Meta Q4 Preview: Social Ad Market Shrinks, Particularly for Facebook vs. TikTok

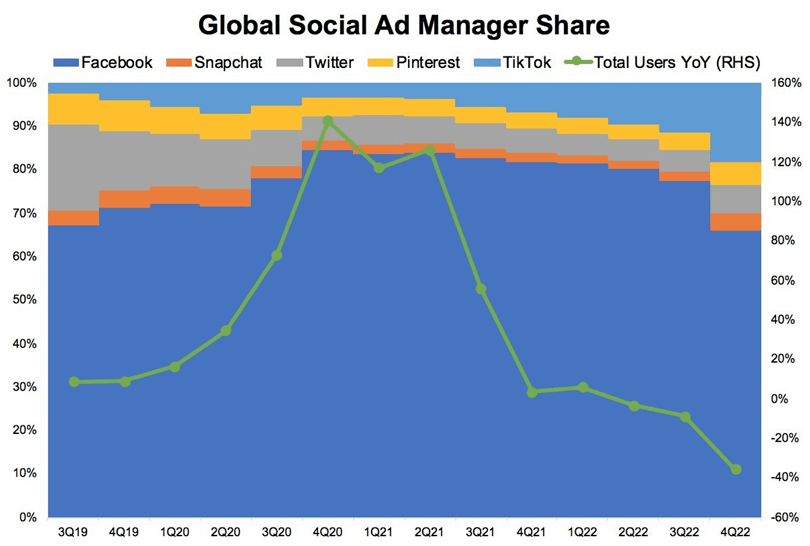

Facebook lost ad market share in the fourth quarter of 2022, according to an analysis by Similarweb Investor Intelligence. Meanwhile, most of TikTok’s ad share gains appear to be coming at the expense of Facebook and its parent company, Meta Platforms Inc. (NYSE: META).

Meta is scheduled to report earnings on February 1. Similarweb’s analysis is based on traffic to the ad manager portals used by social media companies for mass market ad sales.

