Twitter’s Loss of Advertisers May Be Snapchat’s Gain

Snapchat overtook Twitter in attention from advertisers just as Elon Musk took control of the company. Soon after, Musk began complaining about a drop in advertising revenue.

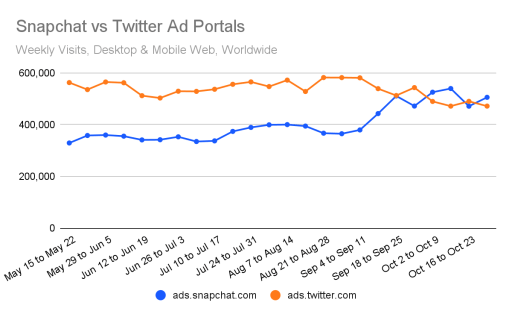

Snapchat parent SNAP Inc. has had its own complaints about ad revenue, although so far more in terms of slowing growth (as it recently reported as part of Q3 earnings). But traffic to its portal for advertisers, ads.snapchat.com, overtook traffic to ads.twitter.com in October.

Snapchat Ads Portal Pulls Ahead

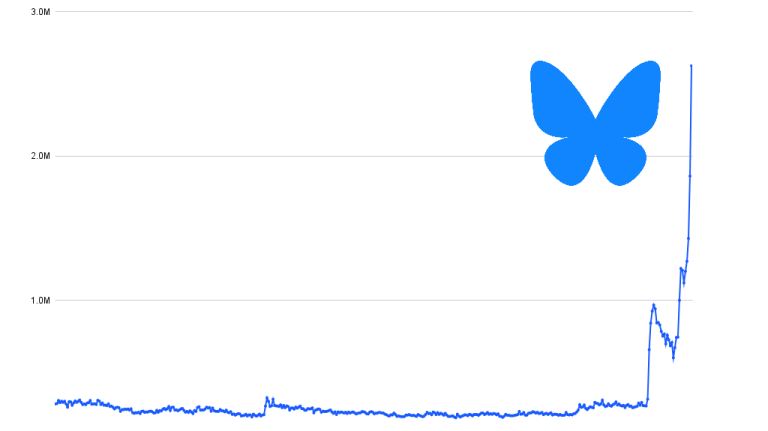

Musk blames left-wing activists for driving advertisers away, but advertisers (and ad agencies) have their own concerns that Musk’s position as a “free speech absolutist” determined to scale back content moderation might result in their ads running adjacent to content they would not wish to be associated with. Some users are quitting Twitter over the same impending changes.

Week-by-Week, Twitter Dropped and Snapchat Gained

If we check web traffic to Snapchat’s ad portal, we can see it began to pull ahead in mid-September. Just as Musk was in the midst of court proceedings that seemed increasingly likely to result in him being compelled to complete the acquisition.

In October, Musk changed his mind about backing out of the deal and agreed – under the court’s watchful eye – to follow through on his original $44 billion purchase of the company. That same month, traffic to ads.twitter.com dropped was down 19% year-over-year.

Coincidence?

Meanwhile, traffic to ads.snapchat.com was up 47% year-over-year and traffic to a related subdomain associated with ad-buying activity was up 163% for October. The implication is that at least some of the advertisers fleeing Twitter see Snapchat as an alternative.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/corp/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!