US Financial Outlook: Top Trends to Watch in 2024

Over the past few years, the US financial services sector has been on a tumultuous journey. Inflation, interest rates, and a cost-of-living crisis have changed how people spend, possibly forever.

Consumers have grown used to tightening their belts and shifted to a much more value-driven mindset, one where every single transaction counts. They’ve also begun to expect enhanced customer experiences powered by technologies like AI.

So, how can businesses keep up with evolving consumer needs and expectations in such a constantly shifting financial landscape?

That’s where Similarweb comes in with our latest consumer trends report on the US FinServ industry.

Using Similarweb Market Research Intelligence, we gathered the very latest data on consumer trends and economic shifts having the biggest impact on the financial landscape in 2024.

With these key insights, you’ll have the information you need to stay one step ahead. Be the first to act on emerging trends (hello, competitive advantage), anticipate product demand, and understand your target audience on a whole new level.

Here are some of the key themes we unearthed in our report:

A quest for financial stability

While credit cards will never truly go out of style, they’re not the focus for consumers at the moment. Instead, people are seeking out tools that will help them gain more financial stability. It’s high-interest savings, debt management, credit score improvement, and short-term loans that are ticking boxes in 2024.

Here’s some of the data:

- US credit card searches may have increased by 8% YoY with 58 million searches, but it’s very specific credit card types that are fueling this growth – like reward credit cards that allow consumers to earn points or cashback

- But, demand for travel reward cards decelerated, possibly due to the lure of better rewards. The younger generation are most interested in travel rewards, with 58% of American Express users in the 18-35 age group

- Consumers are also prioritizing local travel to help control costs. Interest in local experiences and destinations was on the up: ground transportation and tourist attractions grew by 12% and 13% respectively

Mortgages are back

After a challenging few years for aspiring home buyers, mortgages are slowly getting back on track High interest rates have reshaped standards, however, with consumers now looking for the most affordable route to home ownership.

A glimpse into the data on mortgages in 2024:

- There was a 6% increase in traffic to the Real Estate industry between January and February 2024, even though the Federal Reserve rate hasn’t budged from its plateau at 5.33%

- The popularity of FHA loans is on the rise due to lower downpayment requirements and wider credit acceptance, which is crucial for aspiring homebuyers

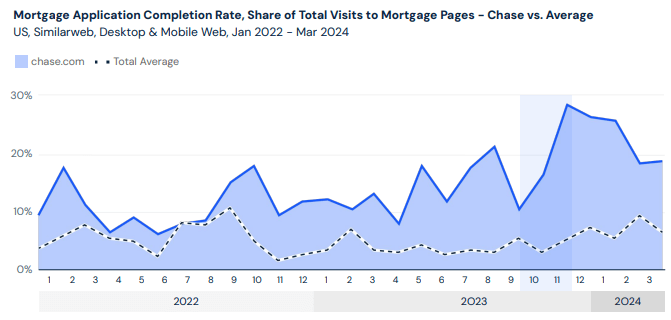

- Chase Bank has the best conversion rate thanks to its superior pre-approval process that qualifies potential customers before applying and commits to matching or beating the lowest rate on offer (as well as offering cash-based incentives):

AI is not just a trend, but the future

It looks like AI is a sure way to increase your market share

Rocket Mortgage is the AI pioneer of the financial services industry. They are among the first to incorporate AI technology into their application process, namely their:

- Customer service

- Mortgage application calls

- Underwriting and risk assessment

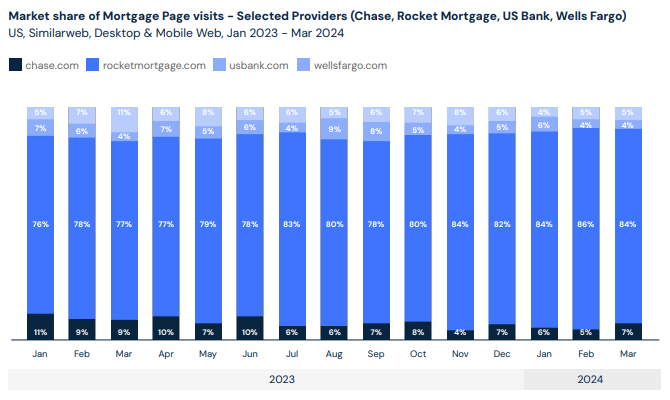

The result? They are the number one mortgage provider in terms of client satisfaction, enjoying a 96% retention rate in the first quarter of 2023. They also increased their market share of visits among the four leading mortgage lenders from 76% at the beginning of 2023 to 84% in March 2024:

Leveraging AI has been a game-changer for Rocket Mortgage, could it also be for your business?

Want more trends like this? Download the full report:

Small business banking is trending up

It’s not just consumers that are feeling the pinch of inflation. Small businesses and self-employed people are under pressure to stretch their money further. Much like the average consumer, they are seeking products that will alleviate these pressures above all else.

Here’s what’s hot in the SMB banking world:

- Business banking may be dominated by bigger players like Bank of America and Wells Fargo, but challenger banks are beginning to make headway with these smaller businesses

- There is a fresh cohort of SMB customers emerging as the number of self-employed and freelancers grew from 27% in 2016 to 36% in 2024 (thanks, Covid)

- Innovation is key in this banking niche: small businesses favor technology-led, cutting-edge features offered by more innovative banks like Found (named in our D100 list after 216% YoY growth).

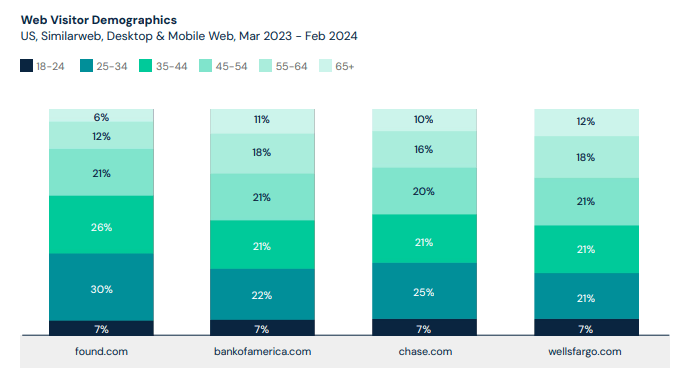

Here’s Found’s growth compared with that of the more traditional banks:

These innovators appeal to younger, tech-savvy generations – over 60% of Found’s visitors are under 45. It’s clear that digital-first is the future of banking.

There’s plenty more where that came from.

Find out what other features and benefits these disruptive challengers offer to outpace traditional banks in the SMB arena. Download the free report for the full lowdown on the most significant business banking trends:

A final word on the future of US finance

As the US financial landscape evolves under the pressures of inflation and shifting consumer behaviors, 2024 holds a lot of opportunity – for those ready to adapt.

Similarweb’s market research offers essential insights to navigate these changes. Our report highlights key trends that will help you refine your strategies, enhance customer engagement, and explore new market opportunities.

Unlock the potential of your financial services with our insights and stay ahead in the rapidly changing economic environment of 2024 by downloading the full report:

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!