Key takeaways

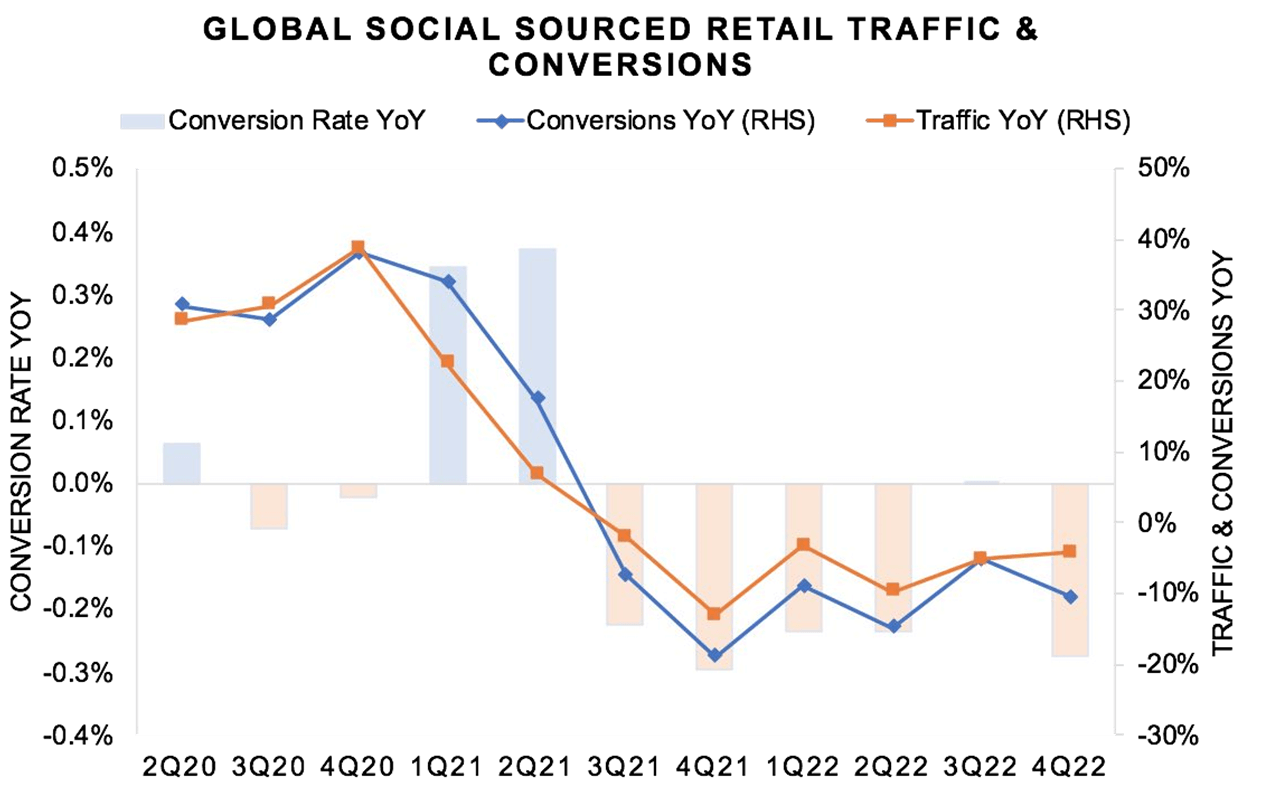

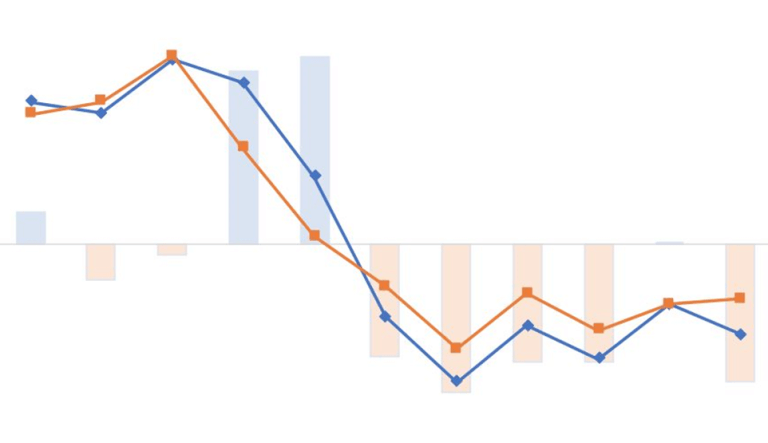

- Social media advertising in general seems to be in decline, possibly because of doubts about its effectiveness. The fourth quarter marked the biggest rate of decline in retail ecommerce conversions from social traffic in the history of Similarweb’s tracking.

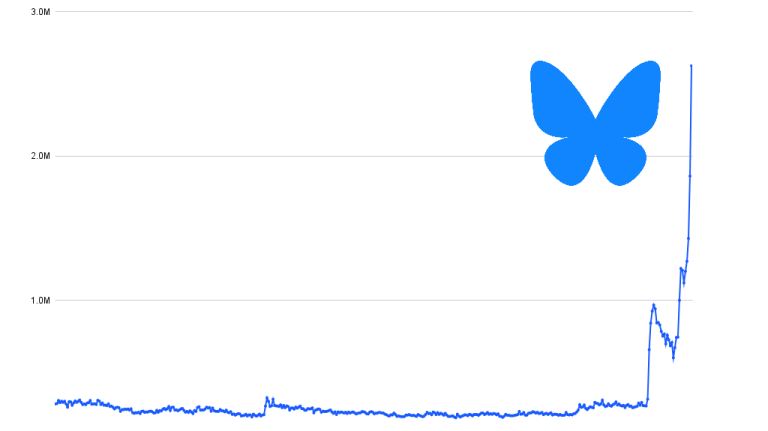

- TikTok’s ad market share gains appear to be accelerating, picking up 11 percentage points of ad manager user share YoY from the key comparable social platforms, with nearly all of that coming from Facebook’s consolidated ad manager portal. That’s up from a 5 percentage point market share gain for TikTok in the first nine months of 2022.

- Overall social ad demand, measured by ad manager users, has been decelerating for four straight quarters. Nearly all of TikTok’s growth in 2022 has been gain in share versus competitors.

