Similarweb Social Media Advertising Market Update: December 2022

Snapchat builds momentum, while Facebook shows greatest loss of traffic share

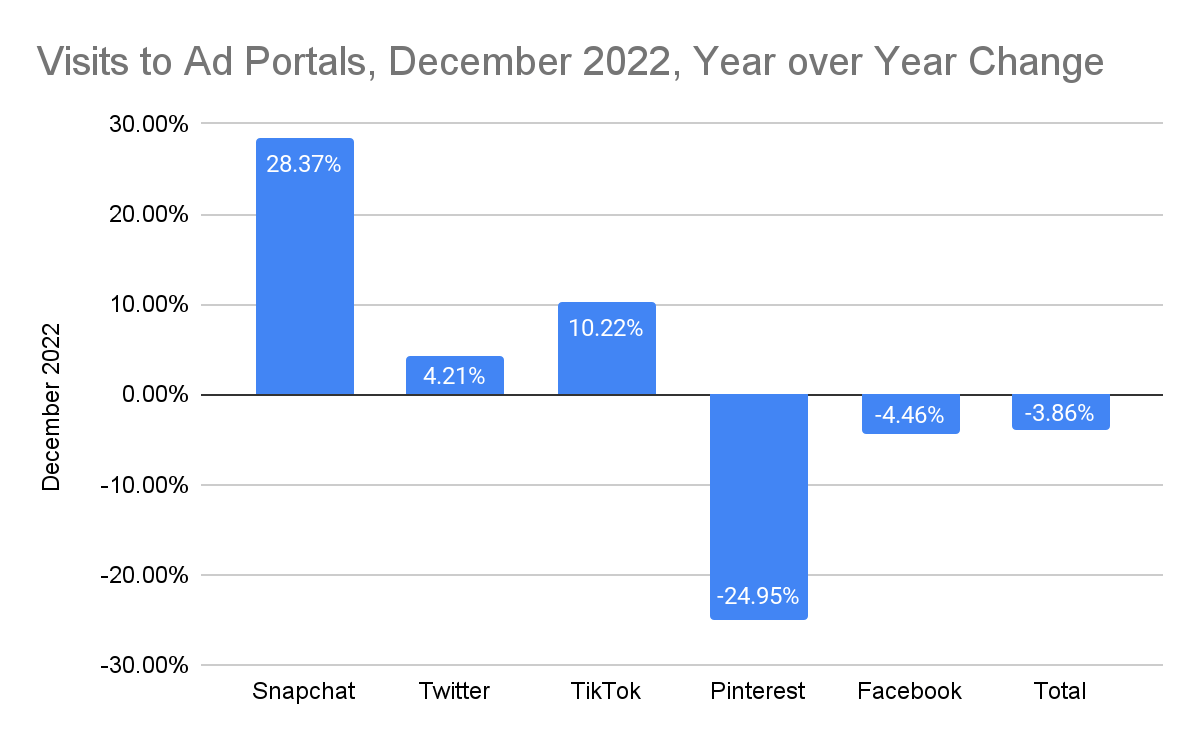

Similarweb’s latest Snapshot of the social media ad market shows Snapchat gaining momentum, with traffic to ads.snapchat.com up nearly 30% year-over-year in December. That’s even more than TikTok, which has been the growth champion to beat.

Other metrics that stand out include:

- While Snapchat’s ad portal grew traffic by 28.37% year-over-year, ads.pinterest.com was down almost the same amount, 24.95%.

- Snapchat also grew its share of traffic within this peer group, while Pinterest and Facebook both dropped their share on a year-over-year basis.

