Snapchat Grows Ad Portal Traffic 126% in April, but Where’s the Revenue?

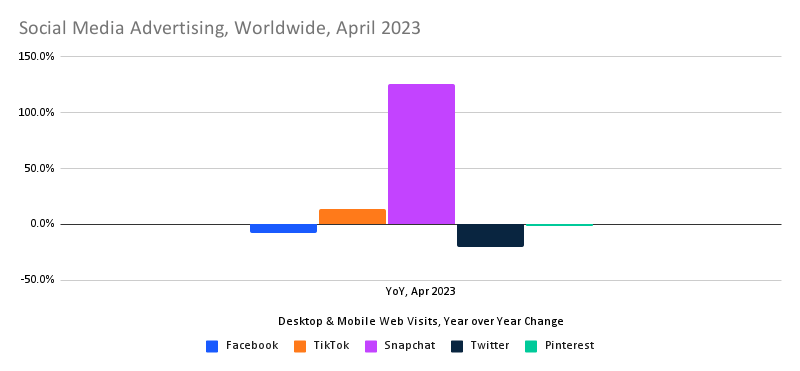

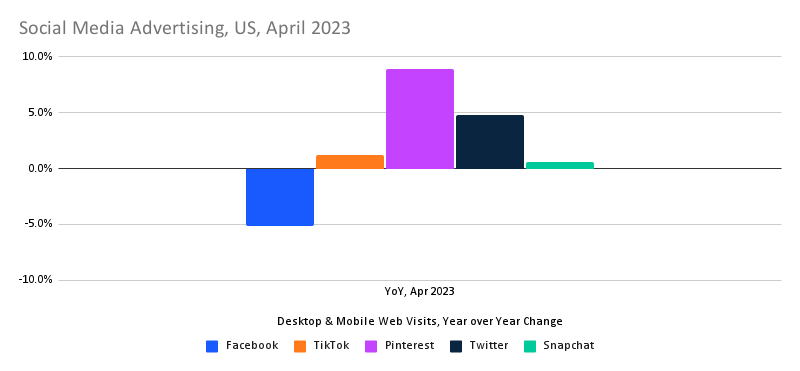

For several months, Snapchat has been attracting increased interest from advertisers worldwide. In the US, Twitter seems to be regaining advertisers’ attention.

Snapchat parent Snap Inc. recently reported disappointing earnings, but it’s not for lack of advertiser interest. For several months, as advertisers have shown less interest in engaging with Facebook and others, they’ve been showing more engagement with Snapchat as one alternative. Yet there seems to be a disconnect between Snapchat getting advertisers in the door and winning their business at the right price. It may have something to do with most of the traffic growth coming from outside of the US, where Snapchat is still seeking to establish itself.

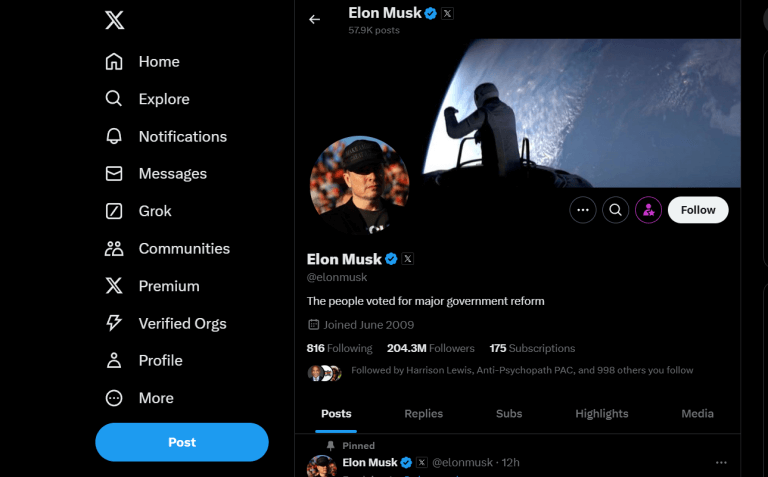

Meanwhile, after slumping for months, US traffic to Twitter’s ad portal was up 4.8% year-over-year in April, according to Similarweb estimates, suggesting that some domestic advertisers may be returning to the platform. However, worldwide traffic to the ad portal was still down 20.7%, suggesting that global advertisers remain more skeptical.