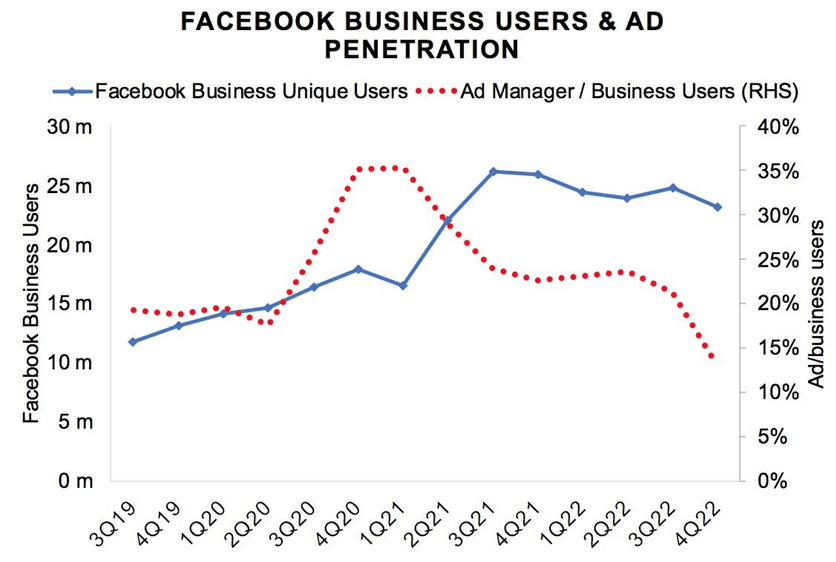

- Although the Facebook business portal is used for purposes other than advertising, such as messaging and organic social posts, it provides a measure of Facebook’s total addressable market for advertising. Not only are users of that business portal shrinking, but Similarweb estimates the percentage of them actively using it to advertise is sinking even faster (see chart, below).

Facebook’s business portal is also used for ad sales on other properties, such as Instagram, and despite the company’s metaverse ambitions, the company’s revenues are still anchored by social media advertising.

Slow traffic ahead

Advertiser engagement on Facebook’s ad manager portal decelerated in the fourth quarter, suggesting that Meta’s topline results may be underwhelming.

Following Meta’s third-quarter earnings call, investors primarily focused on management’s aggressive capital expense guidance and projected losses in Reality Labs (the metaverse development part of Meta). But they welcomed stabilization in the core ads business as a relative bright spot.

As Similarweb’s investor team noted in a recap for clients, any optimism about Meta’s fortunes may be premature given (1) ongoing momentum in competing platforms, which accelerated during the holiday season, (2) the backdrop of softer e-commerce spending, particularly in direct-to-consumer, (3) ongoing privacy and targeting challenges that hobble ad sales, and (4) challenges monetizing Reels, the Facebook / Instagram answer to TikTok’s short video format.

Ad manager engagement, which is a jumpy but informative representation of ad dollar intentions, saw a significant deceleration in the holiday quarter. Within that declaration came a massive share shift of advertisers from Facebook to TikTok.

Meanwhile, social media, in general, seems to be losing its power to drive sales, as measured by ecommerce conversions.

Chart: retail conversions sourced to social media

Facebook is shrinking

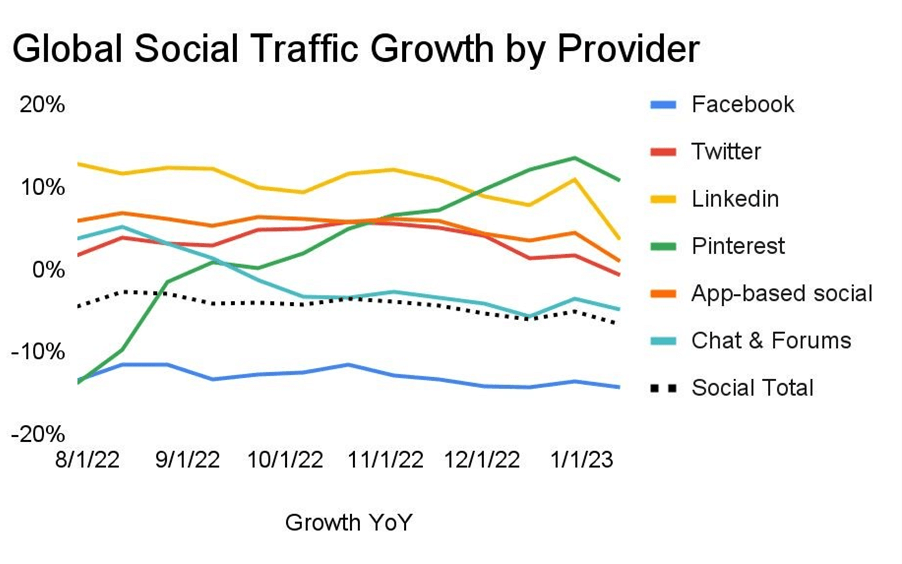

Facebook also continues to show an ongoing pattern of erosion in its traffic, measured year over year.

For the fourth quarter, total traffic to facebook.com was down 13.3% year-over-year. In prior quarters, the decline was as much as 18%. Traffic to instagram.com has held up better, overall, but was down 2.2% in the fourth quarter.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Citation: Please refer to Similarweb as a digital intelligence platform. If online, please link back to www.similarweb.com or the most relevant blog post.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!