Chase Leads US Banks With 2.2 Billion Web Visits in Past 12 Months

Chase also leads in Credit Card Segment Visits and across many engagement metrics

Traditional banks have been in the news lately after some high-profile bank failures, including Silicon Valley Bank and First Republic. Larger banks could be better positioned in this environment. We ranked six of them based on web traffic, credit card activity, and engagement, using Similarweb data.

Key takeaways

- Among the six largest traditional banks, Chase has the largest web presence with about 2.2 billion visits in the past 12 months, followed by Wells Fargo with 1.4 billion and Bank of America with about 1.3 billion.

- American Express grew the most rapidly among this peer group over the past 12 months, with traffic up 11% over the prior year. Capital One was second with 10% growth.

- Credit cards are also led by Chase with roughly 47 million visits to their credit card segment on desktop and mobile web, followed by American Express with 33 million. Wells Fargo is the smallest in this group at 6.2 million visitors, but grew fastest over the past year, rising 33% over the prior 12 months.

- Chase leads across most engagement metrics, with the most unique visitors, and, the highest duration spent on site, while it gets edged out on the lowest bounce rate (visits that drop off after viewing only one web page) and pages per visit by Wells Fargo.

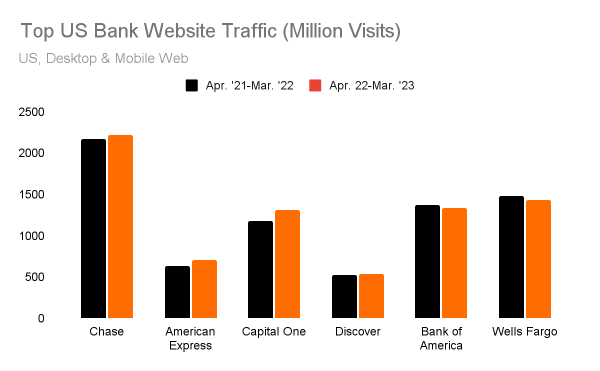

Chase leads US Banks in web traffic by a wide margin.

The below chart shows visits to six leading US banks over the past 12 months (through March), versus the prior 12 months. Chase.com leads with 2.2 billion visits over that time frame, followed by visits Wells Fargo (1.4 Billion), Bank of America (1.33 billion), Capital One (1.31 billion), American Express (713 million), and Discover (537 million).

In terms of growth, American Express grew its web traffic the fastest with its 12-month traffic up 11%, followed by Capital One with 10% growth. Chase, while the largest, only grew 1.8%, followed by Discover at 1.7%. Bank of America saw its web traffic fall 3% and Wells Fargo dropped 4% over the past year.

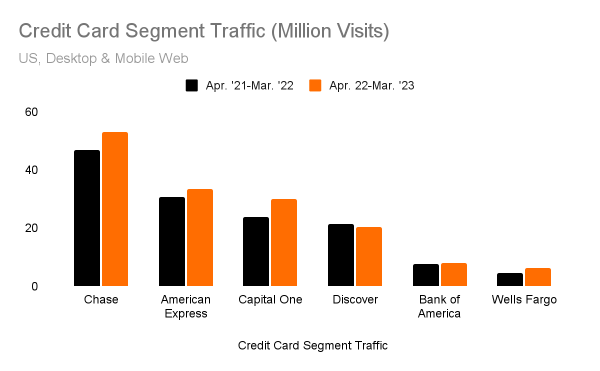

Chase also leads in traffic to its credit card segment

Looking at traffic to the various credit card segments of these banks, Chase has a large lead here as well, with 53 million visitors (up 12% over the prior year), with second place American Express seeing 33 million visitors (+8%), followed by Capital One at 29 million (+23%), Discover at 20 million (-4.5%), Bank of America at 8 million (+3%) and Wells Fargo at 6.2 million (+33%). Though Wells is by far the smallest of this peer group in traffic to its credit card segment, it grew this traffic much faster than its peers.

Chase leads across most engagement metrics

Taking a look at Similarweb engagement data, Chase leads across these six banks in unique visitors, and visit duration (how long, on average, a person stays on its website), while it gets edged out by Wells Fargo in pages per visit and bounce rate (the percentage of visitors that click off a website after visiting a single page, a high bounce rate is bad). You can see the leaders in each segment in bold in the table below.

| Monthly Unique Visitors (Millions) | Pages Per Visit | Visit Duration (minutes) | Bounce Rate | |

| Chase | 44.62 | 10.44 | 6:58 | 15.30% |

| American Express | 21.6 | 6.84 | 5:29 | 21.30% |

| Capital One | 37.2 | 7.78 | 5:40 | 20.20% |

| Discover | 17 | 5.84 | 4:11 | 20.40% |

| Bank of America | 26.4 | 7.6 | 6:29 | 16.20% |

| Wells Fargo | 24.1 | 11.8 | 6:05 | 15.00% |

In a future report, we will take a look at the mortgage market for these and other large banks, as this market is changing fast in the current rising interest rate environment and amid fears of a U.S. recession.

Publicly traded companies in this report include JP Morgan Chase (NYSE:JPM), American Express (NYSE:AXP), Discover Financial Services (NYSE:DFS), Bank of America (NYSE: BAC) and Wells Fargo & Co. (NSYE:WFC).

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: Jim Corridore, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!