Key takeaways

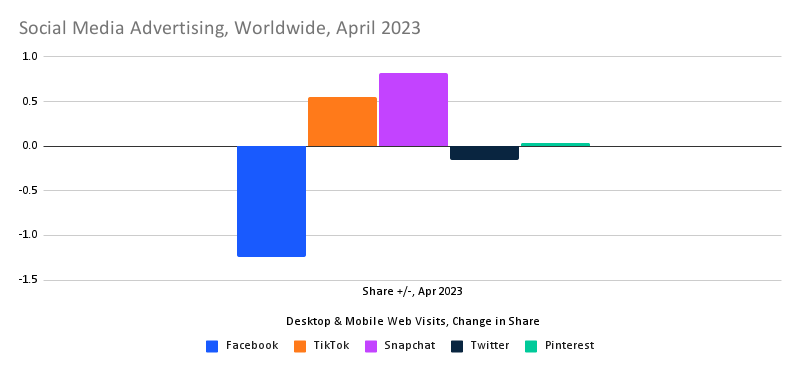

- Snapchat’s worldwide ad portal traffic was up 126% year-over-year in April. Within the set of competitors we track with this report (Meta/Facebook, Twitter, Pinterest, TikTok), Snapchat increased its share of traffic from 0.6% to 1.4%.

- Traffic to the business portal that serves Facebook, Instagram, and other meta brands dropped 7.8%, year-over-year. Facebook takes 94% of the ad portal traffic within this competitive set, down from 95.2% a year ago. It’s not an exact comparison because brands use the business.facebook.com portal for organic social posts as well as for paid advertising. However, a drop in traffic suggests a drop in interest in doing business on the Facebook platform.

- Advertiser interest in Twitter seems to be looking up, but only within the US. Traffic to ads.twitter.com was up 4.8% within the US but down 20.7% worldwide.

- Traffic to TikTok’s ad portal was up 13.4% worldwide but only 4.8% in the US, perhaps reflecting the regulatory challenges TikTok faces in the US market.

We track traffic to the ad portals of these social media companies as a leading indicator for their businesses.

Snapchat continues to show gains in advertiser interest

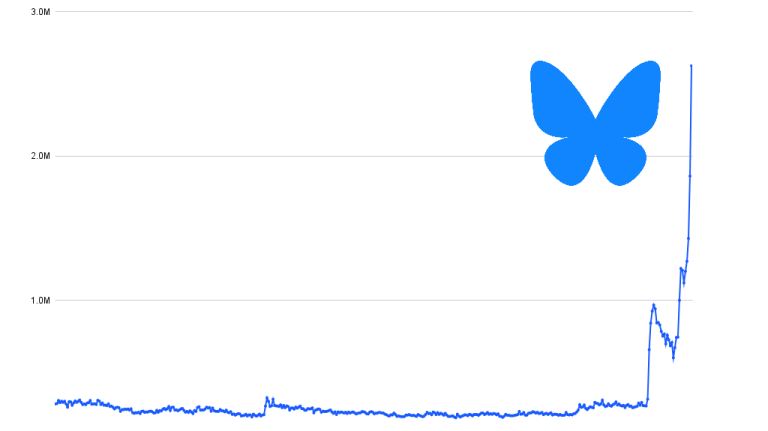

Worldwide traffic to ads.snapchat.com was up 126.2% year-over-year in April. Much of that gain may be related to the company’s efforts to expand internationally, as traffic to the ads portal from within the US was essentially flat.

Here’s what the trend looks like, filtered for traffic from within the US.

Facebook loses share, while Snapchat and TikTok gain

Facebook remains a dominant player. However, its lead has been eroding incrementally, but steadily.

Public companies mentioned in this report include Meta Platforms Inc. (NASDAQ: META), Pinterest (NYSE: PINS), and Snapchat parent Snap (NYSE: SNAP).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!