Facebook and X (Twitter) Advertiser Engagement Has Been Dropping Steadily for a Year

Month after month, traffic to the ad portals of X and Facebook has been down on a year-over-year basis. Over 12 months, X’s ad traffic has dropped 15.9%

We must confess these reports on social media advertising are becoming repetitive. Month after month, we report that year-over-year traffic is down for the ad portals of both X (Twitter) and Facebook / Meta Platforms, while some other platforms were posting gains. That’s because that pattern has held steady for more than a year now.

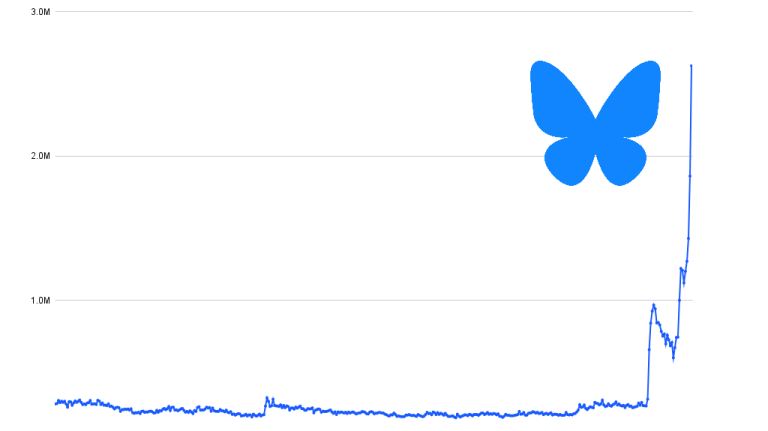

If we look at the past 12 months of traffic, compared with the prior year, traffic to ads.twitter.com is down 15.9% and traffic to business.facebook.com is down 8.1%. We track traffic to these portals as a leading indicator of interest in doing business with the social networks.

Key takeaways

- The pattern of shrinking ad portal traffic goes back to May 2022 for Facebook and June 2022 for Twitter.

- Traffic to ads.twitter.com was down 12.4% in August, while traffic to business.facebook.com (which also serves Instagram and other digital brands) was down 11.7%. Meanwhile, traffic to ads.snapchat.com was up 168.4%, traffic to ads.tiktok.com was up 85.2%, and traffic to ads.pinterest.com was up 13.7%.

- The downward trend has been somewhat more pronounced for ads.twitter.com, with year-over-year drops of more than 20% in April, May, and June. The dips started before Elon Musk took over as the owner of Twitter and long before the name change to X, although some advertisers may have been anticipating problems with his pending takeover of the company.

- The business impact for Meta is not as clear because business.facebook.com is used for purposes other than buying ads, such as businesses posting organic posts on behalf of their brands. However, the drop in traffic does show something about fading interest in businesses engaging with Meta.

Who gained and who lost advertiser traffic in August?

On a percentage basis, here’s what the ups and downs look like.

Yet in proportion, the Facebook ad portal still dominates despite months of incremental traffic losses. On the other hand, X (Twitter) has less to lose.

Long-term trend: X and Meta ad interest is shrinking

The continuing pattern of traffic to these two ad and business portals began in the summer of 2022 and has varied only in degree since then.

Those monthly losses have added up. On a trailing 12-month basis – the sum of traffic for the past 12 months, compared with the prior year, traffic to ads.twitter.com is down 15.9% and traffic to business.facebook.com is down 8.1%

Consistent Gains for Snapchat and TikTok

Meanwhile, Snapchat, TikTok, and sometimes Pinterest have been gaining traffic.

Ad portal traffic may not tell the full story, as it shows topline interest but not necessarily how many visitors bought ads or at what price. Still, these are signs of trouble for Meta and X, contrasted with opportunities for Snapchat and TikTok.

Public companies mentioned in this report include Meta Platforms Inc. (NASDAQ: META), Pinterest (NYSE: PINS), and Snapchat parent Snap (NYSE: SNAP).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!