and presumably someday soon Threads has been dropping, down about 10% year-over-year in June.

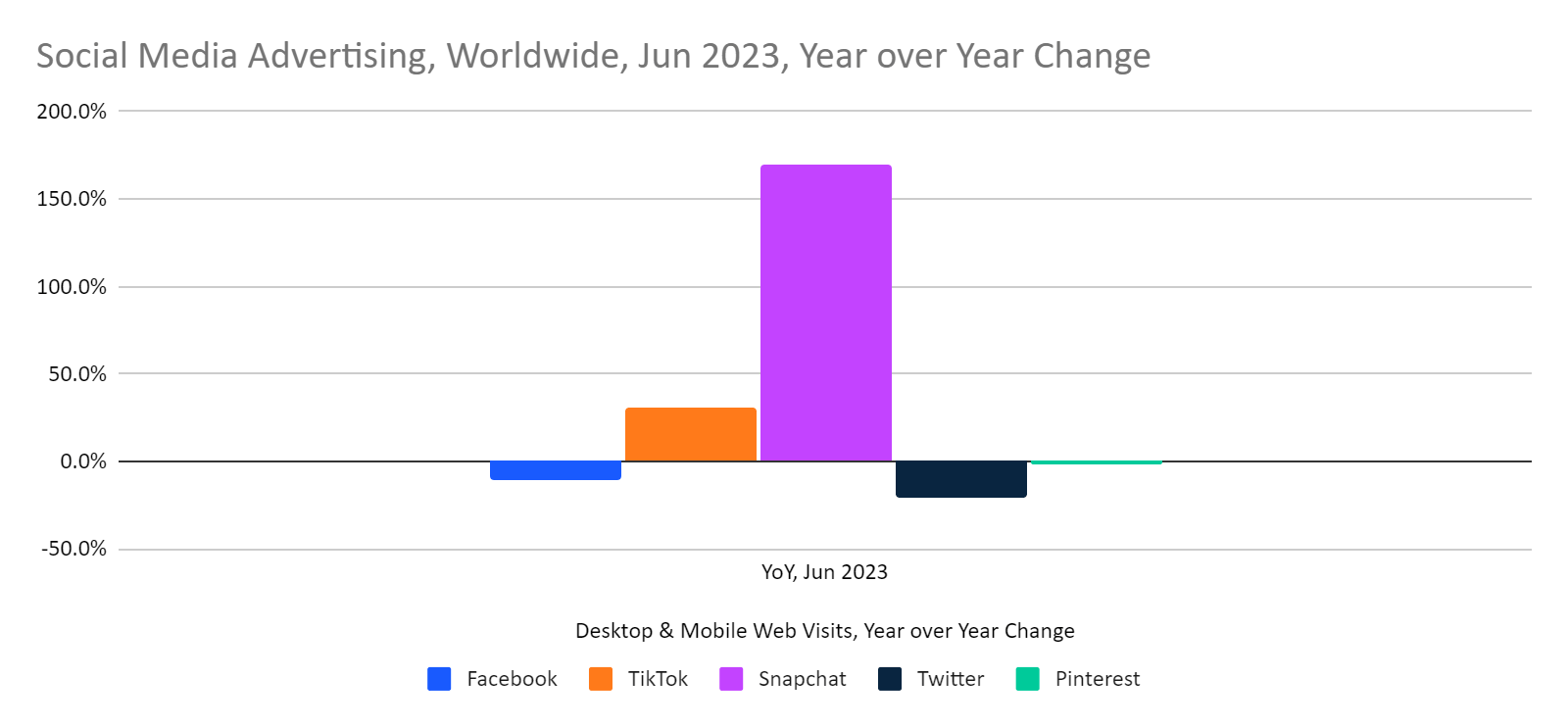

- The news from across social media advertising isn’t all bad. Traffic to Snapchat owner Snap Inc.’s ads portal was up nearly 170% in June, and TikTok gained 31.2% year-over-year. In addition to potential benefits from advertisers seeking alternatives to Meta and Twitter, Snapchat and TikTok tap into the power of visual social media (as does Meta’s strong Instagram business).

- ads.pinterest.com also saw a small drop, down 2.2%.