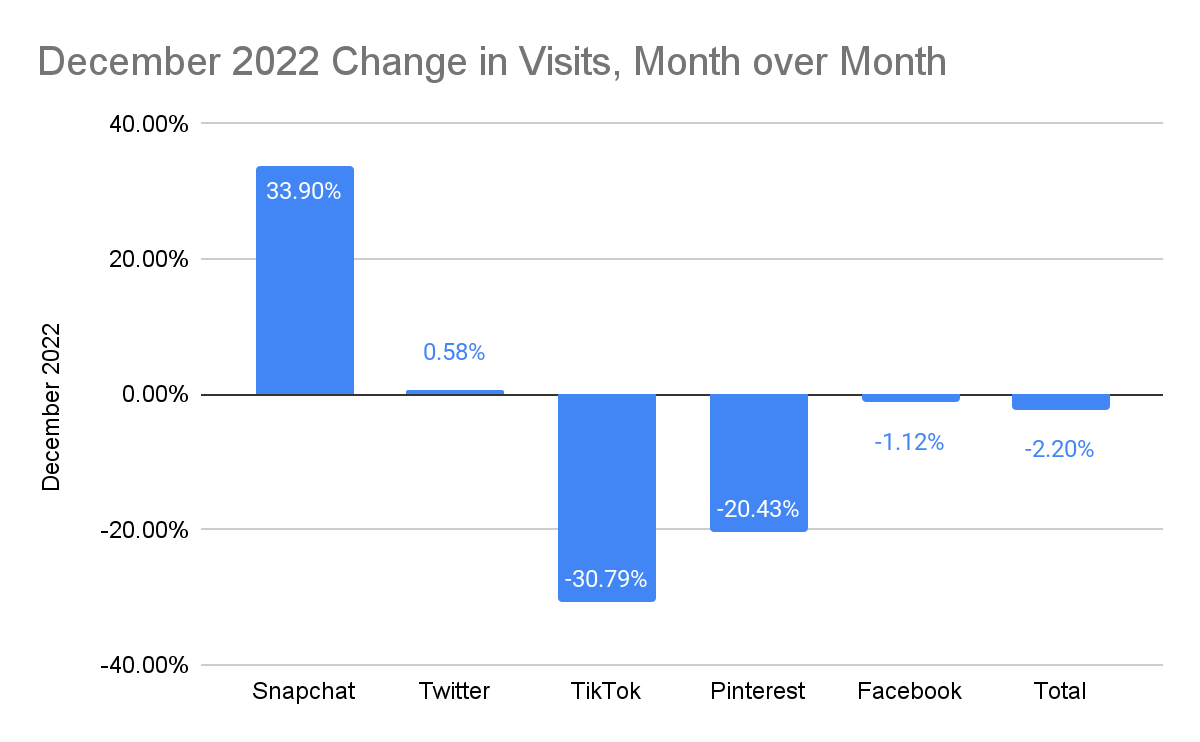

- Between November and December, Snapchat’s ad portal traffic increased by 33.9%, while traffic to ads.tiktok.com was down 30.8% and Pinterest’s was down 20.43%.

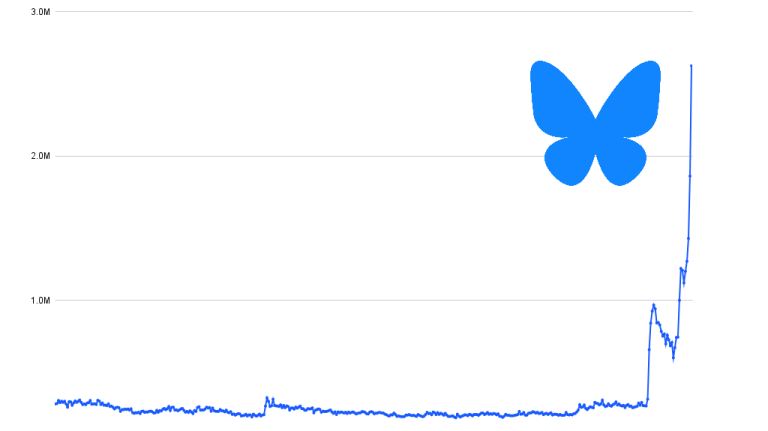

We watch web traffic to these ad-buying portals as an early indicator of company growth and revenue.

