Robinhood Might Need a Hero: Key Metrics Show Little Signs of Rebound in Q1

The tailwinds that buoyed Robinhood Markets during the pandemic, including low-interest rates, its focus on cryptocurrency, and a surge in investing by retail consumers, are beginning to falter, stifling the company’s ability to maintain its growth momentum. The pullback in user engagement is evident when looking at website traffic and could provide a peek into what’s to come when the company reports earnings on April 28th.

Key Takeaways

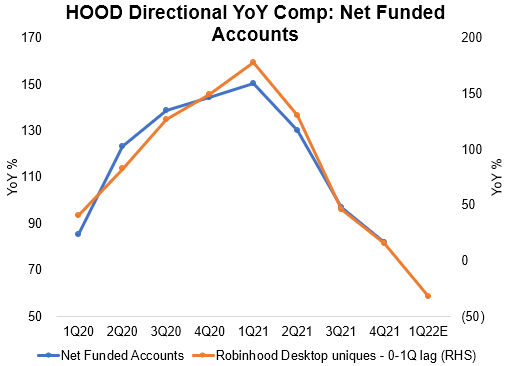

- Based on a high correlation between unique desktop visits and net funded accounts (defined as new funded accounts less closed funded accounts), Similarweb estimates suggest a further decline in net funded accounts during Q1 2022

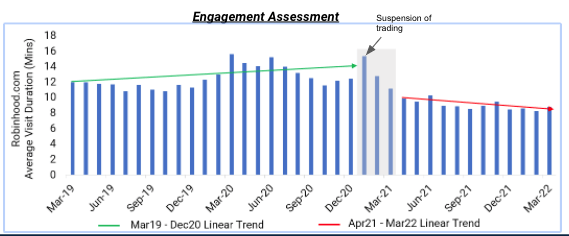

- Engagement metrics show a continued decline in average visit duration during Q1 2022. The slide began in Q1 2021, following the suspension of trading in certain tickers

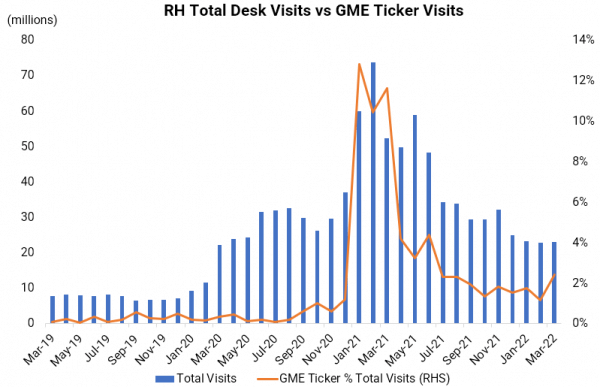

- On the plus side, the meme stock craze is alive and well as Similarweb estimates show. An uptick in page visits to stock purchases pages for Gamestop (GME) from February to March 2022 coincided with an increase in the stock price during late March

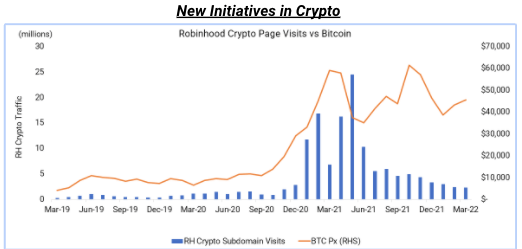

- Jury is still out regarding Robinhood’s ability to attract and retain traditional brokerage customers but crypto offerings may hold the key

Robinhood Markets, Inc. went public in July 2021 to much fanfare, seeing its stock spike to $85 after pricing its IPO at $38. However, the stock has come back down to earth, now that Robinhood has reported three quarters as a public company, and recently bottomed around $10 per share. After this tumultuous debut, the Street will be looking for clarity on some key metrics in the quarter including monthly active users (MAU), assets under custody (AUC), and average revenues per user (ARPU). There will also be questions about Robinhood’s growth plans, as the deceleration in top-line growth is forcing a push to international markets; on April 19th, Robinhood announced that it had entered into an agreement to purchase Ziglu Limited a “UK-based electronic money institution and cryptoasset firm” in order to grow its presence in Europe.

Net Funded Account Deceleration

Similarweb estimates show a downward trend, beginning in Q1 2021, in the rate of growth for net funded accounts that have a strong correlation with the company’s reported net funded accounts. Similarweb estimates show this declining trend continues through Q1 2022.

Meme Stocks Still a Thing

The company benefited from the meme stock craze during 2020 where retail investors snapped up the shares of stocks they learned about on Reddit which included Gamestop (GME) and AMC Theaters (AMC). As a result, these stocks experienced wild volatility which led to a Congressional hearing where Robinhood co-founder and CEO Vlad Tenev testified as to the company’s involvement. We note an uptick in visits to the GME stock purchase page on desktop from February to March 2022, which coincided with an increase in the stock price in late March.

Payment for Order Flow

In order to subsidize free trading commissions, Robinhood uses the controversial method of payment for order flow in order to receive compensation for its trading transactions. This involves selling customers’ market orders to third parties, who execute the orders and earn fees for doing so. Essentially, the market makers, with whom Robinhood works, make their profit by setting the bid-ask spread. These market makers then pocket the profit on the spread. This practice is controversial because often the market makers receive the best execution on the trades rather than the customer, even after taking into consideration the fact that the customer is not paying commissions for the trade.

Declining Engagement Trend Continues

After suspending trading in select stocks in early 2021 due to intense volatility, Similarweb estimates show engagement metrics, as measured by average visit duration in minutes, began to decline and that decline has continued into Q1 2022.

Outlook: Will Robinhood’s Aggressive Growth Plans Overcome Its Recent Stumbles?

In its Q4 results, management laid out its growth plans for 2022. These include a focus on three core areas: be the best place for beginning investors, encourage first-time investors to grow into long-term investors, and continue to serve advanced investors. It has plans to build products targeting long-term investing trends and is developing tax-advantaged retirement accounts with plans to roll out in mid-2022. Robinhood is also developing spending and saving products to help customers save when they spend as well as plans to introduce instant debit card deposits and withdrawals. The company has also previously said it has set “aggressive” goals to open its crypto platform to international customers and its acquisition of Ziglu is a means to that end.

While these plans are an important step toward future growth, the company will need to focus on winning back credibility with investors in order to achieve its growth targets. It will need to avoid future negative headlines that give potential customers pause when considering joining the platform.

Crypto is a space where Robinhood could have an edge if it can successfully leverage its large installed base of mostly young investors to attract more users to both crypto and its traditional brokerage. In doing so it may be able to lure incumbents’ customers to its platform who are considering adding crypto to their portfolios but are looking for an easy and seamless way to do so. This could lead to these new customers transferring their traditional assets, such as stocks, over to Robinhood in search of a single solution for all of their trading needs.

Citation:

Please refer to Similarweb as a digital intelligence platform.

Disclaimer:

All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!