Who’s up and who’s down

Twitter and Facebook/Meta saw significant decreases in engagement with advertisers in June, although the proportional gains for Snapchat and TikTok look even bigger.

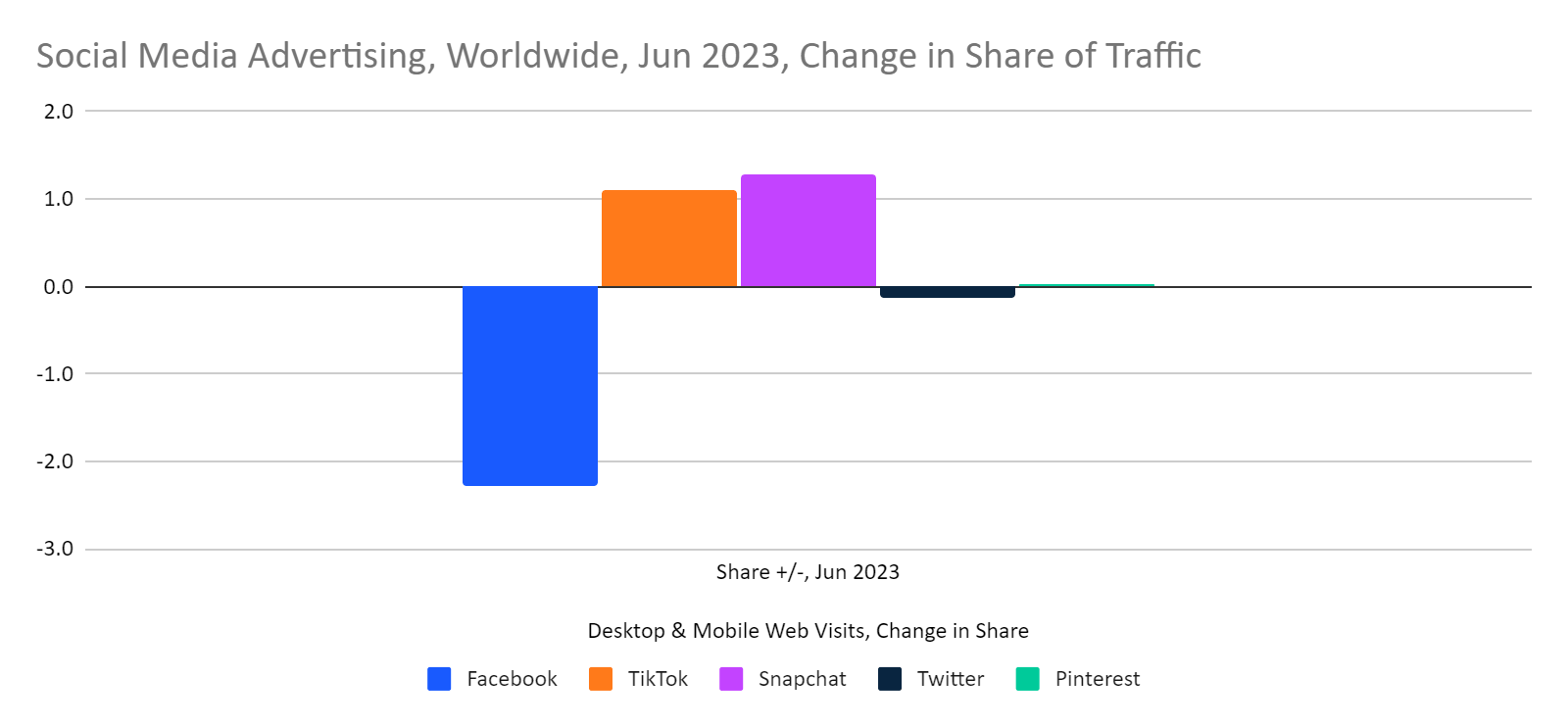

Facebook lost more than 2 points of share, while Snapchat and TikTok gained

Measured by share of traffic, Facebook is the biggest loser among these contenders, with its share of traffic down 2.3 percentage points.