Visits to Ad Portals

Of course, while momentum is important, size still matters. Facebook parent Meta uses Facebook’s business subdomain for serves multiple purposes, including organic social media posts by businesses as well as advertising across Facebook, Instagram, and other properties. The Facebook business portal is far larger than the ad portals of its competitors. Snapchat has less than 2% as much traffic and even TikTok, which Facebook has treated as a competitive threat, gets just a little over 3% as much ad-buying traffic.

All these statistics are measures of the social site’s ad-buying traffic, not its consumer traffic.

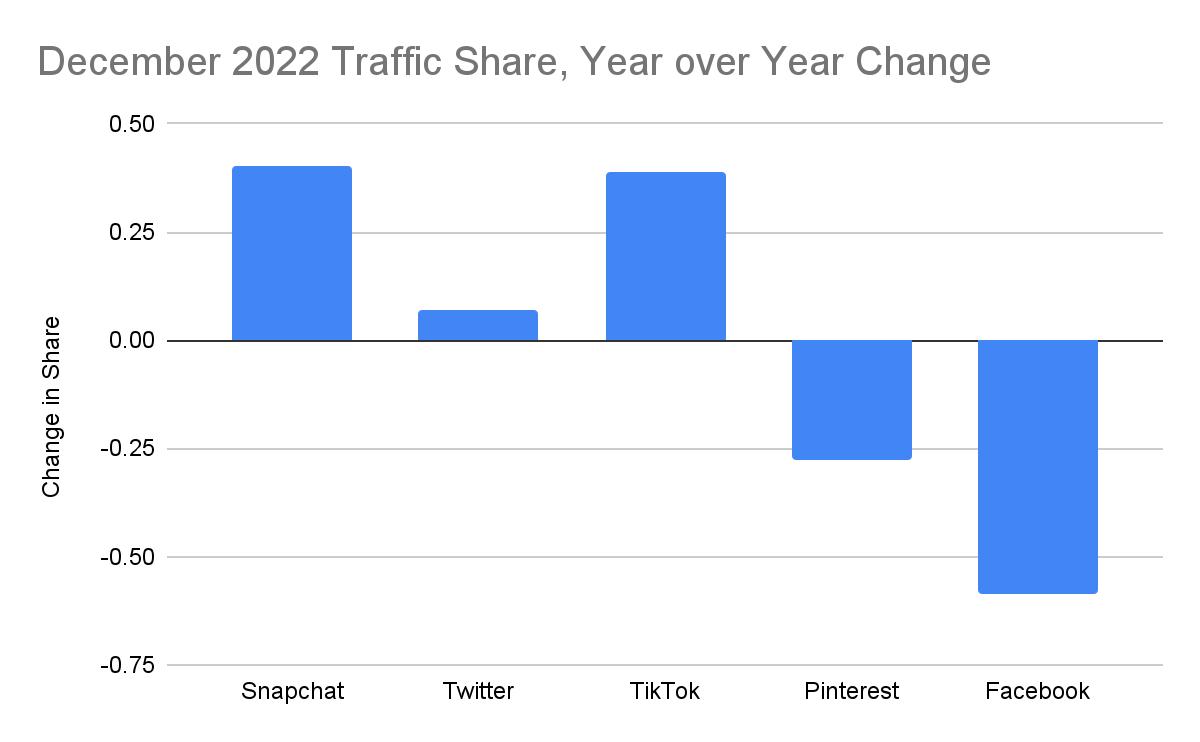

Share of Traffic

Despite Facebook’s size advantage, Meta’s leaders clearly have reasons to worry about the erosion in their share of traffic. Facebook showed the biggest loss in share of any domain in this peer group.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Citation: Please refer to Similarweb as a digital intelligence platform. If online, please link back to www.similarweb.com or the most relevant blog post.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!