SoFi Leads Neobanks in Web Traffic, Up 57% in 2023

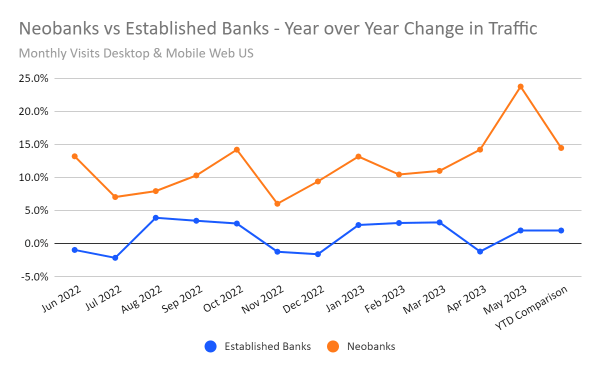

The companies aiming to reinvent banking are up 14.5% on average, year-to-date, compared with 2% for traditional banks

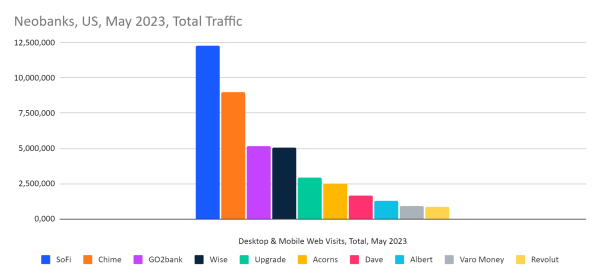

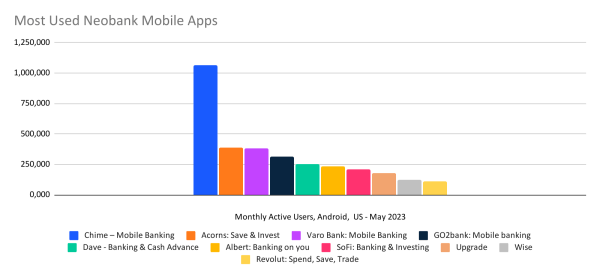

Of the services working to reinvent banking in the US, SoFi leads in web traffic by an almost 40% margin compared with the next biggest service, Chime. However, Chime is way ahead in mobile app engagement, which is important given its focus on mobile banking. The two are the leaders among the “neobanks” in the US, where both do the majority of their business.

Although they’re seeing strong growth in web traffic, a good “top of the funnel” indicator of consumer interest, usage of neobank mobile apps seems to be trending down. That could be a bad sign for ongoing engagement with members of these newfangled banks. On the other hand, SoFi, Chime, and others are seeing rising web traffic from newcomers checking out their services, as well as web users of online banking.

Nerdwallet defines a neobank as “a tech company that provides online banking services through a partnership with an established bank” – although SoFi has gone the extra step of chartering itself as a bank in its own right, as has another competitor, Varo Bank. In addition to offering slick mobile apps, these companies claim to offer credit and other banking services on friendlier terms for consumers. Some also provide stock and cryptocurrency trading.

We used NerdWallet’s list of leading Neobanks as a starting point for our research into this category, focusing on those with the most online engagement.

Key takeaways

- SoFi attracted 12.3 million web visits in May, compared with 9 million for the next-biggest service, Chime, based on Similarweb estimates for the US market. However, the Chime app has better mobile app engagement, with over 1 million monthly active users on Android as of May, compared with about 210,700 for SoFi.

- The savings app Acorn had the second most mobile users, about 390,600. Varo Bank, GO2bank, Dave, and Albert also ranked ahead of SoFi in active mobile users.

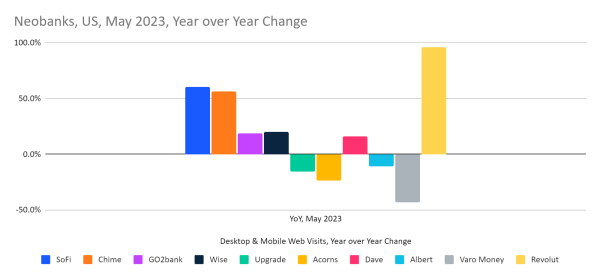

- SoFi and Chime also demonstrated strong web traffic growth, up in May by 60% year-over-year for SoFi and 56% for Chime. Year-to-date, SoFi web traffic is up 57% and Chime is up 40%.

- On a percentage basis, Revolut is coming on even stronger, with web traffic up 125.9% – but is a relatively small player in the US, attracting about 855,500 visits in April.

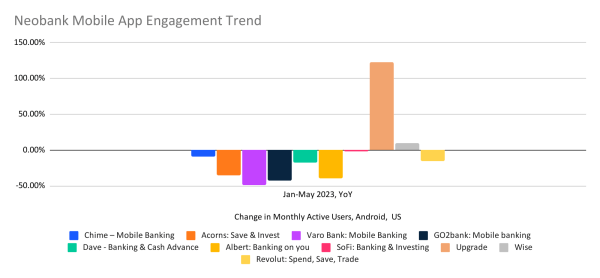

- Mobile app usage stats were down for almost all the players we studied. For the first five months of 2023, Chime’s monthly active user count on Android is down 9.6%, SoFi is down almost 2%, and some others saw much bigger declines, for example -48% for Varo Bank app users. The big exception is Upgrade, which boosted monthly active users by 123%, year-over-year.

Most of the companies in this category are private startups, although SoFi is public (NASDAQ: SOFI), a sis the Mark Cuban-backed Dave (NASDAQ: DAVE) and the money transfer specialist Wise (LON: WISE).

Comparison with “traditional” or “established” banks

The largest of the neobanks still look relatively small if we put their traffic side-by-side with the largest of the established banks.

On the other hand, that leaves them more room to grow – and they have been growing. For the comparison below, we used the aggregate traffic of the neobanks covered in this report versus a list of the domains for top “traditional” banks*.

Who’s biggest?

On the web, SoFi and Chime attract the most traffic, followed by GO2bank, Wise, and Upgrade.

On mobile apps, Chime has a big lead over everyone else, based on Similarweb estimates for Android.

These companies do the majority of their business in the US. If we look at the same web domains based on worldwide traffic, Wise is the clear leader with more than 36 million visits compared to 12.9 million for SoFi and 9.7 million visits for Revolut. Both Wise and Revolut are based in the UK, where Wise attracted 2.2 million visits in May, Revolut attracted 1.6 million, and the other companies on our list barely register. Variations in international banking regulation make international expansion a challenge.

Growing fastest on the web

SoFi, Chime, and GO2Bank boast a strong combination of size and growth, while Revolut is the fastest-growing web property on a percentage basis.

Mobile app usage trending down, with Upgrade the notable exception

While Chime is the leader in monthly active users on Android, that number dropped 9.6% year-over-year in the first five months of 2023, and usage was down almost across the board for the apps of the companies we studied. The big exception was Upgrade, where usage was up 123% over the same period. SoFi’s app usage was down 2%, and Wise gained 9.7%.

Connecting with consumers seeking new options

The Neobanks promise more and different options for access to credit services, and they are showing broad appeal, with many consumers coming to their websites to learn more. They enjoy traffic growth rates more traditional banks can only dream of. However, a decline in app engagement could be a worrying sign for their ability to hold onto customers.

* Traditional bank domains used for comparison chase.com, wellsfargo.com, capitalone.com, bankofamerica.com, citi.com, usbank.com, pnc.com, citibankonline.com, navyfederal.org, regions.com, tdbank.com, citizensbankonline.com, td.com, and citizensbank.com.

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Report By: David F. Carr, Senior Insights Manager

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!