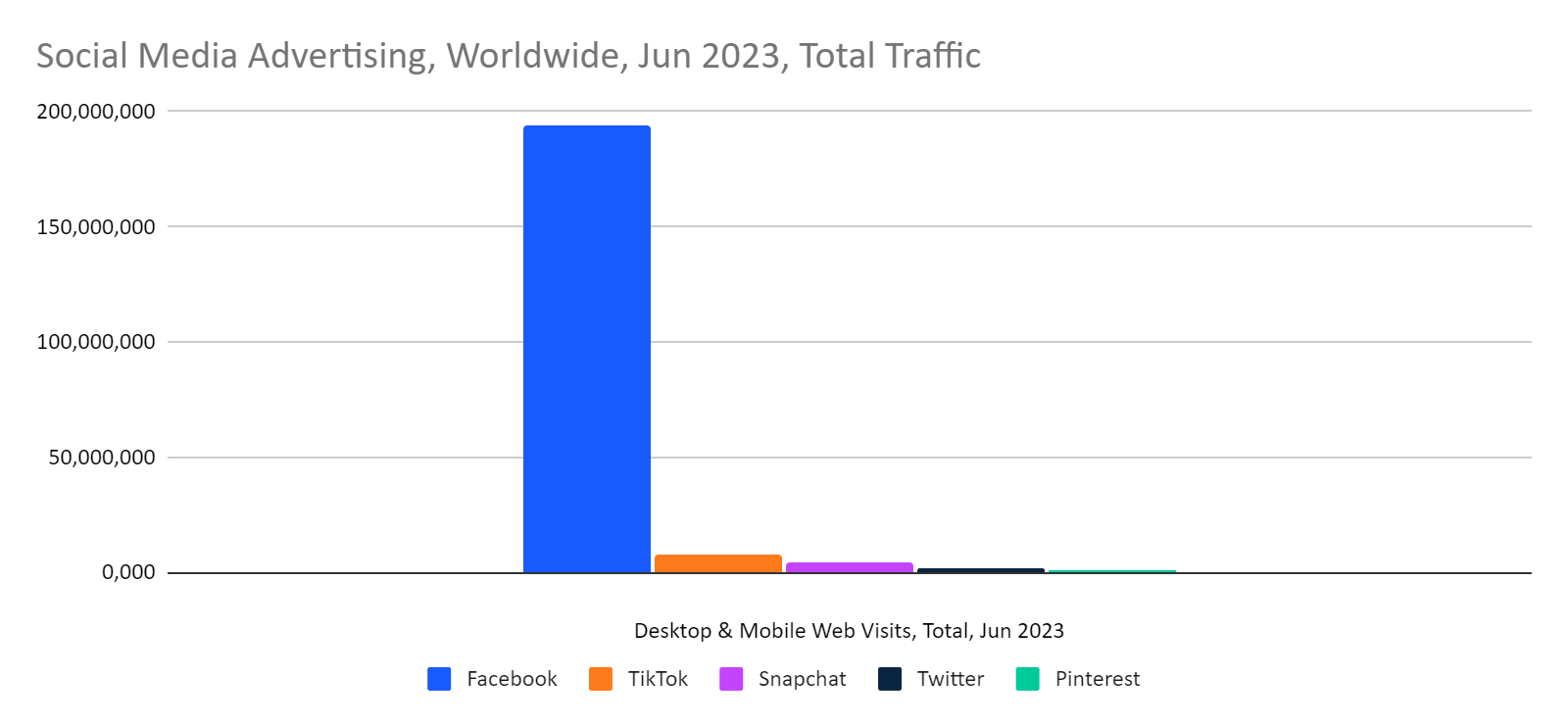

Twitter draws less advertiser interest than Facebook, TikTok, or Snapchat

Facebook’s dominance on the chart below is exaggerated by the fact that its business portal is used for purposes other than advertising, such as organic postings on behalf of a brand. Still, as a measure of how interested businesses are in doing business with Meta, it’s huge – despite slow and steady erosion in total web traffic and in share of traffic.

Meanwhile, Twitter is in fourth place, behind TikTok and Snapchat, and only a little ahead of Pinterest.

Public companies mentioned in this report include Meta Platforms Inc. (NASDAQ: META), Pinterest (NYSE: PINS), and Snapchat parent Snap (NYSE: SNAP).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!